Futures Drift Lower After Kremlin Dashes Ukraine Peace Hopes; Curve Inversion Persists

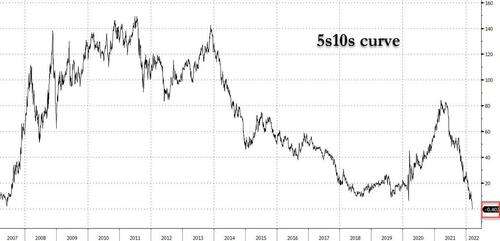

After yesterday’s explosive session, which saw stocks trade in violent kneejerk response to conflicting headlines out of Ukraine at first, only to post the biggest ever post FOMC reversal, as markets realized that the Fed’s overly hawkish ambitions are too great and doom the rapidly slowing economy to an accelerated recession, overnight trading has been positively subdued with emini S&P futs trading in a tight 20 point range between 4,340 and 4,360 until 6 am ET, when European stocks turned negative and US equity futures suddenly dropped as much as 0.5%, after the Kremlin said reports of major progress in Ukraine talks are “wrong” and Kremlin spokesman Dmitry Peskov dismissed reports that the warring parties are moving toward a settlement, blaming Kyiv for slowing the negotiations, crippling any hope for a quick ceasefire deal and adding to worries about the outlook for economic growth as the Federal Reserve’s campaign against inflation gets underway. Futures were already wavering as the bond market flagged a growing risk that the Fed’s efforts to rein in prices could trigger an economic downturn with the 5s10s curve inverting. Ominously, Brent jumped more than $5/bbl after tumbling below $100 yesterday.

Contracts on the Nasdaq 100 dipped 0.4% by 7:30 a.m. in New York, while S&P 500 futures were 0.34% lower. The benchmark S&P 500 on Wednesday posted its best two-day rally since April 2020 as the Fed hiked interest rates by a quarter point and Chair Jerome Powell signaled the economy could weather tighter monetary policy. Gold and 10Y yields dropped to session lows, and bitcoin was modestly lower on the session. Europe was slightly green while Asia stocks closed higher, led by the Hang Seng which rose 7%

On Wednesday, the Fed raised borrowing costs by a quarter percentage point and signaled hikes at all six remaining meetings in 2022, while projecting an “above-normal” policy rate at 2.8% by the end of 2023. Chair Jerome Powell said the U.S. economy is “very strong” and can handle monetary tightening. Treasuries advanced, while a portion of the bond curve – the gap between 5- and 10-year yields – inverted for the first time since March 2020, a sign investors expect recession.

The Fed also said it would begin shrinking its $8.9 trillion balance sheet at a “coming meeting,” without elaborating as Biden breathes down Powell’s neck to get inflation under control. Meanwhile, the commodity shock from Russia’s war in Ukraine is continuing to aggravate price pressures and economic risks, portending more market volatility.

“It won’t be easy — rarely has the Fed safely landed the U.S. economy from such inflation heights without triggering an economic crash,” Seema Shah, chief strategist at Principal Global Investors, said in emailed comments. “Furthermore, the Russia-Ukraine conflict, of course, has the potential to disrupt the Fed’s path. But for now, the Fed’s priority has to be price stability.”

“This type of normalization policy does not always end well,” said Nicolas Forest, global head of fixed income at Candriam Belgium SA. “While the Fed began its tightening cycle later than usual, at a time when inflation has never been so high, financial conditions could also harden, making the 2.80% target ambitious in our view. In this context, it is easy to understand why the U.S. curve has flattened.”

In the latest Ukraine war developments, Russia continued to “hammer” cities like Kharkiv and Cherniyiv with bombardments and rocket systems and isn’t acting like it wants to settle, Pentagon spokesman John Kirby said in an interview with Bloomberg TV. Meanwhile, Russia’s Finance Ministry said a $117 million interest payment due on two dollar bonds had been made to Citibank in London amid mounting speculation that the country is heading for a default. Russia had until the end of business Wednesday to honor the coupons on the two notes. The ruble gained for a sixth day in Moscow trading, while the country’s stock market remains shut. Here are some more headlines courtesy of Newsquawk:

- Ukrainian President Zelensky said talks with Russia are challenging but are still ongoing. He added that Russia has the advantage in the air and already crossed all red lines, while he hopes for assistance from allies.

- Russian Foreign Minister says that discussions with Ukraine are continuing via video link with the sides discussing humanitarian and political issues.

- Ukrainian Defense Minister says so far there is nothing to satisfy us in negotiations with Russia; a peaceful solution can be reached with Russia, but “on our terms”.

- Russian Kremlin says their delegation is putting colossal energy into Ukraine peace talks, conditions are absolutely clear. Agreement with Ukraine with clear parameters could very fast stop what is going on; on the recent FT report re. peace talk progress said this is not right, elements are correct but the entire peace is not true.

A rebound in China stocks listed on U.S. exchanges also cooled a day after they soared the most since at least 2001 on a pledge from Beijing to keep its stock market stable. American depository receipts of Alibaba were down 2% in premarket trading following their biggest gain since their trading debut in September 2014, while Baidu dropped 5.7%. Here are some other notable premarket movers:

- Shares in Marrone Bio (MBII US) jumped 20% premarket after announcing a merger pact with Bioceres Crop Solutions (BIOX US), which falls 5.9%.

- Williams-Sonoma (WSM US) gained 6.2% in extended trading Wednesday after the home-goods retailer reported adjusted fourth-quarter earnings that beat the average analyst estimate. The company also raised its dividend and announced a share buyback authorization.

In Europe, the Stoxx 600 index gained, nearly erasing losses that were sparked by Russia’s invasion of Ukraine. The index then dipped on the abovementioned news out of the Kremlin which said reports of major progress in Ukraine talks are “wrong”, only to bounce back into the green. DAX and FTSE MIB lag, slipping ~1%. Banks, autos and personal care are the worst performing sectors. Energy, real estate and tech outperform. Here are some of the biggest European movers today:

- Deliveroo shares rise as much as 9.8% after reporting full-year results, with Barclays (equal-weight) saying the food-delivery company’s mid-term margin commentary was “helpful.”

- Grenke shares jump 16%, the most since May, after the company reported dividend per share that beat the average analyst estimate.

- EQT shares rise as much as 9.5%, extending Wednesday’s 12% gain following the acquisition of Baring Private Equity Asia for $7.5 billion in what is the biggest takeover of a private equity firm by another in the sector.

- Atos shares jump as much as 7.4% after BFM Business reported that Airbus has been mulling a possible takeover of the French IT firm’s cybersecurity unit. Atos reiterated that its BDS cybersecurity business is not for sale.

- DiaSorin shares soar as much as 9.7%, their best day in nearly one year as analysts upgraded the Italian diagnostics company following results, with the firm reporting net income for the full year that beat the average analyst estimate.

- Verbund shares rise as much as 7.7% after 2021 profit beats estimates and Austria’s biggest utility forecasts higher profit next year.

- Thyssenkrupp shares fall as much as 11% after the company suspended its full-year forecast for free cash flow. The move is a disappointment, given the FCF focus in the steel company’s equity story after years of cash burn, Deutsche Bank says.

Asian stocks extended their rebound through a second day after Chinese shares rallied again on a vow of state support and the Federal Reserve expressed confidence in the U.S. economy. The MSCI Asia Pacific Index rallied as much as 3.6%, lifted by technology and consumer-discretionary shares. Japan and Hong Kong benchmarks led the way, with the Hang Seng Index surging 17% over two days, its biggest back-to-back advance since the Asian financial crisis in 1998, and the Topix jumping 2.5%. A combination of China’s pledge to stabilize markets, Fed comments on the U.S. economy’s strength after the expected quarter-point interest rate hike by the central bank, and hopes for progress on Russia-Ukraine talks have put Asian stocks on track to end four consecutive weekly losses. “Following recent corrections, markets have reached a point that prices in, or presumes, a fair amount of rate hikes and economic stress,” said Ellen Gaske, lead economist for G-10 economies at PGIM Fixed Income. “It would not be surprising to see investors begin to inch back into the market in search of yield.”

Japanese equities rose for a fourth day, as investors were cheered by comments from the Federal Reserve on U.S. economic growth and China’s moves to support its market. Electronics and machinery makers were the biggest boosts to the Topix, which rose 2.5%, to the highest level since Feb. 21. All 33 industry groups advanced. Fast Retailing and Tokyo Electron were the biggest contributors to a 3.5% rise in the Nikkei 225. The yen extended its losses against the dollar after weakening 3.4% over the previous eight sessions. The Fed raised interest rates by a quarter percentage point and signaled hikes at all six remaining meetings this year, while saying “the American economy is very strong” and able to handle tighter policy. Global stocks got a lift Wednesday after Beijing vowed to keep its stock market stable. “The FOMC dot plot clearly shows that the number of interest rate hikes will be reasonable, and the stock market is pleased that the risk of accelerating long-term interest rates rising due to monetary policy following has decreased,” said Kazuharu Konishi, head of equities at Mitsubishi UFJ Kokusai Asset Management. In domestic news, a magnitude-7.3 earthquake struck near Fukushima prefecture late Wednesday, killing four and injuring dozens of people, as well as derailing a bullet train and disrupting power

India’s benchmark stocks index rose, tracking regional peers, as lenders drove gains. The S&P BSE Sensex climbed 1.8% to 57,863.93, in Mumbai. The measure added 4.2% this week, and with local markets closed for a holiday Friday, it is the biggest weekly advance for the index since February 2021. With today’s gains, it completely recovered all losses that followed Russia’s invasion of Ukraine. Mortgage lender Housing Development Finance Corp. rose 5.4%, its biggest jump in over a year and was the best performer on the Sensex, which saw all but two of 30 shares advance. Seventeen of 19 sectoral sub-indexes compiled by BSE Ltd. gained, led by a gauge of realty companies. The NSE Nifty 50 Index added 1.8% to 17,287.05 on Thursday. China’s pledge to support its markets, the prospect of progress on Russia-Ukraine cease-fire talks and the U.S. Federal Reserve’s comments on America’s economic strength boosted sentiment. Brent crude, a major import for India, down to $100 a barrel from $127.98 last week, also eased concerns. The Fed announcement was on expected lines for the market and they rallied in relief, Nishit Master, portfolio manager at Axis Securities wrote in a note. “Despite the recent rally, the markets will continue to remain volatile in the near future on the back of tightening of liquidity conditions globally. One should use this volatility to increase equity allocation for the long term.”

In rates, the post-Fed flattening move has extended as investors continue to digest expectations on latest policy path, with some strategists calling for a top in yields. 10-year yields around 2.12%, richer by ~6bp on the day and outperforming bunds and gilts by 4.5bp and 3bp; 2s10s spread is flatter by ~4bp on the day. US TSY yields are richer by as much as 7bp across long-end of the curve, flattening 5s30s by a further 2.4bp with the spread dropping as low as 24.2bp; the 5s10s was again inverted, trading fractionally in the red after first inverting yesterday during Powell’s FOMC presser.

In FX, the Bloomberg Dollar Spot Index pared a loss and the greenback traded mixed after earlier sliding against all of its Group- of-10 peers apart from the Swedish krona, as risk aversion gave rise to a haven bid. The euro snapped a three- day advance after the news out of Kremlin dampened sentiment; short-dated European benchmark bond yields were little changed while they contracted longer out on the curve. The pound advanced and gilts rose, led by the long end before the Bank of England looks all but certain to take interest rates back to their pre- Covid level. The Australian dollar still outperformed G-10 peers after the nation’s February unemployment rate falls to the lowest since 2008, boosting bets of earlier interest-rate hikes. The yen inched up amid risk aversion, but still held near its lowest level in six years as Bank of Japan Governor Haruhiko Kuroda vowed to continue with monetary stimulus even after the Federal Reserve kicked of its rate hike cycle Wednesday.

In commodities, WTI crude futures climb near $99.50 while Brent rallies through $102; spot gold adds ~$16 to trade around $1,944. Base metals are mixed; LME nickel falls 8% to maximum limit while LME aluminum gains 1.8%. Bitcoin is modestly softer but remains well within yesterday’s parameters and retains a USD 40k handle.

Looking at the day ahead now and housing starts, building permits, initial jobless claims and industrial production are due. We will also hear from ECB’s Lagarde, Lane, Knot, Schnabel and Visco. Earnings releases include Accenture, Enel, FedEx, Dollar General and Verbund.

Market Snapshot

- S&P 500 futures down 0.3% at 4,337.00

- STOXX Europe 600 up 0.4% to 450.44

- MXAP up 3.5% to 178.08

- MXAPJ up 4.0% to 582.21

- Nikkei up 3.5% to 26,652.89

- Topix up 2.5% to 1,899.01

- Hang Seng Index up 7.0% to 21,501.23

- Shanghai Composite up 1.4% to 3,215.04

- Sensex up 2.1% to 58,014.18

- Australia S&P/ASX 200 up 1.1% to 7,250.80

- Kospi up 1.3% to 2,694.51

- German 10Y yield little changed at 0.38%

- Euro up 0.2% to $1.1057

- Brent Futures up 3.0% to $100.97/bbl

- Gold spot up 0.7% to $1,940.77

- U.S. Dollar Index down 0.42% to 98.21

Top Overnight News

- Russia’s Finance Ministry said a $117 million interest payment due on two dollar bonds had been made to Citibank in London amid mounting speculation that the country is heading for a default

- Rates and currency markets are skeptical of the Bank of England’s ability to tame inflation without triggering an economic slowdown. Policymakers may undo tightening as soon as next year, swaps contracts suggest

- After the Federal Reserve raised interest rates and signaled hikes at all six remaining meetings this year, a section of the Treasury curve — the gap between five- and 10-year yields — inverted for the first time since March 2020. Meanwhile the flattening trend between two- and 10-year yields continued

- Hungary’s central bank kept the effective interest rate unchanged after a rally in the forint eased pressure on policy makers to further hike the European Union’s highest key rate

- Commodities trader Pierre Andurand sees a path for crude oil to get to $200 by the end of the year as historically tight markets struggle to ramp up production and replace lost supply from Russia

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks gained post-FOMC while Chinese tech remained euphoric on support pledges. ASX 200 was led higher again by outperformance in tech and following strong jobs data. Nikkei 225 rallied after recent currency weakness and despite the deadly earthquake in Fukushima. Hang Seng and Shanghai Comp. continued to benefit from China’s recent policy support pledges which lifted the NASDAQ Golden Dragon China Index by 33% and with the PBoC boosting its liquidity efforts. Significant gains were also seen amongst developers after reports that China is not planning to expand its pilot property tax reform this year.

Top Asian News

- China Affirms Friendship With Ukraine, Promise to ‘Never Attack’

- Indonesia Holds Rates While Monitoring Inflation, War Risks

- War in Ukraine Triggers Slew of Shelved IPOs in Japan: ECM Watch

- Strong Quake Hits Japan, Killing Two and Halting Factories

European bourses are predominantly negative, Euro Stoxx 50 -0.4%, after a relatively constructive open post Wall St./APAC handover. Initial upside faded as updates on Russia/Ukraine are downbeat overall and push back further on some of Wednesday’s more constructive updates. US futures are lower across the board, ES -0.4%, after yesterday’s upbeat close post a hawkish-FOMC.

Top European News

- Raiffeisen CEO Says Bank is Considering Exit From Russia

- UBS, Mitsubishi Sell Japan Realty Unit to KKR for $2 Billion

- Russia’s Ruined Gameplan for Ukraine Is Visible in the South

- Diageo Rises; JPMorgan Lifts to Overweight on U.S. Position

In FX, the dollar flips after hawkish Fed hike and more aggressive dot plot before unwinding all and more upside in buy rumor, sell fact reaction; DXY almost 100 ticks down from pre-FOMC peak and just off 98.000. Aussie outperforms following upbeat labour data and Kiwi lags on the back of sub-forecast GDP, AUD/USD eyeing Fib ahead of 0.7350, AUD/NZD back up over 1.0700 and NZD/USD capped into 0.6850. Sterling firm awaiting confirmation of 25 bp hike from the BoE and vote split plus MPC minutes for further guidance; Cable close to 1.3200 at best and EUR/GBP sub-0.8400. Euro clears 1.1000 again, while Yen extends decline to cross 119.00 line. Lira looks ahead to CBRT with high bar for any direct support in contrast to Real that got a full point hike from BCB and signal of more to come. Brazilian Central Bank raised the Selic rate by 100bps to 11.75%, as expected, while the decision was unanimous and it considered it appropriate to advance monetary tightening significantly into even more restrictive territory.

In commodities, crude futures continue to nurse recent wounds, with Brent May back around USD 102.50/bbl while WTI April inches toward USD 100/bbl. Upside occurred, picking up from initial choppy action, amid the most recent geopolitical developments from the Kremlin and Ukrainian Defence Ministry. India may purchase up to 15mln bbls of oil from Russia with state-run oil firms preparing to purchase heavy volumes of Russian crude that’s going at a deep discount to help ease the margin pressure oil refiners. China is to increase gasoline prices by CNY 750/ton and diesel by CNY 7220/ton as of March 18th, according to the NDRC via CCTV. Italy is considering blocking the export of raw materials, according to the Deputy Industry Minister. Spot gold/silver are firmer given geopolitical-premia., while LME Nickle hit the new adj. limit down of 8% after the reopen.

In fixed income, debt derives impetus from downturn in risk sentiment as Russia and Ukraine deny major strides towards ceasefire deal. Bond curves remain flatter following Fed’s hawkish dot plots. Bonos and OATs soak up Spanish and French supply.

US Event Calendar

- 8:30am: March Initial Jobless Claims, est. 220,000, prior 227,000; March Continuing Claims, est. 1.48m, prior 1.49m

- 8:30am: Feb. Building Permits, est. 1.85m, prior 1.9m; Building Permits MoM, est. -2.4%, prior 0.7%, revised 0.5%

- 8:30am: Feb. Housing Starts, est. 1.7m, prior 1.64m; Housing Starts MoM, est. 3.8%, prior -4.1%

- 8:30am: March Philadelphia Fed Business Outl, est. 14.8, prior 16.0

- 9:15am: Feb. Industrial Production MoM, est. 0.5%, prior 1.4%

- Capacity Utilization, est. 77.9%, prior 77.6%

- Manufacturing (SIC) Production, est. 1.0%, prior 0.2%

DB’s Jim Reid concludes the overnight wrap

After I press send today I’ll be venturing back on a plane for the first time in two years this morning. I’m off to give a speech at a conference in Cannes just at the time when all the tabloid papers here say that London is going to be hotter than Greece and the Costa Brava in a rare March warm spell here in the UK.

Rarer than a warm spell in the UK in March, we now have the start of only the fourth Fed hiking cycle in 27 years. We saw a wild ride in markets after the decision as initially the hawkish dot plot led to a big sell off in rates, and an S&P 500 that fell nearly -1.5% from pre announcement levels and into negative territory for the session. However markets completely turned on Powell’s comments in the press conference that the probability of recession was “not particularly elevated” and that the “economy is very strong” and can handle tighter policy. The S&P closed +2.24%, completing its biggest 2-day move in 23 months, while the Nasdaq climbed +3.77%. The big winners were mega cap tech stocks, with the FANG+ index putting in its best day on record, climbing +10.19%. The latter were almost certainly helped by earlier news that China would “actively introduce policies that benefit markets” and take steps to ease the most spartan lockdown measures. The FANG index includes Baidu and Alibaba that were up nearly +40% yesterday.

To be fair the Fed meeting and the surrounding price action makes sense. Although I think the risks of a US recession by late 2023 / early 2024 are increasingly elevated I’m not convinced that the risks are particularly high in 2022. The start of the hiking cycle isn’t historically the problem point for the economy or for that matter equities.

Further to this, in my CoTD yesterday (link here) I showed that on average it takes around three years from the first Fed hike to recession. However the bad news is that all but one of the recessions inside 37 months (essentially three years) occurred when the 2s10s curve inverted before the hiking cycle ended. With all the recessions that started later than that, none of them had an inverted curve when the hiking cycle ended. In fact, hiking cycles that ended with the curve still in positive territory saw the next recession hit 53 months on average after the first rate hike, whereas the next recession for hiking cycles that ended with an inverted curve started on average in 23 months, so just under two years. As a reminder, none of the US recessions in the last 70 years have occurred until the 2s10s has inverted. On average it takes 12-18 months from inversion to recession. The problem is that all but one of the hiking cycles in the last 70 years have seen a flatter 2s10s curve in the first year of hikes. The exception saw a very small steepening. So these are the risks.

Indeed the yield curve flattened after the Fed with 2s10s moving from just under +31bps to +21bps an hour later. It closed at +23bps. 10yr yields rose 6bps after the announcement but reversed most of this into the close and ended +4.1bps on the day at 2.18%. We are at 2.137% this morning. The rise in 2 years was more durable at +8.9bps on the day with a -2.4bps reversal this morning to 1.912%. At one point yesterday this was +15bps on the day and at a hair’s breadth below 2%. The tighter policy path meant that breakevens declined and real rates increased; 10yr Treasury breakevens fell -5.5bps to 2.80%.

Digging into the meeting itself. Two years to the day after cutting rates to the zero lower bound, the Fed raised rates by 25 basis points yesterday, and communicated a much tighter path of policy to come (our US econ team’s full recap here). Yesterday’s meeting came with an updated Summary of Economic Projections, and the dots were much more hawkish. The median dot showed expectations for 7 hikes in 2022, including yesterday and in line with what our US economics team is expecting, and which would represent a hike at every meeting for the rest of the year. The median dot reaches 2.75% next year, above the Fed’s long-run estimate for the fed funds rate, signaling policy will need to get to a restrictive stance. Indeed, the dots actually showed the long-run neutral fed funds rate fell, so a restrictive stance will come even sooner. These were just the medians. There was considerable variance in the dots, and Chair Powell noted the risks to inflation were to the upside, suggesting rates could be even higher than what the hawkish medians are suggesting.

On the balance sheet, the Fed noted that QT would start at a coming meeting. Chair Powell signaled it could start as early as May, noting the Committee made excellent progress on the parameters of balance sheet runoff, even if they did not provide more details yesterday. Chair Powell noted the minutes from this meeting would have more details around runoff parameters.

Elsewhere in the press conference, the Chair noted that every meeting was live, and that the Fed would move more quickly if appropriate, which ostensibly means +50bp hikes are on the table, but also said the Fed’s expected QT program will equate to approximately one more hike, which is in line with our team’s expectations for QT this year. Indeed, each of the next few meetings is pricing a meaningful chance of a +50bp hike. He noted the Fed would be evaluating month-over-month inflation readings when determining the pace of policy tightening and that financial conditions needed to be tighter. In all, a hawkish meeting, which was expected, with little for doves to cling to.

After yesterday’s Fed hike, it is the Bank of England turn to raise rates with the decision scheduled for 12pm London time. A preview from our UK economist is available here. Our team expects a +25bps hike to bring the key rate to its pre-pandemic level of 0.75%. They also added a +25bps June hike to their projections for the path of the monetary policy in 2022, which would bring the benchmark rate to 1.5% by the end of this year. Beyond 2022, they see another hike in February 2023 that would bring the key rate to 1.75%, their projected terminal rate. More on their economic outlook for the UK can be found in the UK Macro Handbook here. As of this morning, the market is pricing in slightly less than 70bps of hikes by the end of 2022.

Turning to geopolitics, net net, more positive news flow came out of Russia-Ukraine talks, as a neutrality model that would allow Ukraine to preserve its army seems to be among options on the negotiations table. While comments were otherwise scarce, the head of Russian delegation Vladimir Medinsky said that the talks were going slowly and strenuously. Meanwhile, Russia was officially excluded from Council of Europe yesterday. Putin’s address on Russian TV was pretty hawkish but he was talking to a domestic audience.

An FT report that suggested significant progress in the talks contributed to the optimism that fuelled European shares higher as the STOXX 600 gained +3.06%, although an earlier catalyst for the rally was China’s announcement of economic support. Country-level stock markets like Germany’s DAX (+3.76%) and France’s CAC 40 (+3.68%) have notched even stronger gains. The former is now just 1.30% below its pre-invasion close on February 23rd. On that China story, the news was that Shanghai would not implement a strict lockdown in response to the recent outbreak but would instead encourage working from home helped support risk sentiment. Arguably more impactful for markets, top economic ministers noted that the government would introduce policies to benefit markets after the recent volatility, which was a boon to equities.

Following on from this, Asian stock markets have surged higher for a second day. The regional sentiment remains buoyant as a rally led by the Hang Seng (+5.79%), CSI (+3.19%) and Shanghai Composite (+2.59%) came after a blistering surge in tech stocks over the last 24 hours as a top Chinese official in his comments yesterday stated that the administration will introduce market friendly policies. Elsewhere, the Nikkei (+3.14%) is sharply higher this morning, extending the gains in the previous two sessions while the Kospi (+1.77%) is also surging. US stock futures are fairly flat.

Prior to the Fed’s decision, European yields rallied after Sweden’s Riksbank governor did not rule out a possibility of a hike as early as this year – a significant shift from its previous 2024 projections. Swedish yields marched higher across the curve in response, with 10y rising by +7.2bps and hitting the highest level since January 2019 and the 2s10s curve steepening (+1.3bps), while the krona rose by +1.73% against the dollar in what was an overall down day for the greenback as the Bloomberg USD index declined by -0.35%. The British pound (+0.48%) rose as well ahead of the BoE decision and the yield on gilts (+5.3bps) reached the highest level since November 2018.

Together with aforementioned geopolitical developments, these news fuelled risk appetite and bond yields rose across most of the Eurozone before we even got to the Fed. Moves in bunds (+6.0bps), OATs (+4.2bps) and BTPs (-0.3bps) were accompanied by sizeable declines in underlying breakevens, with those on bunds (-5.1bps) and BTPs (-5.1bps) edging lower.

Inflation expectations were partially muted by a rather calm day for major commodities. Both Brent (-1.89%) and WTI (-1.45%) dipped although this has been reversed so far this morning. There were more fun and games in nickel after a week of no trading due to last week’s massive spike. This time trading was suspended as prices dropped below the new daily threshold and a technical glitch occurred.

Despite relative calm in oil markets, other Russia-related commodities continued to slide, especially so in Europe. The Dutch TTF futures for April delivery fell by -10.73% yesterday and around -70% since their intra-day peak on March 7th. Meanwhile, E.ON, German energy supplier, announced it will stop new purchases of gas from Russian companies, although the firm has no long-term contracts. Soft commodities like corn (-3.69%) and wheat (-7.36%), export of which was recently sanctioned by Russia, also declined.

In yesterday’s data releases, US retail sales came in at +0.3%, below +0.4% expected, with gasoline spending (+5.3%) driving the advance. The NAHB index also disappointed (79 vs 81 expected), dropping to a six month low.

To the day ahead now and housing starts, building permits, initial jobless claims and industrial production are due from the US. We will also hear from ECB’s Lagarde, Lane, Knot, Schnabel and Visco. Earnings releases include Accenture, Enel, FedEx, Dollar General and Verbund.

Tyler Durden

Thu, 03/17/2022 – 07:58

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com