This Is The Worst Earnings Season Since Covid Emerged And It’s About To Get Much Worse

Amid seemingly pervasive gloom and doom that the market is this close from crashing, the reality is that with more than half of S&P 500 companies (accounting for 75% of earnings) having reported earnings, 78.8% of companies have beaten expectations (compared with an average of 84% over the past four quarters, according to Refinitiv).

That’s the good news.

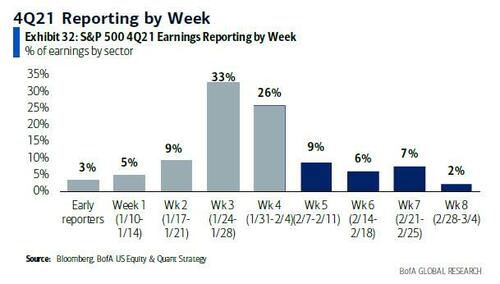

The bad news is that, as Bank of America has calculated, 4Q consensus EPS is tracking just 2% above where it stood on Jan 1, led by tech (but this is about to get hit badly) and financials, while revenue beats are even more precarious, tracking at just +1% versus consensus …

… which is far weaker than prior quarters since COVID when EPS was +11% on average vs. consensus by Week 3.

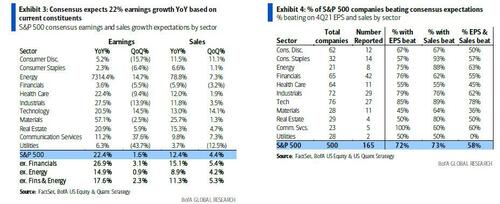

The proportion of beats is also tracking at the weakest level since COVID: 72%/73%/58% beat on EPS/sales/both, better than the post-Week 3 historical average of 64%/58%/44%, but well below the post-COVID average of 80%/77%/67%.

“It was huge beats last year and that’s shrunk,” said Nick Raich, CEO of The Earnings Scout. “It’s partially reverting back to normal, but it’s also the supply-chain pressures and inflationary pressures taking a toll.”

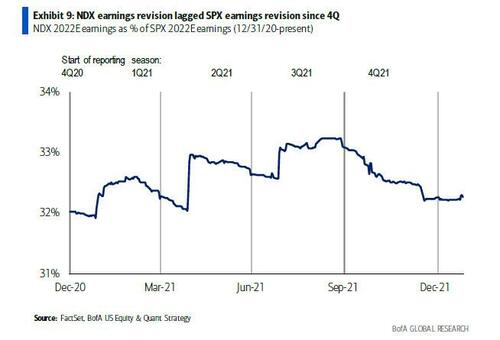

Ominously, the growth stocks which have long served as the market’s “generals”, have underperformed value stocks by 8ppt YTD, representing the biggest underperformance since Feb 2001. A hawkish Fed is seen as the major culprit of the sell-off, but fundamentals have started to weaken relative to Value. Since the end of 3Q21, 2022 earnings estimates for NDX fell 0.8%, while estimates for the S&P 500 rose 1.9%, indicating weaker fundamentals for Growth stocks relative to the overall market. That’s also why according to BofA, despite the big underperformance in Growth YTD, we believe it is still too early to rotate into Growth stocks.

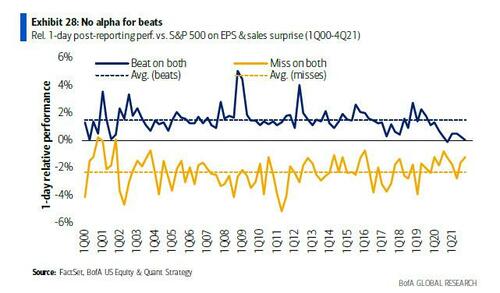

With revenue and EPS beats are clearly stalling, net margins (ex-Fins) are tracking largely in-line with conservative expectations of a big 100bp drop QoQ – margins have driven only a 1% EPS beat, while beats in prior post-COVID quarters have mostly come from better margins. Meanwhile, companies that beat on both sales & EPS performed in-line with the S&P 500 the following day on average, underscoring the backdrop of elevated sentiment/valuations.

This is also why with (stalling) growth priced to perfection, for yet another quarter there has been no reward for beats, as companies that beat on both the top and bottom line see no upside one day after reporting, while the punishment for misses remains stark.

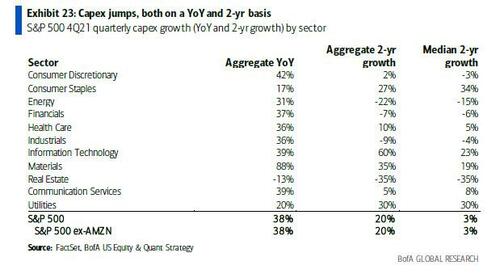

One bright spot of the earnings season is a jump in capex, rising 38% YoY and +20% on a 2-yr basis, accelerating from last quarter’s +3% 2-yr growth rate. It is still early with just 100 companies reporting 4Q capex, but with lingering bottlenecks in the economy, we expect more capex to boost efficiency, particularly on automation.

Drilling down into the cost side of the income statement, BofA’s Corporate Misery Indicator – a macro indicator for profit environment – slightly improved QoQ, as pricing (CPI) accelerated faster than costs (wages). However, a further rise in wages is a bigger risk to corporate margins than PPI or commodities, where labor represents as much as 40% of total costs according to the BEA. The BofA Corporate Misery Indicator, which uses average hourly earnings as a negative input, has been highly correlated to YoY earnings growth (66%). The correlation drops significantly to just 28% using PPI instead of average hourly earnings, and to negative 46% using the Bloomberg Commodity Index (Exhibit 13). To BofA, this means that corporate margins are at risk amid rising wage pressure.

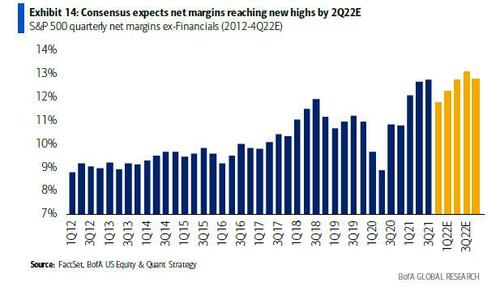

Paradoxically, none of this is registering yet at the macro level, as analysts still expect the S&P 500 to break margin records in 2022

As shown in the chart below, analysts expect 4Q to mark the near-term trough in corporate margins and forecast margins expanding in 2022 to a record high by 2Q. What’s harder to swallow is that this is attributable to two sectors reaching new margin highs: Consumer Discretionary (4Q21 at 5.5% to 3Q22 at 9.0%) and Industrials (4Q21 at 8.6% to 3Q22 at 11.0%) where these are two of the most labor-intensive sectors.

Even though Wall Street refuses to see what’s in front of it, corporate America is starting to freak out: based on BofA’s Predictive Analytics team’s analysis, corporate sentiment remained weak so far this quarter, only slightly recovering from last quarter, which was the lowest level since 3Q20. This matters because sentiment score has been highly predictive of the following quarter’s earnings growth YoY (54% r-sq), and points to slowing earnings growth ahead.

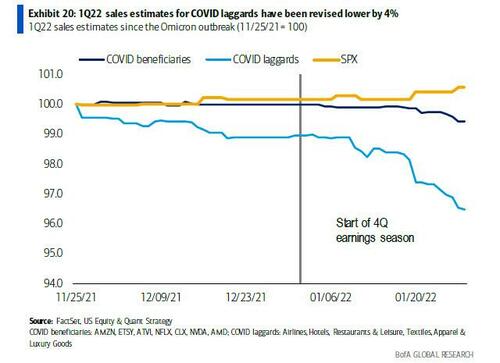

While Q4 is ugly, Q1 2022 is looking even worse, with sales estimates for COVID laggards (e.g. Airlines, Restaurants, etc.) further cut in recent weeks, -4% since Omicron news (vs. +0.6% for the S&P 500). BofA card data suggests continued slowdown in services spending, but the indirect impact on labor and supply chain outweighs the direct impact on services spending.

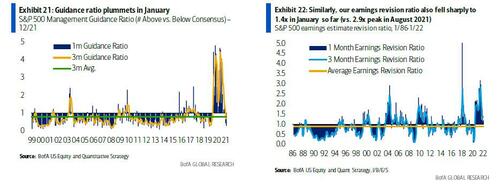

Which brings us to the punchline: amid persistent optimism among investors that the current earnings soft patch will promptly recover, the guidance ratio from corporations – who know their business better than anyone – has plummeted to Feb 2020 level. The biggest deterioration has been in guidance, where BofA’s guidance ratio tracker (# of above- vs. below-consensus guidance) has tumbled to just 0.29x so far in January only slightly better than the Feb 2020 level when COVID first hit (0.26x), with a 3-mo. ratio of 0.67x (vs. the long-term average of 0.80x). Consistently, 1Q EPS also fell 0.6% since the earnings season began, representing the first downward revision for FQ1 EPS since COVID. Similarly, the bank’s earnings revision ratio (# of upward vs. downward revisions) also sharply fell to 1.4x in January so far vs. the 2.9x peak in August 2021.

However, as this is taking place, full-year 2022 EPS has risen 0.5%, implying that analysts are penciling in a temporary blip in 1Q amid Omicron. What’s harder to swallow is analysts expect margins improving to new highs by 2Q, driven by the most labor-intensive sectors (Consumer Discretionary and Industrials), despite a step-up increase in wages.

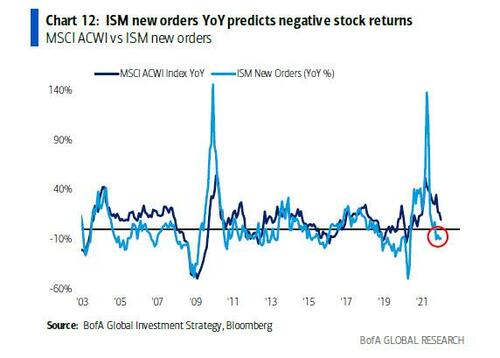

Putting it all together, we go to BofA’s Chief Investment Strategist Michael Hartnett, whose latest uber-bearish note we published yesterday, “BofA Says Endgame Begins: Global Rate Shock Has Triggered Tech Wreck, Recession Countdown And “Systemic Event“”, and which among many things, pointed out why stocks keep slumping as expectations for more rate hikes build – because normally hikes come in a time of economic growth not a slowdown like we have now as indicated by the rapid drop in ISM new orders…

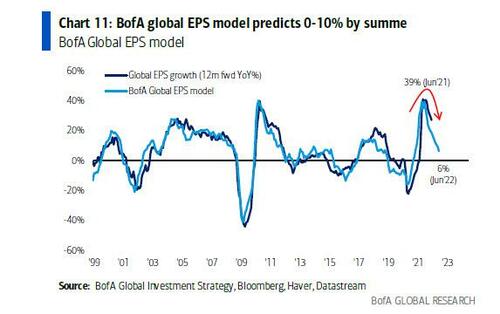

… and also why in addition to slumping economic growth, BofA is now expecting global EPS growth to tumble to 0-10% by the summer. Translation: earnings growth turns negative some time in Q3, just in time for the Fed to throw in the towel on its rate hikes and the economy to slide into recession.

Tyler Durden

Sat, 02/05/2022 – 20:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com