Where Are Russia’s Gold Reserves Actually Stored?

Submitted by Ronan Manly, BullionStar.com

In the current environment of weaponized Western sanctions against Russia, and the critical importance of monetary gold reserves as Russia’s ultimate asset, a timely question to ask is where Russia’s gold reserves are actually stored.

The location of Russia’s gold reserves is especially intriguing given the ongoing freeze of Russia’s foreign exchange reserves – dollar, euro, pound – by Western powers, and the fact that there is a US Congress Bill being introduced by a group of US senators to try to ‘freeze’ Russia’s gold.

At the outset, some clarifications. Most of the gold reserves of the Russian Federation are owned and managed by the Bank of Russia. And with the Bank of Russia being owned by the Russian Federation, these gold reserves of the Bank of Russia are gold reserves of the Russian Federation.

Russia’s National Wealth Fund (NWF) can also invest in gold and other precious metals. While the NWF “is managed by the Russian Ministry of Finance based on investment procedures and terms established by the Russian Government, the operational investment of the NWF is carried out by the Bank of Russia.” So if the NWF also holds gold, which it may well do, then this gold would also classify as part of the gold reserves of the Russian Federation.

Additionally, the Russian Federation’s ‘State Fund of Precious Metals and Precious Stones’ (Gosfund), which is administered by Russian Federation institution ‘The Gokhran’, is also authorised to hold gold. The Gosfund then may well also hold gold, which would also be classified as part of the Russian Federations’ gold reserves.

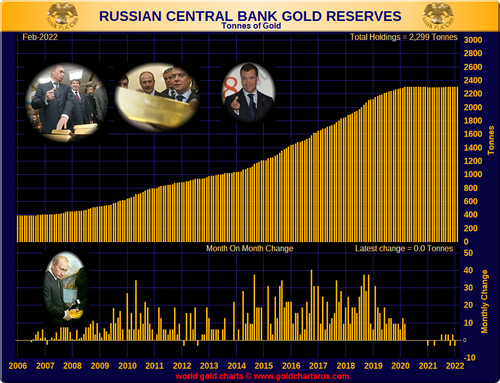

This article, however, will look just at the monetary gold reserves of the Bank of Russia, which at this time are claimed (by the Bank of Russia) to total 2,299 tonnes.

From 400 tonnes to 2300 tonnes of gold

In the central bank gold market, the Bank of Russia stands out for having increased its monetary gold reserves by nearly six-fold over a mere 12 years via gold buying in the domestic Russian market. This gold was sourced from Russian gold refiners by Russian commercial banks, refined to a high standard in Russian gold refineries, and then sold by the Russian commercial banks to the Bank of Russia.

Back in 2007, the Bank of Russia held about 400 tonnes of monetary gold. Towards the end of 2007, the Bank began aggressively adding to its gold holdings, and by early 2011 Russian gold reserves had exceeded 800 tonnes. By the end of 2014, this figure had swelled to more than 1200 tonnes of gold. By late 2016, the total breached 1600 tonnes. And by mid 2018, the Bank of Russia held more than 2000 tonnes of monetary gold.

The growth trajectory slowed down slightly towards the end of 2018, but by early 2020, the Bank of Russia claimed to hold nearly 2300 tonnes of gold, an official figure which has not changed by much since that time (since the Bank of Russia says that it stopped buying gold over most of that time).

The reason for providing this growth summary of Russian central bank gold holdings since 2007 is that it might have some bearing on where the Bank of Russia has stored the additional gold that it purchased over the 2008-2020 period.

The First Visit – January 2011

One of the first references to the Bank of Russia’s contemporary gold storage policy is from 24 January 2011, and is from a press release feature on the Russian government’s own website, where we find that:

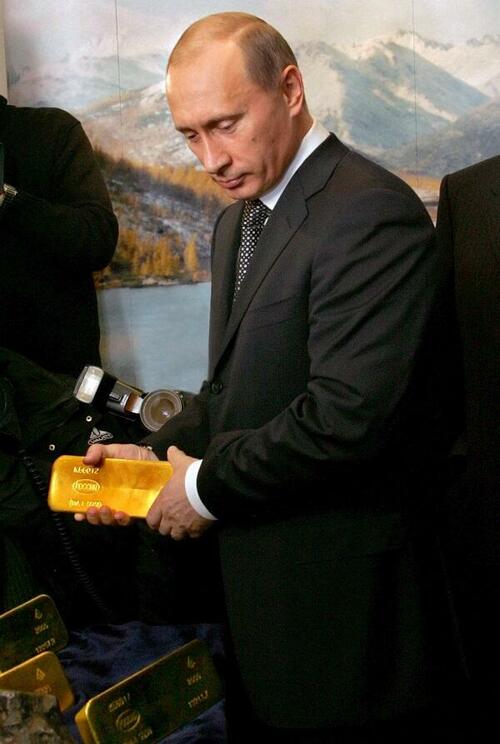

“Prime Minister Vladimir Putin visited the central depository of Russia’s Central Bank, which holds two-thirds of the country’s gold and foreign exchange reserves.”

This press release, which said that Putin was the first ever Russian prime minister to visit the gold vault facility, was accompanied by a now well-known photo of Putin holding a gold bar (see below).

The press release also has three other accompanying photos of Putin and an entourage touring the depository, one (see below) with the caption:

“At the central depository located in downtown Moscow, the prime minister toured the storage facilities for currency reserves and observed the process of control weighing and packing precious metals.”

There is also a well-used photo of Putin looking on as a vault employee in blue overalls takes a gold bar out of a wooden storage box:

And a photo of strong cloth bags that presumably hold coins, but as to whether these are general circulation ruble coins, or gold bullion ruble coins, it’s not clear. Probably investment gold coins of ‘George the Victorious’.

During the tour of the Moscow vault (note that the Russian government didn’t specify where in Moscow the gold vault was located), Putin asked the then deputy chairman of the Russian central bank, Georgy Luntovsky, where the gold in the vault primarily came from, to which Luntovsky replied that they “bought the gold from commercial banks, citing Nomos Bank, VTB and MDM Bank as key partners.”

As to the storage space and the storage arrangements, the press release stated that:

“the central depository has an area of 17,000 square metres with 1,500 square metres occupied by the stored reserves. In addition to gold bars kept in plastic and wooden cases, an emergency stock of banknotes is stored. A standard gold bar weighs between 10kg and 14 kg, and small bars weigh between 100g and 1,000 g. The majority of Russia’s gold reserves is stored in standard bars.”

At this time in January 2011, the Bank of Russia claimed to hold about 800 tonnes of gold, and if two thirds of this gold was stored in the Moscow vault, that would be about 533 tonnes.

Ulitsa Pravdy – Truth Street, Moscow

There are a heap of additional photos available on Russian websites of Putin’s January 2011 tour of the Bank of Russia’s Moscow gold vault, such as the following images from Russian newspaper Komsomolskaya Pravda (www.kp.ru) which can be seen here and below.

There are also some photos of the same vault on the Sdelanounas.ru website here and below, and interestingly, the person posting these photos said the vaults in question are the Gokhran vaults in Moscow, and not the Bank of Russia vaults. A mistake in terminology? Maybe. Maybe not. That poster also claimed (on 20 September 2013) that one third of the Bank of Russia’s gold reserves were at that time being stored in St.Petersburg (more on that below).

Fast forward two years to 11 February 2013, and Bloomberg ran a story about Russia’s gold reserves, with the headline “Putin Turns Black Gold to Bullion as Russia Outbuys World”. At this time in February 2013, the Bank of Russia claimed to have 958 tonnes of gold, i.e. an increase of about 160 tonnes over January 2011, but the Bank (or Bloomberg) was still quoting that ‘two thirds’ of this gold was in Moscow. This ‘two thirds’ quote could only be true in 2011 and 2013 if the Bank of Russia constantly allocated two thirds of its continual gold purchases to the Moscow vault and one third to elsewhere. Otherwise it was just a convenient quote circulated by the Bank of Russia that may have been true in 2011 but that Bloomberg continued to use in 2013.

However, Bloomberg did provide one interesting piece of information, in that it revealed that the general address and street location of the Moscow gold vault is under a building in Pravda Street in central Moscow:

“Russia keeps about two-thirds of its stockpile in a greenish gray stone-and-glass building on Ulitsa Pravdy, or Truth Street, in central Moscow. The road is named after Pravda, the official newspaper of the Communist Party, which also was headquartered there.”

“On 24 January 2011… [Putin] toured the 17,000 square-meter facility, which includes 1,500 square meters of storage, with First Deputy Chairman Georgy Luntovsky, posing for photographs lifting an ingot. Most of the bars weigh 10 to 14 kilograms (22 to 31 pounds) and are boxed in plastic or wooden crates alongside an emergency supply of banknotes.”

Prophetically, this Bloomberg article also had a quote from Russian parliamentarian Evgeny Fedorov, who told Bloomberg in February 2013 that:

“The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency”.

Exactly 9 years later that cataclysm came about in the form of Western powers freezing the Bank of Russia’s foreign exchange reserves in all of the US dollar, euro and pound.

Fast forward another 4 years from February 2013 to 1 February 2017, and an article appeared on the website “Russia Beyond” written by Alexander Bratersky and titled “Where are Russia’s vast gold reserves hidden?”. At this time at the end of January 2017, the Bank of Russia claimed to have over 1600 tonnes of gold, which was 650 tonnes more than February 2013, and twice as much gold as in January 2011.

Yekaterinburg and St. Petersburg

In his article, Bratersky was still quoting the ‘two thirds’ of the gold being in Moscow. This could only have been true if the Russians had been continually allocating two thirds of new purchases to the Moscow storage location, but could also be one of those snippets of information which may have been true in 2011 but may not be so accurate all through Russia’s vast gold accumulation exercise of 2011 – 2020.

But one important piece of new information which Bratersky did add was that the rest of the Russian gold that was not stored in Moscow was being stored in the cities of St. Petersburg and Yekaterinburg. For he wrote:

“While Russia does not have a Fort Knox, almost two-thirds of the nation’s gold is kept in a Central Bank repository in Moscow. The rest is stored away in St. Petersburg and Yekaterinburg. The gold is kept in bullions weighing from 100 grams to 14 kilograms.”

Note that in his article, Bratersky did not provide any sources to his claims that ‘one third’ of Russian gold is stored in some combination of locations in St. Petersburg and Yekaterinburg.

For many people outside Russia, St Petersburg will need no introduction, as St Petersburg along with Moscow is one of Russia’s ‘two capitals’ and a major (and famous) historical and cultural Russian city on the Baltic Sea adjacent to Finland and Estonia. In fact, St Petersburg, is a gateway between Russia and the rest of Europe. St. Petersburg is also Putin’s home city.

But the city of Yekaterinburg, which is 1700 kms east of Moscow and the capital of the Urals region, may be less well known. While Yekaterinburg is Russia’s fourth largest city in terms of population, it is often known as Russia’s ‘third city’ since, in addition to Moscow and St Petersburg, Yekaterinburg is culturally and scientifically important. Yekaterinburg is also logistically critical as it is located “in the main international transportation corridor which leads from Central Russia to the Far East and is the node of the Urals railway system. It has the largest number of direct railway connections of any big regional center and is third in terms of the number of flights.”

Yekaterinburg (sometimes known as Ekaterinburg) is also home to a precious metals refinery in the form of the “Ekaterinburg non-ferrous metals processing plant”, a refinery which was an LBMA Good Delivery Refinery until it got suspended by the LBMA in May 2018.

But Bratersky was not the first to state that Bank of Russia gold was being stored in St Petersburg and Yekaterinburg, because a Russian article from July 2015 on the website Vegchel.ru also stated this. At that time, the Bank of Russia claimed to hold about 1240 tonnes of gold. The Vegchel.ru article wrote:

“Today, two-thirds of the gold and foreign exchange reserves of the Russian Federation are stored in the Central Bank’s Central Bank, located in Moscow on Pravda Street. …The central depository was created in 1940 on the basis of the USSR State Bank Administration. Now the Central Depository is part of the developed system of the Bank of Russia.

In addition to the main storage unit in Moscow, inter-regional storage facilities are located in St. Petersburg and Yekaterinburg.

In general, the system responsible for the distribution of the country’s cash has 608 multi-level cash settlement centers, each of which has storage facilities.

“The storage of gold reserves is carried out mainly in gold bars weighing from 10 to 14 kg, there are also measured bars, the weight of which is from 100 grams to one kilogram.

There are about 6,100 boxes of precious metal ingots in the Central Vault.”

These boxes which the Vegchel.ru article referred to, are the wooden boxes which you can see in the photos (above) during Putin’s tour of the Moscow gold vault in January 2011.

A Far Larger Vault – January 2018

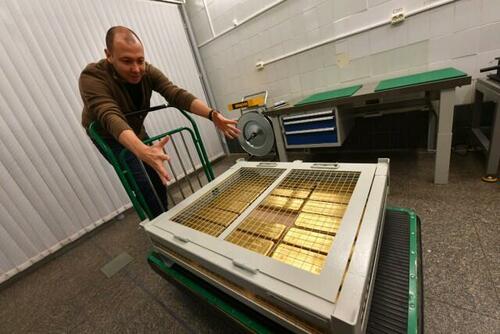

Fast Forward to January 2018, and the reporters from Russian newspaper Komsomolskaya Pravda (www.kp.ru) were back, this time being granted exclusive access to what looked like a far bigger and far more modern gold vault of the Bank of Russia in Moscow. Gone were the small wooden boxes, replaced instead by football field size spaces filled with towers of metal latticed containers, each container holding 20 large gold bars. The vault employees in the vault were also wearing wine coloured overalls.

The KP staff who visited the gold vault were reporter Yevgeny Belyakov and photojournalist Vladimir Velengurin. There are many articles on Russian websites with multiple photos of this gold vault taken by the KP photographer in January 2018. Such as the Russia-Insider website here. Additional photos can be seen on the Yaplakal.com website here.

Notably, the vault which the KP reporters visited in January 2018 also stored thousands of silver bars arranged on pallets and covered with cardboard (see photos below). So the Bank of Russia is not just a gold stacker, but a silver stacker too.

Conclusion

So is the central depository vault on Ulitsa Pravdy (Pravda Street) in Moscow which Putin toured in January 2011 (and which contains the wooden boxes of gold bars), the same vault which the KP news reporters visited in February 2018?

Possibly. The vault space was described in 2011 as a “an area of 17,000 square metres with 1,500 square metres occupied by the stored reserves”, so it’s feasible that the area used to store gold bars was extended as the Bank of Russia’s gold reserves expanded massively over 2011 – 2020. So there could be gold bars still sorted in small wooden boxes as well as stored in the large metal containers (20 bars per container).

Where are the photos of the gold vaults of in the Bank of Russia’s St. Petersburg and Bank of Russia’s Yekaterinburg locations?

Answer – There aren’t any photos within the St. Petersburg and Yekaterinburg gold vaults as far as I can see. If you know otherwise, please highlight sources for such photos in the comments below.

Is the ‘two thirds’ of the gold in Moscow under ‘Truth Street’ and the ‘one third’ elsewhere thesis still valid, or was it ever valid? What is the ‘Truth?

No one outside of official circles knows the answer. But it would make sense from a diversification and security point of view not to store all the gold in the same location.

Could the Russian Federation be storing strategic gold reserves outside Russia? Yes, but they would be very foolish to have been storing any gold in the vaults of Western powers such as in the Bank of England in London or the Federal Reserve in New York or the Banque de France in Paris, as gold in such locations would have been confiscated and frozen by now. But Russia could be storing some of its gold in China, in Beijing or Shanghai. Not so far fetched.

Does Russia’s National Wealth Fund hold gold? Possibly. Does the Gokhran’s Gosfund store gold? Possibly. Could Russia hold more gold than it claims to hold? Probably.

The Bank of Russia has 7 main regional branches and 73 divisional offices, the addresses of all of which can be seen here.

In theory, any of these regional or divisional offices could be storing Bank of Russia gold. Furthermore, the Vegchel.ru article (above) said that the Bank of Russia currency distribution system “includes 608 cash processing centres and almost all of them has a storage facility.” In theory, any of these storage facilities could be used to store Bank of Russia gold.

Additionally, all of the large Russian banks, such as VTB, Gazprombank, Sberbank, Otkritie and Sovcombank, are active in the Russian gold market, and many of these banks have their own private vaults. Since these banks work closely with Russia’s central bank in the domestic Russian gold market, its feasible that the large Russian commercial banks could store gold bars on behalf of the Bank of Russia or the NWF or the Gokhran.

There are also the precious metals refineries such as Krastsvetmet, Prioksky, and Moscow Special Alloys Plant, which are all 100% owned by the Russian Federation. All of these refiners have secure precious vaults, which could be used to store Russian Federation gold.

In short, Putin’s tour of a gold vault in 2011 (11 years ago) and Russian reporters visiting a gold vault in 2018 (4 years ago) are great for optics and marketing – and the Bank of Russia has been very successful in this regard – but without some hard facts about bar numbers and locational details from the Russian government and Bank of Russia, we still don’t know the true state, size and location of the Russian Federation’s gold reserves.

Which is not surprising, since as Chris Powell of GATA has said in the past and will say again:

“the amounts, location, and disposition of government gold reserves are secrets more sensitive than the amounts, location, and disposition of nuclear weapons.

Indeed, under nuclear weapons control treaties, governments with nuclear weapons have often shared that sort of information, even with hostile powers. But gold reserve information is far more tightly held and most gold information provided officially is actually disinformation.

Why is it this way? It’s because gold is an even more powerful weapon than nukes — an alternative currency that is not necessarily under any government’s power; a determinant of the value of other currencies, interest rates, government bonds, and equities.“

* * *

This article was originally published on the BullionStar.com website under a similar title “Where is the Russian Federation’s Gold Stored?”

Tyler Durden

Tue, 04/26/2022 – 05:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com