Aramco Stock Soars Limit Up In Debut After Saudis Force Locals To Buy

Is Jamie Dimon about to get the old bonesaw for leaving $180BN on the table?

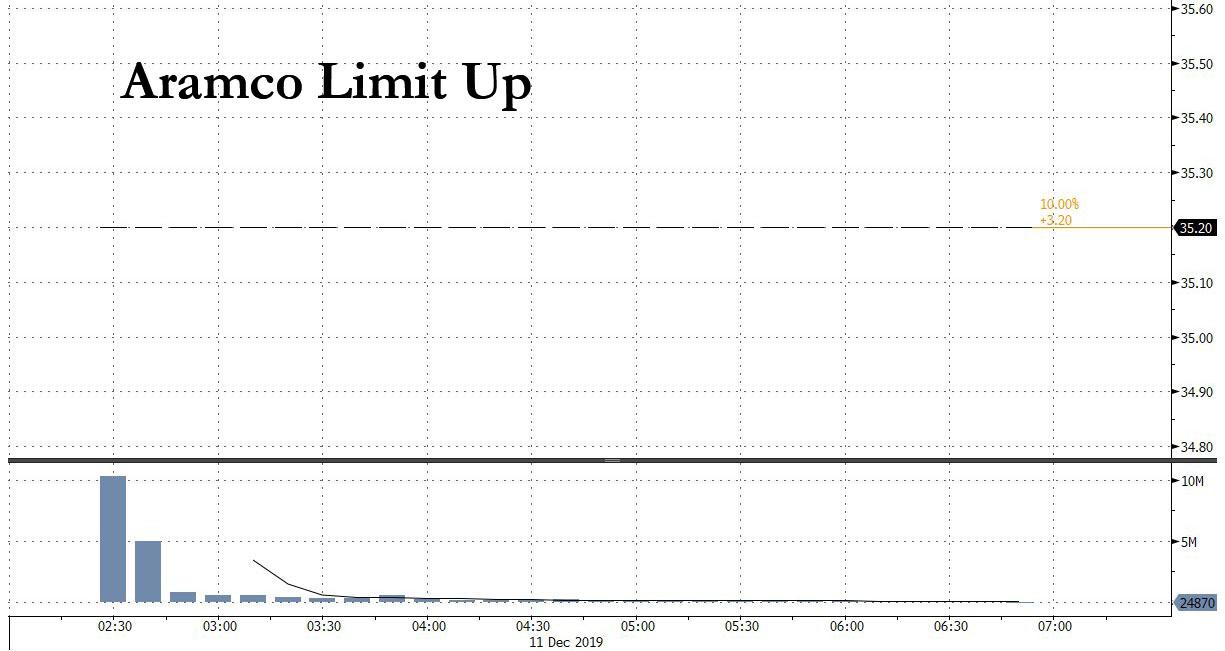

Saudi Arabia’s oil company Aramco soared 10% limit up on its first day of trading, reaching a valuation of $1.88 trillion, higher than any other publicly traded company in the world. This means that after pricing its IPO at $1.7 trillion, Jamie Dimon left about $180 billion on the table, which will hardly impress the Crown Prince.

The record valuation reflects an oversubscribed book of mostly local investors who bought shares on the Saudi Tadawul stock exchange after they were forced by Riyadh to pump the stock.

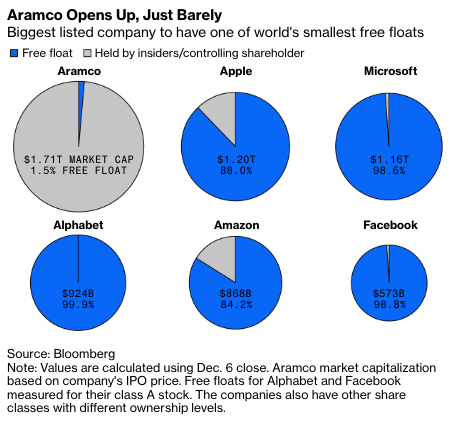

Aramco only sold a tiny 1.5% sliver in the company, meaning that the kingdom and Public Investment Fund of Saudi Arabia (PIF) could easily manipulate the price with such a small fraction of the stock public. Aramco listed on the Tadawul exchange because of other international exchanges and their investors found it hard to value the oil company near the $2 trillion levels.

“They have had to launch the IPO on their own stock exchange as the valuation was unlikely to be achieved elsewhere,” said John Colley, associate dean at Warwick Business School in the U.K, who spoke with Reuters.

Colley said the IPO pump is likely buyers affiliated with the kingdom. Aramco sold .50% of its shares to individual retail investors, many of whom were Saudi nationals, financially incentivized by the kingdom. The remaining 1% were domestic institutional investors and other financial institutions from surrounding countries.

Reuters noted that Aramco would be offering a dividend of at least $75 billion in 2020 to entice investors to hold. Also, investors who hold for more than six months could be rewarded with up to 100 bonus shares.

Saudi Arabia’s central bank doubled leverage for retail investors ahead of the IPO.

State investment funds, like Public Pension Agency and PIF’s Sanabil Investments unit, are among domestic institutions who were buying shares in the open market, reported Financial Times, adding that wealthy Saudi families were ordered by the kingdom to purchase stock.

As the FT reported ahead of the IPO, Saudi Arabia was “persuading” local institutions and wealthy families to buy shares in Saudi Aramco after its initial public offering, as part of a plan to drive up the stock price: the focus was to reach company’s $2t targeted valuation, and as of this morning, the company is more than halfway there from $1.7 trillion.

Families have been asked to pledge further funds, one unidentified adviser to families say

State investment funds were also “encouraged” to buy shares.

Public Pension Agency, the Public Investment Fund and the PIF’s Sanabil Investments unit are among institutions likely to be called on to support the shares once they are trading, FT reports

Aramco declined to comment; PPA did not respond to FT’s requests for comment, PIF denied it would intervene to support the price although clearly that’s precisely what it was doing this morning.

https://platform.twitter.com/widgets.js

The result of this massive pump spurred by the kingdom, which sent shares soaring by the 10% limit on opening day, was Mohamed bin Salman’s attempt to catapult Aramco’s valuation over the $2 trillion level.

“Aramco should easily get to the $2 trillion valuation as soon as tomorrow; there is plenty of appetite for it,” Marie Salem, the head of institutions at Daman Securities in Dubai, told Bloomberg.

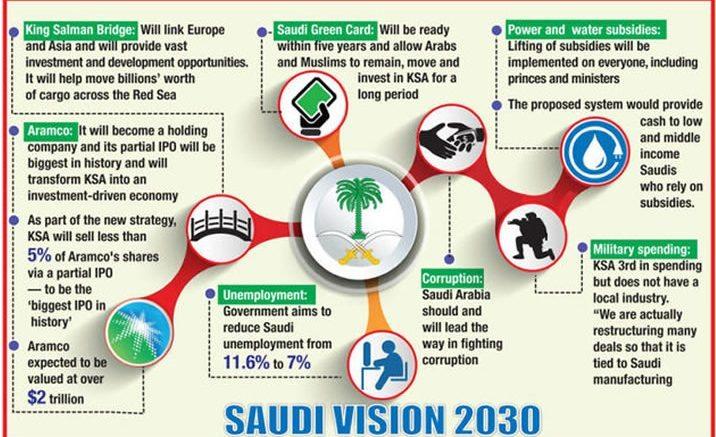

The Aramco IPO proceeds ($25.6 billion) will be used by Crown Prince Mohammed bin Salman (MbS) to fund his Vision 2030 initiative and transform the Saudi economy away from oil and gas.

As MbS and Aramco can claim fame to the world’s largest IPO, there was very little participation from foreign institutions, hence why the kingdom incentivized domestic funds and citizens to buy the stock on the day of the IPO.

Monica Malik, the chief economist at Abu Dhabi Commercial Bank, told Reuters while Ice Brent Crude futures trade around $63-$64, the kingdom needs about $87 per barrel to balance its budget.

And one day before the IPO, the finance minister of Saudi Arabia Mohammed al-Jadaan told CNBC’s Hadley Gamble that he rejected claims that the kingdom is running out of money.

“No we are not running out of money,” al-Jadaan said.

Last month, former director of the Central Intelligence Agency (CIA) David Petraeus told CNBC that he believed Saudi Arabia is “gradually running out of money,” which could explain why Aramco was rushed to IPO.

Sustainability of the Aramco IPO is questionable considering international participation is weak, and the kingdom not only forced domestic buyers to load up as much as they could but also were told to use leverage.

Macroeconomic headwinds of a slowing global economy, dropping Chinese demand and declining fuel consumption across the world could put down pressure on oil prices heading into the new year, but none of that matters because the kingdom has orchestrated one of the most significant one day stock pumps the country or maybe the world has ever seen.

Tyler Durden

Wed, 12/11/2019 – 07:12

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com