“The Growing Risk Is That Inflation Will Land Closer To 3%” – Here Is The Heatmap From Today’s Red-Hot CPI Report

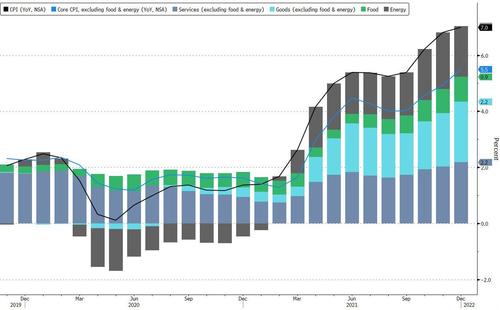

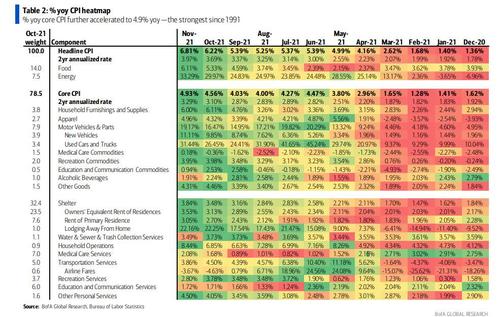

For all the ideologically and politically-biased rhetoric on both sides of the argument, in December consumer inflation continued to surge in line with consensus expectations. The core CPI rose by 0.55% mom, which boosted the yoy rate to 5.45% from 4.93%— the highest since 1991. Headline CPI was up 0.47% mom as energy prices dropped by 0.4% mom and food rose 0.5% mom. Headline % yoy increased to 7.04% from 6.81%—the highest since the summer of 1982 when ET dominated the box office.

Some more details from BofA’s Aditya Bhave: core goods were up 0.9% mom and 10.7% yoy.

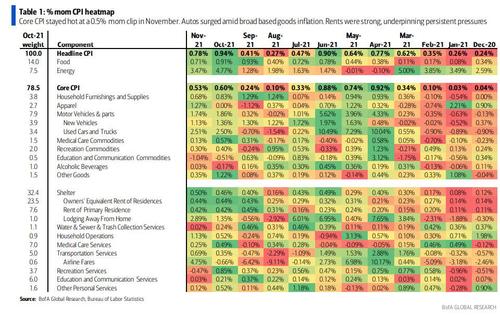

Once more the largest contribution (15bp) was from used cars, which surged 3.5% mom, in line with the Manheim used car index.

Supply issues continue in the auto sector, and as BofA notes, wholesale prices suggest further upside in used car prices in the months ahead. Outside of autos, core goods components broadly gained as apparel jumped another 1.7% and household furnishings/supplies rose 1.3% mom. Meanwhile education/communication commodities slipped for the third consecutive month, this time by 0.4%. According to BofA, the breadth of gains in goods reflects both global supply chain disruptions and the pull-forward in the holiday shopping season, which meant earlier discounting in October.

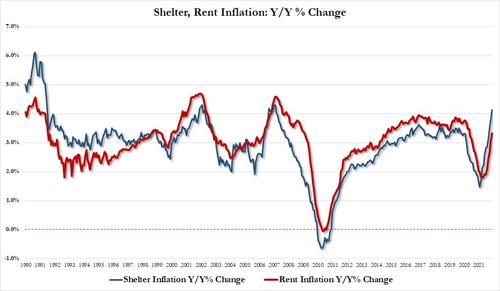

Of course, the surge in inflation is not just due to Covid and other distortions. There is a strong underlying cyclical pickup in prices as well, which is most evident in OER and rent of primary residence: Both series increased 0.4% mom for the fourth consecutive month.

Travel components were also very strong despite the winter Covid surge. Lodging rose by 1.2% mom and airline fares soared 2.7% mom. Given the timing of the Omicron wave, however, its impact might be reflected more strongly in January prices. Broader transportation services fell by 0.3% mom. This was a smaller drop than expected given unfavorable seasonal factors. Outside of that, services components were mixed. Recreation fell -0.1% mom, education / communication was up 0.1% mom and other personal services popped 0.7% mom. Medical care services grew 0.3% mom.

Overall, BofA says that the breadth of the inflation supports the bank’s call for four Fed hikes this year, along with the start of quantitative tightening (a move which we counter will tip the US into recession on short notice and force the Fed to launch a fresh wave of much more aggressive easing shortly thereafter). And while core inflation is likely to peak in March 2022, after which the yoy comparisons will turn highly unfavorable, but the key question is where core inflation lands in the medium term. And increasingly the risks are that it will land closer to 3% than the Fed’s 2% target.

In kneejerk response, the rates market generally looked through the close to consensus print. The nominal curve flattened slightly, inflation breakevens were 2-3 bps lower and real rates 1-2 bps higher. The modest declines in inflation breakevens across much of the curve suggest that the persistent components of the print may not have been as strong as feared, though overall the print still endorses a sooner and more aggressive Fed policy response.

Finally, here is a heatmap of today’s inflation data, first on a M/M basis…

… and here it is compared to a year ago.

Tyler Durden

Wed, 01/12/2022 – 11:46

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com