Forget The ‘Powell Put’, Nomura Warns The Fed Is Now ‘Effectively Shorting Calls’

As we detailed last night, yesterday’s BoE and ECB did not disappoint still-surging global ‘Hawks’, who continue steering future policy-rate pricing into levels which Nomura’s Charlie McElligott notes just a week ago would have been perceived as an impossibility and into “overshoot” territory, as it pertains to lif-off progressions which would jolt financial conditions “tighter” (ECB implieds in particular, where they now price the deposit rate to rise to zero by YE)… but, when mkt expectations are provided so explicitly, with such vigor, and inflation is over-target, with (energy) commodity prices still surging – these CBs will simply have to comply with what the market is giving them at this juncture.

So the European and UK Rates markets are scrambling to reset, with impulse flattening being seen in curves, while in the meantime, Energy prices are exploding higher globally.

5Y Bunds spiked into positive territory to the highest since June 2018

And traders now see a 80%-plus chance of a 50bps BoE rate-hike in March…

The ‘risk off’ flows are accelerating after the massive upside surprise in payrolls, dramatically better than the disaster so many expected and prompted a surge in rate-hike odds (35% chance of 50bps hike in March now)…

Source: Bloomberg

And that’s why looking-ahead, Nomura’s Charlie McElligott continues to believe that there is an overhead “lid” on Equities, where the Fed is effectively shorting Calls / upside because anytime US Equities rally higher substantially higher, US FCI eases… and that’s exactly when we have to anticipate them to “up” their “hawkish” messaging.

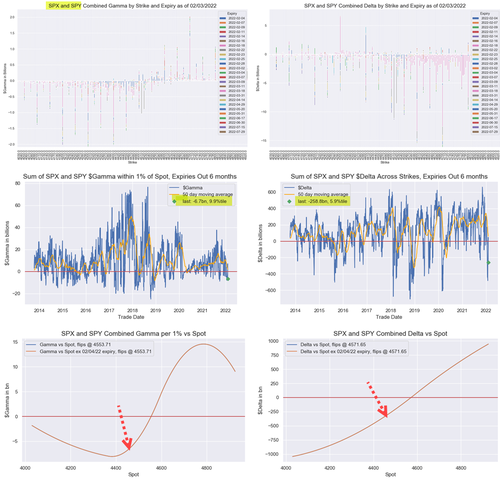

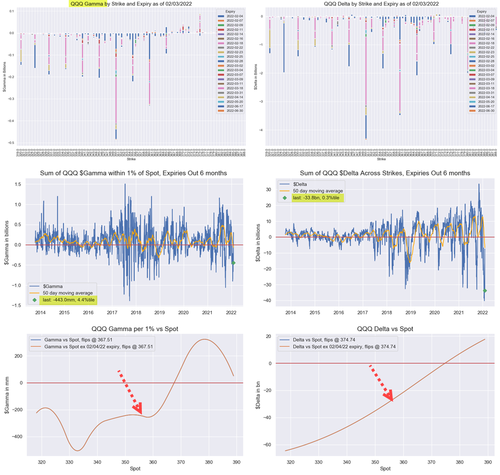

In the meantime, the Nomura strategist warns the resumption of erratic “short Gamma vs Spot” trading looks set to continue locally, with Dealer hedging “accelerant” flows set to press moves either downside or upside (but noting that we are now back to “extreme” short $Delta too, which implies fuel for a rip higher if we start to rally). Options positioning Greeks will remain critical, where we currently see the following profile:

-

SPX Gamma vs Spot Neutral line = 4553 (“short”); $Gamma within 1% of Spot = -$6.7B (9.9%ile); Largest $Gamma Strikes 4500 ($3.8B), 4400 ($3.1B), 4300 ($2.3B), 4450 ($2.1B); Delta vs Spot Neutral line = 4571 (“short”); Net $Delta -$258.8B (5.9%ile)

-

QQQ Gamma vs Spot Neutral line = $367.51 (“short”); $Gamma within 1% of Spot = -443.0mm (4.4%ile); Largest $Gamma Strikes $350 ($816mm), $360 ($565mm); Delta vs Spot Neutral line = $374.74 (“short”); Net $Delta -$33.8B (0.3%ile)

Adding to the uncertainty, today actually sees an outlier “LARGE” non-monthly expiration, with a substantial ~28% of overall QQQ $Gamma coming-off today in particular, and the vast majority of that is being QQQ Puts… so that is potentially supportive flows from Dealers / MMs covering short hedges.

Would also say highlight that “max short Gamma” in SPX at 4400 and currently seeing Spot not impossibly far from it (about -$8B per 1% move), it does actually ease-back “less short” below that.

Specifically, McElligott notes that with VVIX staying well-behaved at 125, it does not feel like there is any sort of convexity out there in the “Big” benchmark index.

But at the same time, Nasdaq / Tech continues to be the “eye of the storm,” and QQQ still has potential to get trickier (currently “max short Gamma” would be down at $335, almost like ~-$550mm per 1% move).

Specifically, with regard ‘mega-tech’, the so-called FANGMAN-bloc had – until relatively recently – traded as an ‘indestructible monolith’ as Bloomberg’s Elena Popina so eloquently describes.

But, McElligott warns that this creates an issue when stocks start moving in different directions, like they did on Thursday, when the parent of Facebook plunged 26% during the regular session and Amazon jumped 11% after the bell.

With exposure in these stocks as concentrated as it is, portfolio managers and traders have to cut their positions — both winning and losing — to not be whipsawed by rollercoaster price swings.

“The intraday realized volatility (as opposed to ‘close to close’) is so substantial that it’s creating a dynamic where buy-side portfolio managers and traders are constantly blowing through their risk limits,” McElligott said by email.

“So even in the case of last night, where Amazon temporarily saved the day, these impossible large swings across the equities market will create a dynamic with risk management where portfolio managers are going to have to simply gross-down to smaller exposure in both directions.”

Finally, with regard to the short-term macro price drivers for US Equities, Nomura’s Quant-Insight model confirms yet again that the downside continues to be driven by the double-whammy that is 1) Real Yields (higher / “tighter”) and 2) Credit Spreads (wider)…

Keep ‘em on your radar, warns McElligott, because both those trends continue to build steam and leak in the “wrong” direction for Equities bulls.

Tyler Durden

Fri, 02/04/2022 – 11:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com