Erdogan Files Criminal Complaints Against Economists Criticizing His Insane Lira “Rescue” Plan

Last week, when we explained “How Erdogan Launched His Lira “Rescue” Plan, And Why It Spells Doom For Turkey“, we quoted several former Turkish central bank officials spoke in surprisingly critical terms of Erdogan’s ridiculous “lira bailout” plan which merely kicks back the moment of terminal collapse of the Turkish economy, and whose boldness we were afraid would be promptly punished by the increasingly deranged authoritarian ruler and head of NATO’s second largest standing military force (after the US).

We were right, and this morning Turkey’s BDDK banking watchdog filed a criminal complaint against five people, including the former central bank governor, over comments which it said violated banking regulations with their critical commentary on the FX-protected lira deposit tool, in other words, were a simple criticism of Erdogan’s recent hare-brained attempt to delay economic collapse until he is re-elected.

The complaint targets Durmus Yilmaz, a former central bankers, economist Guldem Atabay, opposition lawmaker Burhanettin Bulut and TV commentators Emin Capa and Selcuk Gecer, the regulator said on Monday.

As Reuters adds, the regulation they are accused of violating concerns the spreading via public channels of “unfounded claims that can harm or tarnish the reputation of a bank”.

Speaking on Halk TV on Dec. 20, Yilmaz, who’s now an opposition lawmaker, said the advance of the Turkish currency that night presented a “buying opportunity.” Erdogan slammed the former governor for committing the crime of “manipulation in financial markets” and warned that manipulators “will pay the price.” Speaking on Friday, he said “the banking regulator took the necessary steps.”

Economist Atabay rejected the accusations in comments by phone on Monday. “I don’t think I’ve crossed any lines,” she said. “I will wage a legal fight and meanwhile will continue to do my job.”

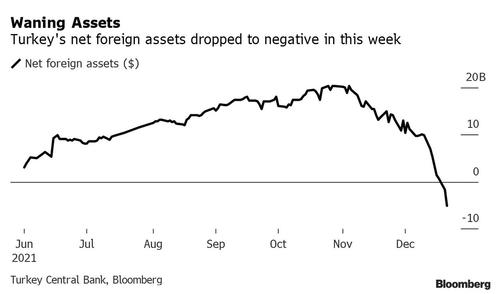

Meanwhile, after surging from its record low last week, which as we learned was catalyzed by the central bank secretly spending tens of billions of dollars to halt the plunge with money it doesn’t have (see “Erdogan Is Secretly Pillaging Billions In Turkish Assets To Prop Up The Lira, And His Rule“)…

… overnight Turkey’s lira finally snapped again, challenging government assurances that it’s on a more stable footing after measures were introduced a week ago to stem its collapse.

The currency slipped 6% to 11.32 per dollar after trading as weak as 11.5831 earlier. The decline took the lira’s drop this year to more than 34%, the sharpest depreciation of any emerging-market currency during 2021.

Monday’s retreat came after President Recep Tayyip Erdogan said Friday that the lira will stabilize “gradually” after measures were brought in to shore up the beleaguered currency, including a new tool to shield lira-deposit holders. Central bank data also suggest authorities have been intervening in foreign-exchange markets. The moves drove the currency to a 54% gain last week, reversing a 15% loss the previous week.

“If the central bank’s possible sales of foreign currency diminish, an upward movement in the dollar-lira exchange rate may occur again,” Ibrahim Aksoy, the chief economist at HSBC Holdings Plc in Istanbul, said in a note to investors, clearly terrified that he will be sequestered, arrested and shipped away to some unknown Turkish province never to be heard from again. Because as today’s event make it quite clear, in Turkey if you dare to speak out against what is now sheer economic insanity, you will most likely be disappeared.

Tyler Durden

Mon, 12/27/2021 – 09:35

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com