Shocker From Fed Repo Oracle Zoltan Poszar: Powell Must Crash The Market

Back on November 7, just one day before the Russell, cryptos and most risk assets peaked for the year and perhaps this cycle, we asked a simple question yet one which the “expert punditry” immediately dismissed as it was – what else – just more conspiratorial thoughts, to wit: “Did The Fed Just Set The Stock Market Up For A Crash?”

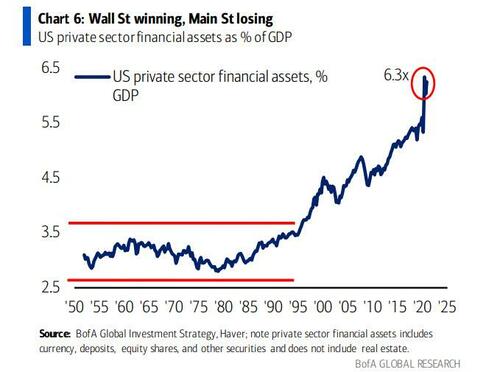

Of course, on its face this would seem preposterous: after all, the Fed’s entire legacy over the past 13 years has been merely creating hyperinflation among risk assets (and creating the largest wealth and social divide the US has ever seen), while doing everything it could to keep broader economic inflation subdued to avoid the risk of an inflationary meltup. Furthermore, crashing the market in a hyperfinancialized world such as this one, where the value of financial assets is now more than 6x US GDP would immediately lead to a major recession, if not outright depression.

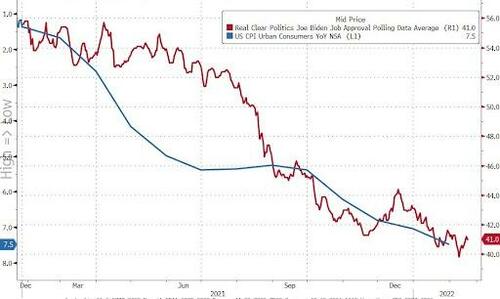

And yet, without a sharp slowdown in the economy, one catalyzed by sharply tighter financial conditions and multiple rate hikes (yesterday JPMorgan joined BofA in predicting seven rate hikes for 2022), the runaway inflation crisis that has crushed Biden’s approval rating will only get worse until we finally reach a breaking point where the Fed will lose all control over inflation expectations, sparking what may become hyperinflation, currency debasement and collapse (as BofA warned last week) and the end of the Fed itself which will no longer be relevant in a world where a 2% inflation target is no longer applicable.

That’s why we suggested that while the Fed does want a mild recession to cool down the economy, the Fed can ill afford a full-blown market crash, especially since virtually everyone in the market expects Powell to step in and rescue risk assets once the strike price of the Fed’s downward adjusted Put (as the Fed’s minutes noted yesterday) is hit, somewhere around S&P 3,800-4,000.

Fed desperate to figure out how to start a soft recession without also crashing the market

— zerohedge (@zerohedge) February 10, 2022

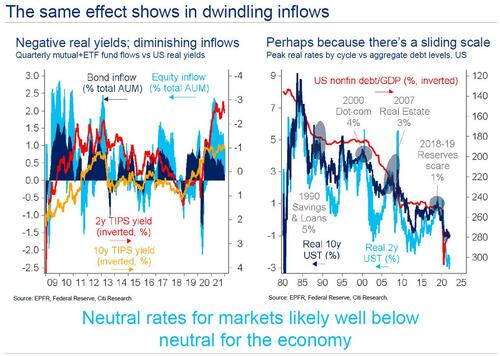

This proposal is hardly controversial: after all, even respected Wall Street strategists such as Citigroup’s finance guru, Matt King, has suggested that the Fed can only bring down inflation by curbing demand, in which case it will need to slow growth in order to ease inflation pressures… although King also warns that while the economy needs many more rate hikes to remove the inflationary overheating, stocks will crash long before this terminal rate is hit, writing that “neutral rates for markets likely well below neutral for the economy.”

We even suggested how the Fed could achieve its objectives of burning out inflation and sparking a much needed economic reset: push oil to $200 (which incidentally would explain why the Biden administration is pressing so hard for a war in Ukraine as a conflict there would instantly push oil to $150, sparking an inflationary tsunami around the globe and crashing the global economy as JPMorgan explained recently). We even described the growing parallels between the current situation and 2008 – when oil soared to $150 and according to many was the proximal factor that sparked the global financial crisis – one month ago in “Shades Of 2008 As Oil Decouples From Everything.”

If Powell really wants to burn out inflation, he should send oil to $200+

— zerohedge (@zerohedge) February 8, 2022

We bring all this up today because in a startling note from one of the most respected Wall Street strategists, repo market guru and former NY Fed official, Zoltan Pozsar, he not only echoes all of our “tinfoil conspiratorial” thoughts but even goes one step further suggesting that “We need a Volcker moment… a Volcker moment, where Vol stands for “vol” – as in volatility.” In other words, Pozsar writes that the Fed needs to crash the market to contain stocks.

Why? Because the Fed currently finds itself in a lose-lose situation, one where both choices are equally devastating – spark a recession or crash the market, or most likely both. As Rabobank’s Michael Every writes today summarizing the Fed’s predicament, “more worrying is that [the FOMC] were non-committal about what the Fed will do at its March meeting because the Fed has no idea what to do. All its choices are bad. There is no oasis ahead, as markets like to believe. There is no Fed ‘masterplan’ to stop inflation without stopping either the asset-price appreciation we’ve built markets on for decades, or the faux appreciation for the working class we’ve built markets on the backs of for decades, or both.”

Rabobank’s Fed-watcher Philip Marey expands on this:

“The minutes also noted that a formal framework review would start in 2024 and conclude in 2025. Although the flexible average inflation targeting (FAIT) strategy was reaffirmed at the January meeting, it has caused the Fed to fall far behind the curve. Policy rates are at the zero bound and the Fed is still buying assets when GDP growth is 6.9%, CPI inflation is 7.5% and unemployment is 4.0%. Is this rational monetary policy or are the lunatics running the asylum? There is no need to wait until 2024; the Fed’s groupthink has produced another failed strategy that should be terminated immediately.” But let’s not hold our breath: the Fed will continue to swagger arrogantly around as if it knows best, and things will get thrown and broken.

But it’s Pozsar who summarizes the dilemma facing Powell best:

The FOMC has one big problem: inflation. There are two ways to slow inflation: by hiking short-term interest rates or by forcing long-term interest rates higher. Historically, the Fed used rate hikes to engineer recessions that generated the slack needed to keep inflation in check (“opportunistic disinflation”). With the Fed’s “updated dual mandate” of inclusive low unemployment and the political imperative of redistribution through firmer wage growth at the bottom of the income distribution, the Fed aiming to slow inflation via a recession is unimaginable. Hikes today then are meant to slow inflation without a recession…

…which is not something that the Fed has ever managed to achieved before.

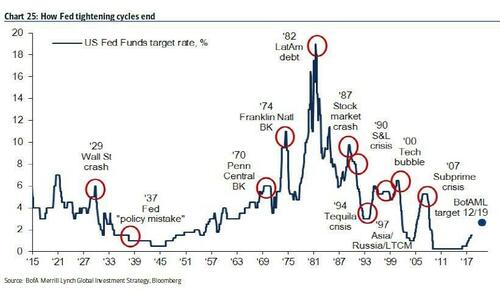

This is, of course, spot on – just two months ago we again repeating our favorite mantra, that “every Fed tightening cycle ends in a crisis.”

Yet after launching the lunacy of helicopter money, also called Modern Market Theory by socialists posing as finance gurus and market experts, the Fed is out of choices. Even so, Zoltan’s argument is that while the Fed should avoid a recession as it will crush the only benign form of inflation – wage inflation – Powell has to do something and that something is to, well, spike volatility – another word for crash markets, to wit: “Volatility is the best policeman of risk appetite and risk assets. To improve labor supply, the Fed might try to put volatility in its service to engineer a correction in house prices and risk assets – equities, credit, and Bitcoin too…“

Maybe the Fed should hike 50 bps in March, put an end to press conferences, and sell $50 billion of 10 -year notes the next day… Maybe FOMC members talk too much. They don’t keep the market guessing. They suppress volatility…

Yes, maybe… and then maybe the Fed should watch an unprecedented social panic unleashed the next day when the S&P plunges more than 50% to its ex-Fed fair value, and flee to a non-extradition country when yields – not just overnight rates but long-term rates too – explode into the double digits as hyperinflation is unleashed.

Then again, while many would have previously dismissed this proposal as the deranged rambling of a “conspiracy theory” website such as this one (with the one asterisk, of course, that all conspiracy theories discussed here eventually come true) the fact that a former Fed staffer – one who has both the NY Fed and Powell’s ear – is suggesting a market crash as a much needed inflationary catharsis should spark great fear among the market bulls who still expect Powell to step in and do what he did in March 2020 when the Fed started buying up risk assets for the first time.

Incidentally, while Powell may ignore the collapse in stocks, it is the upcoming implosion in the increasingly illiquid credit and bond markets (discussed here two days ago) that will shock the Fed out of its stupor when the central bank (and Pozsar) see the US economy grinding to a halt as interest rates explode higher in a crisis that will make March 2020 seem like child’s play by comparison.

So while it is debatable that the Fed will crash the market just to contain inflation (we sincerely doubt it), the fact is that thanks to the former NY Fed repo guru, this is now a part of the conversation and it is likely that as Zoltan’s view gains traction, Biden will confront the Fed chair with just this choice: shock the markets, crash stocks, and hammer inflation before the midterms (and certainly 2024) as the alternative is a historic rout for the Biden admin and Democrats.

It will be up to Powell at that point to decide if he will risk not just the Fed’s legacy and the western way of life, or scramble to appease the senile, 79-year old president who is now clutching at straws to preserve even a shred of his legacy… even if means destroying tens of trillions of (fake) wealth in the process.

So for the interest of what may soon be the biggest financial crisis in history, below we republish Zoltan’s entire note (also available in its original format to professional subs in the usual place).

We need a Volcker moment…

…a Volcker moment, where Vol stands for “vol” – as in volatility.

The FOMC has one big problem: inflation. There are two ways to slow inflation: by hiking short-term interest rates or by forcing long-term interest rates higher. Historically, the Fed used rate hikes to engineer recessions that generated the slack needed to keep inflation in check (“opportunistic disinflation”). With the Fed’s “updated dual mandate” of inclusive low unemployment and the political imperative of redistribution through firmer wage growth at the bottom of the income distribution, the Fed aiming to slow inflation via a recession is unimaginable. Hikes today then are meant to slow inflation without a recession…

…which is not something that the Fed has ever managed to achieved before.

Don’t envy the Fed: the inflation picture is complex. Goods prices were a steady source of disinflation for the past two decades, which gave the Fed precious time and cover to figure out what to do with policy rates to control services inflation. Not today. Goods inflation is now a tailwind, not a headwind. Your correspondent is no expert on goods price inflation, but he reads the papers enough to sense that with supply chain and distribution bottlenecks everywhere, goods inflation won’t disappear (slow maybe; disappear no). What used to give the Fed cover now exposes it: goods price inflation is a problem now, and at the same time services inflation is an issue too. There is no cover; “we need to fix this yesterday”.

The leadership of the FOMC knows what they can and cannot control…

They understand that they have no control over goods prices unless they curb demand through a recession – which given their updated mandate isn’t an option. But they also know that they have a lot of control over services inflation – which, unlike goods inflation, is mainly a function of domestic nominal factors.

The two big components of services inflation are OER and all other services. The former is a function of house prices, the latter is a function of labor supply. Both respond to financial conditions, and financial conditions are driven by long-term interest rates (term premia) and less so by short-term interest rates. The large number of hikes the market has priced and theFed implicitly sanctioned has had little impact on long-term interest rates, mortgage rates, or equities to date.

Don’t get us wrong – there’s been some impact, but not enough. More is needed. To slow OER inflation, mortgage rates need to get higher and house prices flat or outright lower. To slow all other services – driven by a shortage of labor – we need more supply of labor, not less demand for it through a recession. Again, inclusive low unemployment is a political imperative and, by extension, so is redistribution via stronger wage growth. If we agree on that, what follows is that we need to slow services inflation by slowing, not killing, wage growth, by bringing about more supply of labor, not less demand for it via a recession.

Maybe to increase labor supply, we need lower asset prices…

Just as your correspondent is not an expert on inflation, neither is he an expert on labor matters, but growing up in Hungary, his common sense whispers that if the post -Communist government response of generous transfer payments and early retirement sapped labor force participation and hurt the real growth prospects of Hungary and other economies, the capitalist market response to low interest rates and QE through sky -high equity valuations, house prices, and the rise of Bitcoin probably does the same: if the young feeling Bitcoin-rich are less inclined to work and the old feeling mass affluent are eager to retire early, labor force participation drops to the detriment of real growth prospects. If early retirement wasn’t good for Hungary, it won’t be good for the U.S. either.

Maybe the path to slower services inflation – OER and all other services – is through lower asset prices. We recognize that what we are saying is extreme, but we think the Fed will soon incorporate some version of this though t process. It wasn’t tried before, but what was tried before, the Fed cannot do anymore due to the political imperatives of inclusive low unemployment and redistribution.

Hence the need for a Volcker moment.

Volatility is the best policeman of risk appetite and risk assets. To improve labor supply, the Fed might try to put volatility in its service to engineer a correction in house prices and risk assets – equities, credit, and Bitcoin too… Legendary central bankers like Paul Volcker or Mario Draghi either sparked or tamed volatility: Draghi tamed volatility with his bumblebee -themed speech, and Volcker sparked volatility by starting to target quantities instead of rates, and he didn’t talk too much about what he was doing – he kept the market guessing.

Maybe the Fed should hike 50 bps in March, put an end to press conferences, and sell $50 billion of 10 -year notes the next day… Maybe FOMC members talk too much. They don’t keep the market guessing. They suppress volatility…

A new Volcker moment should also mean a radical change in the Fed’s strategy and involve going from targeting rates to targeting quantities once again – not the quantity of reserves in the banking system, but the quantity of duration in the market -based shadow banking system to jolt all sorts of risk premia higher.

No, lower risk assets won’t kill growth [ZH: spoiler alert, oh yes it will[. This is not a balance sheet recovery, and no, higher mortgage rates won’t kill growth either – wage growth at 5% can absorb higher monthly payments. The curve is flat and borderline inverted, and delivering slope into it can come from higher term premia engineered by the Fed, not only rate cuts as the “policy -mistake -in -the -making” crowd would have it…

The Volcker moment is the eight h channel of QT (from passive to active QT), and today’s Dispatch is the eleventh in a series exploring QT, and an eleventh hour appeal to market participants to start thinking about QT in a macro (active vs. passive), not just a micro (beautiful, ugly, or whiplash) sense…

The decisions of central bankers are always redistributive. For decades, redistribution went from labor to capital. Maybe it’s time to go the other way next.

What to curb? Wage growth? Or stock prices? What would Paul Volcker do?

Tyler Durden

Thu, 02/17/2022 – 11:49

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com