Japan Emerges As Biggest Driver Behind Recent Surge In Treasury Yields

It was about a year ago, when the calendar was moving from the end of the first quarter of 2021 and into the second quarter, when we first reported that one of the catalysts behind the forceful emergence of the “reflation trade” in the first quarter was the powerful move higher in yields which many interpreted as markets pricing in higher long-term inflation. In reality as we reported last year, the move which coincided perfectly with the end of Japan’s fiscal year on March 31..

… was largely, if not exclusively, a byproduct of Japan’s giant pension fund, the GPIF, drastically shifting out of treasuries as it slashed its US Treasury exposure by a record amount. This blow out in yields, which also coincided with that infamous “failed” 7Y auction in Feb 2021, was material as most investors mistook the rise in yields as validation for a super-hot economy, and the consensus bought into the idea that 10-year yields were headed above 2%. Of course, as we cautioned investors, yields had overshot relative to the economic reality and over the coming weeks, economic data in the US couldn’t keep up with unrealistic expectations, and 10-year yields started grinding lower (similar to what we expect will happen in the next few months).

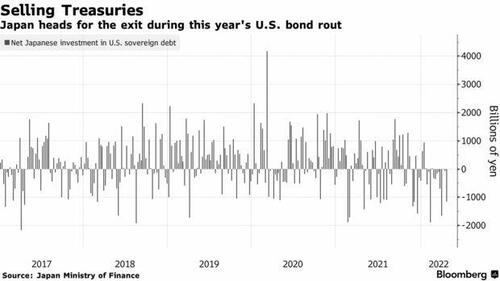

We bring this up because a bout a month ago we speculated that Japan was engaging in another wholesale liquidation of US paper ahead of (and following) its fiscal year end on March 31, with potentially huge false signal consequences…

*JAPAN SELLS MOST U.S. SOVEREIGN BONDS SINCE APRIL 2020 IN FEB.

And there it is again – Japan was in full blown liquidation ahead of fiscal year end

— zerohedge (@zerohedge) April 7, 2022

… this has been confirmed and as Bloomberg writes overnight, Japanese institutional managers – best known for their legendary U.S. debt buying sprees in recent decades – are fueling the great bond selloff just as the Federal Reserve pares its $9 trillion balance sheet.

Validating our hypothesis that Japan is behind the great Treasury rout for the second year in a row, the latest data from BMO Capital Markets shows the largest overseas holder of Treasuries offloaded almost $60 billion over the past three months! And while that may be small change relative to the Japan’s $1.3 trillion stockpile, its effect is magnified by the near record illiquidity in the Treasury market.

“It’s a significant amount of selling and on par with what we saw in early 2017 from Japan,” said BMO rates strategist Ben Jeffery.

Furthermore, the divestment threatens to grow because the monetary path between the U.S. and the Asian nation is diverging ever more, the yen is plumbing 20-year lows and market volatility stateside is breaking out, something Albert Edwards discussed in debt last weekend (see here). As we discussed last week, while the aggressive Fed tightening cycle to combat inflation could result in multiple 50 basis-point hikes in the coming months, the Bank of Japan remains locked in endless stimulus. That’s weakening the yen and upending the economics of buying Treasuries especially since the BOJ last week confirmed that the 10-year Japanese government bond will remain indefinitely capped around 0.25%, even if it means the total collapse of the yen.

This historic monetary policy decoupling is ramping up currency-hedging costs and completely offsetting the appeal of higher nominal U.S. yields, especially among large life insurers. As shown in the chart below, the cost of currency hedged Treasurys is the highest in two years, making it uneconomical for Japanese buyers to buy hedged TSYs, even with 10Y yields approaching 3%. In fact, near-zero-yielding bonds at home look ever-more appealing even as U.S. debt offers some of the highest rates in years.

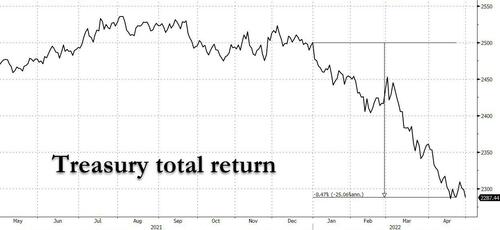

It means that while Japanese accounts are contributing to the historic Treasury rout, they may not return en masse until the benchmark 10-year yield trades firmly above 3%… which it did earlier today.

While 10-year U.S. yields briefly traded above 3% today for the first time since 2018, buyers who pay to protect against fluctuations in the yen-dollar exchange rate see their effective yields dwindle to just 1.3%. That’s because as shown above, hedging costs have ballooned to 1.66%, a level not seen since early 2020 when the global demand for dollars spiked in the pandemic rout.

Remarkably, a year ago the Treasury benchmark was offering a similar hedged yield, when the cost of protecting against moves in the exchange rate thanks to a modest 32 basis-point hedging expense.

“Hedge costs are the issue for investing in U.S. Treasuries,” said Eiichiro Miura, general manager of the fixed-income department at Nissay Asset Management Corp.

Worse, while Fed tightening and associated market volatility, have tempered Japanese buying of Treasuries in the past, in this cycle, the high level of uncertainty surrounding U.S. inflation and interest-rate policy may trigger an extended absence according to Bloomberg.

At the same time, Japanese traders have other, far more lucrative hedged offshore options as euro-hedging costs remain near the one-year average: “In the span of next six months or so, investing in Europe is better than the U.S. as hedge costs are likely to be low,” said Tatsuya Higuchi, executive chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. “Among the euro bonds, Spain, Italy or France look appealing given the spreads.”

“The Fed is being super aggressive,” said John Madziyire, portfolio manager at Vanguard Group Inc. “Are you really going to buy when Treasuries will probably get to more attractive levels?”

One broad Treasury index is already sitting on a more than 8% loss so far this year. Much now rests on whether the 10-year can consolidate in a range of 2.80% to 3.10% this month once the upcoming Fed meeting is absorbed by the market along with quarterly debt sales from the U.S. Treasury.

“Japanese investors will wait for some stabilization in long-dated yields before they sense a buying opportunity,” said George Goncalves, head of macro strategy at MUFG. “If the 10-year settles during May, that will help attract buyers and at those yield levels you are getting compensated now.”

As for how messed up the market signaling may be due to Japan’s forced selling, and the market’s interpretation that – just like in 2021 – the US economy is getting stronger and able to accommodate Fed rate hikes when in fact the spike in yields is just a function of, well, forced selling, we hope to find out in a few months when the Fed will have hiked 50gps and maybe even 75bps into a full-blown recession, which will then send yields crashing back to 0%.

Tyler Durden

Mon, 05/02/2022 – 14:43

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com