“Eventually The Party Will Stop”: Blain’s Financial Outlook For The 2020s

Bill Blain’s Financial Porridge Outlook – 10 More Years… of what?

“It was the era of risk, it is the era of sustainability, it was the age of unicorns, it is the age of wisdom, it was the epoch of renewal, it is the epoch of repair, it was the season of sure fire gains, it is the season of uncertainty, it was the spring of monetary policy, it is the winter of fiscal credulity, we had everything behind us, we have nothing ahead of us..”

The Next Decade: The most exciting 10-years will be the next 10-years.

Introduction

The global market is a dynamic, energetic and malicious entity. It delights in confounding those who try to understand it. Blain’s Market Mantra No 1 states: “The market has but one ambition: to inflict the maximum amount of pain on the maximum number of participants.”

The global economy is equally dynamic. It does not exist as a steady-state entity. It is constantly evolving with increasing rapidity. Competition among new unicorns demonstrates what we once held to be constant and forever, is now likely to be done, dusted and obsolescent over a very short-time frame, but also the fundamentals of good, profitable businesses don’t change.

I am only a part-time market strategist – most of my day is spent trying to figure out who will buy my latest private debt deal, venture capital issue or where to finance yet another jet or block of commercial property. It does mean I spend my days actually talking with investors, traders, issuers, government and regulatory officials, rather than just looking at numbers. I’m sitting in the middle of a trading floor watching screens, hearing deals, and after 35 years of listening to market mumble-swerve with a trained broker ear… some of it is finally beginning to make sense!

(Most traders my age retired long ago with the loot they amassed during their careers. Not me. I am addicted to sailing and yachts. It will say on my grave: “He spent it on fast boats, fast cars and fast women his wives, and squandered the rest….”)

My greatest difficulty is collating what I hear, explaining my experiences, and putting them together into context as meaningful market insights… It’s fairly easy to do when I’ve got a time horizon of the next day – which I do on the Morning Porridge each day.

To make this more difficult, I am going to give you a market outlook for the whole of the next decade – the 2020s.

More Years – It’s all about Themes and the Narrative

An awful lot happened over the last 10-years. Stock markets have risen dramatically. Bonds yields have never been so low. Passive index tracking has become the norm. Interest rates have never stayed so low so long. We have seen a European sovereign debt crisis and repeated country crisis in Latin America, Russia and Asia. Fintech, cryptocurrencies, unicorns, gaming, streaming and lots of other stuff we’d never heard of 10-years ago now dominate our current thinking. Our world has become much more complex, integrated, more fractious, innovative and changes far more swiftly.

What word would you chose to sum up the last decade?

- Credulous – the era of showing too great a readiness to believe.

What word will sum up the next 10-years? Who knows? I suspect:

- Cautious – eventually the party will stop…

The pace and breadth of change across electorates, governments, businesses, and new opportunities over the next 10-years will have enormous implications for markets. There are so many potential points of divergence, it’s going to prove even more impossible to accurately predict the numbers, but we can certainly make educated guesses at what the themes are likely to be.

Given an infinite number of economists, analysts and strategy geeks armed with computers, I suppose it would be possible to brainstorm the future and come out with proper predictions. Flying cars? 3D Star Trek replicators producing perfect steaks? Teleportation? Investment certainty? Dow to hit 100,000?

I was going to start with one high-probability prediction: “this will be the last Decade Outlook I write”, but who knows: if interest rates remain this low, will I be able to afford to retire in my 60s?

Markets are Event Driven, but trends are critical

Economists and Strategists pepper their yearly outlooks with comments on the likelihood of recession, downturns, upturns, the shape of yield curves, overbought and undersold markets, sector developments and where gold, currencies, rates, and commodity prices are heading.

Investment banks and fund managers are very good at producing pages and pages and pages of graphs, charts and pies showing just how the market will develop. Prices move in line with trends, which are set by events.

Events can take form of a tiny little improvement to a product that increases its sales, right the way up to the scale to fundamental economic shifts, like a trade war or a surprise in politics. They can be momentary “no-see-ums” like an earthquake, or a culmination of a long-term trend, such as the unravelling of Unicorn tech valuations. Markets are determined by events. Some are predictable, some are not. The UK election illustrates how an event moves markets – on the back of increased Brexit certainty, sterling rallied, and we can predict businesses will move forward with new investment plans in terms of Capex, infrastructure, hiring and property plans. Even more prices move up and down.

Themes are very different. They are the tides, currents and winds of markets around which events occur and trends follow. Skilled investors who can read these themes and use them to navigate the global markets by making educated guesses on where they will lead us next. Themes tend to merge and change as they encounter other narratives, becoming new market moving themes in themselves.

Let me present a number of themes and narratives I reckon will play out during the next decade. Individually they might be limited, but it will be how they interreact with each other that will be most significant.

Seven Major Themes

There are 7 themes which I reckon will really matter:

1) Market Distortion

- Are the market distortions of the 2010s in terms of QE and monetary experimentation sustainable?

- How damaging are the unintended consequences of distortion – inflated financial asset prices driving sub-optimal investment decisions and increasing income inequality across economies?

- Can/will central banks continue to prop up markets and repress volatility via monetary policy?

- Are central banks caught between a desire to normalise rates, but can’t?

- If they withdraw monetary support, will markets tumble?

- How violently could markets correct?

- Are we still looking at lower for longer rates and zero inflation, or will inflation return?

- Are deflation and Japanification greater threats than ongoing distortion?

2) New Opportunities and business

- A fourth industrial revolution is underway – Artificial intelligence, robotics, 3-D printing, nanotech, AR/VR, longevity, health, bio-pharma and climate cure tech will change business, employment and incomes.

- The invention/innovation/commercialisation cycle is accelerating.

- As the economy evolves, the need for new approaches to education and work will create bottlenecks.

- Consumption, supply chains and work patterns will evolve.

- New industry and manufacturing chains will require massive investment and financing to benefit.

- Focus to shift back on profits, payback, competition and fundamental risks.

3) Politics

- Increasing dissatisfaction with politics, the political classes, and policies will lead to increasing unrest across democratic economies – raising the prospects of political event risk and/or gridlock.

- Mature democracies may find new leaders emerging into the current political vacuum. Increased populism, especially on the right wing. Raised risk of charismatic leaders on right winning power.

- 10 years of austerity will prove difficult to unwind through fiscal reflation in stressed debt markets – increasing political dissatisfaction.

- Dissatisfaction with big-tech, surveillance capitalism, and Income inequality may spawn considerable voter pressure and regulatory backlash – ‘blame somebody’ theory.

- Europe likely to suffer particular problems as the “committee” structure fails to agree fiscal policy, banking union, and how to enact fiscal support to struggling economies. Increasing imbalance and tensions between key members could pressure Euro.

- US political cycle will continue to dominate markets and confidence in dollar and central banks.

- Perversely, a period of potential calm for UK may beckon in early part of decade.

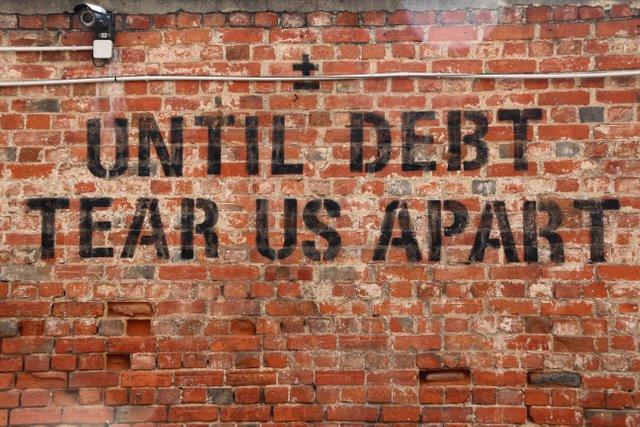

4) Debt Crisis

- If fiscal spending is the answer, will global debt levels test the limits of political credibility and thus the likelihood of rising rates and inflation?

- Corporate debt levels look unsustainable and a result of distortion – will they break?

- Liquidity issues will dominate any debt crisis.

- Personal indebtedness is rising in line with diminished responsibility and victimhood society – it’s nobody’s fault but yourself does not play anymore.

- Massive implications for risk – risk has been transferred from banks to asset managers. Can nonbanks manage rising fixed income risk?

5) Geopolitics

- Tensions between Europe, US, China and Russia will continue to rise.

- Need for fundamental defence review and increased spend across democracies.

- China likely to set own economic sphere using Chinese tech and Chinese government system – market driven communism.

- Changing global supply chains will exacerbate tensions

6) ESG/Sustainability and Fundamentals

- ESG has emerged as a critical component of investment decision making over the last few years. It is likely to further develop as a theme.

- It will become more thorough to prevent greenwashing, ensure sound governance and increasingly play to social themes.

- Labels such as “Green Bond” will be redundant – everything will be expected to include a green element and be compliant.

- Risk that potential regulatory capture of climate change agenda causes as much distortion as QE… for instance, disrupting supply chains by penalising fossils fuels and investments perceived as non-green.

- Sustainability as an investment precept will become increasingly important; analysing firms, their business, and their place within the social and changing real environment as the critical issues in investment management. It’s a less proscriptive and more effective way to judge companies than ESG 101.

- In a new global business environment of increased competition and shorter and shorter business life cycles, investors can’t wait aeons for profits. It will mark a return to fundamental investment based on rational expectations, profitability and sound businesses.

- Opportunity to invest in efficient sectors damaged by excessive ESG.

7) Climate Change

- The easy one to predict– but the 2020s will likely confirm the reality of the environmental threat.

- It raises increased sudden event risk from meteorological disasters, stressing the abilities of markets to cope with sudden large insurance and stranded costs.

- Likely to create a massive new climate cure opportunity – inventing, innovating and commercialising climate cure technologies.

- Perhaps the best way to address climate change is to stabilise populations – which could be done through education and jobs – but raising the issue of how to sustain growth while cutting emissions?

And the rest…

It’s a rule of markets that while things are never as bad as you think they might be, they are never as great as you hope. In a new era of financial realism and the re-establishment of monetary sanity, the new businesses claiming to have discovered a philosopher’s stone – for instance turning base automobiles into gold plated EVs worth trillions – are likely to be tested to destruction.

Two Major Narratives

There are multiple narrative possibilities, but two particular stories are most likely to dominate the next 10-years. From these flows many of the other themes, including geopolitics and how we react to Climate Change.

Unravelling 10-years of Financial Repression: Past Performance is not an indicator of future performance.

My first prediction for the next 10-years is: Markets are likely to hurt if and when they ever normalize. However, there is a possibility they remain distorted for far longer than we expect due to central banks fearing a stock or bond crash would trigger damaging global congestion.

If you simply invested all your money in global stocks in 2010 you would have done rather well. Spreading it out to cover bonds also would have further enhanced your returns. If you did so, did you thank the Central Banks who funded your market upside?

Can central banks continue to repress market volatility and push markets higher by throwing cash at them? That’s effectively what’s happened over the last 10-years. QE, ultra-low interest rates, and now the US Fed is repeating QE to stem a crisis in the repo market.

The result has been massive market distortion – low rates chased investors down the credit risk curve in search of returns and into the equity markets; yield tourism. Corporate owners took advantage of low rates to leverage up and buy back stock, and spend on M&A.

How complex will it get before it all breaks?

We have to pay the piper not just for the last 10-years of distortion, but for the last 40 years spent in a bull interest rate environment. As yet there is little sign of inflation in the real economy – all the inflationary money created by central banks has flowed into the inflated financial assets. When I started in markets in 1985 the US 10-year Treasury was yielding around 12%, having fallen from 21% in 1980, and 15% in 1982 as I studied economics. Today its yielding 1.5%!

Let’s remind ourselves how financial assets played out over the past 10-years:

- US 10 Year Treasury – Rallied from 3.91% to 1.79%

- Dow Jones – Rallied from 10,329 to 28,000

What do such low interest rates tell us? Conventional economics would tell us low rates describe a global economy in slowdown, depression, limited inflation, minimal growth and few positive prospects. It sounds like the lower for longer economy many analysts predicted in 2010.

Or you could look at the stock markets. Totally contradictory story. The US Dow is 3 times higher than 2010! It’s been driven by an insane mix of inspiration, insights and insolence as Unicorns reared and stumbled, corporate buybacks and low rates. A glance at stocks would suggest it remains a global boom time.

The bottom line is simple. The last 10-years has been a story of massive central banking distortion to address the 2008 crisis. Now central banks face the consequences and are trapped. The distortion can’t go uncorrected indefinitely.

10 years of monetary experimentation, QE, ultra-low interest rates fuelled and juiced an extension to an ongoing 30-year binge of irrational exuberance. It has fuelled massive inflation in financial assets – stocks and shares. Whatever lessons were learnt in 2008 have been quickly forgotten as investors followed the money and gorged on financial assets.

Globally debt yields have tumbled. Most government bonds have flirted around negative yields. Even serial debt basket cases like Greece now trade within a few points of financial paragons like Germany. Ultra-low interest rates have meant debt levels are at a place that would have given bond analysts conniptions just a few decades ago.

Equity prices are at record levels – juiced by corporates who have raised billions on the bond markets to buy back their own stocks and yield tourists looking for higher returns.

Meanwhile, regulators have overseen rules that have resulted in risk being quietly transferred from banks to the investment sector – putting the savings of billions of pensioners and savers in peril

- Analysts will tell you the markets can’t continue to hide the distortion.

- Central bankers will privately admit there is nothing else they can do except maintain the distortion.

- Traders will tell you to follow the money and buy the distortion

The traders called it right for the last 10-years, backing their hunch central banks were trapped. They coat-tailed QE and low rates with a certainty global central banks have no alternative but to maintain low rates and keep juicing the markets.

Analysts know it can’t continue indefinitely. Experienced traders know markets can remain irrational longer than investors can remain solvent. Global central banks know that to take their fingers off the monetary easy dead-man’s switch will destroy confidence. If they do extract the proverbial digit, then the all-out contagion consequences could make 2008 look like a slightly runny nose.

The real threat would appear to be deflation and the Japanification of occidental economies. That may change if a crisis was to uncork the inflationary genie?

How the end of financial distortion plays out depends on how other themes develop.

Debt Markets depends on how much credibility Governments maintain.

Prediction 2 – Global Debt is likely to Hurt. Lots.

Global GDP is around $85 trillion, meaning the global economy is levered by a factor of some 3:1 – on $260 trillion of public and private debt, which is startling.

The first question to ask about debt should always be: how will interest and principal be repaid? Have the trillions that have been raised in the last 10 years been spent in ways likely to return money to investors? Has the money been spent on building factories, creating jobs or building efficient infrastructure that will generate the returns necessary to repay the debt? Anyone looking in at how ultra-low interest rates have driven stock prices higher due to an orgy of debt-funded corporate buy-backs or to fund ill-advised M&A, or how massive populist-driven fiscal spending programmes are likely to increase

government debt, would immediately assume the current debt markets are completely unsustainable…. The looming debt crisis of the 2020s will be complex and multifaceted. Even governments with access to magic money trees, who retain the keys to their own printing presses, are going to struggle to retain credibility and financial probity in the face of massive funding needs.

Government Debt

Over the next 10-years governments are going to be forced to correct the fact fiscal policy has effectively been ignored the last 10-years – buried in austerity budgets. There are two main factors that point to the need for massively increased government spending in coming years – populism and decay.

Populism

Electorates are angry. They increasingly perceive the last 10-years of monetary mistakes have made the rich richer by ramping financial assets and executive bonuses, while they were forced to pay through austerity public spending. The UK election illustrates the competition between politicians willing to buy votes through fiscal spending programmes. The revolting French illustrate the refusal of electorates to accept tough decisions. Pensions, health services and other public goods including defence and educationdemand spending.

Decay

A massive infrastructure rebuild is required across the occidental economies – simply to maintain the current dilapidated occidental system. Yet infrastructure and government spending are massively inefficient in terms of cost overrun, delay and effectiveness.

- Any significant infrastructure enhancements – including HS2 in the UK – are going to be luxuries, perhaps killed by other competing demands.

- To replace ageing infrastructure with new climate-cure compliant rail, roads and port facilities, while rebuilding hospitals, schools and the housing stock to meet green goals is going to be massively expensive.

- 10-years of government austerity programmes have created the need for massive social infrastructure catch-up spending. Education, health, benefits and care are all under pressure.

- Rising geopolitical threats in an increasingly uncertain world where food and water security become the major issues means spending on defence will need to dramatically increase.

The bottom line is government spending has to rise, at a time when rates are likely to be rising. Does that matter for economies that can create their own money? Not really, the choice is to create new money and call it debt.

The factor that matters is credibility – if governments are credible and deliver credible spending plans then global investors will be prepared to fund debt at low prices. If credibility in the government wavers, the price of debt starts to increase.

The problem here is not the amount of debt – because governments can create as much money as they care to. It’s the credibility of the government that sets the price of the debt – and that’s a political issue.

Politics is the major factor likely to break the credibility of governments and trigger a succession of major global government debt crises.

This is especially true in Europe where governments don’t hold the keys to the printing presses – they are owned by the committee called the ECB. This actually works in favour of some governments – where the credibility of the ECB outweighs the lack of credibility specific governments with investors who are willing to accept an implicit assurance the ECB will “do what it takes” to conditionally bail-out bad governments. What if that breaks? As it nearly did during the European sovereign debt crisis in 2010?

Corporate Debt

Corporate debt is dead simple. If interest rates rise, then lots of companies will struggle to repay debt and will go bust. Highly levered private companies that form the bulk of CLOs will probably collapse first, triggering a wave of panic around the market. Investors trying to exit corporate debt will find themselves trapped in illiquidity, driving prices swiftly down – which will look like a massive buying opportunity…. eventually.

A few years later analysts will wonder why we allowed covenant-lite borrowing by barely solvent borrowers; why companies were allowed to bankrupt themselves by transforming equity into debt via buybacks; or how stockholders failed to constrain company managements.

Corporate debt spreads show how the market is undervaluing risks. Corporates can’t make money the way governments do – they can’t create more; they have to borrow and most certainly pay it back. The risks of corporate debt are completely different to governments – the business ability to repay, the business environment etc. That risk is significant and isn’t covered when junk borrowers can issue debt a point over governments. When the market realises… it will be a wake-up moment.

Personal Debt

If you start your working career encumbered by £50k of student debt, with no chance of ever getting on the housing ladder, and with limited job prospects as careers are automated or digitised while workers are treated as anonymous resources to be hired/fired and employed by algorithms, then it’s hardly any wonder young Millennials, Gen X, Y and Z are increasingly angry. What else is there to do but spend money and borrow more.

When a company can make workers redundant and skip paying wages or redundancy, and makes off with the pension pot, then what’s the incentive on the young workers to repay their pay-day lending? Go buy a car – what else would you spend your gig-economy wages on? If the delivery company lays you off because of a recession or replaces you with a drone – what can you do about it….

If personal debt flattens consumption, then the whole corporate party tumbles off the merry-go-round as consumers stop buying. Helicopter money?

History repeats. Egyptian masons downed tools building pyramids and swiftly robbed graves when they weren’t paid. Peasants were revolting in Plantagenet England. A guillotine was erected in Paris on the back of bread riots and an ill-timed comment about cake instead. The Nazis arose from the inflation of the Weimar era.

Rising personal debt in this age of fake, easy money is presented as a consumer choice and desirable outcome – it’s not. It’s a massive political threat.

Details, just details

The predictability of events ranges from a nailed-on dead certainty, to a completely unexpected “no-seeums”. Without intending to insult believers in the Cygnus Atrastus, the predictability of events is not digital – almost everything is predictable, especially from the perspective of hindsight! Themes are complex and are only doors to more and more questions. Investors should regard the themes and narratives I’ve described above as concepts to drill down into further.

There is so much more I would like to find the time to write about.

I have a massive list of things that will solve everything, like cracking the capacitance problem; doing away with inefficient batteries and making electric vehicles light and efficient. Or maybe we will see the fusion problem solved – fusion power could save us with unlimited power, and its only 30-years down the line. (Its been 30-years down the line since fusion was declared our energy messiah in the 1950s).

I would love to write how opportunities to develop new technologies to clean the seas of plastic, to develop hydrogen and electric aircraft will develop, or how we can crack the water crisis with desalination and icebergs. These things are all possible, but will require significant investment.

Or I could look at areas like global aviation, berate both Boeing and Airbus for their failure to develop new cheap efficient regional aircraft using modern tech. Both got greedy and stuck with 1960s and 70s designs. Maybe the Chinese will win that one – surprising us all by introducing a competitor. Even a plane with similar capabilities to the current aircraft would cause a demand shock in aviation.

Maybe I should spend time talking about market risks from defaults, distressed debt, a new EM crisis brewing… but there is only so much I can say without getting really boring.

For instance:

Animal Protein

Cutting back on meat production will reduce methane. It will drive business opportunities for protein replacement in terms of fake meat, vegetable alternatives, and the prospect of increasing food security by replacing land used for meat production with crops for human production. It will spur the development of 3D meat printing.

It will also trigger a luxury meat market – where countries that can produce Co2 efficient meat command premium prices.

These sub-themes create multiple new narratives:

The UK could benefit from a shift from meat to crop production – our damp climate produces superb pasture allowing the production of high-quality luxury animal protein with a limited carbon footprint (because we don’t have to hack down forest to provide grazing). It opens the opportunity to export our meat around the globe.

In contrast, repurposing former rain forest that was slashed/burnt to create cattle ranges by planting food crops will require soil enhancement and new farming infrastructure across South America at a time when water security is becoming difficult – begging further questions!

Or,

How about China?

How successfully can China under the new great helmsman Xi navigate the next 10-years? Will China end up on a path of tumbling into a new gerontocracy of elderly men whose experience was moulded as children during the pain of the cultural revolution and the great leap forward? Or will it find a new route forward to successfully manage its evolution from a developing country into superpower?

What are the prospects for success? Can it innovate technical solutions to its demographic, environment and bureaucratic challenges? I reckon China faces as much pressure as any state to improve its environment, and far from being suspicious of its ongoing reliance on power, the fact its embraced renewables is fascinating. Can China sustain growth without a debt bubble or does that actually matter if the state simply prints money and internalizes debt? Where does the party take the country – domestic capitalism or state control?

It looks like China will go its own way – developing its own tech ecosystem, hi-value goods in autos, aerospace, shipping and rail. It will stage its own industrial revolution – AI, robotics, energy, pharma and health. The Chinese economy is going to move forward – and in the face of the increasingly erratic behaviour of the US president, and the political gridlock apparent to anyone trying to read US politics, perhaps long-term relationships with China will be preferable to a relationship with a flaky USA?

Finally…. Some predictions from readers:

Markets

“I am expecting to see a massive correction in the bond markets. 10 yr UST moving above 3%, 10 yr Bunds above 1%. Credit spreads blowing out and Stock markets falling 20 to 30%.”

“We will not see much higher yields next year. There is no case for inflation. Rates will go back to January 2019 levels once Trump settles with China. There is a case for margins to widen. We need a couple of spectacular defaults and that could signal a turn in the market. A future crisis will not be with banks but with institutional investors who have to write-off a lot of debt in their balance sheet and will try and sell deals.”

Fiscal Policy

“2020 will be the year where we will hear much more about governments’ opening up the purse strings in response to widening inequality. This is likely to result in developed market bond yield curves meaningfully steepen and 10-year Bund yields turn positive as the Germans finally give in to some stimulus.”

“2020: Who wants to invest in the long Euro government bonds at -.5% or -0.7% of the countries that need to borrow heavily, i.e. that are in deficit? Only if you are forced to…Therefore capital controls are coming in Euroland sooner or later!”

US Politics

“Donald Trump will be easily beaten in November 2020 and win fewer electoral college votes than John McCain managed in 2008. The US economy will grow nicely but the impact of Trump’s unpresidential behaviour and his deep unpopularity with women will be impossible to overcome. In the early part of 2020 speculation will emerge that Hillary Clinton will enter the democratic primary. She will be blocked from running however – centrist candidate Biden will win the Dem nomination and then the election.”

“In 2020 markets will fret about the choice between four more years of Donald Trump or a Democrat elected on a “socialist” platform. The battle will mean delays in corporate, and investor, decision making suggesting a sluggish economy and a sluggish market.”

Tech Unicorns

“2020 will be the year when Silicon Valley investors are caught swimming without trunks. IPOs start to dry up for cash-guzzling companies that have followed the ‘blitzscaling’ growth strategy and that has a knock-on impact on sentiment amongst the funders that have supported them to date. VCs start to look for businesses that can achieve profitability even if their ambitions are more modest than dominating entire industries or creating new paradigms.”

Tyler Durden

Sat, 12/28/2019 – 15:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com