Banks Float Fewer Rate Hikes Due To Ukraine Crisis

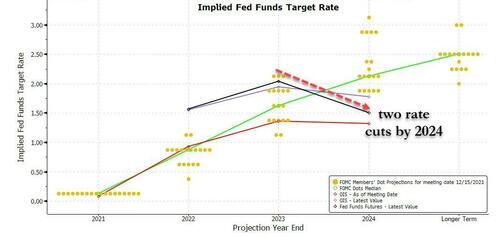

For the past month we have countered that amid predictions of “six or seven” rate hikes in 2022, and – most recently – as much as nine consecutive rate hikes as JPMorgan forecast last Friday, the Fed will be able to pull off at most a handful (see “Market Starts Pricing-In Rate-Cuts As Hot CPI Confirms Fed Policy Error Imminent“) before it is forced to relent as the market realizes the Fed is hiking right into a policy error.

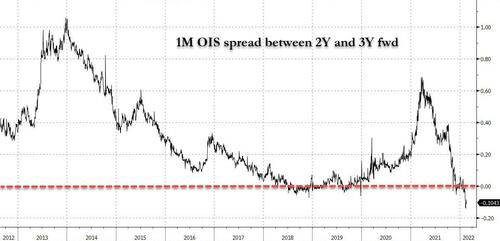

Curiously, it was none other than JPMorgan (no, it was another analyst there, not the one who called for 9 consecutive rate hikes) who late last week warned that the forward OIS curve is now the most inverted it has ever been, confirming that the forward looking rates market is already focusing on the rate cuts that will come after the current brief tightening cycle.

In fact, it was just last week when we said that in a short 6 months, Wall Street consensus will turned dramatically, and some time in the late summer, strategist will be tripping over each other who can come up with the biggest number of rate cut forecasts for 2023 and onward, as the economy hits a brick wall.

6 months from now: Wall Street trips over each other to come up with a greater number of rate cuts in late 2023/early 2024. One bank suggests NIRP https://t.co/g53v9QNbQD

— zerohedge (@zerohedge) February 18, 2022

Now, with the Ukraine situation in play and with oil surging and threatening to explode to levels that would promptly crash global economic growth (similar to what happened in the summer of 2008 when $150 coupled with the Lehman bankruptcy promptly sparked the Global Financial Crisis), others are also starting to admit that what comes next is not some exponential rate hiking spiral, but a Fed that returns to its grass roots of monetary stimulus, especially after the midterms when the GOP will take control of Congress making new fiscal stimulus impossible for years.

In a late Monday note from SMBC Nikko Securities chief currency and foreign bond strategist, Makoto Noji, he wrotes that the U.S. rate market will gradually price in the possibility that a terminal rate for the Fed of 2% or lower will be sufficient to keep inflation in check, as “a deepening correction in stocks will lead to a higher savings rate for U.S. households, cooling consumption and damping down inflation.”

As such, according to Noji, the Fed won’t have to be dovish to support stock prices, although the central bank is unlikely to avoid raising rates in March or to rethink a hike path beyond March (unless, of course, there is some unexpected market crash in the next 4 weeks). According to SMBC, long-term Treasury yields are likely fall moderately into summer, and indeed they have fallen sharply already, tumbling from over 2.1% last week to 1.85% as of this moment on military conflict fears… because the surest way to a global recession, and much more central bank stimulus, is an economic-shock inducing eruption in oil prices. In fact, just two weeks ago we suggested that if the Fed really wants to nuke inflation and spark an economic slowdown (or recssion), it should send oil to $200 first.

If Powell really wants to burn out inflation, he should send oil to $200+

— zerohedge (@zerohedge) February 8, 2022

Noji is not the only one to suggest that the events in Ukraine will impact the Fed’s strategy: none other than JPMorgan’s Marko Kolanovic wrote last Monday that “while the risk of conflict in Ukraine is high, it should have limited impact on global equity markets and would likely prompt a dovish reassessment by CBs.“

Because if there is anything that the Fed won’t hike into, it’s global war one would think…

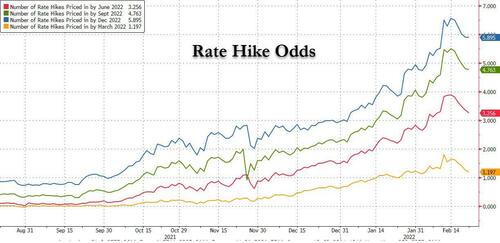

Meanwhile, the market is already responding and swap traders trimmed bets on future rate hikes by the Federal Reserve as escalating tensions over Ukraine hit risk assets. As shown below, overnight-indexed swaps signal a 19% chance of a 50bps hike in March, compared with a 56% probability seen a week ago. The odds have been steadily coming down given geopolitical risks and recent speeches from Fed officials downplaying that possibility.

Still, OIS indicate the Fed will raise its policy rate by almost 150bps, or 6 rate hikes, by the end of this year, well below the 175bps last week.

Should the conflict in Ukraine, and the US economic slowdown escalate further, watch as the number of rate hikes priced by the rates market at the end of 2022 shrinks with every passing day, until the tightening scare of January 2022 is a distant memory.

Tyler Durden

Mon, 02/21/2022 – 22:10

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com