China Cuts Reserve Ratio To Cushion Slowing Economy As PBOC Runs Out Of Easing Space

It became clear that a widely telegraphed RRR cut was coming on Friday a little earlier in the day, when the People’s Bank of China refrained from cutting its one-year policy loan rate (currently at 2.85%) or injecting liquidity into the economy via the medium-term lending facility, sending Chinese stocks sliding as traders had hoped that the central bank would provide stimulus by cutting the reserve requirement ratio as early as today.

“There’s 100% chance of an RRR cut before Monday –definitely a consensus there,” said Li Xuetong, a fund manager at Shenzhen Enjoy Equity Investment Fund Management earlier on Friday. “If that doesn’t happen, there will be disappointment.”

Li was right and moments ago – and late on Friday in China local time – the central bank assured there won’t be disappointment when it cut the RRR ratio, the amount of cash banks must hold in reserve, in the latest attempt at targeted monetary easing meant to cushion the slowing economy from its worst Covid outbreak since early 2020.

The People’s Bank of China lowered the reserve requirement ratio for most banks by 25 basis points and for smaller banks by 50 basis points to the lowest level since 2007, according to a statement published Friday. The change is effective on April 25 and will unleash 530 billion yuan ($83 billion) of long-term liquidity into the economy, the central bank said. This was the first RRR cut since December.

Cutting the RRR is an effective way to unleash cheap long-term liquidity. With local governments speeding up infrastructure bond sales, the cash boost may help banks to finance the surge in bonds.

The move itself was not a surprise, as it was widely signaled by the State Council, China’s cabinet, at a meeting on Wednesday. Top Chinese politicians have also repeatedly warned of risks to growth and the need for more monetary and fiscal stimulus as the economic outlook worsens (although the PBOC has so far been quite stingy in easing further). Stringent measures to contain the Covid outbreak have damaged production, strained supply chains and curbed consumer spending.

Major banks have downgraded their growth forecasts for this year, and economists now predict the economy to expand by 5%, below the government’s target of around 5.5%. Authorities have also urged commercial lenders on Friday to lower their deposit rates, according to people familiar with the matter, a move to help ease funding costs for banks so they can boost lending.

While the RRR cut was expected, what the central bank does next remains a mystery as the PBOC is running out of policy space to ease: as a reminder, China is one of the very few countries that are currently cutting rates in the face of a world where developed central banks are rushing to tighten and contain inflation. As such, rate hikes by the Fed Federal Reserve have begun to fuel capital outflows and threaten the yuan. Tighter monetary policy in the U.S. has already wiped out China’s yield premium over U.S. Treasuries.

To confront investor fears, Chinese banking regulators said Friday that China remains appealing to global investors given the economy’s long-term prospects and its higher real interest rate.

The room for further RRR reductions may be shrinking though. Economists say the central bank may soon need to shift away from a widespread use of the RRR as it’s already relatively low and is becoming a less effective tool to deal with the economy’s structural challenges.

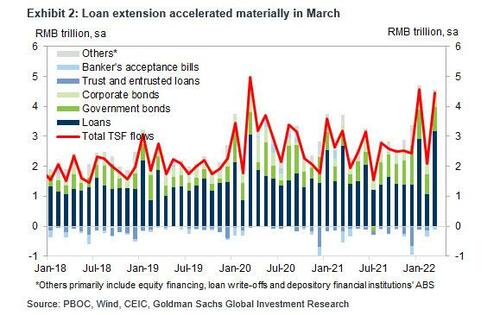

The RRR cut takes place just days after China announced an unexpectedly big credit injection for the month of March, when total social financing, RMB loans and M2 growth accelerated materially and were all well above market expectations on the back of policy support. The breakdown was as follows:

- New CNY loans: RMB 3130 bn in March vs. consensus: RMB 2750bn. Outstanding CNY loan growth: 11.4% yoy in March vs February: 11.4% yoy.

- Total social financing: RMB 4653bn in March, vs. consensus: RMB 3550bn.

- TSF stock growth was 10.6% yoy in March, faster than the 10.2% in February. The implied month-on-month growth of TSF stock accelerated to 14.4% from 11.5% in February.

- M2: 9.7% yoy in March (+24.4% SA ann mom) vs. GSe: 9.0% yoy, Bloomberg consensus: 9.4% yoy. February: 9.2% yoy (+11.3% SA ann mom estimated by GS).

According to Goldman, tghe composition of RMB loans suggests broad acceleration of loan growth across sectors (with the only exception being household short-term loans, which might reflect the drag from anti-pandemic measures because short-term household loans are typically consumption loans), however bill financing growth was still much faster than medium-to-long term loan growth, which continued to imply weak credit demand relative to credit supply.

In other words, with much more credit supply than demand, China has set the stage for its latest credit bubble as excess credit will now be finding its way into alternative conduits, and is why Goldman continues to expect further policy easing – and apparently beyond just RRR cuts – to support growth in light of the growth headwinds from Covid outbreaks.

Tyler Durden

Fri, 04/15/2022 – 08:10

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com