World’s Most Bearish Hedge Fund Manager: “This Will End Up Being My Worst Year Ever”

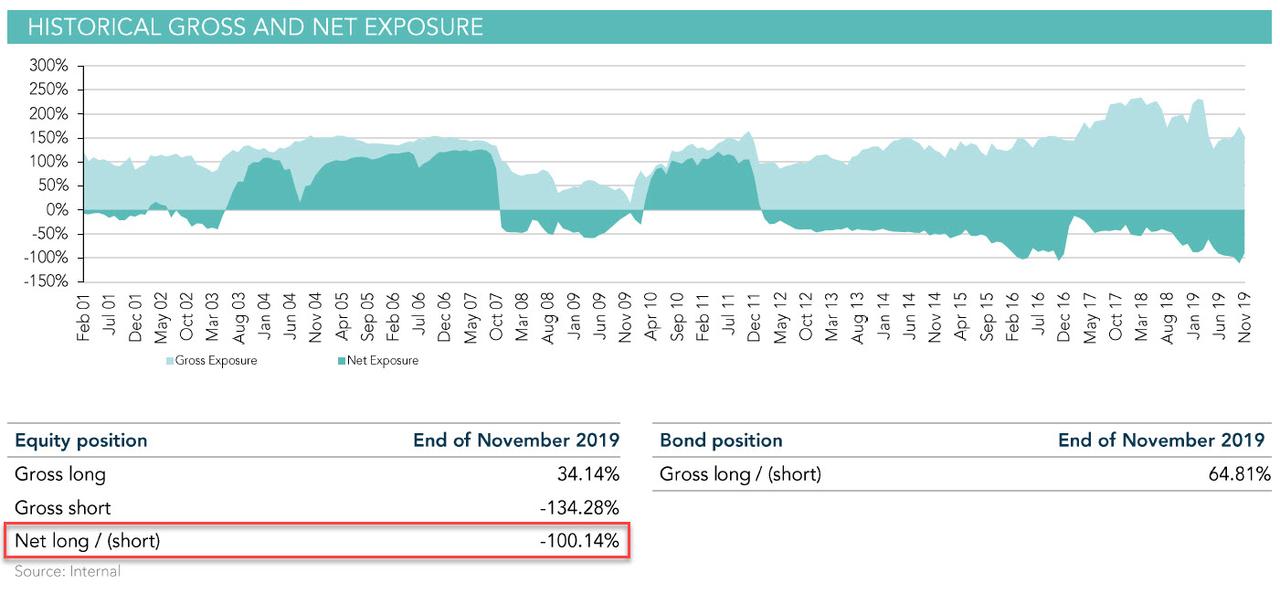

It is unclear exactly when we entered bizarro world, but we are well and truly in it now. How else does one explain that Horseman Global, the fund which we first dubbed “the world’s most bearish hedge fund” and which has only gotten more so with time, most recently clocking in at a near record -100% net short exposure…

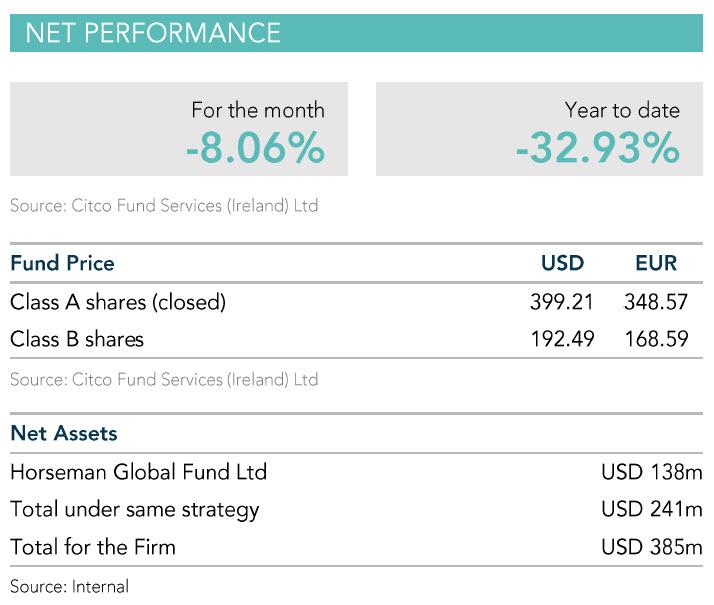

… is shutting its European hedge fund, which despite being up 28% YTD has shrunk over the years to manage just $66 million, even as the larger Horseman Global Fund continues to operate despite being down a record 33% YTD?.

According to Bloomberg, the Horseman European Select fund will close at the end of February after returning 28% through November this year. With the fund “set to be one of the most successful European hedge funds of 2019, I feel that this is an opportune time to change course,” manager Stephen Roberts told investors Tuesday. “I will continue to invest by managing my own family office.”

Whether Roberts is indeed merely seeking the quiet and stability of a family office, or simply no longer wishes to be packaged alongside the far more controversial (and underperforming) Global Fund, is unknown but it does add to the already unprecedented pressure crushing Horseman Global CIO, Russell Clark, who as he writes in his latest letter to investors (reposted below) is about to suffer his “worst year ever” following an 8.1% drop in November and a 33% drop YTD, and whose only hope “is a huge plunge in markets at year end.“

Below we repost Clark’s latest, November letter to investors, even as the fund’s AUM has collapsed from $525MM in Dec 2018 to just $138MM currently. While the future of the fund can at best be described as a “going concern”, it does not detract from Clark’s ideas – traditionally some of the best in the financial realm when it comes to contrarian originality – especially as relates to his continued bearish view of shale and semis, as well as his doomsday idea that Clearinghouses will implode during the next crisis, resulting in a Fed bailout of large, leveraged funds. While it’s only a matter of when, not if, that happens, it remains unclear if Clark will be around to trade it.

Your fund lost 8.06% this month. The short book, bond book and forex books all lost money.

This year has not worked out as planned and, unless there is a huge plunge in markets at year end, will end up being my worst year ever. Coming into this year there were a huge number of reasons to be bearish. Credit spreads were widening. The market was beginning to understand the capital destructive nature of the US shale industry. Japanese machine tool orders were plunging and continue to plunge. Auto sales were declining, and global trade was, and is, in decline. On top of that there still exists a huge amount of autocallables that would act as an accelerant to any sell off.

If there was one big misjudgement this year, it was that US restrictions on Huawei would reduce Chinese demand for US technology, given the risks of being blacklisted. What seems to have happened instead is that Chinese firms have front-loaded demand for semiconductors and semiconductor making equipment, so that they have inventory on hand, just in case they get blacklisted. This had led to a very large dislocation between traditional lead indicators for the semiconductor stocks. We have been reducing this short area all year, but despite the current dislocation, the problems of rising Chinese competition are increasing. There are signs that Chinese makers of semiconductor equipment are beginning to gain share among domestic semiconductor producers. Semiconductors are priced as if there will be no down cycle again, much like the view given to commodity stocks not so long ago.

The BIS Quarterly Report was issued on 8th December. While much commentary was on the analysis the BIS gave to the repo market, the much more interesting part of the Quarterly Review comes later, when it discusses portfolio compression. Compression and netting have allowed notional outstanding to stay stable, but the trading volume would be suggestive of a market that is taking 4 times more risk. Regulators (and the BIS) do not focus on this, but JP Morgan and other big members of clearinghouses plainly agree with me.

Clearinghouses have become the center of the financial system, but they do not bear the cost of any mistakes they make in pricing risks. This is borne by other clearinghouse members. But what the BIS note and the note issued by the banks and other users of clearinghouses makes clear is that the market has become very directional, with banks supplying liquidity to the repo market, while leveraged funds are taking liquidity (until 2017 banks were taking liquidity from the system). As the near bankruptcy of a clearinghouse highlighted last year, it is other members that bear the risk when things go wrong, and hence big US banks have acted rationally in looking to reduce liquidity to the repo market, which of course forced the Federal Reserve to act. Unfortunately, this does not solve the problem that risk is mispriced, and the banks will still be on the hook if other members default.

So what do you do if you run a major US bank, and you are feeling uncomfortable about the risks that clearinghouses are taking, but your efforts to reprice risk are thwarted? Well if it was me, I would have to start to think about nuclear options to force the issue. What would that nuclear option be? Namely to threaten to cancel membership to the clearinghouse, and hence get rid of the potential liability you might face. From the documents I have seen, this only requires 10 days notice. Ultimately if risks were priced correctly, leverage fund unwinding trades would cause a market dislocation. The only way to calm markets sustainably, would be for the Federal Reserve to lend directly to large leveraged funds. I guess this is possible, but I would assume you need a crisis first to cross that Rubicon.

I increasingly hear talk that central bank and government activism has ended recessions and possibly bear markets. Maybe this is true, but it seems to me that we are at a turning point. Large financial institutions have been willing to go along with central bank policy since the financial crisis, but risks to big banks and pension funds are all becoming more and more apparent. In a strange twist of fate, private banks might end up taking away the punchbowl from the Federal Reserve and other central banks. Your fund is short equities, long G7 government bonds.

Finally, for those asking, here is a list of Horseman’s Top 10 long positions by NAV:

Tyler Durden

Tue, 12/17/2019 – 17:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com