Covid, Weak Credit Spark Talk Of China Rate Cut

By Ye Xie, Bloomberg Markets Live commentator and analyst

Three things we learned last week:

1. China’s worst Covid outbreak since the early days of the pandemic and disappointing bank lending data add pressure for further policy easing. Domestic infections topped 1,000 a day, prompting a lockdown of a city of 9 million people in the northeast. The outbreak has increased challenges for the government to reach its “about 5.5%” growth target this year. Apple supplier Foxconn is halting operations at its Shenzhen sites, one of which produces iPhones, in response to a government-imposed lockdown on the tech hub city.

On Friday, credit data came in well below expectations, underscoring the growth drag from Covid and the housing slowdown. Long-term household borrowing – a proxy for mortgage loans – fell for the first time ever. The data led some economists, including those at Citigroup, to expect a cut in the medium-term lending facility rate on March 15. If delivered, it would sharpen the policy divergence with most other central banks, as the Fed is expected to raise rates this week.

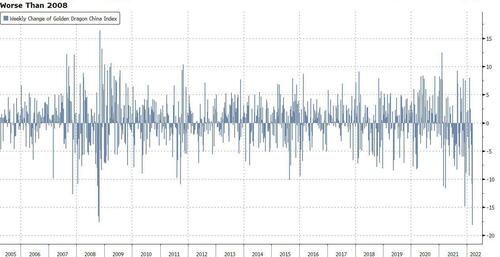

2. The risk of being delisted from American exchanges triggered a record slump among U.S.-traded Chinese stocks. The Nasdaq Golden Dragon China Index lost 18% last week, surpassing the previous record slump during the financial crisis in 2008. The move came after the SEC identified five Chinese companies that could be kicked off the exchanges, if they fail to open their books to U.S. auditors as required by a new law. While considered a routine procedure to implement the law passed in December 2020, the move nonetheless rattled investors who have already been unnerved by rising geopolitical risks.

So how does an investor hedge the risk? Morgan Stanley advised clients to go long those ADRs eligible for a Hong Kong listing and short those that are unqualified, and with high foreign ownership.

3. Negative sentiment toward Chinese assets finally penetrated the strong yuan. The offshore yuan weakened 0.5% on Friday, the worst day in six weeks. The currency has weakened past its 50-day moving average and is on track toward the 100-DMA. Further spread of the virus – possibly leading to factory closures and port disruptions – could cloud China’s export outlook and add pressure to the yuan selloff.

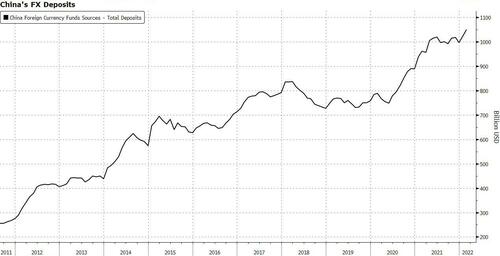

To be clear, any depreciation is likely to be limited. Friday’s credit data showed that foreign-currency deposits onshore surged to a record, suggesting that the domestic market is still awash with dollars.

Tyler Durden

Sun, 03/13/2022 – 22:59

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com