The Average Millennial Has A Subprime Credit Score

As Millennials rage against older generations of Americans, they appear to have forgotten one thing: their own deplorable credit score, or as Experian notes, “what many people might not know: Millennials also have one of the lowest average credit scores of any generation.“

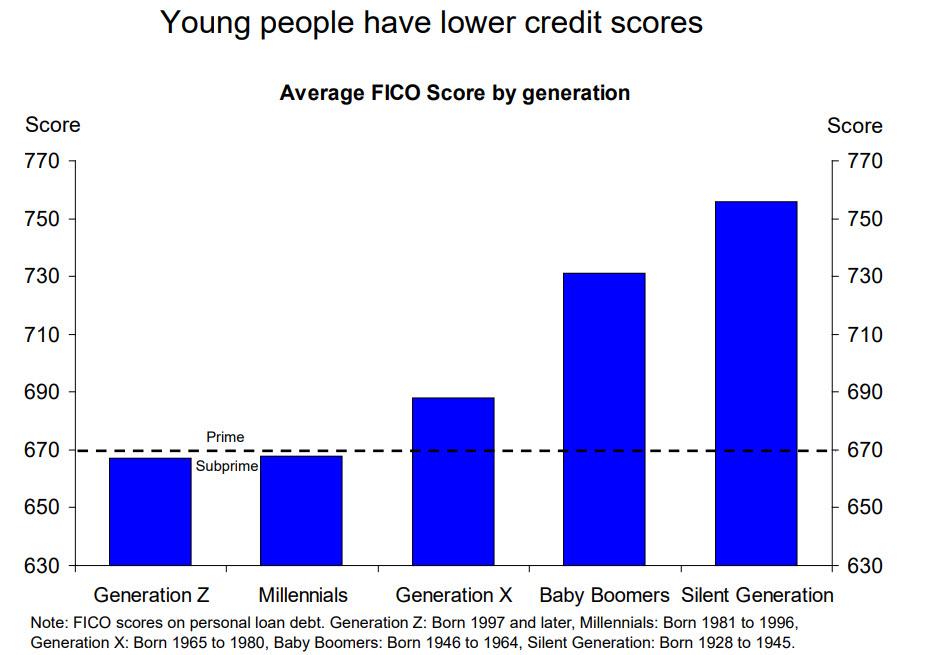

As the following chart from Deutsche Bank shows, the average FICO score for both the Millennial and the younger, Gen Z, generation is below 669, the level that defines Subprime borrowers.

Why are millennials scores low? Rod Griffin, director of consumer education and awareness at Experian, recently said part of it may be that “because they are young and haven’t yet established a robust credit history.” Indeed, a young millennial might be barely out of college, and “at 22, most people have very little credit history and so would likely have lower credit scores,” he explains. And while one can argue that it takes time to build out a credit score, the fact that Gen Zers have effectively the same FICO score as Millennials, is quite troubling and suggests there is more to the problem than merely the follies of youth.

Commenting on the depressed Millennial scores, in a recent report, Experian found that millennials — people between ages 23 and 38 — have had a tough time getting ahead financially: “held back by their credit scores, some millennials have struggled to obtain new credit and, as a result, may be finding it hard to reach certain financial milestones.”

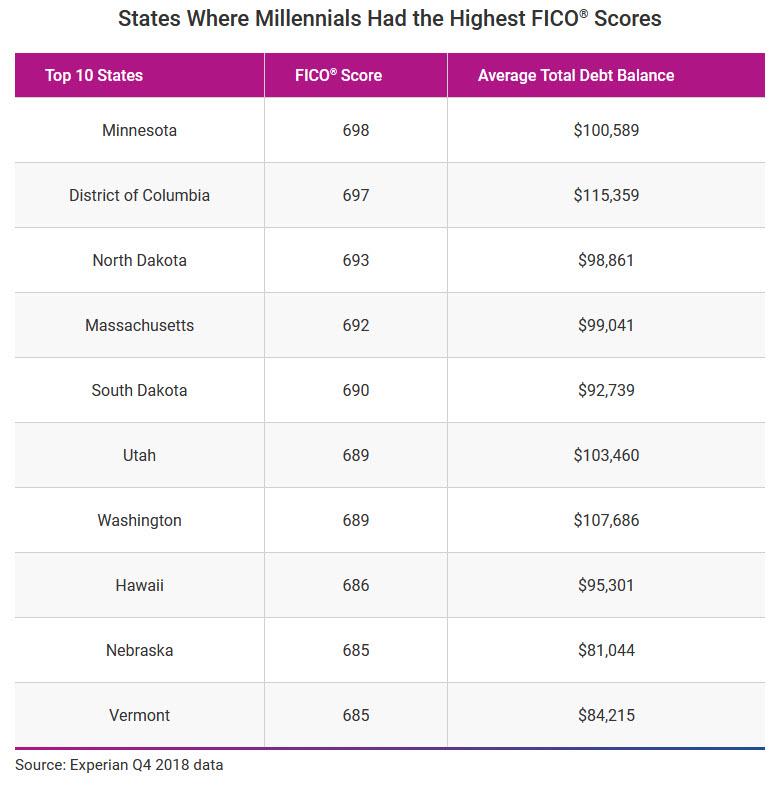

To understand more about millennial credit scores, Experian took a look at data from the fourth quarter of 2018 to see where these consumers had the best and worst FICO, what type of debt they had and how they’ve progressed in the past year.

Here are the facts.

Compared with the national average of 701, millennials had an average FICO Score of 665 in the fourth quarter of 2018, according to Experian data. The silent generation, those in their 70s and older, had the highest average FICO Score of 756, followed by baby boomers, who had an average score of 732. Generation Z—the youngest group, with people between ages 18 and 22—had the same average score as millennials.

- Millennials have an average credit card balance of $5,231, up 7% year over year from $4,869 in 2017.

- Millennials carried an average of $34,770 in student loan debt, up 8% from $32,239 in 2017.

- Millennials have an average total debt amount of $80,666, up 11% from $72,988 in 2017.

Minnesota had the highest average millennial FICO Score among states, with an average of 698—just three points shy of the national average of 701, according to Experian data from the fourth quarter of 2018. The District of Columbia followed with an average score of 697 for millennials, and North Dakota came in third with an average score of 693. Massachusetts had the fourth-highest average millennial FICO Score at 692, followed by South Dakota, which had a 690.

On the other end, Mississippi millennials had the lowest score with an average FICO Score of 621—a 44-point difference from the millennial average of 665. Alabama had the second-lowest average score at 633, followed by South Carolina at 635 and Louisiana at 636. West Virginia—the only state not located in the South—came in fifth with an average FICO Score of 637.

As MarketWatch recently observed, such depressingly low scores matter because they end up costing young Americans tens of thousands of dollars in excess interest payments. The reason: People with lower scores are less likely, on average, to repay their debts, so the companies lending them money will charge them higher interest rates to offset the risk they’re taking.

Here’s an example: Let’s say you’re borrowing $250,000 to buy a home and get a 30-year-loan, which is standard. If you had a score of 760 or higher, your mortgage rate might be something like 4.161%, according to FICO, a credit scoring company; that would mean the total interest you’d pay to the lender over the life of the 30-year loan would be $188,069. Now let’s say you have a score of 652 (the average for a younger millennial). In that case, your rate would be 5.204% — and you’d wind up paying $244,422 in interest, which is roughly $56,000 more than the person with the better score.

It’s not just mortgages that low scores impact. “A credit score can play a part in getting that new cell phone you want, in qualifying for an apartment lease, for setting up utility service with lower security deposits, and when applying for car or home insurance,” explains Griffin. “Having good credit scores can save you money by having to pay lower interest rates, reduced activation fees, lower security deposits, and reduced insurance rates.”

It could even impact the job you get. “A limited version of your credit report may be reviewed when you apply for a job or promotion, particularly for jobs that involve handling a company’s money or to verify our identity,” he adds.

Ultimately, it boils down to one simple thing: don’t borrow what you can’t afford, and certainly what you can’t repay. Sadly, instead of taking responsible control over their financial (lack of) disciple, Millennials are far more eager to just blame older generations, as has now become the case with the laconic (and iconic) retort to pretty much everything: “Ok Boomer” to which one can now add: “…but can Boomers please co-sign for my credit card?”

Tyler Durden

Thu, 12/26/2019 – 16:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com