The Fed Explains Why The This Time The Fed Put Strike Price Is (Much) Lower

It was exactly two months ago when we delivered some bad news to all those bulls who were hoping that the Fed would immediately step in and rescue their P&Ls as soon as the market “crashed” a whopping 5% – as Morgan Stanley’s Michael Wilson wrote then, “the Fed put still exists but the strike price is much lower now, in our view. If we had to guess, it’s down 20% rather than down 10% unless credit markets or economic data really start to wobble.“

A subsequent analysis from BofA’s (similarly bearish) strategist Michael Hartnett reached a similar conclusion: writing one month ago, Hartnett said that “the Fed put is at SPX 3800-4000, and IG spreads >150bps.”

While these analyses differed on the margins, they agreed in principle: stocks will have to drop substantially lower before the Fed comes to the market’s rescue this time.

And just to validate this bearish take that stocks will have to slide well below current levels for the Fed’s Plunge Protection Team to activate, the Fed dedicated a sentence in its latest minutes not only to asset prices, which it again saw as elevated, but also to why it sees current asset valuations as “less of a threat” to financial stability, to wit:

Participants who commented on issues related to financial stability cited a number of factors that could represent potential vulnerabilities to the financial system. A few participants noted that asset valuations were elevated across a range of markets and raised the concern that a major realignment of asset prices could contribute to a future downturn.

Notably, for what may be the first time ever, some FOMC members are starting to grasp that the biggest asset bubble of all time is their fault:

A couple of these participants judged that prolonged accommodative financial conditions could be contributing to financial imbalances.

Just a couple? What did the rest think? That the PE multiples hit 23x because of the masterful handling of the economy by the amazing Biden administration?

Sarcasm aside, here is the punchline:

… a couple of other participants cited reasons why elevated asset valuations might prove to be less of a threat to financial stability than in past reversals of asset prices. In particular, they noted the relatively healthy balance sheet positions of households and non-financial firms, the well-capitalized and liquid banking sector, and the fact that the rise in housing prices was not being fueled by a large increase in mortgage debt as suggesting that the financial system might prove resilient to shocks.”

And there you have it: the Fed’s explicit warning that this time the central bank is willing to let risk assets drop significantly more – due to “healthy balance sheet positions of households and non-financial firms, the well-capitalized and liquid banking sector, and the fact that the rise in housing prices was not being fueled by a large increase in mortgage debt” – before it steps in.

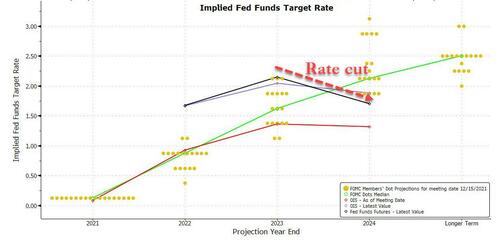

Which begs the question: sell now and wait to buy back in in the upper 3800s, or hold on for the next 18 months at which point the Fed will have pushed the US into a recession, sent asset prices sharply lower, and be forced to begin its next – and perhaps final – easing cycle.

Tyler Durden

Wed, 02/16/2022 – 14:42

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com