JPMorgan Warns The Ghost Of 2018 Will Steamroll Goldman’s Bullish Narrative

Despite the wild rollercoaster ride in markets which refuses to slow down due to the record low liquidity in the emini S&P which is whipsawing risk assets on a daily basis, and despite Goldman’s chief equity strategist David Kostin cutting his year-end S&P estimate from 5,100 to 4,900 last Friday as the bank scrambles to catch down to far more downbeat realistic strategists such as Michael Wilson and Michael Hartnett, Goldman flow trader Scott Rubner pointed to one of the most remarkable, and perhaps perplexing, features of the market in 2022 – despite the sharp drop in stock prices, the YTD period has been marked by a relentless tidal wave of inflows as burst after BTFD burst enters – which Rubner cited as a reason why it is unlikely that we will see a capitulatory flush lower in stocks.

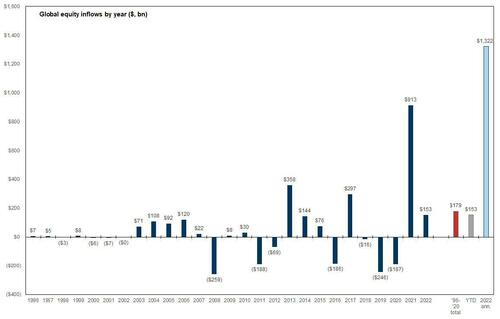

As a reminder, on Sunday we noted that according to EPFR data, cumulative equity flows YTD in 2021 have hit a record $153bn, exceeding the pace of early-2021 (when the year started with $151bn in inflows, ahead of a record year of more than $1tn inflows), despite what appears to be widespread revulsion toward risk assets.

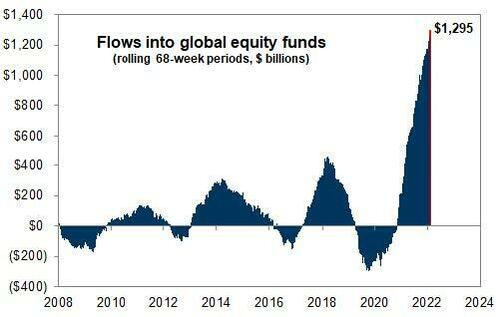

Picking up on this peculiar flow dynamic, Rubner wrote that “with money flowing into global equities “at extreme levels”, this would need to change before a larger correction can take place: I would turn bearish if the money slows or reverses” he said, adding that “portfolio rebalances of this size typically last for the full quarter (Q1 2022).”

But if Rubner’s trigger to turn bearish is the slowing or reversal of record inflows, then JPMorgan quant Nick Panigirtzoglou who publishes the popular weekly Flows and Liquidity newsletter, has some bad news: the record tsunami of inflows is coming to an end.

Speaking to Bloomberg, Panigirtzoglou echoes what we first said last Friday in “Despite Turmoil, Stocks Seeing Largest Ever Inflows In 2022“, and points to the record $152 billion in equity fundflows sunk by investors YTD (or $5.7 billion on average for each of the 27 trading days this year, which annualizes to $1.322 Trillion), after a gangbusters 2021 for both stock returns and flows, which defies the worst January for the S&P 500 since 2009…

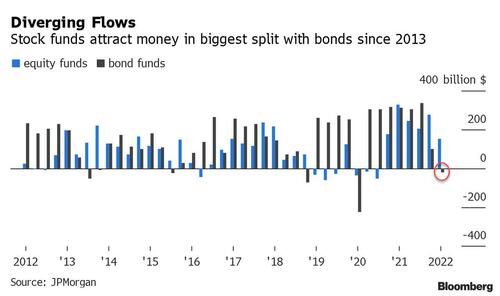

… even as bond funds have already seen the first outflows in two years.

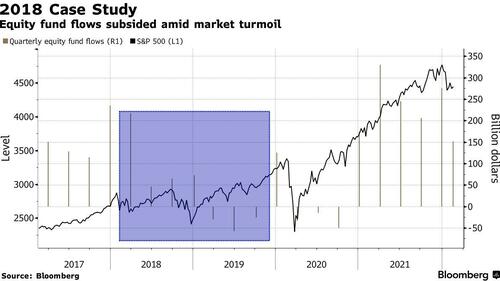

But unlike his Goldman peer, Panigirtzoglou believes that stock managers are set to join their outflow-lashed peers in the bond world as upcoming rate hikes spur greater volatility just like in 2018. Back then, FOMOed investors funneled capital into equity funds in the first quarter, only to divest en masse as monetary policy tightened further.

“There is a good chance that 2022, in terms of equity fund flows, will look like 2018,” Panigirtzoglou told Bloomberg in an interview. “It started very strong in continuation of the previous year, but at some point that flow picture will be wilting.”

With bond funds having already seen $20 billion in outflows YTD, this quarter is shaping up to the biggest win for stock allocations since 2013. The diverging flows – which as we discussed previously have been sparked by a Pavlovin BTFD reaction among both retail and institutional investors and follow a retail trading boom born out of the depths of the pandemic boredom – are noteworthy because individual investors largely dumped stocks in favor of bonds during the 10-year bull market that started in March 2009, only to see this trend reverse dramatically in 2021.

Of course, calls for a “great rotation” are nothing new and virtually every single year since 2009 we have heard one or more sellside analysts predict that a massive rotation out of bonds and into stocks is imminent, yet one never arrived (the massive equity inflows in 2021 were coupled with sizable inflows into bonds as well as trillions in newly created money were allocated across all risk assets). Meanwhile, thanks to faster price appreciation, equity allocation from U.S. households has already stood at a record high.

Curiously 2022 may be the closest we have come to a pure “great rotation”, as U.S. large-cap stock funds attracted $34.1 billion alone in the week to Feb. 9, the most ever, even after the new year bleeding in technology companies. The inflows were funded from withdrawals from fixed-income and money-market funds.

Others, such as Rich Weiss, CIO at American Century Investments, agree: he notes that the current taste for equity funds reflects the fact that the S&P 500 has posted three straight years of double-digit returns. As rates rise at a time when profit growth is estimated to slow, he doesn’t view the backdrop as constructive for equities either.

“The flows follow the returns, not the other way around,” Weiss said. “By moving out of bonds and going into stocks because you’re afraid of rising interest rates, you’re likely jumping out of the frying pan into the fire in many cases.”

While the past is hardly prologue, consider the events of 2018 highlighted by Panigirtzoglou when real rates were also on the rise. Investors initially funneled almost $220 billion into equities in the first quarter, extending a robust streak of inflows from 2017. But after the S&P 500 suffered a 10% decline from its peak in that February, money dwindled to $60 billion a quarter for the rest of 2018. Flows then turned outright negative at the start of 2019 after the benchmark plunged to the brink of a bear market.

Not everyone agrees with this unexpectedly gloomy outlook from the JPM quant, one which flies in the face of everything that Panigirtzoglou’s co-worker (and boss) Marko Kolanovic has been preaching in his weekly “BTFD” permabull sermons. And indeed, the bull case for equities will be familiar to many: while soaring inflation threatens to crush profit magins, and erode the value of future bond returns and devalues future “growth” company cash flows, companies have ridden the wave of price pressures to record profits. With income from S&P 500 firms expected to expand in each of the next two years (not if Morgan Stanley’s Michael Wilson has anything to say about it) many view stocks as being better positioned than fixed income. That’s especially true with Treasuries down almost 4% in 2022 already and could well close out the year in the red at this rate, in what would be the first back-to-back annual losses in history.

Indeed, one can argue – as we have – that while stocks are poised to drop, bonds will suffer even greater losses as the Fed proceeds to hike rates and drain trillions in liquidity, as such flows out of the greater of two evils and into stocks is certainly conceivable: after all, there will come a moment when the Fed will capitulate and ease, a moment which will send risk assets explosively higher.

Meanwhile, as we discussed yesterday corporate bonds – whose liquidity is suddenly collapsing – have slipped 5.9% since January, on course for the worst quarter since the 2008 financial crisis.

“Bonds typically are where you can put money in and just wait out any volatility, but right now I think the volatility is centered in the bond market and will continue to be centered in the bond market,” said Chris Gaffney, president of world markets at TIAA Bank. “You’re almost guaranteed to see those assets lose value in the coming year. And therefore it pushes investors to move out of bonds into equities.”

The worst possible scenario, if 2018 is any guide, is that both bond and stock fund managers may face an uphill battle attracting money from investors. And with traders pricing seven rate hikes this year, the appeal of cash-like instruments is poised to rise at long last, according to Panigirtzoglou who agrees with Goldman’s tactical call from this weekend to go into cash..

“As the Fed raises rates and other central banks are following the Fed, the risk is that at some point equity fund flows dissipate, or even turn negative,” he said. “I would not be surprised if we could have some sort of a repeat of 2018.”

Tyler Durden

Wed, 02/16/2022 – 19:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com