Amazon Soars After Announcing 20-For-1 Stock Split, $10 Billion Stock Buyback

Finally validating a market rumor that had been circulating for years, moments ago Amazon whose stock has tumbled this year, announced that it would split it stock price 20-for-1. The company also announced plans for a $10 billion stock buyback, which while novel is not exactly unprecedented and back in February we reported that for the first time in a decade, the company had repurchased a little over $1 billion.

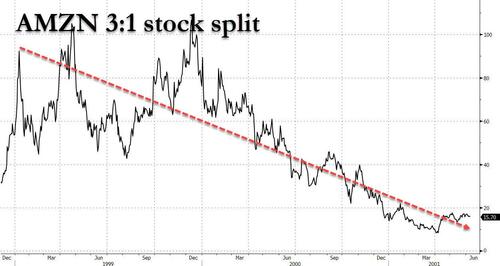

The question here is whether what is clearly an act of desperation to keep the stock propped up by appealing to retail investors who may find the lower price “cheaper” – as a reminder the last time AMZN did a stock split was in 1999, just before the market crashed – is the beginning of a bright new future for the company, or just confirmation that the best days for Amazon are now behind it.

For now the answer is the latter, with the stock surging as much as 10% after hours, from $2780 to $3,090 following the news. However, the stock has since lost some $100 from its peak.

And for those asking, the last time AMZN split its stock was in January 1999. It was about 80% lower a little over a year later.

Tyler Durden

Wed, 03/09/2022 – 17:02

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com