Worst Ever US Home Affordability Is Just 0.5% Away

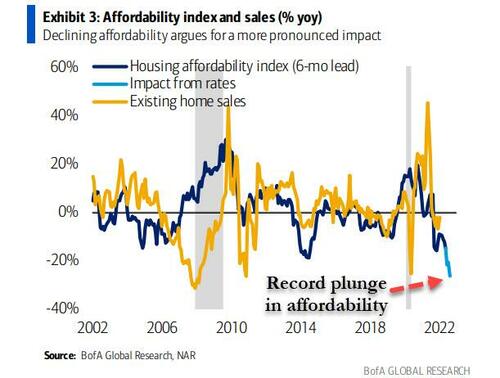

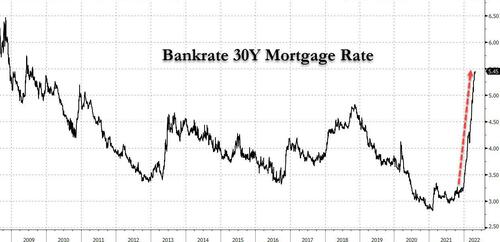

A month and a half ago, when mortgage rates were exploding higher with the 30Yr fixed mortgage rate averaging 4.5%, the highest since 2018 and up more than nearly 100bp from the December average of 3.26%, we said that “Housing Affordability Is About To Crash The Most On Record“, and warned that the mortgage “rates shock” meant housing affordability would be down more than 25% yoy by March – a record decline – with additional downside from higher home prices.

Once again, we were right, and as CNBC reported overnight looking at the latest spike in mortgage rates, which just hit their highest level since 2009…

… and with home prices continuing to experience double-digit gains, all of the major housing markets in the United States are less affordable than they have been historically, and “affordability is near its worst point on record.”

The average rate on the 30-year fixed started this year at 3.29% and hit 5.55% on Monday, according to Mortgage News Daily. Rates will move even higher after Wednesday’s Federal Reserve meeting, when markets will get more commentary on the Fed’s drive to curb inflation.

Citing research from Black Knight, a mortgage technology and data provider, CNBC shows that 95% of the 100 biggest U.S. housing markets are less affordable than their long-term levels. That figure was at 6% at the start of the Covid pandemic. And with thirty-seven markets already less affordable than they have ever been, expect this to soon spread to all markets… before we have another huge market crash just like in 2006.

While home prices did pull back slightly in March, they were still up 19.9% year over year. Compared with February, prices rose 2.3%, the fifth time since the pandemic began when home prices rose more than 2% in a single month. Adding across, prices are up almost 6% in the first three months of the year even as consumers are grappling with rising prices across categories, from real estate to airfare to groceries, and defecating all over Biden’s approval rating in the process.

According to CNBC, homebuying affordability has not been this bad since July 2006, when rates were around 6.75%. Back then, it took 34% of the median income to cover the monthly mortgage payment, including principal and interest, for a home purchased with a 20% down payment.

As of April 21, that payment-to-income ratio had reached 32.5%. Historically, a ratio above 21% has caused the housing market to cool off, with the exception of the last two years. The pandemic has created an anomaly in the housing market, because demand is so high and supply is so low. A relentless flight from liberal cities – that have been turned into bastions of crime – into the suburbs, has only helped to push home prices to the stratosphere.

If rates were to rise just 50 basis points more – which they will – or home prices were to increase just 5% more, home affordability would be the worst on record, according to Black Knight.

What would that mean in practical terms? Well, as of this moment, that monthly housing payment is at a new high, up $552 (an increase of 38%) year to date to $1,809, and up $790 (or 72%) since the onset of the pandemic. It will take just a modest increase to hit new all time highs.

According to CNBC, in reaction to weaker affordability, and in a repeat of what we saw just before the 2007 housing bubble burst, consumers are suddenly turning to adjustable-rate mortgages, which offer a lower interest rate. The ARM share of rate locks from potential homebuyers jumped from 2.5% in December to nearly 8% in March, according to Black Knight. As of last week, that share was more than 9%, according to the Mortgage Bankers Association.

At this point some may ask how how it is possible that demand has yet to fade despite these near record prices. The answer is simple: not enough supply, too much demand, and a surge in purchases ahead of even higher rates.

A Tuesday report from the National Association of Realtors found – what else – that home prices continued to surge in virtually every corner of the U.S. during the first quarter even as mortgage rates rose rapidly. Many buyers rushed to lock in purchases in the first quarter before rates climbed even higher, according to real-estate agents.

The median sales price for single-family existing homes was higher in the first quarter compared with a year ago in 181 of the 185 metro areas tracked by the NAR, the association said Tuesday. Nationwide, the median single-family existing-home sales price rose 15.7% in the first quarter from a year ago to $368,200, the NAR said.

The current housing boom has been geographically widespread, with most metro areas in the country posting robust home-price growth in the past two years. The Punta Gorda, Fla., metro area posted the strongest median-price increase in the first quarter, up 34.4% from a year earlier. Following Punta Gorda was the Ocala, Fla., metro area, up 33.8%, and Ogden, Utah, up 30.8%.

The only metro areas to post declines in the first quarter from a year earlier were Cape Girardeau, Mo., where median prices fell 2%, Topeka, Kan., down 1.9%, and Rockford, Ill., down 1%. Prices were unchanged in Bismarck, N.D.

“The housing market remains very active right now,” said Nick Bailey, chief executive of Re/Max LLC, on a Re/Max Holdings Inc. earnings call last week. “Buyers are rushing to beat anticipated mortgage rate hikes.”

Still, economists expect rising mortgage rates to lead to slower home-price growth by the end of the year. Prices can be slow to respond to changes in buyer activity because sellers often wait weeks before dropping their list prices. Some buyers are also less sensitive to rising rates, such as cash buyers or those moving from high-cost markets to more affordable ones. Homes typically go under contract a month or two before the contract closes, so the first-quarter data largely reflects purchase decisions made in late 2021 or the beginning of the first quarter.

On the other hand, the ability for many households to work remotely continues to spur home-buying demand. Millions of millennials are also aging into their prime home-buying years.

Tyler Durden

Wed, 05/04/2022 – 11:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com