Stocks Ramped To A Green Close As Oil Soars While Surging Yields Hammer Techs

With gamma unclenched after Friday’s major OpEx, as some $2.4 trillion in gamma expired allowing the S&P to trade away from the massive 4,700 gamma gravity, Tuesday saw more of the same pain for Nasdaq as tech stocks were slammed…

… while the S&P managed to ramp into the green thanks to a last 30 minute ramp driven by energy and other value sectors …

… with the Dow closing near session highs propelled by “old school” sectors such as energy, banks and homebuilders, while tech and small caps got hit for another day.

The opening ramp, momo ignition failed for stonks for the second day in a row…

Nasdaq traders thus far today…. pic.twitter.com/Vcs0cNPvAX

— NOD (@NOD008) November 23, 2021

… driven by a continued ramp in real yields, which in turn has hammered high duration-exposed names, while breakevens continue to sink…

… despite today’s surge in oil which soared as soon as Biden announced a global coordinated SPR which the market has laughed at all day…

…knocking on to many different asset-classes…

Growth Stocks notably underperformed value once again…

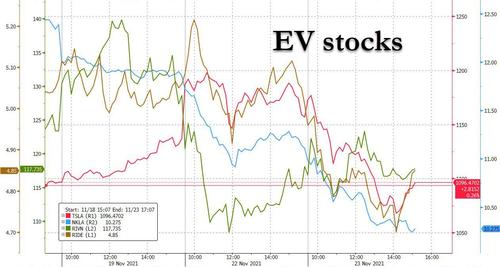

One sector that was hit hard was EV makers: Tesla led electric-vehicle stocks lower, falling as much as 8.1% after climbing for five straight days when it gained 14% in the previous five trading sessions. Other EV stocks also fell, with Nikola down 6.9%, Lordstown Motors -4.2%, ElectraMeccanica -4.1%, Workhorse Group -2% and Rivian -1.6%.

Interestingly, the Nasdaq-Small Caps (Growth/Value) pair has seen a notable regime shift in the last few days relative to real yields…

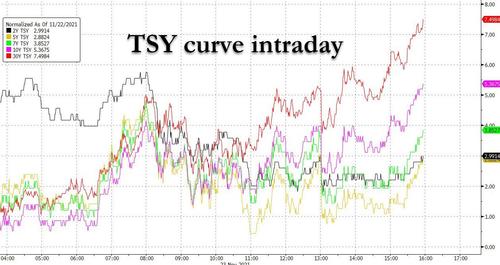

And also Value/Momentum has soared relative to the tight relationship it has had with the TSY yield curve…

Even though STIRs shifted very modestly dovishly today, the market is still pricing a 55% chance for a May 2022 rate-hike and a 95% chance for a June 2022 rate-hike. As a reminder, the odds of the Fed hiking in a mid-term year – no matter how high inflation is or isn’t – are virtually nil, and Powell will not do anything to jeopardize his MMT JV partner at the Treasury – Janet Yellen – even if it means coming up with new inflation definitions.

Treasury yields were mixed today with the short-end outperforming (2Y -2.5bps, 30Y +5bps)…

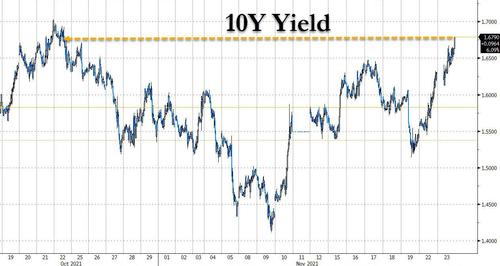

… as 10Y yields

30Y Yields pushed back above 2% today…

The dollar continued its recent rise, pushing up towards the 9/25/20 recent peak…

Cryptos bounced back from yesterday’s ugliness, pushing bitcoin back above $57k…

Ethereum rallied back above $4300 today, as the much-watched 2Y2Y inflation swap rate corrected some of its exuberance…

Gold dropped back below $1800 today…

Finally, the Biden administration was thoroughly embarrassed today after crude prices soared following the much-heralded release from the SPR…

Source: Bloomberg

And most notably, his actions today, sending prices for crude higher, will negate the impact of the drop in crude and wholesale gasoline prices that would bring pump prices lower. Simply put, the president is lying when he talks about retailers gouging – and given his lack of actual business experience, seems to have no idea how the supply chain from crude to gasoline works…

Oh, and remember “this is not, I repeat not, due to our environmental policies.”

Tyler Durden

Tue, 11/23/2021 – 16:03

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com