You Only Die Once As TINA Quietly Leaves The Building

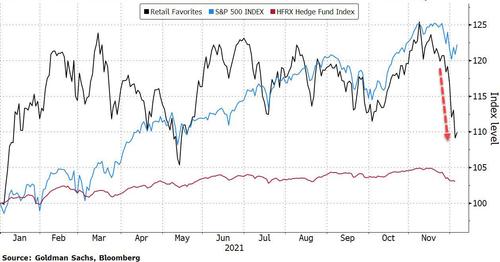

It was about a year ago when we first pointed out a remarkable divergence in this broken market: retail investors (as proxied by the 50 most popular retail-held stocks) were outperforming the smart money by a factor of 10 to 1 (and blowing out the S&P500 in the process).

Is This The End For Hedge Funds: Retail Investors Outperform “Smart Money” Ten-To-One https://t.co/UsGDZKCnIx

— zerohedge (@zerohedge) November 13, 2020

And while retail investors continued to dramatically outperform both the entire hedge fund universe (and to a lesser extent the broader market) for much of the following year, this unprecedented outperformance by stimmy-fueled apes almost came to a screeching halt last week when, as we noted, the universe of retail favorite stocks – mostly low liquidity, low float, high momentum small and mid-cap names as well as a couple of giga-caps such as Apple and Tesla – was on the verge of ending its remarkable streak of steamrolling the rest of the market:

This is getting ugly: at this rate 20-year-old daytraders will soon barely outperform billionaire hedge fund PMs by more than 200% pic.twitter.com/WjcG4Kjh4w

— zerohedge (@zerohedge) December 2, 2021

A few days later, it got even uglier, as the “retail basket” of non-profitable, mostly tech, high momentum names continued to slide following Friday’s rout, sending it to the lowest level since May, and back to levels first seen in Jan 2021. And while retail continue to outperform (modestly) the HFRX hedge fund universe, the 50 favorite retail stocks are now trailing the S&P500 by about 50% on a YTD basis.

Picking up on the recent stretch of miserable retail performance, Bloomberg this morning writes that individual investors “are facing a moment of reckoning” adding that “the obsession with risk-on assets – short-handed by the term YOLO for you only live once – was a blessing for amateur traders during the meme-stock craze.” However, as we first showed last week, it has since turned “into a curse as the going got rough in every nook of the stock market last week.” And when looking at our chart of (last) week, today Bloomberg points out that Goldman’s basket of the 50 most-popular stocks among individual investors plunged 7.8% last week, trailing companies most-favored by mutual funds by 5.8 percentage points, the most ever.

Virtually no momentum name was spared: retail investors incurred several big losses last week, from Plug Power Inc., which plunged 17%, Beyond Meat, which lost 16%, and Tesla which shed 6.2%.

This is a problem because the retail crowd, which was among the first to scoop up shares during the 2020 pandemic rout, now appear to be leaving the YOLO mentality behind because, well, YODO.

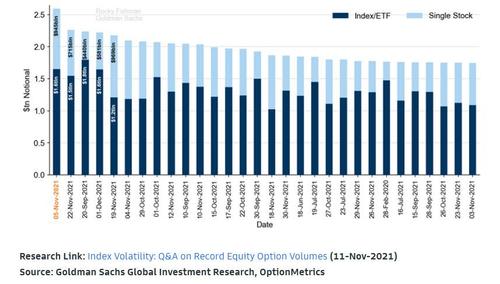

As confirmation, Bloomberg notes that last week, the daily average premium that small-lot traders – those buying or selling 10 options contracts or less – shelled out for protection jumped to about $786 million, surpassing a January peak for the highest level in recent history, according to a Susquehanna analysis of the latest Options Clearing Corp data.

That premium spent on small-lot put buys is about twice as high as where it was two months ago.

“While the small-lot call premiums continue to outpace those put premiums in absolute terms, we can see that they are trending in different directions,” said Chris Jacobson, a strategist at Susquehanna. That’s “suggesting that retail activity on the put side is in fact ramping up alongside the market weakness.”

Of course, a different – and perhaps more correct – way of analyzing the data is that even retail investors are smart enough to hedge their positions during times of surging market vol… like right now. And if stocks tumble, retail investors will have puts to fall back on. As in, you know, hedging – something that hedge funds used to do once but then completely forgot how to do in centrally-planned markets.

Still, with stocks remaining in deep negative gamma territory and market pain showing no end to its weakness, retail traders whose willingness to stand firm amid prior turmoils, are showing little appetite for risk. Evidence is piling up quickly: SPACs are taking a drubbing. Until today, bitcoin was hovering steps away from a 30% correction from its peak. Off-exchange volume has dropped to near the lowest level since last year’s rout. A gauge of newly minted initial public offerings, measured by the Renaissance IPO exchange-traded fund, lost 11% last week.

A separate analysis from Goldman Sachs showed that last Wednesday some $2.2tn in option were traded in the US, with puts dominating amid a frenzy to hedge downside.

“There must be an issue with either 1) meme stocks losing interest, 2) general profit taking into year end,” said Ben Emons, global macro strategist with Medley Global Advisors LLC.”

To this all we can add say is that i) the data, when massaged enough, can show whatever one wants it to – after all, just last week we also showed that contrary to Bloomberg’s, and Susquehana’s analysis, retail investors were in fact buying the dip furiously and waving in everything that hedge funds had to sell. After all, according to Vanda Research, retail stock purchases rose to a new record on Tuesday of $2.2 billion, after reaching $2.1 billion during Friday’s rout.

That said, until we get evidence to the contrary, it’s probably safe to say – as Bloomberg’s Cormac Mullen did – that for U.S. stock investors TINA has left the building. His thoughts below:

It’s time to look for alternatives to America’s outperforming stock market, especially for global investors with a longer-term horizon.

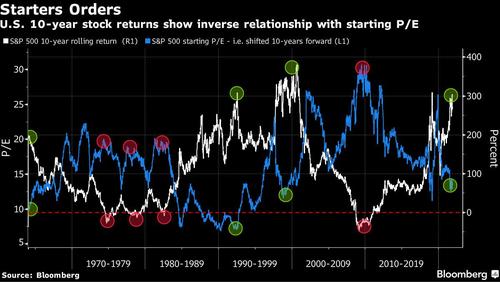

As any good Irishman will tell you when you ask for directions, you shouldn’t really be starting from here. Anyone seeking to put fresh money into U.S. stocks right now will see them already at a record relative to the rest of the world, with margins at an all-time high, trading at their most expensive since the dotcom bubble.

But history shows the best returns for U.S. stock investors come when they buy at more sensible valuations and that they leave themselves open to losses when they pay up. Here’s a look at 10-year rolling returns for the S&P 500 superimposed with the starting P/E at the beginning of the investment period, which shows a strong inverse relationship since the 1960s.

The relative valuation gap between American shares and global peers is also at a record, with the MSCI AC World ex-U.S. Index on less than 14 times forward earnings compared to the MSCI USA Index on 21 times.

Forget TINA, that suggests there are plenty of opportunities in other markets for investors willing to take a chance: from bets on a rebound in China’s beleaguered shares (12 times earnings), to Japan’s economic reopening (14 times) to a contrarian wager on the U.K. (11 times). The French, Dutch, Austrian, Czech and Vietnamese benchmarks are already set to beat the S&P 500 this year — at least in data through Friday — along with over 20 others.

None are without risk, but U.S. stocks face their own country-specific headwinds from the withdrawal of stimulus to the potential for a policy error to the threat of increased regulation of tech firms to mean-reverting margins. All without a decent valuation buffer.

U.S. shares have been a fantastic investment, with a total return of almost 350% over the last decade compared with 100% for their international peers. But the risk/reward looks less favorable for the next 10 years, suggesting it’s time investors take a more serious look at alternatives.

In conclusion, it is safe to say that all bets are off: after all, this morning Gartman called for a bear market sparking a furious market rebound and short squeeze (just as Goldman predicted would happen as the lows for the year are now in)…

Stocks Soar After Gartman Says “A Bear Market Is Required” And “Stocks Are Headed Lower” https://t.co/zegdDGTG0q

— zerohedge (@zerohedge) December 6, 2021

… and should the extremely oversold rally continue tomorrow, wiping out the sour taste of the post Thanksgiving rout, then retail investors may be one surge higher away from taking the S&P to new all time highs.

Tyler Durden

Mon, 12/06/2021 – 22:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com