NBC’s Stephanie Ruhle Embarrasses Herself Over “Dirty Little Secret” About Inflation

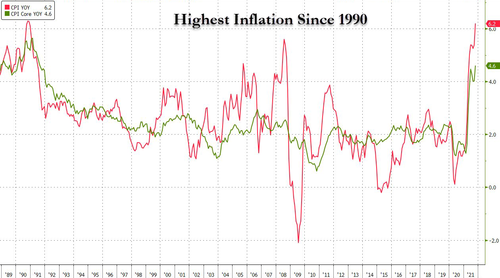

FACT: The cost of ‘stuff’ that Americans are buying is rising at its fastest pace in 30 years…

FACT: Short-term inflation expectations surged to a new cycle high – the highest since 2008…

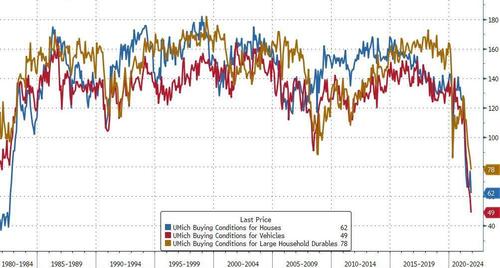

FACT: As ‘Buying Attitudes’ for homes, cars, and large household durables have crashed to record lows (citing high prices)…

…President Biden’s Approval Rating is at the lowest of his term, falling at the fastest pace of any president since World War II…

So it’s no surprise that last week we saw MSNBC go to bat for the Biden administration, deploying their best pretzel-logician to explain why all this inflation is literally – wait for it – good.

In a now-deleted tweet, MSNBC attempted the ultimate gaslighting by claiming that “the inflation we’re seeing now is a good thing”…

Not surprisingly, after getting ratio’ed in a furious backlash, MSNBC did the only thing it could and deleted its tweet, as its latest attempt at mass gaslighting propaganda went terribly wrong.

But the ‘NBC’ wing of the White House refuses to abandon its propagandizing.

And now, NBC Reporter Stephanie Ruhle, clearly in ‘Camp Transitory’ even as The Fed itself is starting to distance itself from that narrative, explains in a recent interview that “nobody knows exactly when [prices] are going down,” but, she says, don’t sweat the soaring cost of living America, because, as the former Wall Streeter explains “you have to put all this in perspective…”

She continues:

“This inflation is not in isolation, and the government predicted it was going to be a challenging recovery, recovery all tied to Covid.

So it’s why you see things like that expanded child tax credit. You’ve got the families of over 60 million kids, on average, getting $430 a month. For people on fixed incomes, older people on social security, they’re getting those fixed payments adjusted next year up 5.9% for inflation.

And the dirty little secret here, while nobody likes to pay more, on average we have the money to do so.

[ZH: No Stephy love, real wages have declined for seven straight months…]

[ZH: As consumer prices are accelerating away from incomes…]

Household savings hit a record high over the pandemic.

[ZH: and what has happened since our dear Steph? The savings-rate has crashed back to pre-COVID norms as Americans have burned through that ‘pent-up’ cash to cover the soaring cost of living with Bidenflation.]

While the stock market isn’t the economy, you have over half of American households with some investment in the markets and they hit market highs.

[ZH: oh Stephy, have you seen what Main Street has been doing since Wall Street reaches record-er and record-er highs]

So we need to put all of this in perspective. This time last year when you and I were talking nobody had a vaccine. Now 200 million Americans do, and we’re seeing this push of demand and that’s pushing up pricing.”

“Perspective” indeed!

Watch the full gaslighting here:

How long before this NBC segment is deleted?

And what affords Ms. Ruhle such a truly unique perspective to opine on the problems of the poor?

She started her career in finance in 1997 with Credit Suisse First Boston. At CSFB she served as a vice president and was the highest producing credit derivatives salesperson in the U.S.

After a six year stint at Credit Suisse, Ruhle moved to Deutsche Bank where she worked as managing director in structured credit sales within the fixed-income division.

Just as we mocked with MSNBC’s now-deleted tweet, desperately gaslighting that inflation is a ‘good thing’, the meme is complete…

The meme is completehttps://t.co/DANBF35fsb pic.twitter.com/vOkFruAR8f

— zerohedge (@zerohedge) November 8, 2021

You’ll get higher prices, Americans, and like it!!…

We’ve come full circle on inflation pic.twitter.com/0qwqP1XDxA

— Greg Price (@greg_price11) November 8, 2021

Meanwhile, even the notorious optimistic Wall Street is starting to tell the truth, with Goldman warning that things are going to get a lot worse before they get better.

Tyler Durden

Sun, 11/14/2021 – 14:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com