BofA Is Bearish On Markets Ahead Of The 2022 “Rates Shock”

For those who have been following BofA CIO Michael Hartnett’s sometimes disjointed thoughts and observations, dutifully jotted down in his weekly Flow Show report (and summarized here), it will come as no surprise that the Bank of America strategist has been turning decisively bearish in recent months (see BofA Chief Strategist: Markets Are About To Be Hit With Three Shocks; This Is How One Bank Will Trade The Bursting Of The Biggest Ever Asset Bubble In 2022; and ““2022: The Year Of The Rate Shock”: The Fed’s Policy Mistake Already Happened And Next Year Everyone Pays”).

Even so, it was certainly helpful for Hartnett’s clients (and our readers) to be presented with a more structured and organized version of the CIO’s views for the year ahead, which is what he did overnight in his latest periodical The Thundering Word, titled appropriately “Fin de Siecle” in which he finally makes it clear that “we are market bearish” for many of the same reasons we have discussed previously namely that the “growth show” of 2020, which was followed by the “inflation shock” of 2021 will be followed by the “rates shock” in ’22 (as described here). The sharply higher rates, a taste of which we got today when real rates spiked following news that Powell will be renominated for another 4 years…

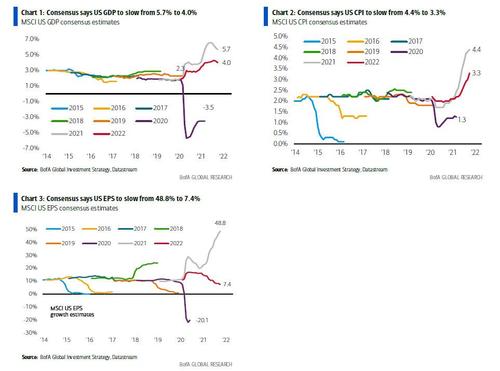

… will tighten financial conditions via Wall St and/or policy action; and since asset prices are driven by rates & profits, with short rates rising in 2022 (as QE ends, threatening to invert the yield curve) and as EPS sharply slow…

… Hartnett expects low/negative and volatile asset returns in ’22 after 18 months of fat returns in crypto, credit & US equities.

Hartnett’s bearish views aside, the strategist admits that BofA economists and strategists predict robust GDP growth with weak China the outlier; and while inflation is predicted to be above consensus like GDP it too should decelerate next 12 months; All this leads to the bank’s house view of 3 Fed rate hikes forecast in ’22 (unlike Morgan Stanley which stubbornly expects no rate hikes in 2022 and with more covid lockdowns on the way, may well be right) with 10-year Treasuries ending the year at 2%; BofA also expects the US dollar & oil to remain well-bid (oil peaks around $117/barrel in Q2), and gold will appreciate.

So with that macro background in mind, here is Hartnett summarizing 2021, or “The Year Behind“…

The Year Behind: ’21 started with an insurrection, ended with inflation, narratives flipped from political “blue waves”, China credit/regulatory crackdowns, institutionalization of cryptocurrencies, US infrastructure, supply-chain disruptions and so on, but 3 dominant investment themes were…

- The Vaccine: number of global vaccinations against COVID-19 surged from 10 million jabs to over 7 billion; this in turn led to a “reopening” of the US & European economies and a surge in corporate profits (e.g. US EPS flipped from -20% in ’20 to 49% in ’21); at the same time the world was unable to say “end of COVID” and summer delta fear and “growth shock” in Aug/Sept engorged the bull via prolonging…

- The Stimulus: policy makers added almost $9tn in policy stimulus this year ($4tn fiscal, $5tn QE) to the $23tn announced in ’20 ($15tn fiscal, $8tn QE); central banks remained exceptionally dovish & behind-the-curve, led by the Fed (see real rates); the vaccine & the stimulus led to…

- The Inflation: excess stimulus/demand clashed with insufficient supply across a wide range of sectors and markets including transportation, energy, goods, services, housing and labor.

2021 in Returns:

- Inflation explains commodities (up 46% for best year since ’73) & government bonds (down 8% for worst year since ’49)…

… as well as outperformance of energy & banks (Table 2).

Excess liquidity helps explain the ascent of cryptocurrencies (a transformative technology).

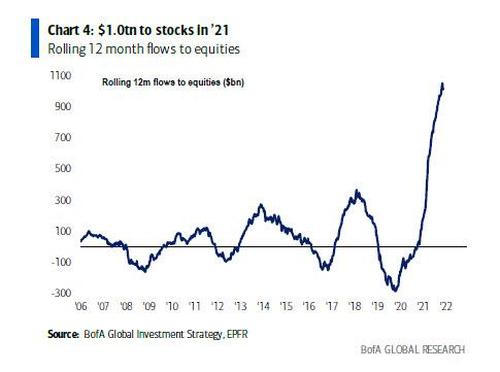

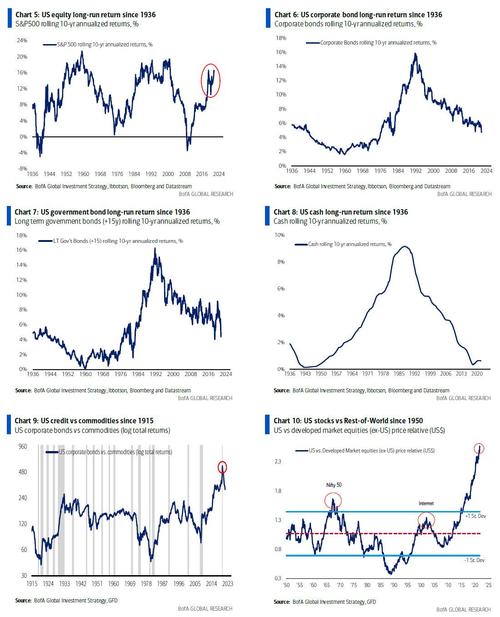

- Dovish central banks & V-shape in EPS explain splendid performance of stocks ($1.0tn of institutional flows to stocks in ’21), particularly US stocks which have outperformed the RoW by most since ’97 (19.8pps); note 10-year rolling outperformance of US stocks vs government bonds widest since 1964 (12.2pps).

China & monetary tightening meant miserable performance of Emerging Markets (LatAm stocks relative to US just hit lowest level since LTCM crisis of 1998).

* * *

Which brings us to 2022: The Year Ahead, and the bank’s three scenarios

Base case…

- 2021-22 investment backdrop similar to early stagflation of late-60s, early-70s…period of inflation & interest rates breaking higher from secular low/stable trading ranges on back of high budget deficits, Vietnam, “Great Society” policies, civil unrest, political & acquiescent Fed; late-60s/70s “stagflation” winners were real assets, real estate, commodities, volatility, cash, EM, all of which held their own vs inflation; losers were bonds, credit, equities, tech, all of which ultimately struggled (see Stagflation Quilt chart below); we think we’re in the ’69-’71 period.

- Hartnett is convinced 2020 was the secular low point on inflation and interest rates; last 2 great inflection points for bond markets were 1966, 1980…2020 watershed driven by social/economic shifts from Wall St to Main St, Deregulation to Intervention, Globalization to Isolationism, Wealth to Health, Capital to Labor…COVID simply the accelerator.

- The CIO also believes that the 2020s will see secular bull markets in volatility & commodities beginning, while the bull market in stocks & credit ending (as shown in secular return charts 5-10); He also expects the US dollar to peak in 2022; note the “permanent portfolio” of 25/25/25/25 of cash, commodities, stocks, bonds appreciated 15.4% annualized in 2021 highlighting an era where greater diversification rewarded also beginning.

- For 2022, Hartnett sees consensus bullishly positioned for another year of “stocks go up, bonds go nowhere, and Fed does nothing.” And indeed, BofA’s Bull & Bear Indicator does not suggest an immediate “short” opportunity but as in 2018 that can change quickly. Here Hartnett is quick to note that asset price sensitivity to central bank liquidity has been extremely high in past decade, and a global tapering has begun (G5 liquidity add was $8.5tn in 2020, $2.1tn in 2021, will be just $0.1 in 2022); meanwhile BofA’s global EPS growth model peaked at 40% in June, it is currently running around 30% and predicts further EPS deceleration to <10% in H1’22. “We are therefore bearish and believe capital preservation will grow as a theme in the year ahead.”

Bull case…

- This one should be self-explanatory: Lowest rates in 5000 years, 1000 rate cuts since Lehman, $32 trillion policy stimulus since COVID ($840 million per hour central bank asset purchases), global stock market cap up $60 trillion in 18 months, GDP >10%, CPI>5%, house prices >20%, largest worker shortages in 50 years…this most unconventional of cycles highly unlikely to follow a conventional path…the-mother-of-all bubbles in crypto & tech remains a “fat tail”.

- More prosaically stock market upside could continue if it becomes clear in H1 that Fed determined to keep real rates deeply negative (expect a market narrative that the Fed can’t “bankrupt” US Treasury), and US monetary policy dictated by a credo of Wall St “too big to fail” (this goes without saying but a “big fall in credit & stocks prices quickest route to recession, civil unrest, institutional crisis and so on“).

Bear case…

- By far the biggest downside risk is Fed stays hawkish even if Wall Street corrects because fears of wage-price spiral grow; in addition a return of bond vigilantes across developed world (they returned in EM in 2021) causes bond & currency volatility.

- Even more extreme downside risks include a crypto-derivatives crash, geopolitical events related to China & Taiwan, and that a receding liquidity wave exposes credit-events to the detriment of private & public equity.

- Not even the bearish Hartnett expects these to materialize (just yet).

Finally, this is how BofA will trade based on these views:

- Macro trades: long US$, MOVE, VIX (tighter financial conditions); long quality, defensives e.g. staples, telco, big pharma (EPS deceleration); long oil, energy (inflation); long real asset (best inflation hedge), short copper/semis (IP lower); short PE/XBD (wider credit spreads).

- Contrarian trades: long GT30 & gold (yield curve inversion/recession); long EM (spring peak in US dollar); long CRE/CMBS (global reopening); long China credit; long small cap value (hedge for US tech bubble); long income streams in commodity markets (dollar debasement); short Nasdaq (rates & regulation).

Tyler Durden

Mon, 11/22/2021 – 19:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com