Investing Legend Turns Apocalyptic, Expects Stocks To Crater 50% In Largest Wealth Destruction In US History

It was several years ago when Jeremy Grantham quietly turned from stock bull to vocal permabear, and while his market notes turned breathlessly alarmist (if only to those who were long his multi-billion fund GMO), such as this from June 2020 “Stock-market legend who called 3 financial bubbles says this one is the ‘Real McCoy,’ this is ‘crazy stuff’”, it wasn’t until early 2021 that Grantham’s warnings of an imminent crash became especially shrill… and spectacularly wrong. Recall, back in January 2021, Grantham wrote that “Bursting Of This “Great, Epic Bubble” Will Be “Most Important Investing Event Of Your Lives“, while was followed by warnings of a “Spectacular” Crash In “The Next Few Months.”

Needless to say, no crash followed as the Fed and other central banks went all in on stabilizing the market, resulting in an epic year for risk assets which closed 2021 at all time highs, while GMO suffered not only steep losses but also substantial redemptions, a humiliating outcome for Grantham who had previously called the bursting of both the dot com and housing bubbles, but failed to account for just how determined the Fed is to avoid another bubble bursting.

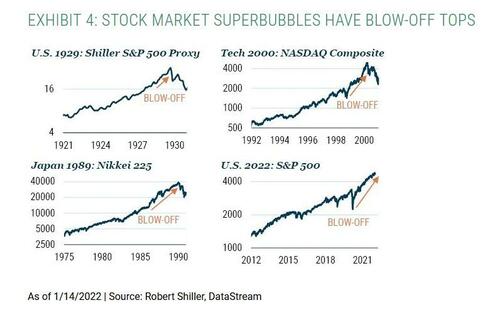

But with stocks again swooning on fears Fed support of gradually fading, it didn’t take long for the 83-year-old Grantham to publish his most apocalyptic note yet, “Let The Wild Rumpus Begin” out this morning, in which he revisits the familiar them that we are currently living in a superbubble – only the fourth of the past century – and like the crash of 1929, the dot-com bust of 2000 and the financial crisis of 2008, Grantham is “nearly certain” the bursting of this bubble has begun, sending indexes back to statistical norms and possibly further.

How much lower? The iconic value manager sees the S&P tumbling by nearly 50% to 2,500 from its all time highs of 4,800 just a few weeks ago. The Nasdaq Composite, which closed in a technical correction on Wednesday down 10% from its all time high, may sustain an even bigger correction.

“I wasn’t quite as certain about this bubble a year ago as I had been about the tech bubble of 2000, or as I had been in Japan, or as I had been in the housing bubble of 2007,” Grantham told Bloomberg in a “Front Row” interview. “I felt highly likely, but perhaps not nearly certain. Today, I feel it is just about nearly certain.”

The signs that Grantham has been looking at are hardly a secret: the first indication that the bursting of the superbubble has begun came last February, when dozens of the most speculative stocks began falling. One proxy, Cathie Wood’s ARK Innovation ETF, has since tumbled by 52%. Next, the Russell 2000, an index of mid-cap equities that typically outperforms in a bull market, trailed the S&P 500 in 2021. Indeed, many of the bubble baskets which are a proxy of central bank liquidity, have been sharply lower for the past year with a handful of exceptions.

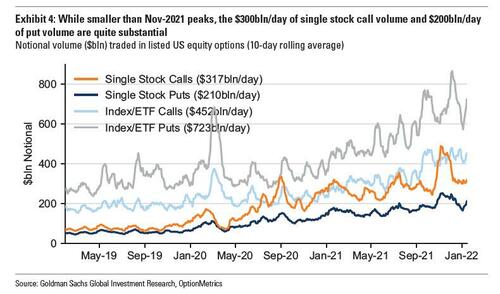

Grantham also points to the kind of “crazy investor behavior” indicative of a late-stage bubble: meme stocks, a buying frenzy in electric-vehicle names, the rise of nonsensical cryptocurrencies such a dogecoin and multimillion-dollar prices for non-fungible tokens, or NFTs. However, while it has certainly become more subdued, as the following chart of single stock option activity from Goldman shows, retail is still solidly in the market.

“This checklist for a super-bubble running through its phases is now complete and the wild rumpus can begin at any time,” Grantham, writes adding that “when pessimism returns to markets, we face the largest potential markdown of perceived wealth in U.S. history“

To be sure, Grantham admits that he may not have timed the top perfectly, but says it’s only a matter of time before the bubble bursts. In the meantime, we are living in the “vampire phase of the bull market” which will survive for a while but eventually it “keels over and dies. The sooner the better for everyone”, to wit:

… we are in what I think of as the vampire phase of the bull market, where you throw everything you have at it: you stab it with Covid, you shoot it with the end of QE and the promise of higher rates, and you poison it with unexpected inflation – which has always killed P/E ratios before, but quite uniquely, not this time yet – and still the creature flies. (Just as it staggered through the second half of 2007 as its mortgage and other financial wounds increased one by one.) Until, just as you’re beginning to think the thing is completely immortal, it finally, and perhaps a little anticlimactically, keels over and dies. The sooner the better for everyone.

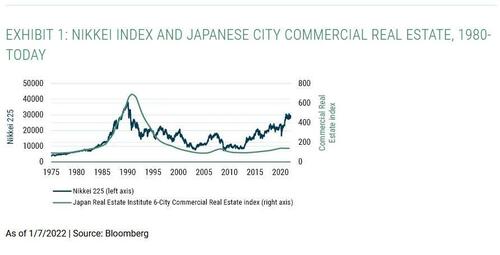

Sparing no superlatives to describe what is coming, Grantham said the coming crash could rival the impact of the dual collapse of Japanese stocks and real estate in the late 1980s, with catastrophic consequences.

Not only are equities in a super-bubble, according to Grantham there’s also a bubble in bonds, “the broadest and most extreme” bubble ever in global real estate and an “incipient bubble” in commodity prices. Even without a full reversion back to statistical trends, he calculates that losses in the U.S. alone may reach $35 trillion.

While Grantham is one of the iconic (and last remaining) value managers who’s been investing for 50 years and calling bubbles for almost as long, Bloomberg’s Erik Shatzker writes that he knows his predictions are fodder for skeptics. One obvious question: How could the S&P 500 advance 26.9% in 2021 — its seventh-best performance in 50 years — if stocks were poised to plummet, especially when Grantham was warning of an epic crash last January?

Rather than disprove his thesis, Grantham said the strength in blue-chip stocks at a time of weakness in speculative bets only reinforces it: “This has been exactly how the great bubbles have broken,” he said. “In 1929, the flakes were down for the year before the market broke, they were down 30%. The year before they’d been up 85%, they had crushed the market.” In other words, Grantham is pointing to the same lack of market breadth that prompted even Goldman to ring the alarm last month, when the bank pointed out that 51% of all market gains since April are from just 5 stocks..

Having seen the same pattern that played out in every past super-bubble is what gives him so much confidence in predicting this one will implode similarly.

Echoing what we have said since 2009, when the view was largely contrarian and has since become consensus, Grantham puts the blame for bubbles of the past 25 years on bad monetary policy. Ever since Alan Greenspan was Fed chairman, he argues, the central bank has “aided and abetted” the formation of successive bubbles by first making money too cheap and then rushing to bail out markets when corrections followed.

Now, Grantham warns, investors may no longer be able to count on that implied put. He says that with inflation running at the fastest clip in four decades “limits” the Fed’s ability to stimulate the economy by cutting rates or buying assets,..

“They will try, they will have some effect,” he added. “There is some element of the put left. It is just heavily compromised.”

Under these conditions, the traditional 60/40 portfolio of stocks offset by bonds offers so little protection it’s “absolutely useless,” Grantham said. He advises selling U.S. equities in favor of stocks trading at cheaper valuations in Japan and emerging markets, owning resources for inflation protection, holding some gold and silver, and raising cash to deploy when prices are once again attractive.

“Everything has consequences and the consequences this time may or may not include some intractable inflation” Grantham writes. “But it has already definitely included the most dangerous breadth of asset overpricing in financial history.”

Here, we disagree: yes, there will be a crash, one which will send deflationary shockwaves around the world, but it will only prompt an even bigger rescue by the same Fed which no longer has an alternative after it crossed the Rubicon in 2020 and bought corporate bonds and junk bond ETFs to avoid an all out collapse in the post-covid turmoil. In the next crash the Fed, whose only contribution over the past 100 years has been to make the rich richer and create an epic “wealth effect” bubble, will buy stocks and ETFs, transforming into the Bank of Japan, before eventually it loses all credibility. But by then, stocks will be orders of multiple higher, completely disconnected from reality and fundamentals and trading only on the quadrillions in liquidity central banks inject to preserve the western way of life.

Incidentally, the question of what happens after the next crash is one that was posed just yesterday by another market bear, Stifel strategist Barry Bannister, who predicts a market drop to 4,200 in Q1 2022, but wonders what happens post-correction, when he writes that “equities risk the third bubble in 100 years if the Fed loses its nerve and cancels much of the tightening plan. We doubt that occurs anytime soon, because we believe bubbles are exceptionally poor policy, and the prior two equity bubble tops (1929 and 2000) were followed by “lost decades.”

We do not doubt it at all, and are absolutely certain that the Fed – which has no choice but to blow an even bigger bubble after the coming market crash – will do just that.

The only question we have is how much of a crash can the Fed weather before it capitulates, i.e., what is the level of the Fed put. We are confident that another 10-20% lower – which will obliterate Biden’s ratings and Republican avalanche in the miderms, surging inflation notwithstanding – and the market will finally discover what it is looking for.

Grantham’s full note is below (pdf link).

Tyler Durden

Thu, 01/20/2022 – 15:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com