Australia Shocks With Bigger Than Expected Rate Hike, As Lowe Admits Embarrassment At Being So Wrong

In our preview of what was expected to be Australia’s first rate hike since 2010, we said that consensus expects a 15bps rate hike to 0.25%, with a handful of bank still expecting a hold (including CBA, Goldman and HSBC) and nobody expected a greater than 15bps rate hike. Well, everyone was wrong, because a few hours ago, Australia’s central bank – one of the developed world’s last remaining doves turned hawkish – and joined the global tightening bandwagon when it increased interest rates by more than any economists anticipated, rocking markets with a bigger-than-expected interest-rate hike in the middle of an election campaign and signaled further hikes to come, sending the currency and bond yields higher, while stocks slumped.

Abandoned his pledge of just two months ago to remain patient, Reserve Bank Governor Philip Lowe topped economists estimates by raising the cash rate 25 basis points to 0.35%, defying expectations for a hike of 15 basis points. It was the first time borrowing costs had been lifted in an election campaign in almost 15 years. That move and suggestions that more hikes will follow sent benchmark three-year bond yields soaring through 3% for the first time in eight years.

“The RBA managed to wrongfoot every forecaster and even the market — no one was braced for 25 basis points,” said Sean Callow, a senior currency strategist at Westpac Banking Corp. Economists’ consensus was for a 15 basis-point hike.

Pouring gasoline on the hawkish case, the RBA forecast for 2022 is that headline inflation will accelerate to about 6% and core inflation will rise to around 4.75%. The RBA targets inflation of 2-3%. In response to a question about why the RBA had previously guided against rate hikes, Lowe said that “Inflation has surprised everyone on the upside.”

Lowe is now trying to recalibrate rate expectations following data last week that showed headline inflation surged to the highest level in more than two decades, while underlying price gains breached the top of the RBA’s 2-3% target.

“I expect that further increases in interest rates will be necessary over the months ahead,” the governor said in a press conference. “The board is not on a pre-set path and will be guided by the evidence and data.”

“Global central banks are stepping up and they are front-loading rate hikes so why shouldn’t the RBA, particularly when their policy is extremely accommodative,” said Su-Lin Ong, head of Australian economic and fixed-income strategy at Royal Bank of Canada.

Lowe also signaled a pressing need to get policy away from emergency settings. “The board is committed to doing what is necessary to ensure that inflation in Australia returns to target,” he said in a statement. “This will require a further lift in interest rates over the period ahead.”

Lowe conceded it was embarrassing that his previous forward guidance that rates would remain at a record-low until 2024 had proved so wrong. Markets and some economists have been forecasting since last year that the RBA would hike in 2022.

The RBA’s statement also provided key figures from its quarterly update of economic forecasts that will be released in full on Friday.

- The central forecast for 2022 is headline inflation will accelerate to around 6% and core inflation to around 4.75%.

- By mid-2024, headline and underlying inflation are forecast to have moderated to around 3%

- Australian GDP is seen to grow by 4.25% over 2022 and 2% over 2023

- Unemployment is predicted to decline to around 3.5% by early 2023, the lowest level in half a century

Also on the agenda Tuesday was the central bank’s plan for future bond maturities after it tripled its balance sheet to about A$650 billion to support the economy through the coronavirus pandemic.

The RBA decided against reinvesting the proceeds of bonds that mature in coming months, effectively embarking on a gradual quantitative tightening. The impact of the widely expected decision is likely to be minor over the next year as only a small number of bonds are due to mature.

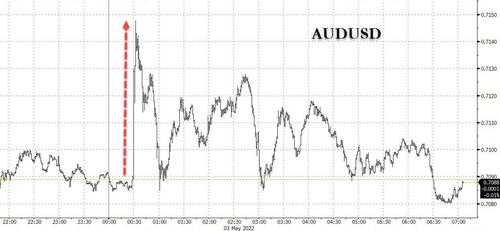

In response to the surprise hike, Australian three-year yields jumped 19 basis points to breach 3% for the first time since 2014, while ten-year yields climbed to 3.39%. The currency rose as much as 1.4%, before giving up part of the gain to trade at 70.90 U.S. cents.

The benchmark stock index fell.

Interbank cash rate futures are pricing in another 25 basis-point hike for June and signal the RBA will raise to 2.75% by year’s end. That’s again well ahead of a central bank whose economic forecasts assume a cash rate of 1.5%-1.75%.

As Bloomberg notes, the RBA’s tightening presents a problem for Prime Minister Scott Morrison’s government (not to mention Joe Biden) as the Australian electorate is heavily indebted and already grappling with consumer prices rising much quicker than wages growth. Commonwealth Bank of Australia, the nation’s largest lender, immediately announced it will raise variable home-loan rates by 25 basis points.

Morrison blamed offshore events for pushing borrowing costs higher, while opposition Labor Party shadow Treasurer Jim Chalmers said the RBA had “completely shredded” the prime minister’s economic credentials.

Australia’s bigger than expected rate hike did no favors to risk sentiment one day ahead of the Fed’s own 50bps (or is it 75bps) rate hike decision, and pushed global equities lower.

Tyler Durden

Tue, 05/03/2022 – 07:13

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com