How Does The S&P500 Perform After Years With A 25% Return

With three more trading days left in the year, and the S&P500 in full-blown melt up mode, it is likely that the S&P will not only surpass the 29.6% return of 2013 (it is currently up 29.24%), but likely post a 30%+ return – its best full year return since 1997. In any case, barring some last minute cataclysm, it is virtually assured that the S&P will generate a return above the psychologically important barrier of 25%.

What does the historical record say about years when the S&P manages such a remarkable return?

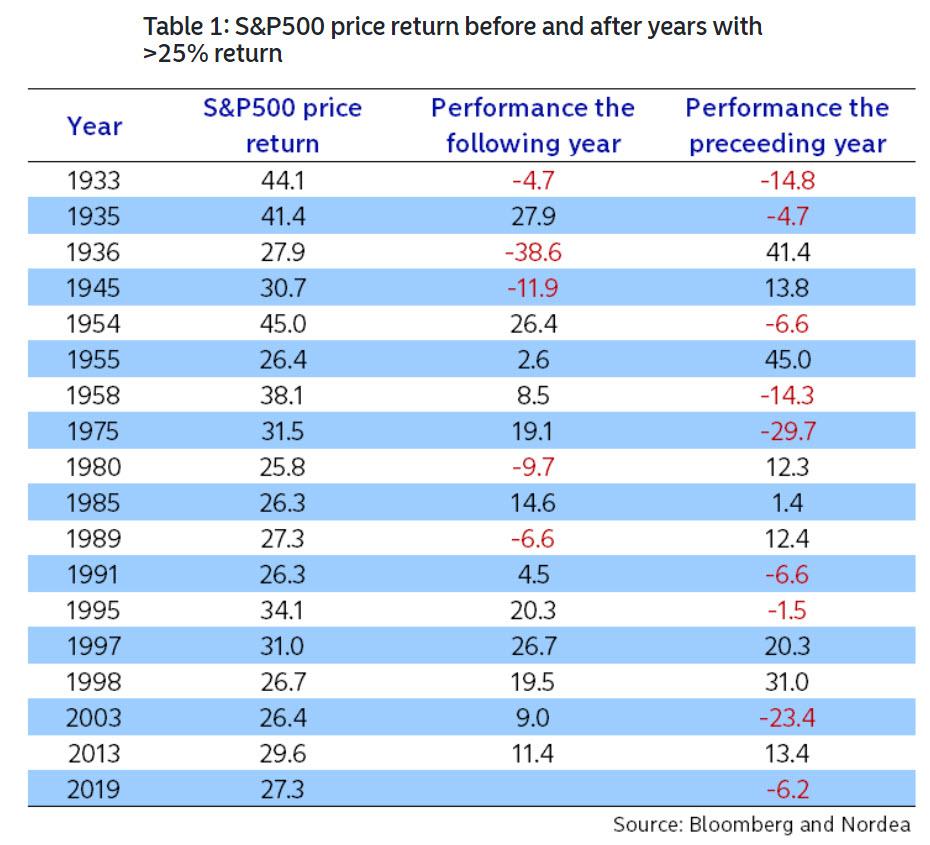

According to Nordea, the historical pattern on data since 1928 is that equities rise by an average of 7% the following year and do so 12 out of 17 times. Narrowing the time horizon to the Greenspan-Bernanke-etc era – due to the Fed put – the index has climbed by an average of 12% following such blockbuster years, and only fallen once out of these seven observations. In other words, the historical (normal?) pattern is that equities continue to rise after a year giving 25% price return.

That said, 2019 was a most bizarre year as Morgan Stanley previously explained, and as Nordea’s Martin Enlund and Andreas Steno Larsen further write, “one might want to keep in mind that 2019 offered a perfect starting point after the appearance of a Bad Santa by the end of 2018.”

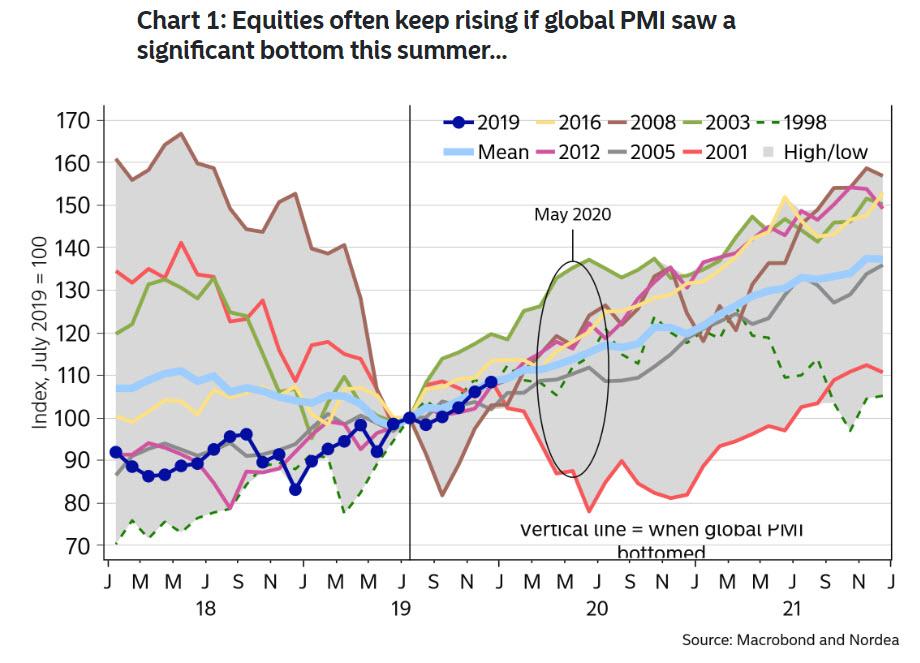

There’s more: the (normal) historical pattern is that equities (or risk appetite, if you will) keep delivering after a significant bottom in the global manufacturing PMI. So if one deems the trough in global PMI this summer as truly significant rather than a false start, bulls may be proved right also in 2020.

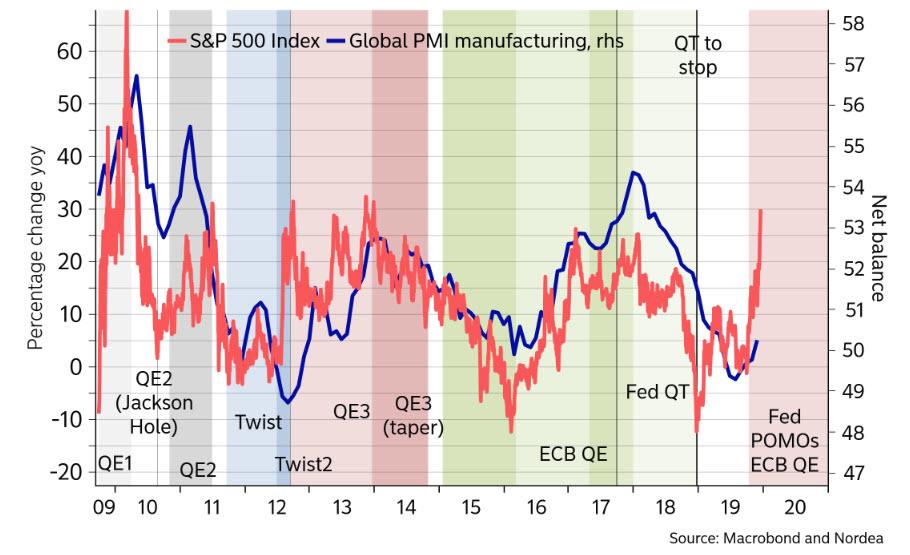

But, as the Nordea duo caution, “nothing has really been normal as of late”, and if the market never reacted negatively to all the bad news that it had to digest throughout 2019, aren’t they already pricing in all the good things that may or may not come? The answer, as shown below and as we discussed previously, is that markets have already priced in the fastest economic recovery since the financial crisis!

Tyler Durden

Fri, 12/27/2019 – 09:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com