Albert Edwards’ 2022 Outlook: Four Big Surprises… And Lots Of Pain

One month ago, just after all the Wall Street banks come out with glowing year-ahead outlooks and market forecasts, we observed a funny irony: the arrival of a new covid strain threw everyone in for a loop, one which would only get much worse a few weeks later when Biden’s Build Back Better stimulus collapsed.

Just days after all the banks sent out their cheerful 2022 Economic outlook pieces, everything goes to hell.

— zerohedge (@zerohedge) November 19, 2021

Since then things been a little embarrassing for the likes of Goldman (and most of its peers) which promptly slashed its GDP forecast over the weekend to just 2.0% from 3.0% and from much higher earlier in the year.

However, one strategist who isn’t concerned about how to revise his 2022 outlook, is SocGen’s in-house bear, Albert Edwards for the simple reason that he sees nothing but pain in the coming year.

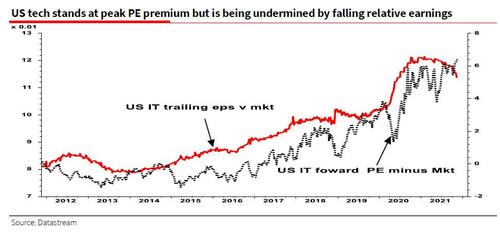

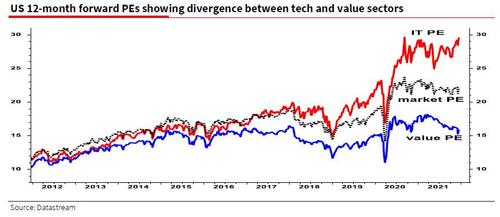

As a reminder, two weeks ago Albert penned a rather doomsday forecast about the future of the market-leading “generals”, the FAAMGs, or as they are better known now, the GAMMA stocks, warning that despite the sharply declining EPS of the broader IT sector, the FAANGs continue to trade at a “nosebleed PE valuation at 30x which looks vulnerable vs the market’s 22x – the widest gap since the Nasdaq bubble.” This is happening just as forward IT PEs are starting to rerate lower.

Fast forward to this week when Albert summarizes the current market state as follows: “as we end the year, markets are becoming increasingly nervous that US equities – and the US tech sector specifically – are having the rug pulled out from under them. Market internals are also giving out loud warnings. Just as in 2001, could the unraveling of the recent tech bubble trigger the Vortex of Debility that destroys all before it?“

Picking up on his recent warning, Edwards writes that the US tech sector that has so dominated this bull market in one form (the IT sector) or another (the FAANGs) “seems to be pretty invulnerable in the face of some of the major threats it is now facing. But we have seen a similar Vortex of Debility before, most recently just ahead of the Lehman bankruptcy and written up here by Paul Murphy at the FT.”

How does that play into the SocGen strategist’s year-ahead outlook?

Well, as he notes “it’s the time of year when strategists publish huge tomes to give their year-ahead views” but, he adds, “readers will be relieved to know that I can summarize my 2022 outlook in a few lines” and four surprises.

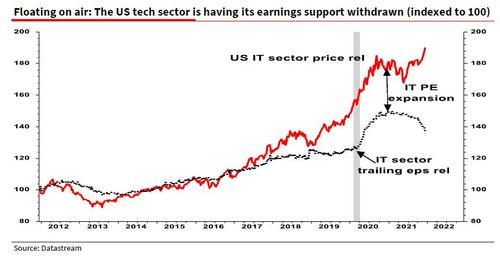

As the first “big surprise” of the coming year, Edwards expects that equity markets will startle most investors when they “fall sharply as US tech unravels in the first half.” Presenting a slightly different chart from the one he showed two weeks ago, Edwards then addresses the elephant in the room, namely the FAAMGs again, and writes that “unsupported by earnings growth (see chart below) and with poor market breadth (see inside), it may not be higher bond yields that burst this tech bubble.”

Edwards then echoes what Morgan Stanley’s Mike Wilson said last week, and lays out what he believes will be the “second surprise” for next year: if an all-out equity bear market unfolds, “investors will find that while the Powell Put still exists, the strike price may be a lot lower for equities than it was at end 2018.” This is almost a carbon copy of what Wilson said last week when he predicted that “the Fed put still exists but the strike price is much lower now, in our view. If we had to guess, it’s down 20% rather than down 10% unless credit markets or economic data really start to wobble.”

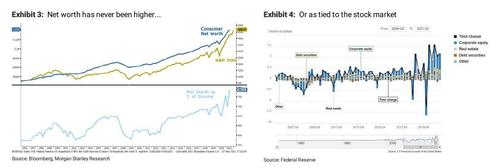

Why? Because as Edwards explains, “policymakers globally now understand that QE creates as many problems (mainly distributional) as it solves, and that fiscal policy must do more of the stimulus work.” He then asks a rhetorical question: “Would the Fed really hold back if the S&P was down 30% plus? And wouldn’t that be one huge surprise for investors?.” Here we disagree with Edwards: it is our view is that no matter what, the Fed will always panic when stocks are down 15-20% – after all so much of the US wealth effect and household net worth is now tied into stocks, that Powell will not dare risk an all out collapse…

… but maybe this time is truly different.

His “third surprise” may be, well, the most surprising – Edwards expects that easing supply bottlenecks combine with soggy commodity prices to drive US headline CPI inflation back well below 2% (this is also the inventory glut thesis floated by Morgan Stanley and Deutsche Bank). Hence, the SocGen skeptic expects “current inflation fears to evaporate as H1 unfolds and bond yields to decline sharply.”

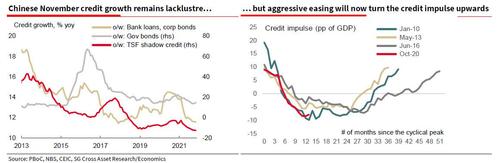

The “fourth and final surprise” will come out of China, where after continued growth disappointments in the face of tight money (that has helped weaken industrial commodity prices in H2 2021), Beijing will be forced to launch a Powell-like policy pivot (we have already seen the early signs of this in the past few weeks) and the Chinese monetary floodgates are re-opened – including a burst in China’s credit impulse and rapid renminbi devaluation .

* * *

Digging a bit deeper into these four key forecasts/surprises, and starting with the pivotal role that the giga-tech stocks will play, Edwards repeats what he said two weeks ago, and notes that as “we move into next year the US tech sector (and also the FAANGs) could hold the key for markets.” Unlike any other major equity market, the S&P is dominated by these stocks and if they go belly up, inevitably so too does the whole market. As the “floating on air” chart above shows, while until recently there had been a supportive underlying earnings story, now the sector has become reliant on massive multiple expansion relative to the rest of the market (also see chart below).

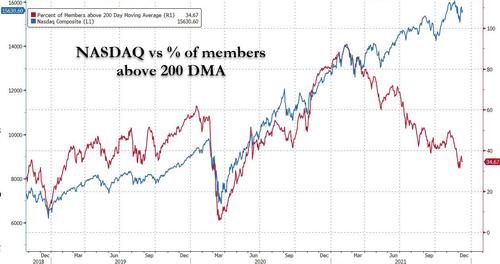

Edwards then points out something we noted last week when we showed that barely 40% of the Nasdaq’s 3000 stocks are trading above their 200-DMA (a catastrophic breadth which prompted even the traditionally cheerful Goldman Sachs to issue a warning that this is unsustainable)…

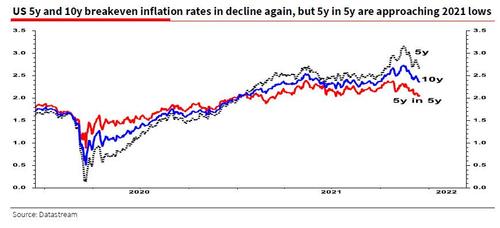

… and leads him to conclude that “the sickly aroma of fear is beginning to invade the nostrils of investors. Certainly, this may be one explanation why real yields remain so low and why implied 5y inflation expectations in 5 years have begun to slide to 2021 lows – all but ignoring the recent very high CPI data.”

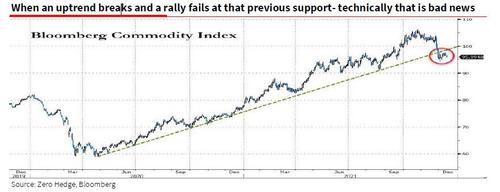

There is another reason why Edwards believes that we may soon look fondly upon the days of soaring inflation: pointing to one of our own recent charts, the SocGen strategist writes that “the Fed’s newfound hawkishness (as they admit that maybe higher inflation is not so transitory after all) is underpinning a buoyant dollar. This together with the tightness of the China Credit impulse this year has taken the shine off commodities. Zero Hedge notes that an important uptrend has now been breached which may in itself trigger even lower prices.”

There is, however, a glimmer of hope: China. Whereas China’s credit impulse had been sliding for much of the year (as we warned exactly one year ago), it has now officially bottomed and posted its first uptick in 8 months. From here, it will only go higher thanks to the recent burst of stimulus being unleashed by Beijing in the coming months.

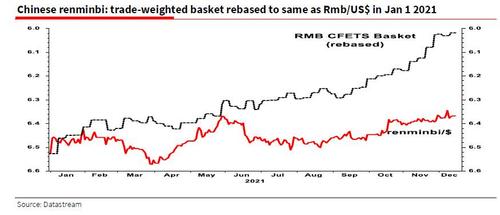

Edwards then shares a second “shocking chart”, and this has to do with the soaring Chinese yuan, and Edwards prediction that it is now far too strong and will lead to devaluation one way or another: “we all know that the renminbi has been pari-passu against a robust US dollar, but the officially targeted trade-weighted renminbi is through the roof this year and stands at an equivalent Rmb6.00/$. At a time when Chinese credit conditions are too tight, this is simply intolerable. Despite Chinese exports remaining robust, investors should be on the alert for a 2015-like surprise renminbi devaluation.“

Edwards then spends some time looking at what shadow fed funds rate the Fed’s hiking cycle will conclude (details in his full note inside, available to professional subs) before concluding dramatically that “we are transitioning away from The Ice Age (due primarily to turbo-charged fiscal policy), and ultimately short and long rates will exceed the peak of the previous cycle” but in the near-term, “the Fed may inadvertently burst the Nasdaq bubble pretty soon with just a few taps of their foot on the brake (or less gas).”

And just as the last recession surprised by being one of the shortest in history, maybe the fifth, and biggest surprise of 2022, will be that this expansion could yet end up as one of the shortest ever, forcing the Fed to revert to easing mode (lower rates, more QE, NIRP, etc) in just a few months…

Tyler Durden

Wed, 12/22/2021 – 20:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com