Did Powell Just Burst The ESG Megabubble

Over the past few years we have been quite vocal in our disdain for the widespread virtue-signaling scam that is ESG:

- Behold The “Green” Scam: Here Are The Most Popular ESG Fund Holdings

- ESG Investing – The Great Wall Street Money Heist

- More ESG Fraud: BofA Finds That Tech Is One Of The Dirtiest Industries

- SEC Cracks Down On “Dubious” ESG Labels Tied To $35 Trillion In Assets

- Wall Street ‘Wins’ Again As ESG Scam Infiltrates Retirement Plans

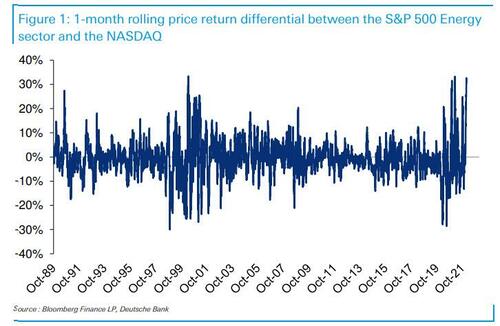

Well, we are happy to report that a silver lining of the recent market crash, or as DB’s Jim Reid puts it, “one of the side effects of the hawkish pivot from the Fed in 2022, that continued this week” is that it could finally crack the facade of ESG and make January a catastrophic month for ESG investors; this is shown in Reid’s Chart of the Day which lays out the 1-month rolling difference between S&P 500 Energy sector returns and the NASDAQ.

Clearly this is a very crude measure of ESG under-performance but the nature of the US market means that ESG funds in the US market are very tech heavy.

A look the tables below (courtesy of DB’s Luke Templeman’s ESG monthly) reveals the largest holdings in the big US…

… and European ESG ETF funds.

Note the big European funds are far less tech exposed and also that overall some funds are buying into energy companies because of their environmental transition plans. So as the market develops, Reid notes that ESG is becoming increasingly nuanced and complicated.

Back to the Fed and this hawkish pivot has occurred at a point where the US Energy sector is up +18% YTD and the only positive performance of the 11 top level sectors within the S&P. With just a day to go in the month, could January mark the biggest divergence between this and the Nasdaq on record? The 30-day rolling difference in returns is within 2% of the highs seen since we have sector data from 1989 onwards.

And while ESG is (unfortunately) here to stay – especially since Wall Street collectively needs to periodically wash its conscience in hollow but expensive acts of virtue signaling which will mean much more money flows toward the three letters – January is proving that performance can be influenced by bigger picture themes.

Tyler Durden

Sat, 01/29/2022 – 20:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com