Are Macro Investors Idiots?

By Russell Clark, published in Capital Flows and Asset Markets

Personally, I have always preferred macro investing, and hence I am one of the idiots referred to in the title. Quality investing however has been the place to be for the last 10 years.

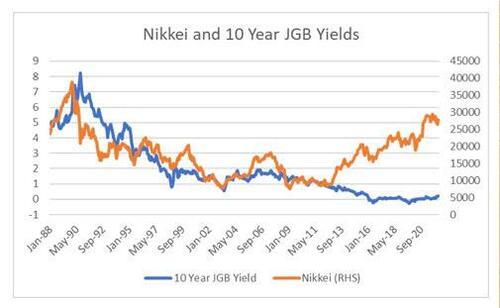

Various popular investing themes can easily be grouped under the “quality” theme include, but not limited to, TINA, FANG, Dividend Aristocrat, Compounders, Moat Investing, or just buying the S&P 500. Leading practitioners of quality investing would include Warren Buffett, Chris Hohn and Terry Smith, and all three would use a variation of the investing idea that if the free cash flow yield of a quality stock is higher than government bond yield, then its a buy. Macro investors would have looked at the experience of Japan from 1990 onwards, and generally assumed that the deflation tendencies that made bonds do so well, were generally bad for earnings, at least until last 10 years.

So what has changed? Or was Japan just an aberration, and we should all be quality investors all the time? Where I think macro investors (or at least me) have gone wrong is the government attitudes towards bond markets.

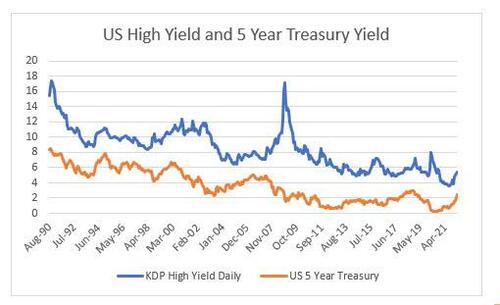

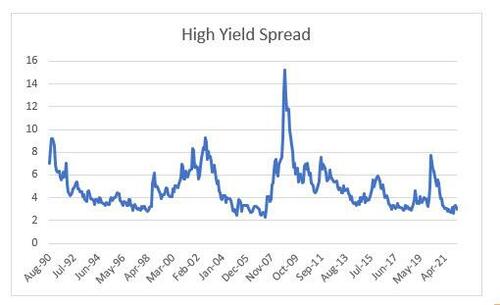

For me, corporate bonds and government bonds (sovereigns) were two distinct assets classes, with corporate bonds trading much more like equities. In practical terms, sovereigns did well in bad times, and corporates bonds did bad in bad times. Using KDP High Yield daily, you can see during recessions, typically sovereign and high yield bonds yields would go the opposite direction. This was the case in dot com bubble, the GFC and Covid recessions.

In essence, since the financial crisis there was an implicit guarantee for the corporate bond market (the Fed put), which has now morphed into an explicit guarantee for the corporate debt market. When we look at the spread between US 5 year treasuries and high yield debt, even with the sell off in high yield debt this year, there has been no spread widening.

In essence, the quality trade has been a very good political trade, as governments have guaranteed corporate bond markets (Europe is a little different, as the ECB’s main focus has been to guarantee peripheral sovereign debt). Emerging market investors are aware of both the advantages and disadvantages of having a corporate and sovereign debt tied together.

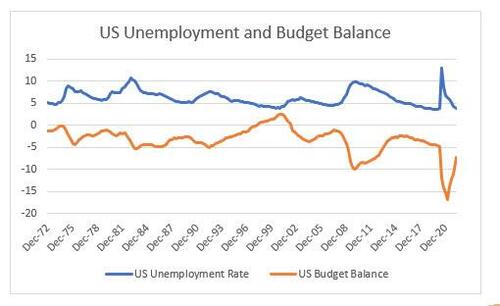

If the US was an emerging market (ie borrowing in another currency) it would likely be seeing downgrades as its structural budget deficit has ballooned in recent years. Given the unemployment rate and record stock market and property market, the US should be close to budget balance, but instead is close to levels seen in the debts of the financial crisis.

From an economic perspective, there is little chance of the US being forced to borrow in another currency. However other changes in the macro environment make me think inflation is becoming more secular than cyclical, and this is shifting the “political winds” that have supported a windfall that quality investing has had for the last 10 years. The shift in inflation from cyclical to secular is the subject of another post.

Tyler Durden

Thu, 04/14/2022 – 17:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com