China Economy Crashes Worse Than Expected Amid Covid Lockdowns

Following Friday’s catastrophic new credit data, which saw the fewest new loans in half a decade, and after this morning’s report that Chinese authorities allowed a further cut in mortgage loan interest rates for first-time homebuyers in another push to prop up its property market and revive a flagging engine of the world’s second-largest economy, few expected any upside surprises from Monday’s economic data dump out of China, but even fewer expected anything quite as bad as what Beijing just reported.

With Europe, UK and the US all on the verge of recession, China just boldly took the step to get there ahead of everyone, with Beijing reporting that China’s economy contracted sharply in April, as Covid outbreaks and lockdowns dragging the industrial and consumer sectors down to the weakest levels since early 2020 as millions of residents were confined to their homes and factories were forced to halt production, while the local unemployment rate soared to the 2nd highest level in modern history.

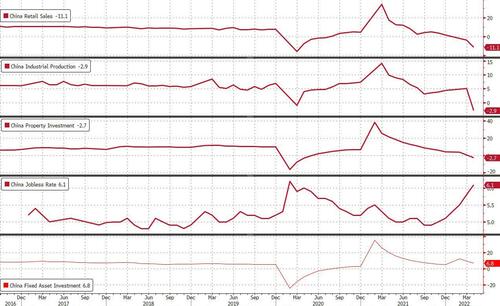

Here are the details:

- Industrial output fell 2.9% in April Y/Y, far worse than the median consensus estimate of a 0.5% increase, only the second monthly contraction since 1990 and the biggest drop on record!

Well then. China’s factory output fell the most in 32 years (or since industrial production data began on the terminal). April was only the second monthly contraction for IP since 1990 @BloombergTV pic.twitter.com/fHj1QKRbB0

— Haidi Lun Stroud-Watts 伦海迪 (@HaidiLun) May 16, 2022

- Retail sales tumbled 11.1% , almost twice as worse as the consensus estimate 6.6% drop.

- The unemployment rate climbed to 6.1%, higher than the forecast of 6%, and just shy of the 6.2% unemployment rate hit in Feb 2020 during the peak of the covid crisis.

- Fixed Investment for the YTD period was the only silver lining, rising 6.8%, and while also missing the estimate of a 7.0%, it could have been far worse; the number was supported by the government’s push to expand infrastructure spending.

If that wasn’t bad enough, here’s some even uglier data which confirms that the biggest driver of household wealth in China – housing – remains in a state of shock:

- Home sales value -32.2% ytd y/y to 3.32 tln yuan

- Home sales area falls 25.4% ytd y/y to 337m sqm

- Property sales value -29.5% ytd y/y to 3.78 tln yuan

- Property sales area falls 20.9% ytd y/y to 398m sqm

- New property construction falls 26.3% ytd y/y to 397m sqm

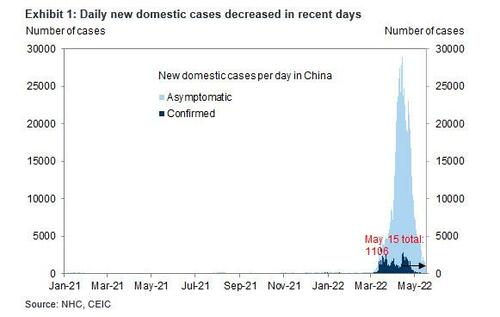

The good news is that the shockingly bad economic data is the direct result of Beijing’s Zero Covid policy, which has taken a huge economic toll from the government’s efforts to keep the virus at bay. Despite growing social outrage and anger, Beijing has insisted on sticking with its Covid Zero strategy to curb infections, even though the high transmissibility of omicron puts cities at greater risk of repeatedly locking down and reopening compared to earlier strains. We say “good” news because as the following chart shows, at this rate, Covid will soon no longer be a factor in China.

“Covid outbreaks in April had a big impact on the economy, but the impact is short-term,” the National Bureau of Statistics said in a statement. “With progress in Covid controls and policies to stabilize the economy taking effect, the economy is likely to recover gradually.”

While the latest collapse in credit was viewed by many as the trigger for more easing and rate cuts, monetary stimulus has proven less effective because of the stringent virus restrictions. Meanwhile, the PBOC left the interest rate on one-year policy loans unchanged on Monday, despite expectations by a growing number of economists that Beijing has no choice but to cut rates more, as inflation pressure and worries about capital outflows reduce the scope for more easing.

In kneejerk reaction to the latest dismal news out of China, US futures slumped to session lows, dropping below 3,990 after earlier rising as high as 4,042 with China’s benchmark CSI 300 stock index down 0.3% after earlier rising as much as 0.7%…

… although the data was so bad it was actually good: after all, if China is indeed sliding into contraction, there is no way the Fed will be hiking 5, 6, 7 or more times in a time when the rest of the global economy is about to fall off a cliff, no matter how many times an angry, senile Joe Biden calls Powell.

There was some more good news: as we hinted above, in the midst of all this terrible economic data out of China, Bloomberg blasted news that suggests China’s Covid plague may be on its way out:

- Shanghai aims to fully resume normal orders of production and life by mid to late June by normalizing Covid control measures, Vice Mayor Zong Ming says at a briefing.

- Shanghai will gradually resume rail transit and bus services from May 22, Zong says

- There have been no community Covid spread in 15 of 16 districts in the city: Zong

- Around 980,000 of the city’s total population of about 25 million remained under strictest lockdown, says Wu Jinglei, head of the city’s health commission

Expect a full reversal of the session’s losses by the time US traders get to their desks in a few hours.

Tyler Durden

Sun, 05/15/2022 – 22:39

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com