No Wonder The Market Is Skittish

Authored by Charles Hugh Smith via OfTwoMinds blog,

The equity, real estate and bond markets all rode the coattails of the Fed’s ZIRP and easy-money liqudiity tsunami for the past 13 years. As those subside, what’s left to drive assets higher?

No wonder the market is skittish:

1. Every time the Federal Reserve began to taper quantitative easing / open spigot of liquidity over the past decade, reduce its balance sheet or raise rates from near-zero, the market plummeted (“taper tantrum”) and the Fed stopped tightening and returned to easy-money expansion.

2. Now the Fed is boxed in by inflation–it can’t continue the bubblicious easy-money policies, nor does it have any room left to lower rates due to its pinning interest rates to near-zero for years.

3. So market participants (a.k.a. punters) are nervously wondering: can the U.S. economy and the Fed’s asset bubbles survive higher rates and the spigot of liquidity being turned off?

4. The market is also wondering if the economy can survive the pricking of the “everything” asset bubbles in stocks, bonds, real estate, etc. as interest rates rise and liquidity is withdrawn. What’s left of “growth” once the top 10% no longer see their wealth expand every month like clockwork?

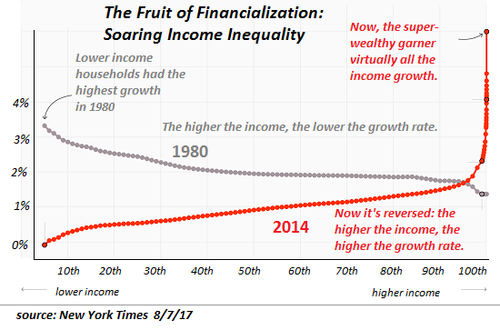

5. The unprecedented expansion of asset valuations driven by expansions of credit and liquidity (i.e. low-cost credit chasing scarce assets) has greatly increased the wealth of the top 10% (especially the wealth of the top 0.1% and top 1%). Since the top 10% collect about half of all income and account for roughly half of all consumer spending, the “wealth effect” generated by ever-rising asset valuations has underpinned “growth” in both asset purchases and consumption.

If assets actually decline in value and the wealth effect reverses (i.e. punters feel poorer), then what will drive expansion of capital and spending going forward?

6. The Federal Reserve and U.S. Treasury have institutionalized moral hazard, the disconnect of risk and consequence, for America’s financial elite: rather than force those who gambled and lost to absorb the losses in 2008-09, the Fed and Treasury bailed out the too big to fail, too big to jail financial elite, establishing an unspoken policy of encouraging the wealthiest individuals and enterprises to borrow and gamble freely, knowing they could keep any winnings (and pay low or no taxes on the gains) and transfer any losses to the Fed and/or taxpayers.

7. This institutionalization of moral hazard combined with zero interest rate policy (ZIRP) and an open spigot of liquidity has driven wealth and income inequality to extremes that are economically, politically and socially destabilizing. Insider trading in the Fed and Congress has finally leached out into the public sphere, and the cozy enrichment of the already super-wealthy has now reached extremes that invite destabilizing blowback.

8. As noted here recently, inflation is now embedded due to structural, cyclical changes in supply chains and the labor market: rather than importing deflation, global supply chains now import inflation (higher costs) and scarcities. After being stripmined of $50 trillion over the past 45 years, labor has finally gained some leverage to claw back a bit of the purchasing power that has been surrendered to corporations and finance over the past two generations.

9. Inflation spirals out of control if the cost of credit (interest rates) don’t rise to reward capital with inflation-adjusted income: if inflation is 6% annually, a bond paying 1% loses 5%. This is not sustainable, for it distorts the pricing of risk.

10. As rates rise, lower-risk bonds become more attractive than risky stocks, and capital leaves stocks for income-producing securities. Rising rates are historically bad for stocks, so what will keep stock markets lofting higher if rates rise, liquidity is reduced and capital exists risky stocks?

11. The stock market is overvalued by traditional measures of value, and any mean reversion will lower the market significantly. So what’s left to push risk assets higher? The only answers with any substance are: A) rising profits due to companies having pricing power in an inflationary environment and workers getting more purchasing power so they can afford to pay higher prices and B) massive inflows of global capital due to perceptions of lower risk and higher returns in U.S. dollar denominated assets. If neither transpires, there’s no real support for stocks to continue lofting ever higher.

12. The equity, real estate and bond markets all rode the coattails of the Fed’s ZIRP and easy-money liquidity tsunami for the past 13 years. As those subside, what’s left to drive assets higher? It’s an open question, and so skittishness is rational and prudent.

In summary:

By rewarding financialization and the largest concentrations of capital at the expense of labor, small business and productivity, the Federal Reserve and federal / state governments have made the economy and society precariously dependent on asset bubbles, corruption (pay to play politics) and financial trickery.

The only real foundation for growth is to widen the distribution of gains in productivity, shift the gains from capital to labor and reward small-scale investment in productivity gains rather than funnel all the gains into asset bubbles and financialized casinos that enrich the top 0.1% at the expense of the nation and its people.

* * *

My new book is now available at a 20% discount this month: Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $8.95, print $20). If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Tyler Durden

Fri, 01/28/2022 – 12:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com