A New Conundrum Emerges: Why Is The US Dollar Falling On “Good” News

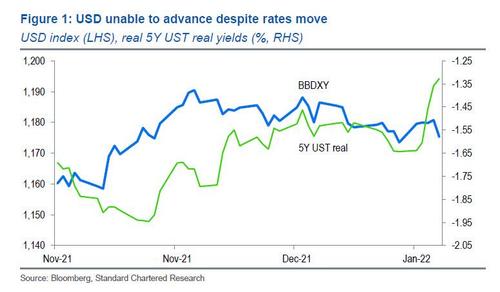

Ignore the bond market conundrum (where back-end Treasuries are sticky and refuse to rise more than the front-end, or even in parallel): a bigger conundrum is emerging in the FX realm where the US dollar has been declining steadily since peaking in late November despite the Fed’s growing conviction in more rate hikes, a balance sheet runoff and general tightening.

Indeed, overnight Standard Chartered FX strategist Steve Englander writes that he is “struck by the USD’s inability to gain ground in recent weeks on developments that are usually USD-positive.”

While Englander notes that he had expected USD weakness to become more pronounced as 2022 progressed, he also observes that the recent weakness – as both real and nominal TSY rates are rising and equities are struggling – is puzzling (we disagree as it may simply reflect the coming recession into which the Fed is tightening, more on that in a subsequent post).

In any case, with the dollar downtrend firmly established, Englander believes that the USD’s lack of response to interest rate moves that should be USD-positive could signal that the positive news is priced in. Here we would also add that it could also signal that the dollar is merely pricing in the coming economic slowdown and/or stagflation. And indeed, recent messaging from San Francisco Fed President Daly and St. Louis Fed President Bullard expressing a preference for a flatter fed funds path combined with faster balance-sheet reduction may suggest that the Fed still wants to balance policy normalization, slowing inflation AND firm growth.

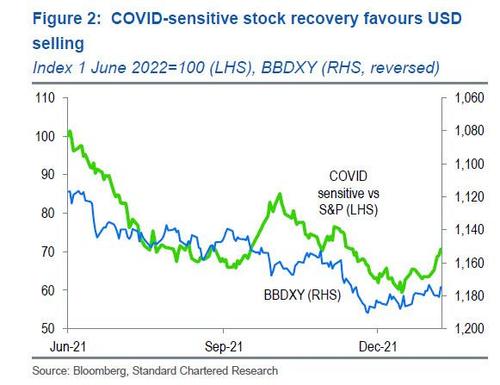

Of course, there are obvious reasons why the USD should be declining: one clear USD negative is the market’s increasing confidence that COVID will fade. Englander’s index of COVID-sensitive stocks versus the S&P has regained almost all the territory lost since Omicron hit the headlines.

Indeed, rising COVID fears had been a consistent plus for the USD and the unwinding of the Omicron leg of these fears is a USD headwind, and COVID-sensitive stocks are much cheaper versus the S&P than they were earlier this year.

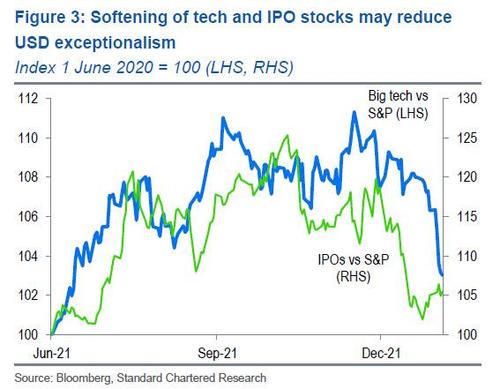

There is another equity-based explanation that may explain at least some of the recent dollar weakness: as the Std Chartered FX strategist notes, the recent sharp underperformance of big-tech and IPOs stocks versus the S&P is also of interest, as it may be removing one of the factors that make US asset markets ‘exceptional’ – unwinding support for USD.

US equities have underperformed global peers by c.3% in the last two weeks, following a 21% outperformance over the course of 2021. The turnaround in relative equity performance between the US and the rest of the world has coincided with a reversal of USD performance.

To be sure, portfolio flows driven by US asset outperformance have driven at least some of the USD gains over the past year, despite a widening US current account deficit and low US real yields. The danger now is that the USD could lose this flow support If rising US yields weigh on the long-duration growth/technology stocks, which have been a key driver of US equity outperformance.

Of course, this brings up a mirror-image question: is a weaker USD actually needed to attract foreign buying?

It goes without saying that rising expectations that the Fed’s balance sheet will start shrinking very soon after the first Fed policy rate hike is also weighing on the USD, or at least partly offsetting the impact of higher yields. It seems likely that as the Fed shrinks its holdings, the US Treasury will issue at shorter maturities. As Englander notes, if more UST paper is released into the market at the short end as a result of the bill and note runoff, USD weakness may be required to induce foreigner investors to add to their holdings, particularly of short-term assets with still-low yields.

Looking ahead there are other reasons why the USD will continue sliding despite the Fed’s unprecedented (at least rhetorically) urgency to tighten financial conditions.

As part of its base case, Standard Chartered expects the Fed to pause after hiking rates twice in H1, but even if inflation proves to be more persistent, Englander sees risk that peer central banks, particularly the ECB, will accelerate their policy normalization plans; this could weigh on the dollar via narrowing yield differentials. The 10Y German breakeven is up c.90bps since the start of 2021 (less than the c.50bps rise in the 10Y US breakeven). Still, the 10Y Bund yield is up only c.50bps, sending real yields c.40bps lower (in contrast, the 10Y UST yield is up c.90bps, with the real yield up c.40bps).

This suggests that the market belief’s in prolonged ECB accommodation could be tested by persistent inflation. The 35bps rise in 10Y Bund yields in the last three weeks (with the real yield rising c.25bps) is worth watching in this context. Even with this expectation that accommodation will last, the 40bps increase in money-market rates between the 1st and 5th Euribor contracts is the steepest since 2011.

Of course, with some institutions wary of receiving negative interest rates, an anticipated euro-area exit from negative rates could lead to portfolio investment in the EUR. However, with the ECB pushing back against expectations of any move towards normalization, investors will likely want to wait for a more concrete signal that normalization is coming. This may happen later in 2022 or more likely in 2023 (if ever). Until then, the EUR will be a somewhat low-beta beneficiary of USD weakness.

* * *

Putting it all together, Englander’s USD-bearish view implies that commodity currencies will regain their lost ground and more. AUD is about 3.25% weaker than before the onslaught of US inflation and Omicron worries in mid-November, and CAD is about 1.6% weaker.

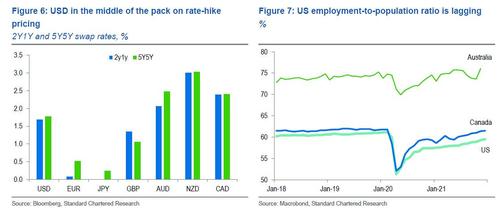

Based on current market pricing, the USD lies in the middle of the pack on rate-hike expectations. Rate differentials remain favorable for the likes of AUD, NZD and CAD, where the market is pricing faster and longer rate-hiking cycles. Expected commodity currency short-term rates have kept up with moves in the US in part because their labor markets have recovered more fully – Canada and Australia have closed the gap in their employment-to-population ratios versus pre-COVID levels, while the US has not. So the commodity currency central banks are likely to be less ambivalent on normalizing rates than the Fed, with its employment mandate and its added commitment to reduce the dispersion of labour-market outcomes.

In terms of long-term valuations, AUD is among the cheapest G10 currencies, and looks undervalued relative to its terms of trade and yield differentials. By contrast, GBP is the strongest G10 currency against the USD since 8 November, and CHF is the second-strongest. CHF could lag if risk appetite returns. JPY should continue to underperform on prolonged BoJ policy accommodation, although risk-off sentiment poses appreciation risk.

Tyler Durden

Tue, 01/11/2022 – 13:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com