“Tesla Is Netflix” And “This Stock Market Is Going Much Lower”: Mark Spiegel

Submitted by QTR’s Fringe Finance

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter this weekend, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast (and will be coming back on again soon hopefully) and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Photo: Real Vision

Mark was kind enough to allow me to share his thoughts from his April 2022 investor letter, where he noted that his fund was up 20.2% for the month, compared to the S&P, which fell 8.7%:

For April 2022 the fund was up approximately 20.2% net of all fees and expenses. By way of comparison, the S&P 500 was down 8.7% while the Russell 2000 was down 9.9%. Year to date the fund is up approximately 26.7% net of all fees and expenses. By way of comparison, the S&P 500 is down 12.9% while the Russell 2000 is down 16.7%. Since inception on June 1, 2011 the fund is up 117.1% net while the S&P 500 is up 281.5% and the Russell 2000 is up 154.5%. Since inception the fund has compounded at 7.4% net annually vs 13.1% for the S&P 500 and 8.9% for the Russell 2000.

For Mark’s additional take on a lot of macro that I didn’t want to repeat here (and if you’ve never read one of his investor letters recently), you can, and should, read his March 2022 investor letter here.

Mark’s Thoughts On Tesla

For years I’ve said “Tesla is Blackberry”—the maker of a first-generation version of a product that—once the market was proven—would be supplanted into niche obscurity by newer, better versions; now I can provide a much more recent analogy: Tesla is Netflix.

For years, Netflix had an absurd valuation based on its pioneering position in streaming media, but once it proved that such a market existed a myriad [of] competitors swarmed all over it, and in April the stock collapsed when we learned that not only is Netflix no longer in “hypergrowth” mode but, for the first time since 2011 (when it transitioned from physical DVDs), it actually lost subscribers.

Chart annotation by QTR, does not appear in Spiegel’s letter

I believe Musk knows that Tesla is “the next Netflix” (hence his recent “Twitter buying distraction”), with VW, Hyundai/Kia, Ford, GM, BMW, Mercedes, BYD & other Chinese competitors and, in a few years, Toyota & Honda, being the Disney, HBO Max, Amazon Prime, Peacock, Hulu, Paramount +, etc., of the electric car market, stealing Tesla’s share and eventually pounding its stock price down 95% or so from today’s, into the valuation of “just another car company.”

In fact, in April, Tesla reported that Q1 deliveries were sequentially nearly flat (just 1398 additional cars, a gain of just 0.45%) vs. the previous quarter, and even that was only “achieved” by a sneaky redefinition by Tesla of what “a delivery” is.

Yes, the company is chip-constrained, but its competitors (who, unlike Tesla, are unwilling to delete safety equipment or use untested chips to maintain production) are even more constrained, and in fact waiting times are longer for Tesla’s direct EV competitors than they are for a Tesla; for instance, Ford’s Mustang Mach-E is so in demand that it has even halted additional orders for the 2022 model year. (Current annual Mach-E production capacity is around 65,000 for the U.S. & Europe and tens of thousands more for China, but in 2023 U.S. & European capacity will expand to 200,000.)

Ford Mach-E

The worst thing that can possibly happen to “the Tesla story” will be when its German and Texas plants are fully operational and the subsequent excess capacity stares the world right in the face, thereby ending its myth of “unlimited demand” (especially at current, drastically-raised prices, where the cheapest Model 3 now starts at $47,000 and the cheapest Model Y begins at $63,000); in fact, look for margin destroying price cuts by late this year or early 2023.

Meanwhile, the “record” profits that accompanied Q1’s nearly flat delivery number were obtained via a myriad [pf] one-time items, including $679 million of emission credit sales that will disappear over the next year or two as every automaker ramps up its EV sales, a mysterious $502 million reduction in SG&A expense (of which only $140 million was due to reduced stock comp) despite opening new factories in Germany and Texas (what is Tesla capitalizing instead of expensing?) and a combination of FIFO accounting and multiple sticker price increases that allowed Tesla to expense rapidly rising raw materials costs at older, lower prices while selling cars built from those materials at new, considerably higher prices.

Adjusting for these factors, Tesla had GAAP earnings for the quarter that were at least $1/share lower than the posted $2.86, and annualizing that realistic $1.86/share to $7.44 means that at April’s closing price Tesla (on a no-growth quarter) had a PE ratio of around 117 vs. an industry-wide figure of less than 10. (Also, Tesla’s Q1 free cash flow was only around $1.8 billion, a drop of almost $1 billion vs. the previous quarter, despite a massive increase in net accounts payable.)

And for those of you who think that Tesla is “really an energy company,” in Q1 “Tesla Energy” had revenue of just $616 million (down 10.5% sequentially) and cost of revenue of $688 million, meaning it had a negative gross margin. So if Tesla is “really an energy company,” it’s even more screwed than if it’s just a car company!

Gigafactory Berlin mockup

Meanwhile, many Tesla bulls sincerely believe that ten years from now the company will be twice the size of Volkswagen or Toyota, thereby selling around 20 million cars a year (up from the current run-rate of around 1.3 million); in fact in March Musk himself even raised this as a possibility.

To illustrate how utterly absurd this is, going from 1.3 million cars a year today to 20 million in ten years means that in addition to one million cars a year of eventual production from the new German and Texas factories, Tesla would have to add 35 more brand new 500,000 car/year factories with sold out production; i.e., a new factory nearly every single quarter for ten years! And what then? Well, then you’d have a car company approximately twice the size of Toyota (current market cap: $239 billion) or Volkswagen (current market cap: $97 billion). If that would make Tesla worth, say, $500 billion in 10 years, discounting that back at 15%/year and allowing for enough share dilution to pay for all those factories, Tesla—in that absurdly optimistic scenario—would be worth just $100/share today, down almost 90% from its current price. (To be clear, I think it’s going much lower than that!)

Another favorite hype story from Tesla bulls has been “the China market,” but Tesla’s Q1 2022 domestic China sales sequentially declined by approximately 8000 units vs. Q4 2021, and it had only around 1.9% of the overall Chinese passenger vehicle market and just 11% of the BEV market.

Meanwhile, as Tesla continues to sell its fraudulent & dangerous so-called “Full Self Driving” the head of that program recently took a four-month sabbatical; the last major Tesla executive who did that (Doug Field) never returned. In a sane regulatory environment Tesla, having sold this garbage software for over five years now…

Today’s content is free, but if you enjoy it and have the means to support the blog, we’d be humbled by your subscription:

Mark’s Thoughts On The Rest Of The Market

The biggest asset bubble in U.S. history was blown with the Fed printing $120 billion a month and short term rates at zero while the government concurrently ran a record fiscal deficit and inflation was moderate. Now we have the Fed about to reduce its balance sheet, medium and long-term Treasuries yielding near 3% (on their way, I believe, to much higher), no extra fiscal stimulus and the highest inflation rate in over 40 years, while increased military spending for the entire western world (as well as Japan and South Korea) is about to erase the so-called “peace dividend.” In other words, the bubble was destined to burst and we were, and remain, positioned for it (although there will undoubtedly be some fierce bear market rallies, and I shall do my best to navigate through them).

The last time the 10-year Treasury yield was where it is now (approximately 2.9%) was December 2018 when the S&P 500 was around 2700 (approximately 35% lower than it is today), yet inflation was vastly lower (allowing much higher PE multiples) and growth prospects were far better. And although corporate earnings are higher now than they were then, I believe inflation expectations are in the process of substantially lowering the PE multiples placed on those earnings, as happened in the inflationary era between 1973 and 1975 when the S&P 500’s PE rapidly dropped from 18x to 8x. (Perhaps a move from 30x to 15x might be in order this time around.) So I think this stock market is going much lower, and we thus continue to have a large short position in the S&P 500 via the SPY ETF (although I temporarily reduced the position size in late April, as the market looks a bit short-term oversold to me), as well as a large short position in Tesla, the biggest bubble-stock in this entire bubble era, which will soon be to electric cars what Blackberry became to smartphones: the pioneer that wound up with arrows in its back.

Meanwhile, even last year when short-term rates were set at just 0.125% and average rates were around 1.5%, the interest on the $30 trillion of federal debt cost $562 billion. That interest cost is now on a path to double, yet even then would still be far below the anticipated rate of inflation. Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the even higher interest cost that would be created by upping those rates to a level commensurate with even 4% or 5% inflation (not to mention today’s over 8%)? Powell doesn’t have the guts for that, nor does anyone else in Washington; thus, this Fed will likely be behind the inflation curve for at least a decade. And that’s why we remain long gold (via the GLD ETF).

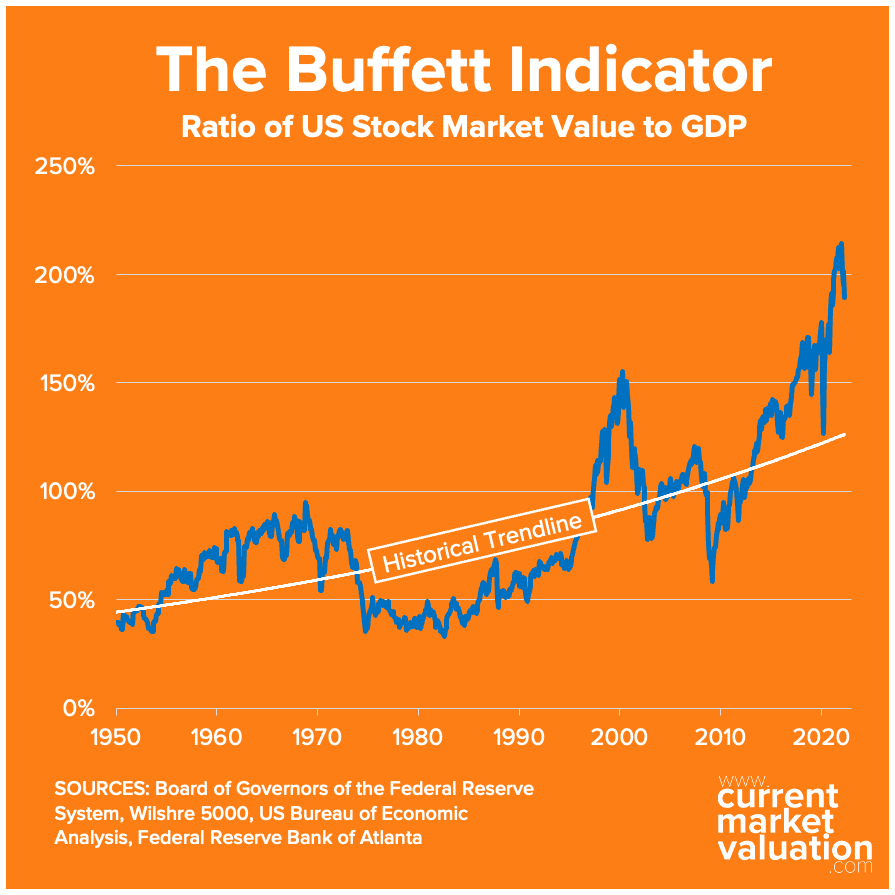

And finally, we can see from CurrentMarketValuation.com that (as of April 21st) the U.S. stock market’s valuation as a percentage of GDP (the so-called “Buffett Indicator”) is still astoundingly high, and thus valuations have a long way to go before reaching “normalcy”:

When stocks get meaningfully cheaper I’ll flip net long, but until then we’re likely to remain net short.

About Mark Spiegel

Mark manages Stanphyl Capital, established in 2011, a deep-value equity & macro long-short investing fund based in New York City. Mark can be reached at [email protected] or at @StanphylCap on Twitter.

This post is 100% free, but if you want to support Fringe Finance and have the means, I would love to have you as a subscriber: Subscribe now

Thank you for reading QTR’s Fringe Finance . This post is public so feel free to share it: Share

Disclaimer: This letter was not reproduced in full. I own Tesla call and put options, as well as ARKK call and put options. QTR is long various gold and silver miners and has both long and short exposure to the market through equities and derivatives. You should assume I have positions in any names I publish about. I have no position in Mark’s funds. Mark is a subscriber to Fringe Finance via a comped subscription I gave him and has been on my podcast. The excerpts from Mark’s letter, above, shall not be construed as an offer to sell, or the solicitation of an offer to sell, any securities or services. Any such offering may only be made at the time a qualified investor receives formal materials describing an offering plus related subscription documentation. There is no guarantee the Fund’s investment strategy will be successful. Investing involves risk, and an investment in the Fund could lose money.

Tyler Durden

Mon, 05/02/2022 – 08:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com