Futures Tumble As Global Bond Yields Surge

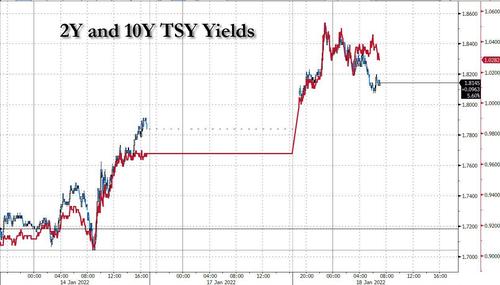

Yesterday when US stock markets were closed but both bond and equity futures were trading, we pointed out that 10Y Treasury futures implied a yield of over 1.80%, a number which was the highest in years and which we warned would cause headaches for stock traders when the US reopened fully on Tuesday. And sure enough, with 10Y yields surging as high as 1.8536% overnight and 2Y yields jumping to 1.05% (up a whopping 15bps from 0.90% last Friday)…

…. futures are getting hammered this morning, with emini S&P futures down 48 points or over 1% and just above 4,600, while Nasdaq futures were getting hammered again, sliding 1.62% or 254 points. The dollar rose and Brent oil touched $88/bbl, the highest price since 2014.

Global stocks have had a turbulent start to the year as investors shift out of more expensive and rates-sensitive sectors such as technology into cheaper, so-called value shares. Market participants are now waiting for the earnings season to gauge whether companies can continue delivering robust profits despite higher costs and challenges from omicron.

“With rates biased higher over the coming months, investors should be prepared for parts of the tech sector to again be challenged,” Seema Shah, chief strategist at Principal Global Investors, wrote in a note to investors. “Although rising bond yields are challenging the entire tech sector, investors must distinguish between profitless names that are a long way from demonstrating healthy earning power and mega-cap tech firms that can defend their margins.”

Fed rate hikes are in focus as premium builds in front-end yields – the move was driven by lots of jawboning after last week JPM’s Dimon flagged potential for 7 Fed rate increases, while over the weekend billionaire investor Ackman said U.S. central bank is losing inflation battle and needs to raise 50bps in March to “restore its credibility.”

Intel Corp., Apple Inc. and Tesla Inc. were among the biggest declines in U.S. premarket trading. Bank of America Corp.’s January global fund manager survey showed that net allocation to the tech sector fell 20% month-over-month to 1%, the lowest since 2008, though they expect inflation to fall this year and are placing record bets on a boom in both commodities and stocks overall. Other notable premarket movers:

- Apple (AAPL US) -1.9%, shrugging off a PT raise at Deutsche Bank; Tesla (TSLA US) -3.2%, Microsoft (MSFT US) -2.2%.

- Snowflake (SNOW US) raised to outperform at William Blair following the software solutions provider’s better than expected growth in 2021 and a pullback in the stock. Shares down 0.9% in premarket.

- Amazon.com (AMZN US) has made a last-minute reversal to its plan to ban the use of Visa’s credit cards issued in the U.K. Shares down 2% in premarket.

- Under Armour (UAA US) “represents a healthy brand thrown out with the industry bath water,” with recent selloff making the company’s risk/reward “particularly compelling,” BMO says, upgrading to outperform. Shares up 0.7% in premarket.

Tech also led the retreat in Europe, where equities traded poorly with most indexes close to, or through last Friday’s lows. Euro Stoxx 50 drops as much as 1.6%, FTSE 100 and IBEX fare marginally better. Weakness is most pronounced in tech and travel stocks with only energy and telecoms holding in the green.

In rates, as noted above, Treasuries slumped across the curve in bear-flattening moves as traders intensified bets the Fed will hike early and often. The largest moves were in the short end where two-year yields soared above 1% for the first time since 2020 on increased speculation of a Federal Reserve rate hike in March.

Treasury yields gapped higher led by front end when trading resumed after Monday’s US holiday as Fed rate-hike expectations went into overdrive. Swaps fully price in an initial hike in March and a total of four this year. Treasury two-year yield climb 7bps to 1.04%, touches 1.06%, adding to Friday’s 7bp jump. Two-year hits 1.06%, and 10-year reaches 1.85% — both are highest seen since before pandemic struck. Though off session highs, yields remained cheaper by more than 6bp in 2-year sector, which reached 1.056% during Asia session, flattening 2s10s curve by 3bp on the day; 10-year yields around 1.82%, cheaper by 3.6bp with comparable bunds and gilts outperforming by 2.5bp to 3bp. Bear-flattening Treasuries move briefly pushed 5s30s spread under 50bp, flattest since March 2020; it remains tighter by ~4bp on the day at ~52bp.

Australia’s 3-year bond yield climbed to the highest since April 2019 as investors forecast global tightening moves to force the RBA to abandon its plans to hold record-low rates until at least 2023. German 10Y Bunds rose as high as -0.005%. Gilts yields add 1-1.5bps across the curve with 10y yields trading either side of 1.20%. 10y Italy underperforms peripheral peers, widening ~2bps to Germany.

In FX, the Bloomberg Dollar Spot Index rose as the dollar was higher or steady against all of its Group-of-10 peers; Scandinavian and Antipodean currencies were the worst performers while the Canadian dollar held up against the greenback amid a continued rise in oil prices. The euro gravitated toward $1.1380, a key technical area. The pound weakened on the back of a broadly stronger dollar, with focus on inflation figures due Wednesday. Britain’s labor market grew strongly despite a surge in coronavirus infections late last year. Further pound gains aren’t that straightforward for options traders. Ten-year gilt yields are flirting with their highest level since before the pandemic ahead of a seven-year sale. The yen recovered from an Asia session loss after Bank of Japan Governor Haruhiko Kuroda looked to quash speculation that the phasing out of stimulus is anywhere near the horizon.

In commodities, Brent oil surged to the highest level in seven years, underscoring the inflation challenge facing the Federal Reserve. Easing concerns about the impact of the omicron virus strain on demand, together with shrinking inventories and geopolitical risks are contributing to Goldman forcasting a $105 per barrel crude price in 2023. With US traders walking to their desks, crude futures are in the green but off session highs. WTI gains over 1.5%, holding above $85, Brent gains stall near $88. Spot gold drifts ~$8 lower near $1,810/oz. Most base metals trade well: LME tin adds over 2.5% to a record high. LME lead and copper are in the red

Looking at the day ahead now, and data releases include UK unemployment for November, the ZEW Survey from Germany for January, whilst in the US there’s the Empire State manufacturing survey for January and the NAHB’s housing market index. Central bank speakers include the ECB’s Villeroy and earnings releases include Goldman Sachs and BNY Mellon.

Market Snapshot

- S&P 500 futures down 1.2% to 4,597.00

- STOXX Europe 600 down 1.3% to 478.04

- MXAP down 0.6% to 193.63

- MXAPJ down 0.7% to 632.44

- Nikkei down 0.3% to 28,257.25

- Topix down 0.4% to 1,978.38

- Hang Seng Index down 0.4% to 24,112.78

- Shanghai Composite up 0.8% to 3,569.91

- Sensex down 0.8% to 60,816.76

- Australia S&P/ASX 200 down 0.1% to 7,408.78

- Kospi down 0.9% to 2,864.24

- Brent Futures up 1.3% to $87.61/bbl

- Gold spot down 0.4% to $1,811.82

- U.S. Dollar Index little changed at 95.35

- German 10Y yield little changed at -0.01%

- Euro down 0.1% to $1.1395

Top Overnight News from Bloomberg

- Brent oil surged to the highest level in seven years as physical markets run hot in the world’s largest consuming region and Goldman Sachs Group Inc. said prices are headed for $100 a barrel

- If the Bank of England pulls the trigger and raises interest rates to 0.5% next month, that would be the first back- to-back hikes since 2004. It also opens the door for the BOE to start reducing its record balance sheet

- Some investors call for more frequent remit revisions from the U.K.’s Debt Management Office amid widespread support for more short and inflation- linked issuance

- Chinese President Xi Jinping called on nations to secure global supply chains and prevent inflation shocks, as the leader of the world’s No.2 economy seeks a smooth path to clinching a precedent-defying third term in power

- The Chinese property market expectation has been improving steadily as property sales, land purchases and financing gradually return to normal recently after efforts from various sides, Zou Lan, head of PBOC’s financial market department, says at a briefing

- China will aim to keep the yuan exchange rate stable, and market and policy factors will help correct any short-term deviation from its equilibrium level, a senior central bank official said

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with early optimism in the region soured by a resumption of the surge in US yields as trade got underway from the US holiday. US equity futures resumed trade flat but thereafter experienced pressure with the NQ (-1.8%) the laggard as US yields surged, with the 10yr cash yield briefly topping 1.85%. European equity futures were also softer overnight but to a lesser extent. In APAC, the ASX 200 (-0.1%) was initially kept afloat by strength in tech and the mining sectors with the latter unfazed by Rio Tinto’s weaker quarterly iron production and shipment numbers as the mining heavyweight’s FY22 guidance was relatively in line with forecasts, although the gains were later faded amid losses in the top-weighted financials sector and a rise in US yields to their highest in two years. The Nikkei 225 (-0.3%) benefitted early on from the recent JPY weakness and after the BoJ policy announcement in which it maintained policy settings as expected and reaffirmed its dovish stance. The central bank reiterated that it will take more action without hesitation if needed and that it expects rates to remain at current or lower levels, which was at a contrast to a prior source report that suggested debate among policymakers on how soon a rate increase can be signalled, although the Japanese benchmark later slipped into the red as the spotlight turned to the higher US yields. The Hang Seng (-0.4%) and Shanghai Comp. (+0.8%) were mixed with outperformance in the mainland following the PBoC’s liquidity efforts and with many anticipating further policy action from China. This helped the mainland shrug off the early indecision brought on by ongoing developer headwinds and virus concerns that have prompted China’s decision to refrain from selling Beijing Winter Olympics tickets to the general public amid the COVID-19 outbreak. Finally, 10yr JGBs were initially kept afloat with mild support heading into the BoJ policy announcement where the central bank maintained it policy settings and reiterated its intentions to sustain powerful monetary easing, although JGBs then retreated in tandem with the pressure in T-note futures as US yields resumed their advances to the highest levels since January 2020 which saw yields in the belly up by around 10bps and the 10yr yield briefly rose above 1.85%.

Top Asian News

- Bank Indonesia Names New Monetary Policy Head

- Tokyo Area Faces Three-Week Covid Quasi-Emergency, NHK Says

- DaFa Properties Failed to Pay 9.95% Senior Notes Due Jan. 2022

- China Diplomat Calls U.S. Omicron Surge ‘Greatly Out of Control’

Major European bourses are firmly in negative territory (Euro Stoxx 50 -1.5%; Stoxx 600 -1.2%) as sentiment was hit amid surging bond yields as US cash bonds resumed trade overnight. APAC saw somewhat of a mixed closed with Shanghai benefitting from the prospect of further policy loosening after commentary from the PBoC, who also intimated that the divergence with some Western central banks is manageable. US equity futures have extended their APAC losses as volumes pick up and yields remain at high – with the NQ (-2.0%) the hardest hit. On that note, Deutsche Bank’s January survey showed 49% of respondents believe US tech stocks are in a bubble, 39% disagree, 12% do not know, whilst the BofA January survey suggested investors cut net overweight positions in the Tech sector to their lowest since December 2008. Back in Europe, EUR-bourses see relatively broad-based losses and overlooked a sizeable rise in the German ZEW Economic Sentiment (51.7 vs exp. 32.0) – which indicated the economic outlook has improved considerably since the start of 2022. Meanwhile, the UK’s FTSE 100 (-0.9%) initially saw some losses cushioned by oil majors – which remains the outperforming sector despite trimming earlier gains. Broader European sectors are in the red across the board with some defensives towards the top of the bunch, while the other side of the spectrum sees Tech and Travel & Leisure as the marked laggards, with the former under heavy pressure from rising yields, with the German 10yr cash yields eyeing positive territory. The latter meanwhile is weighed on more by its Leisure subsector as sector-heavyweight Evolution Gaming (-4.8%) sits towards the foot of the Stoxx 600. The auto sector is also under pressure following lacklustre EU27 car registrations, whilst Toyota also cut its output forecast amid the chip shortage and as its auto plant in Tianjin remains suspended following the regional COVID outbreak. In terms of individual movers, Hugo Boss (-0.3%) conforms to the regional losses despite seeing an initial spike higher at the open following encouraging earnings.

Top European News

- German Investor Confidence Surges Amid Hopes for 2022 Recovery

- Spotify Backer GP Bullhound Said to Join Amsterdam SPAC Rush

- Brexit Gives $228 Billion Boost to Irish Bank Balance Sheets

- Ex-Citi Banker Says He Was Fired for Flagging ‘Toxic’ Dubai Unit

In FX, some respite for the Greenback after its marked reversal from early 2022 peaks (index at 96.422 on January 4th), and the latest ratchet higher in US Treasury yields is providing impetus even though other global bonds are tracking the moves amidst more upside in oil prices that is stoking inflation pressures and prompting further reflation trades. The DXY is trying to form a firmer base above 95.000 within a 95.126-95.454 range in the face of heightened risk aversion that is boosting demand for safer havens and crimping commodity related gains for currencies within and beyond the basket. Ahead, only NY Fed manufacturing and the NAHB housing market index on a relatively quiet agenda after the long MLK holiday weekend.

- JPY – The Yen has recovered pretty well from overnight lows posted against the Dollar following a still dovishly positioned BoJ and subsequent comments from Governor Kuroda underlining that policy stance with little inclination to change tack anytime soon, irrespective of source reports claiming the contrary. Indeed, Usd/Jpy is back down around 114.60 having popped above 115.00 and a Fib retracement level at 114.92 that could be pivotal on a closing basis from a technical perspective rather than pure risk-off/on dynamics.

- CAD/EUR/GBP/CHF – All softer vs their US rival to varying degrees, as the Loonie continues to derive a degree of traction/underlying support from WTI extending to Usd 85.74/brl at one stage and now awaiting Canadian CPI for further direction hot on the heels of yesterday’s broadly upbeat BoC business outlook survey. Usd/Cad is flattish between 1.2486-1.2534 parameters, while the Euro has lost grip of the 1.1400 handle, Sterling is back below 1.3650 and the Franc is straddling 0.9150 in wake of a rather mixed German ZEW survey, solid UK jobs data on balance and a slowdown in Swiss producer/import prices.

- AUD/NZD – The Aussie and Kiwi have both faded above round numbers that have acted as support and resistance of late, at 0.7200 and 0.6800 respectively, but the former is holding up a tad better given a modest bounce in the Aud/Nzd cross in the low 1.0600 zone after a deterioration in NZIER confidence and decline in cap u. Moreover, Aud/Usd may glean impetus from decent option expiry interest between 0.7190-0.7200 (1.065 bn).

In commodities, WTI and Brent front month futures have pulled back from overnight highs but remain at elevated levels with WTI Feb around USD 85/bbl (83.50-85.74 range) and Brent March north of USD 87/bbl (86.44-88.13 range). Several factors are in play for the complex from both sides of the equations. Geopolitical risk premium continues to be woven into prices as tensions remain at highs between NATO/Ukraine and Russia, adding to that the middle eastern developments between the UAE/Saudi and Houthis. Further on the supply side, the under-production from several OPEC members continues to underpin prices. On the demand side, the reopening of economies in the West provides the complex with bullish omens, albeit the East remains cautious – with China adhering to its zero-COVID policy and Tokyo reportedly planning to raise its COVID warning level by one notch, according to TV Asahi. Meanwhile, Goldman Sachs upped its forecast and expected oil hitting USD 100/bbl in H2 2021 amid a lower-than-expected hit to demand from Omicron. The bank sees USD 90/bbl in Q1 2022 and USD 95/bbl averaging in Q2 this year. Elsewhere, spot gold is under pressure from the rising Buck and yield, with the yellow metal in close proximity to its 21 DMA (1,809), 50 DMA (1,806) and 200 DMA (1,803). LME copper has succumbed to the risk aversion and currently trades around session lows but north of USD 9,500/t.

US Event Calendar

- 8:30am: Jan. Empire Manufacturing, est. 25.0, prior 31.9

- 10am: Jan. NAHB Housing Market Index, est. 84, prior 84

- 4pm: Nov. Total Net TIC Flows, prior $143b

DB’s Jim Reid concludes the overnight wrap

In around an hour or so we will be publishing our latest monthly survey results. It’s fair to say that there’s a more bearish tilt to the responses than there was before Xmas. We asked a few of the same 2022 questions and there has been a further bias towards higher rates, more Fed hikes, less strong risk/equities and a slightly earlier likely next US recession date. There’s lots more so watch out for the results at 8am London time.

By next month’s survey it might be worth asking who hasn’t played “Wordle”. I discovered this new global craze over the last week and have become quickly addicted to the daily search for the 5-letter word of the day. For the uninitiated you have 6 attempts to guess the word from scratch. After each guess you get told if you have any of the right letters in order and whether any of the letters are correct but in the wrong order. Each guess has to be an actual word to count. From there is a process of skill/elimination and luck! When I’ve succeeded it’s the former, when I’ve failed it’s the latter. It’s highly addictive and it’s certainly improved my vocabulary of 4-letter words when I can’t work it out.

It’s a shame there is only one new word every day as yesterday’s quiet US session would have given plenty of opportunity to play. Although it was a predictably slow session, familiar themes dominated and investor conviction hardened that the Fed were set to embark on a regular series of rate hikes starting in March. Indeed, yesterday marked a number of fresh milestones, as it was the first time that Fed funds futures were fully pricing in a March rate hike, up from 97% on the close on Friday. And for the year as a whole, futures are now pricing in 3.99 hikes, up from 3.79 on Friday and again the highest number to date. Bear in mind that at the start of October, futures were pricing in just a single hike in 2022, so we’ve added nearly 3 additional hikes in the space of just 3 and a half months, which begs the question of what we might be saying in another 3 and a half months from now. A reminder of the “What’s in the tails?” note from our economists over the weekend detailing the risk scenario of a Fed that may choose to get to neutral earlier than expected than expected. They outline a scenario where the Fed needs to raise rates at every meeting from March. This is inline with my thinking that unless financial conditions tighten notably, every meeting from March is live. See their report here.

US Treasury markets themselves were closed as a result of the holiday but yields have jumped across the curve in the Asian session this morning. 2yr yields have risen +6.8bps and above 1% (1.034%) for the first time since February 2020 while 5yr (+7.2bps) and 10yr yields (+5.2bps) have both jumped to the highest level since January 2020. Overnight oil has hit the highest level since 2014 and is up around +1.5% as I type. The complex’s is up more than +10% on a YTD basis and is the best performer YTD in our global list of key macro variables.

This all follows a selloff in sovereign bonds across the board in Europe yesterday. In Germany, yields on 10yr bunds were up +2.0bps to -0.03%, which puts them back around their highest level since the pandemic, and not far off reaching positive territory for the first time since May 2019. They got close yesterday but stepped back from the parapet. Given the Asian session, today could be the day that German bonds give you a positive yield again! Over in France, yields on 10yr OATs (+2.3bps) hit a post-pandemic high of their own, and their Spanish counterparts (+2.0bps) saw yields at their highest since June 2020.

In spite of the prospect of tighter monetary policy before much longer, European equities posted a decent performance yesterday, with the STOXX 600 advancing +0.70% as part of a broad-based advance. Technology stocks led the way, with the STOXX Technology index (+1.59%) recovering after 2 consecutive weekly declines, whilst the STOXX Health Care Index (+1.06%) also pared back its losses after a weak start to the year so far. In the UK, the FTSE 100 (+0.91%) closed at its highest level in almost 2 years and cemented its status as one of the top-performing of the main European and US equity indices on a YTD basis, having risen +3.1% in 2022 thus far. And on top of that, the gains for both France’s CAC 40 (+0.82%) and the German DAX (+0.32%) meant that both indices were back into positive territory on a YTD basis as well.

Asian stock markets are without a clear trend this morning with the Nikkei (+0.12%) fluctuating after the BOJ maintained its negative interest rate while keeping the bond yield target and asset purchases intact, in-line with market expectations. In its outlook report, the central bank raised its inflation forecast for the fiscal year from April due to rising energy costs alongside a weak yen. The BOJ revised up its inflation forecast to +1.1% in fiscal 2022 from a +0.9% rise estimated earlier and sees inflation for fiscal 2023 reaching +1.1% from +1.0%. Additionally, it refreshed Japan’s growth outlook to +3.8% for fiscal 2022 compared to +2.9% three months ago, despite increasing concerns over the rapid spread of the Omicron variant. Elsewhere, the Shanghai Composite (+0.94%) and CSI (+1.07%) are extending their previous session gains this morning. Meanwhile, the Kospi (-1.02%) is edging down after opening higher while the Hang Seng (-0.14%) is trading in the red at the time of writing. Moving ahead, futures market in the DM world indicate a negative start with the S&P (-0.50%) and DAX (-0.28%) contracts moving lower.

Back to the energy complex, Galina in my team put out a comprehensive report on carbon pricing and trading yesterday. It’s packed full of interesting stuff and the ramifications of the sharp rise higher over the past year. See here for more.

Turning to the pandemic, there was continued positive news from the UK on cases, which are now down by -42% over the last 7 days relative to the preceding week, which is a very promising sign for elsewhere given that the UK was one of the first of the advanced economies to be hit by the Omicron wave.

To the day ahead now, and data releases include UK unemployment for November, the ZEW Survey from Germany for January, whilst in the US there’s the Empire State manufacturing survey for January and the NAHB’s housing market index. Central bank speakers include the ECB’s Villeroy and earnings releases include Goldman Sachs and BNY Mellon.

Tyler Durden

Tue, 01/18/2022 – 07:34

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com