“Unprecedented” China Auto Market Collapse Heads Into Third Year After November Sales Drop 4.2%

The ongoing recession in the global auto market has undoubtedly been lead by China – and if November’s trends are any indication, the entire industry could be setting up for an ugly 2020.

Sales of sedans in China fell 4.2% in November to 1.97 million units, according to the CPCA on Monday.

This marks the 17th decline in the last 18 months and all but ensures that China will see a second straight annual drop for its auto market, according to Bloomberg.

Last year was the first time the market shrunk in decades, with ripple effects extending to places like Europe, Latin America and the rest of Asia. The industry has faced headwinds in the ongoing trade war, in addition to an overstretched consumer and ride-hailing and car-sharing services.

Areas outside of China’s big cities suffered the most, as a slowing economy kept consumers out of the showrooms that sold cheaper local brands. Experts are predicting consolidation in the industry as a result. Some brands, like Suzuki and PSA Group, have pulled out of China (or are in the process of selling stakes).

Bigger names like Toyota and BMW have weathered the storm well due to demand for hybrid cars – but this demand is anything but a guarantee moving forward.

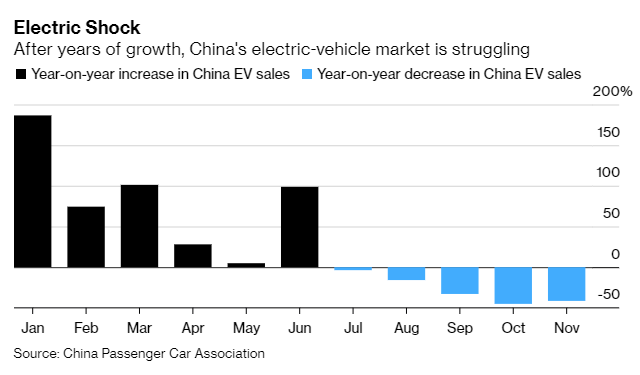

EVs were once a reason for optimism, especially with Volkswagen spending $4.4 billion next year to ramp up EV production in the country and Tesla moving a new plant to Shanghai.

But last month, wholesales of NEVs fell a stunning 42% to 79,000 units.

Recall, as we reported days ago, it’s looking like Beijing isn’t so excited to help sustain the EV niche of the market anymore.

We also noted that Beijing’s ambivalence was starting to show up in the numbers. EV sales fell off a cliff after June of this year, when the government slashed purchase subsidies. From July to October, sales of new energy cars were down 28% from the year prior.

Subsidies are unlikely to come back, we noted. The government is now aiming for “quality instead of just quantity”, noting that subsidies would be more costly than they were a few years ago, when the market was smaller. Instead, Beijing said it will spend the money on building out its infrastructure, like its charging stations.

A Bloomberg NEF report predicts that the EV market will rebound next year, however, stating: “Potential cuts to subsidies at the beginning of 2020 are keeping the industry in limbo. A shrinking market could force the government to give up its plans on cuts.”

Tyler Durden

Tue, 12/10/2019 – 19:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com