Payrolls Preview: This One Actually Matters

October’s NFP (consensus exp. +450k) prints tomorrow morning, two days after the FOMC taper announcement on Wednesday. And due to the flexible nature of the monthly tapering, employment reports (together with inflation prints) will now be far more critical as part of the broader evolution of data, which if too divergent could serve to accelerate/decelerate the pace of tapering, not to mention their importance in gauging the road to full employment, and as a result eventual rate lift-off.

As Newsquawk notes in its NFP preview, labor proxies have largely been constructive, with the ADP report surprising to the upside, although everyone knows about the rocky correlation between the two. Initial Jobless Claims and Continued Jobless Claims continued to show a decline to successive post-pandemic lows after some prior bumps due to Hurricane Ida. ISM business surveys continued to signal growth, with the Manufacturing employment sub-index rising further into expansionary territory, but Services declining slightly with continued high rates of turnover, albeit still above 50.0. While Challenger Layoffs saw the second consecutive M/M rise to take the level to its highest since May, the firm reported vaccine mandates as the biggest factor for October layoffs.

WIth that in mind, here is what consensus expects when the Bureau of Labor Statistics will release the October employment situation report at 08:30EDT on November 5th:

- Change in nonfarm Payrolls: exp. 450K, Last 194K

- China in private nonfarm payrolls: exp. 415K, Last 317K

- Unemployment rate: exp. 4.7%, Last 4.6%

- Underemployment rate: exp. Last 8.5%

- Labor force participation rate: exp. 61.8%, Last 61.6%

- Average hourly earnings M/M: exp. 0.4%, Last 0.6%

- Average hourly earnings Y/Y: exp. 4.9%, last 4.6%

POLICY: The October jobs report comes two days after the Fed made its taper announcement. The FOMC statement said that the taper rate of USD 10bln/m and USD 5bln/m of Treasuries and MBS, respectively, could change if needed. Accordingly, an extreme jobs report in either direction could serve to be the trigger for taper adjustments. Meanwhile, Powell said he wants to see more progress on the employment rate before considering rate lift-off, but interestingly, said maximum employment could be met by the middle of next year (although Powell had no clue just what that means).

PAYROLLS: The consensus looks for 450k nonfarm payrolls to be added to the US economy in October after 194k in September, which would be a cooler rate of growth than the three- and six-month average rates at 550k/month and 583k /month, respectively. Aggregating the nonfarm payrolls data since March 2020, 154mln Americans are employed as of September, still down by around 5mln from pre-pandemic levels.

Goldman Sachs looks for +525k, above the consensus of +450k. As the bank writes, “after two weak months of job growth, tomorrow’s report reflects the first full month of hiring following the expiration of federal enhanced unemployment benefits. The bank’s forecast reflects improving public health, strong labor demand,and a partial education rebound as schools gradually fill positions left open at the start of the school year. On the negative side, the seasonal factors may have evolved to fit the strong October 2020 data, raising the seasonal hurdle into morrow’s report.

MEASURES OF SLACK: The Unemployment Rate is expected at 4.7% (prev. 4.8%); Labour Force Participation previously at 61.6% vs 63.2% pre-pandemic; U6 measure of underemployment was previously at 8.5% vs 7.0% prepandemic; Employment-population ratio was previously 58.7% vs 61.1% pre-pandemic. These measures of slack will again be used to provide more insight into how Fed officials are judging labor market progress, with many in recent months noting that they are closely watching the Underemployment Rate, Participation Rate, and the Employment-Population Ratio for a better handle on the level of slack that remains in the economy. Indeed, Powell on Wednesday reiterated his view that the unemployment rate understates the shortfall in employment with ground still to be made.

EARNINGS: Average Hourly Earnings expected at +0.4% M/M (prev. +0.6%); Average Hourly Earnings expected at +4.9% Y/Y (prev. +4.6%); Average Workweek Hours expected at 34.8hrs (prev. 34.8hrs). ADP: The ADP National Employment Report was encouraging, showing 571k jobs added in October, beating the expected +400k and a better pace than the prior +523k (revised lower from +568k). The report highlighted “Leisure and hospitality remains one of the biggest beneficiaries to the recovery, yet hiring is still heavily impacted by the trajectory of the pandemic, especially for small firms. Current bottlenecks in hiring should fade as the health conditions tied to the COVID-19 variant continue to improve, setting the stage for solid job gains in the coming months”. Note ADP’s correlation to ADP lately has been far from perfect, thus should be taken with a pinch of salt when trying to determine the strength of the BLS’ NFP. Analysts at Goldman Sachs suggest “The October ADP report is consistent with a strong pace of job gains following the end of the federal enhanced unemployment benefits, and we continue to expect nonfarm payroll growth to rebound in this Friday’s employment report”.

INITIAL JOBLESS CLAIMS: Initial jobless claims data for the week that coincides with the BLS jobs report survey window saw claims at 291k – down from the 351k for the September jobs data survey window – where analysts said claims had fallen at a faster rate than the bump up induced from Hurricane Ida; the corresponding continuing claims data has fallen to 2.480mln in the October survey period vs 2.802mln in the September survey period. In aggregate, the data continues to point to a declining trend, with the bump in prior months seemingly fading.

BUSINESS SURVEYS: The Services and Manufacturing ISM reports showed divergent trends again in October, with the service sector employment sub-index easing to 51.6 from 53.0, signalling growth, but at a slower rate, while the manufacturing equivalent rose for a second month, printing 52.0 from 50.2. On the manufacturing sector, ISM said companies are still struggling to meet labour-management plans, but for a second month there were modest signs of progress: “An increasing percentage of comments noted improvements regarding employment, compared to less than 5 percent in September.” It said, “an overwhelming majority of panellists indicate their companies are hiring or attempting to hire,” where 90% of comments were about seeking additional staffing, while 28% of those expressed difficulty in filling positions down from “nearly half” in September. “The increasing frequency of comments on turnover rates and retirements continued a trend that began in August,” ISM said. Meanwhile, in the services sector, employment activity remained in expansionary territory for a fourth straight month; respondents noted, “Staffing and turnover remain significant challenges” and “Continued difficulty filling positions, especially front-line.” Also, “Drivers are in short supply; rate of turnover has increased.”

CHALLENGER LAYOFFS: Job cuts rose to 22.8k in October, the highest since May, from 17.9k in September, marking the second consecutive M/M rise from the Challenger report. 22% of those cuts were attributed to vaccine mandate refusals. Challenger writes, “Last month, the majority of cuts (5,796) were attributed to plant, store, and unit closing. Workers’ refusing to comply with vaccine mandates accounted for 5,071 cuts in October.” It adds, “Since June, when vaccines were widely available to adults, 6,843 workers have been cut or left their jobs for this reason. It is currently the 10th highest reason for job cuts this year.” On seasonal hiring, “Through October, Challenger has tracked 939,300 seasonal hiring plans from Retailers, Transportation, and Warehousing companies, up 11% from the 849,350 announced during the 2020 holiday season.” Challenger concludes, “It is the most since the firm began tracking these direct announcements in 2012.”

ARGUING FOR A BETTER-THAN-EXPECTED REPORT

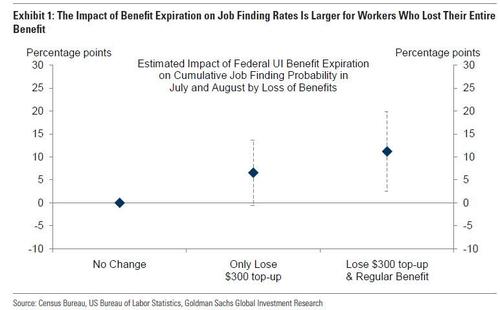

- End of federal enhanced unemployment benefits. The expiration of federal benefits in some states boosted job-finding rates over the summer, and all remaining such programs expired on September 5. As shown in Exhibit 1, the microdata indicated a cumulative 6pp boost to job-finding probabilities for workers losing $300 top-up payments and a 12pp boost for workers losing all benefits. 4.2mnindividuals stopped receiving unemployment compensation between early September and the October survey week, and we are assuming a boost to October job growth on the order of 250k-400k from this channel.

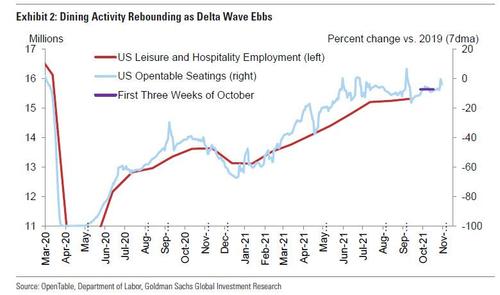

- Public health. The Delta wave coincided with a late-summer slowdown in job growth, with leisure and hospitality employment growth slowing sharply in August and September (see Exhibit 2). Covid infection rates peaked just before the September survey period and steadily declined over the following month, and restaurant seatings on Open Table have also rebounded (see same Exhibit). Leisure and hospitality job growth picked up from the +56k average pace of the last two reports to around 200-250k in October. This would still be well below the ~400k monthly pace of June and July. Relatedly, the number of workers on unpaid leave increased by 742k cumulatively in August and September (sa by GS), some of whom likely returned to work in time for the October survey period.

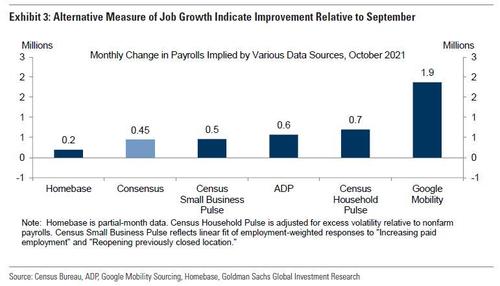

- Big Data. High-frequency data on the labor market were mixed but generally encouraging between the September and October survey weeks. Four of the five measures tracked indicate an above-consensus payroll gain (see Exhibit 3). However, the Homebase data that directionally flagged last month’s payroll miss indicates a smaller rise

- ADP. Private sector employment in the ADP report increased by 571k in October, above consensus expectations for a 400k gain and consistent with strong growth in the ADP panel. Employer surveys. The employment components of business surveys generally increased in October. The Goldman services survey employment tracker increased 0.2pt to 54.6 and the manufacturing survey employment tracker increased 1.4pt to 59.0. The Goldman Sachs Analyst Index (GSAI) increased 4.4pt to 72.9 in October, and the employment component rose 2.1pt to a record-high of 74.0.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—increased to 45.0, the highest level since 2000. JOLTS job openings decreased by 659k in August to 10.4mn but remain significantly higher than the pre-pandemic record. Jobless claims. Initial jobless claims fell during the October payroll month, averaging 320k per week vs. 339k in September. Continuing claims in regular state programs decreased 572k from survey week to survey week.

ARGUING FOR A WEAKER THAN EXPECTED REPORT:

- Seasonality. The October seasonal factors may have evolved unfavorably due to the crisis—specifically by fitting to last October’s reopening-driven job surge (privatepayrolls +954k mom sa). Coupled with above-trend October growth in several of the years leading up to the crisis, the seasonal factors may evolve to offset some of the strength we forecast in the BLS employment panel in tomorrow’s report.

- Vaccine mandates. The vaccine mandates announced by the Biden administration non September 9 may have weighed on October job growth in healthcare and government. But while the mandates apply to roughly 25mn unvaccinated workers,the deadline for compliance is generally not until early January. Accordingly, any payroll growth drag is more likely to materialize in future reports.

NEUTRAL/MIXED FACTORS:

- School reopening. Education payrolls declined 180k in September (public and private), despite all 100 of the largest school districts being open for in-person learning, as some janitors and support staff did not return for the fall school year,perhaps due to labor supply constraints. While schools will eventually fill these open positions, the start-of-year catalyst for a large rise in education jobs has passed, and Goldman assumes only around 50k of job creation in these industries in tomorrow’s report (mom sa).

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas rebounded 18% month-over-month in October after increasing by 12% in September (sa by GS).Nonetheless, layoffs remain near the three-decade low on this measure

Tyler Durden

Thu, 11/04/2021 – 22:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com