Yields Slide After Stellar 7Y Auction Sees Highest Directs Since June 2019

After two ugly auctions to start the holiday-shortened week on Monday, when both the 2Y and 5Y auctions tailed badly amid overall poor demand, traders were understandably nervous about the outcome of today’s $59BN sale of 7 year paper: after all, it was the catastrophic 7Y auction back in February that started a cross-asset rout in both bonds and stocks which lasted for weeks and led to billions in losses across various macro investors.

In retrospect, there was no reason to be nervous because moments ago the Treasury announced that the 7Y auction priced at a respectable 1.588%, which while the highest since Dec 2020 as expected, stopped through the When Issued 1.598% by 1 basis point – this was the first stop through since June, and followed four consecutive tailing auctions.

The Bid to Cover was just as solid, rising from 2.245 in Oct to 2.424, the highest since August 2020, and well above the recent average of 2.305.

The internals were a touch weaker with Indirects awarded 59.3%, down from 63.9% in October, and below the six auction average of 60.5%. And with Directs jumping to 23.3%, the highest since June 2019, Dealers were left with 17.43%, which while higher than October’s 16.6% was below the 19.4% average.

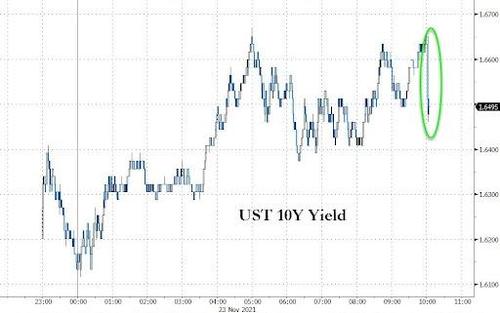

Overall, this was a very solid auction and allowed concerned bond traders who were sweating amid a round of February 2021 deja vu to exhale – the bond crash will not take place today and instead 10Y yields slumped following news of the strong auction. Then again, concerns about the spike in real rates may be enough to lead to quite a few sleepless nights.

Tyler Durden

Tue, 11/23/2021 – 13:19

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com