As Markets Swing Wildly Seeking The Fed Put, Morgan Stanley Has Some Bad News

With markets swinging around like yoyos spun by drunken monkey ever since the bizarro ramp following Powell’s uberhawkish presser, which one day later – as humans took over trading from algos – transformed into an even more furious selloff, investors have coalesced around just one question: how low do stocks have to fall for Powell to capitulate and end his rate hiking plans, or said otherwise, what is the strike price of the Fed put?

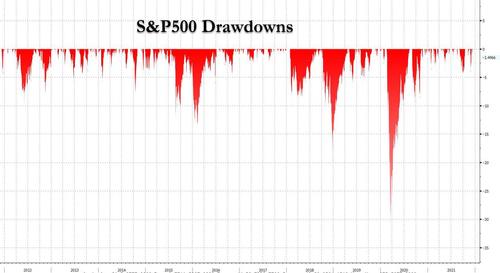

As a reminder, over the past decade, any time markets sold off between 10-15% (and in some cases even less), we would immediately experience some intervention from the Fed – be it verbal or actual – to stabilize risk assets. In fact, the biggest drawdown in the post-Lehman era (until the covid collapse) was the 20% bear market observed on Christmas Eve 2018 which promptly crashed the Fed’s tightening plan.

And, of course, the 30%+ crash in the aftermath of the covid pandemic, is how we got the biggest monetary and fiscal stimulus in world history, ushering in not just helicopter money but also explicitly backstopped markets, when the Fed started buying up corporate bonds.

However, this may all be now over, because as traders search for that magical level in the S&P500 that will force the Fed to cry CTRL-P, Morgan Stanley’s chief equity strategist, Michael Wilson, has some bad news – this time around, the strike price on the Fed’s put is lower. Quite a bit lower.

As Wilson writes in his latest weekly note, which we profiled earlier this week, in “Morgan Stanley Warns The Fed’s Turbo Taper Will Trigger Market Chaos Over “The Next 3-4 Months“, Wilson writes that while his base case always assumed the Fed would respond appropriately to the higher inflation, the pivot by Chair Powell at his recent Congressional testimony was more aggressive than what Morgan Stanley had expected, especially in light of the new Covid variant, which at the time was a known unknown.

And with Omicron now looking like a lower risk to growth than 2 weeks ago – despite the media’s best efforts to spark another round of global panic – this only raises the probability that the Fed will indeed taper its asset purchases much faster than the last tapering episode in 2014, something Powell confirmed on Wednesday when he revealed that the Fed’s latest dots expect some 3 rate hikes in 2022.

But while the pace of the Powell taper may change, where there is a notable difference from previous Fed is that, according to Wilson, Fed Chair Powell “will be under much less pressure from the White House versus the last time they tried to take the punch bowl away in late 2018.”

Part of this is due to the fact that inflation is a much bigger problem today for Biden than it was in 2018 – see “Biden Starts To Freak Out About Soaring Inflation” – and part of it is due to Wilson’s observation that this White House is not as preoccupied with the stock market.

Bottom line, according to Morgan Stanley, “the Fed put still exists but the strike price is much lower now, in our view. If we had to guess, it’s down 20% rather than down 10% unless credit markets or economic data really start to wobble.“

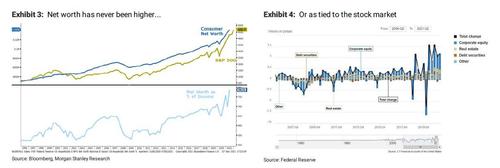

And while Wilson may well be right that for Biden containing soaring inflation is more important than preserving the wealth effect – because we have reached a point where the two are mutually exclusive – sacrificing markets to contain inflation could be a huge mistake. Why? Because as Wilson also observes, if asset markets correct more significantly – as they would in a 20% correction – “it could have a greater than normal effect on the economy too given how levered the consumer is to the stock market and other asset prices like housing and crypto currencies.”

As he then notes, when just considering the stock market, it’s easy to see that consumer net worth has increased dramatically as many key assets have risen inexorably over the past 18 months: “While this is a good thing for consumer demand if prices remain elevated, it definitely increases the odds that tapering could be tightening for the economy, too, if it leads to a significant asset price deflation. We think the risk of that is greatest over the next 3-4 months as the Fed exits QE on this faster time table.”

Tyler Durden

Fri, 12/17/2021 – 12:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com