China PMIs Show Economy On Verge Of Contraction Amid Continued Growth Slowdown

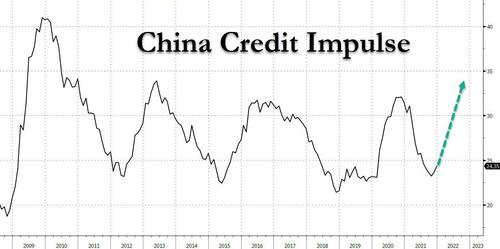

While China’s credit impulse recently bottomed and is already starting its next major upcycle, the remnant of the current slowdown are still hitting the economy and overnight the latest PMI data showed that China’s manufacturing sector expanded at a slower pace in January amid a seasonal slowdown, Covid-19 outbreaks and a housing market drop which dragged activity at small firms to the weakest since the depth of the pandemic.

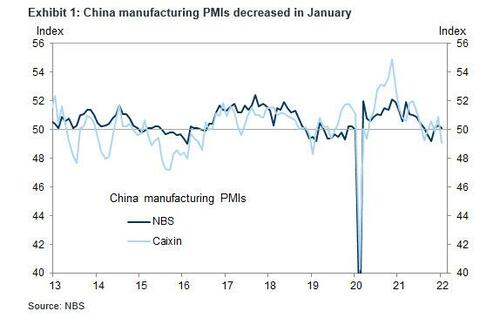

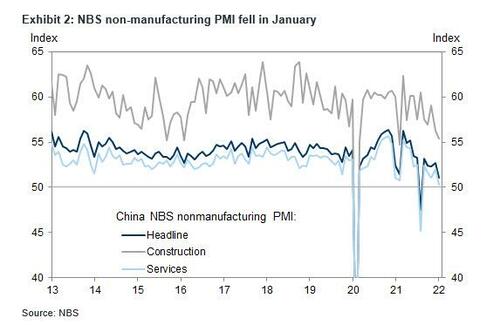

In keeping with China’s penchant for always beating expectations, Beijing’s National Bureau of Statistics reported that the official manufacturing purchasing managers’ index declined to 50.1 from 50.3 in December, just above the median estimate of 50.0 which separates expansion from contraction. Likewise, the non-manufacturing PMI, which measures activity in the construction and services sectors, fell to 51.1, also just fractionally above the consensus forecast. Meanwhile, the non-government Caixin manufacturing PMI fell to 49.1 in January from 50.9 in December, likely due to local outbreaks.

Some details from the NBS report:

- Among major manufacturing sub-indexes, the output index fell to 50.9 from 51.4, and the new orders sub-index decreased to 49.3 from 49.7.

- The new export order sub-index increased to 48.4 in January vs. 48.1 in December, and the import sub-index fell to 47.2 in January vs. 48.2.

- The manufacturing employment sub-index decreased to 48.9 in January from 49.1. The raw material inventories sub-index edged down to 49.1 from 49.2, and the finished goods inventories sub-index fell to 48.0 from 48.5 in December.

- The suppliers’ delivery times sub-index fell to 47.6 from 48.3, suggesting slower suppliers’ delivery likely due to local outbreaks and related restrictions.

- By enterprise size, the PMI of large enterprises rose to 51.6 (vs. 51.3 in December), the highest in six months while the PMIs of small enterprises fell to 46.0 (vs. 46.5 in October), the lowest since February 2020 and taking a contracting streak to a ninth month.

Price indicators in the NBS manufacturing survey suggest inflationary pressures picked up in January with the input cost sub-index rebounding significantly to 56.4 (vs. 48.1 in December), and the output prices sub-index rose to 50.9 (vs. 45.5 in December), both are higher than November levels. NBS mentioned both input cost and output price sub-indexes of petroleum, coking and other fuels, and smelting and pressing of nonferrous metals were above 60.

The official non-manufacturing PMI – comprised of the services and construction sectors – also fell in January to 51.1 vs. 52.7 in December, driven by a decline in services sectors – the services PMI fell to 50.3 (vs. 52.0 in December), and the lowest since August. According to the survey, the PMIs of monetary and financial services were above 60 in January, while the PMIs of high-contact consumer services, including accommodation and transportation, were below 50 due to local outbreaks in January.

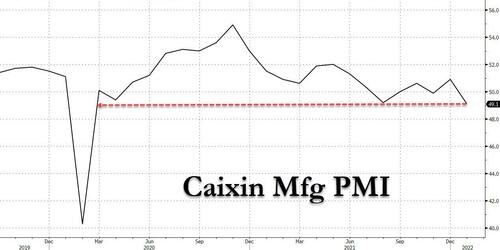

The Caixin manufacturing PMI was released later in the morning. The headline index fell to 49.1 in January from 50.9 in December: this was the lowest print since the Covid crash in March 2020.

Sub-indexes in the Caixin manufacturing PMI showed themes were mostly consistent with NBS PMIs except new export orders (stronger in NBS, weaker in Caixin):

- deceleration in output and new orders in January (48.4 and 48.5 vs. 52.7 and 50.9 in December),

- weaker employment (47.9 vs. 48.7 in December),

- falling inventories in both raw inputs and finished goods (49.8 and 48.7 vs. 50.3 and 50.1 in December),

- renewed inflationary pressures in input and output prices (both rose to 52.6 in January vs. 50.8 and 49.2 in December),

- slower suppliers’ delivery (47.5 vs. 48.7 in December), while new export orders sub-index in Caixin fell to 46.5 in January (vs. 49.9). Caixin survey mentioned the recent uptick of COVID cases home and abroad impacted sales and supply chains in January.

Despite the traditional fudging of PMI numbers especially on the NBS side, the numbers signaled a clear slowdown in the economy – with weaker output and new orders, weaker employment, falling inventories, slower supplier’s delivery, heightened inflationary pressures – although to be expected not just due to local outbreaks and related restrictions but because Chinese factories often see a production lull in January and February as workers head home for the Lunar New Year holidays. The divergence between NBS and Caixin in new export orders could be related to potentially geographic coverage differences and sector bias – NBS closely linked to raw materials, Caixin tilted towards machinery – between the two surveys. Activity has also been affected this year by the government’s orders for steel plants to trim output to reduce air pollution ahead of the Winter Olympics in Beijing which begin Friday.

“Industrial activities slowed due to weak domestic demand,” Zhiwei Zhang, chief economist at Pinpoint Asset Management Ltd., wrote in a note. “The slowdown is particularly severe for the small firms.”

The disruptions have added to the woes facing the Chinese economy, with home sales falling and consumption sluggish due to tightened restrictions to contain the spread of the highly-contagious omicron virus variant. Residents in places where there have been recent Covid-19 outbreaks, including Beijing, Shanghai and the northern port city of Tianjin, have been urged to not leave the cities unless necessary.

Manufacturers were also squeezed by higher costs, with input prices rising at the fastest rate in three months, according to the official data.

“That could drive the producer price index up and narrow the room for monetary policy,” said Bruce Pang of China Renaissance Securities Hong Kong, although in light of the recent commitment to easing policy, we doubt that even a solid bounce in the PPI will derail Beijing’s new-found monetary generosity.

To spur growth, the central bank has cut key interest rates, lowered reserve requirements for lenders and vowed to open its toolbox wider, in response to top leaders’ call for prioritizing stability. Still, a set of earliest available indicators tracked by Bloomberg sent mixed signals about the state of the economy in January, with the housing market and consumer spending staying weak and business confidence and stocks tumbling.

Elsewhere, construction activity continued to cool this month, with the NBS sub-index falling to 55.4, suggesting sentiment remained subdued given the property downturn and the limited effect that government spending on infrastructure is having so far. The approaching holiday and cold winter may have also had some impact on building.

“The weak PMI indicates the policy easing measures from the government have not yet been passed to the real economy,” according to Pinpoint’s Zhang. “We expect the government will step up policy supports in coming months, particularly through more fiscal spending.”

Translation: China’s all important credit impulse will soar, perhaps hitting its cycle high around the US midterm elections.

Tyler Durden

Sun, 01/30/2022 – 15:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com