Robinhood Craters To New Record Low After Another Catastrophic Quarter

Unlike last quarter, we didn’t need to look at Robinhood’s 606 filings ahead of earnings. We had a feeling that the results would be ugly (as we predicted last quarter), and we were wrong: they were disastrous and absolutely horrific.

As a reminder, in its dismal guidance last quarter, when the stock imploded, Robinhood slashed its outlook seeing 4Q revenue of just $325M, a huge miss to consensus est. $500.7M, and predicted funded accounts of about 660,000. Well, had RH missed its own guidance, the stock would probably have to collapse to $0. And while it at least managed to come above its own bogey, it once again missed virtually every sellside consensus. Here is what the company reported:

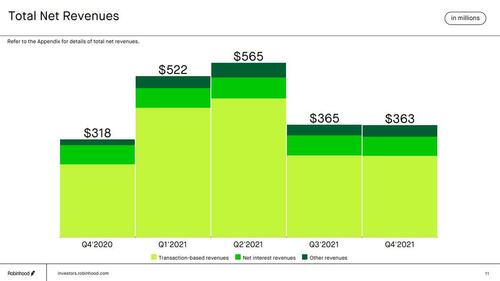

- Net revenue $362.7 million, missing the estimate $370.9 million

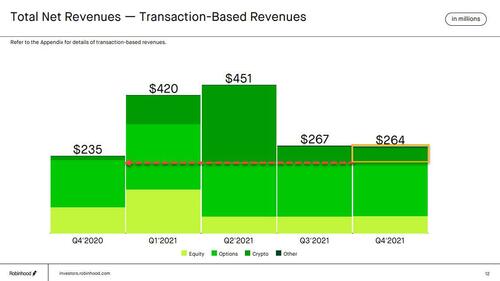

- Transaction-based revenue $263.9 million, missing the estimate $269.3 million

- Crypto revenue $48 million, -5.9% q/q, missing the estimate $55.0 million

- Net Interest revenue $63.4 million, missing the estimate $66.3 million

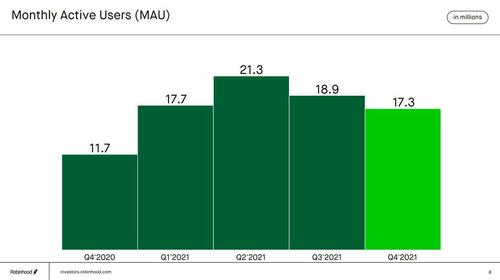

- Monthly active users 17.3 million, a slowdown of 8.5% Q/Q, and missing the estimate of 19.9 million

While crypto trading has been a core strategy of Robinhood, and its zero-commission transactions have helped it enlist new users, making it a major competitor to cryptocurrency exchanges such as Coinbase, this particular revenue stream has imploded. After peaking at $233 million in crypto-trading revenue in Q2 as retail investors plowed into digital assets like Bitcoin, In the third quarter, crypto revenue — 40% of which was made up from Dogecoin trading — plunged to $51 million. It has since dropped again to just $48 and if cryptos continue to tumble, it will only get worse.

But while the numbers were dreadful, the company’s own charts – which inexplicably are in green when they should be in red – speak much louder. Starting with MAU, we see that the “growth” company is now slowing for a second consecutive quarter…

… going to Assets under custody, which at least flat were flat…

… ARPU was an unmitigated disaster, dropping to the lowest level in the past year.

Fewer users and lower ARPU means just one thing: a continued decline in revenue, which is now less than the price of a Ken Griffin apartment.

Believe it or not, it actually gets even worse, with the company’s transaction based revenue (i.e., what it actually does) down to $264 MM, or almost down 50% from Q2. But wait, because if one excludes $48MM (down from 51MM last quarter) in crypto revenue, one gets just $216MM in total transaction based revenues, basically the lowest in the past year!

That said not everything was plunging: operating expenses more than tripled, as the company at least took money from shareholders and gave it to employees.

Some more commentary on what was (once again) the ugliest quarter in HOOD’s post-IPO history:

- Robinhood introduced first trade recommendations to all new customers who have yet to place a trade, helping users get started with a diversified ETF portfolio based on their risk profile and investment objectives.

- Robinhood launched Automated Customer Account Transfer Service (“ACATS”) In a few weeks ago to a small set of customers and has been gradually expanding its availability, with early results looking promising. This feature allows customers to transfer assets from other brokerages into Robinhood and the company will continue to improve the experience and expand the availability to all customers in Q1 2022.

- Robinhood continued to improve its options experience for customers, introducing Options Alerts, Options Watchlist and making it simpler to roll option contracts.

- Robinhood made considerable progress on its fully-paid securities lending program, continues to discuss with its regulators, and believes it will be able to launch the program during the first half of the year.

- Robinhood is close to delivering an even larger window of available trading hours and expects to roll this out later in Q1 2022. This will be one of several improvements the company plans to make to the trading experience this year.

- Robinhood successfully completed alpha testing on Crypto Wallets and has launched a public beta, which will continue to provide valuable insights as the company prepares for a full launch of wallets in Q1 2022.

- During the holiday season, Robinhood launched Crypto Gifts, which enables customers to send crypto to family and friends. The company will take learnings from this launch and look to apply them to transfer capabilities beyond crypto.

Of course, CEO Vlad Tenev tried to spice up the doomsday atmosphere but… he failed:

“We had a momentous year, nearly doubling the number of customers on the platform and making critical investments in our team and infrastructure to support growth. This year, we’ll expand our ecosystem of products that make Robinhood the best place to start investing and build wealth”

…. for Ken Griffin, he forgot to add.

But wait, there’s much more and yes, it’s all ugly: in an echo from 3 months ago when HOOD warned Q1 2022 would be ugly and this time the company’s terrible guidance will be taken much more seriously:

Sees Q1 revenues of less than $340 million, a huge miss to expectations of $447 million: “This implies a year-over-year revenue decline of 35% compared to the first quarter of 2021, during which we saw outsized revenue performance due to heightened trading activity, particularly relating to certain meme-stocks.”

But while revenue is collapsing expenses keep rising: Robinhood expects total operating expenses, excluding share-based compensation, to increase 15-20% year-over-year.

In light of all the catastrophic numbers above, it is a miracle that the stock is down just a buck after hours, or about 10%, down to the lowest level since the IPO and briefly dipping below $10.

Traders should have taken our advice from 3 months ago when the stock crashed to a then-all time low of $34.82 to take the money and run. Alas, the smart money always knows better. Which smart money? These guys to start:

Tyler Durden

Thu, 01/27/2022 – 18:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com