Glencore Pleads Guilty To Decade Of Bribery And Market Manipulation, Will Pay $1.5 BIllion Penalty

Swiss commodity trading giant Glencore agreed to plead guilty to multiple counts of bribery and market manipulation and pay penalties of up to $1.5BN to settle US, UK and Brazilian probes that have hung over the commodities giant for years.

The settlements will help remove question marks that have long overshadowed the trader’s (shady) business, profiled extensively in the gripping book The World For Sale. But the charges and admissions of guilt paint a damning, globe-spanning picture of how far the company, founded by U.S. fugitive Marc Rich, has been willing to go in pursuit of profit.

According to Bloomberg, Glencore units agreed to plead guilty to a list of charges that range from bribery and corruption in South America and Africa, to price manipulation in US fuel-oil markets.

The UK’s Serious Fraud Office on Tuesday charged the group’s subsidiary Glencore Energy UK with seven cases of profit-driven bribery and corruption in connection to oil operations in Cameroon, Equatorial Guinea, Ivory Coast, Nigeria and South Sudan. In a statement, the SFO said that its case was that “Glencore agents and employees paid bribes worth over $25mn for preferential access to oil, with approval by the company”.

In the US, Glencore pleaded guilty in two separate criminal cases and agreed to pay approximately $1.1bn in criminal fines and forfeiture. One case involved what prosecutors described as a decade-long bribery scheme, and in the second, Glencore’s US commodities trading arm pleaded guilty to engaging in an eight-year scheme to manipulate US fuel oil price benchmarks.

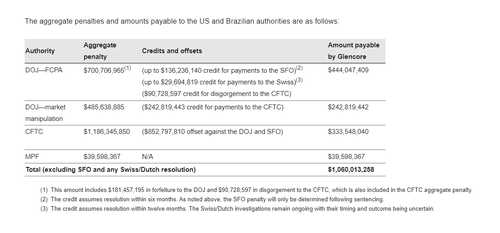

Glencore said it would pay about $1.5bn in overall penalties, including the $1.1bn to US authorities, $40mn to Brazilian prosecutors and an amount due to the UK to be finalised at a sentencing hearing. The company made a $1.5bn provision for the settlement in February, and said in an update on Tuesday that it does not expect the total fines to “differ materially” from what it has set aside.

Merrick Garland, US attorney-general, called it the US Department of Justice’s “largest criminal enforcement action to date for commodity price manipulation conspiracy in oil markets”.

“Bribery was built in to the corporate culture,” Manhattan US Attorney Damian Williams said at a press conference. “The tone from the top was clear: whatever it takes.” Glencore paid more than $100 million in bribes to government officials in Brazil, Nigeria, the Democratic Republic of the Congo and Venezuela, he said.

Glencore is the largest among a handful of independent commodity merchants that dominate global trading of oil, fuel, metals, minerals and food. The company and its rivals, most of which are privately held, have traditionally operated outside of the view of regulators and been willing to go to countries and do deals that others shy away from. In recent months, Glencore has fallen under the microscope for continuing to conduct Russian oil trade despite blanket western sanctions.

Glencore first said it was being investigated by the US in 2018 and details of the corruption in Africa began to emerge last year as a former Glencore trader pleaded guilty in the US to participating in an international scheme to bribe officials in Nigeria to win favorable treatment from the state-owned oil company.

The commodity trader and miner said in February it expected to resolve the UK, US and Brazilian investigations this year and set aside $1.5 billion. However, it still faces investigations in Switzerland and the Netherlands.

In an order Tuesday, the Commodity Futures Trading Commission describes how Glencore traders would use codes like “newspapers” or “chocolates” to refer to corrupt payments. The corruption and manipulation took place from at least 2007 through at least 2018, the CFTC said.

The investigations overshadowed the last years at the helm for former Chief Executive Officer Ivan Glasenberg, who built the company in its current form and remains a top shareholder. Glasenberg handed over the leadership last year to his handpicked successor, Gary Nagle, as part of a wider generational transition.

The company, which shifts millions of tonnes of metals, minerals and oil across the globe, also faces probes by Swiss and Dutch authorities, the timing and result of which remain uncertain.

Last July, a former Glencore oil trader pleaded guilty in New York over his role in a scheme to bribe government officials in Nigeria in return for lucrative oil contracts. The allegations in the original US DoJ investigation, which date as far back as 2007, happened during Glasenberg’s 19-year reign at the top of the company.

And while two Glencore traders have pleaded guilty as part of the US cases, the company’s top executives have so far escaped punishment.

Glasenberg and his top lieutenants took the company public in 2011 in what was then one of the largest ever flotations in London. It partly used the funds to transform the company from a pure commodity trader into a mining company through a merger with Xstrata in 2013 and a series of acquisitions.

But the company has struggled to shake off a reputation for sometimes questionable activity that many investors saw as embedded in its DNA, stretching back to its time as a privately held trading house, the FT notes.

“We acknowledge the misconduct identified in these investigations and have cooperated with the authorities,” CEO Nagle said in a statement. “This type of behavior has no place in Glencore, and the board, management team and I are very clear about the culture that we want and our commitment to be a responsible and ethical operator wherever we work.”

While the expected total payment is among the largest anti-corruption fines on record, it’s a pittance amount for Glencore. The company is expected to earn more than $17 billion this year, according to analysts’ consensus, meaning that it would make back the $1.5 billion in less than 5 weeks, according to Bloomberg.

“Glencore shouldn’t be allowed to gloss over what these charges reveal,” said Alexandra Gillies, an adviser at the Natural Resource Governance Institute. “These are some of the poorest countries in the world, countries where citizens have suffered the terrible costs of corruption for many years.”

Some more details from Bloomberg:

Glencore expects to pay about $1 billion to U.S. authorities after accounting for credits and offsets payable to other jurisdictions and agencies, and about $40 million to Brazil, the company said. The payment to the UK will only be finalized after a hearing next month but Glencore said it doesn’t expect the amount will result in the total penalties differing materially from the $1.5 billion previously disclosed.

Earlier Tuesday, Shaun Teichner, the general counsel for the company, told a federal judge in New York that Glencore International AG knowingly and willingly entered into a conspiracy to violate the Foreign Corrupt Practices Act by making payments to corrupt government officials.

“It’s a good day for them to finally get this done because it’s been hanging over them for a while,” said Ben Davis, a mining analyst at Liberum Capital. “It at least allows them to start to move forward.”

The bottom line, however, is that today’s settlement once again reveals that there are those who can pay their way out of legal trouble, and those who go to jail. Glencore, and its executives, are among the former: as Bloomberg’s Javier Blas notes, “not a single senior executive faces jail time. Other than Enron’s executives, the US last jailed a top oil trader in 2007-08 when it sent to prison David Chalmers and Oscar Wyatt, the CEOs of Bayoil and Coastal after the Iraq’s Oil-for-Food scandal.”

Further on Glencore. *So far*, not a single senior executive faces jail time. Other than Enron’s executives, the US last jailed a top oil trader in 2007-08 when it sent to prison David Chalmers and Oscar Wyatt, the CEOs of Bayoil and Coastal after the Iraq’s Oil-for-Food scandal

— Javier Blas (@JavierBlas) May 24, 2022

Tyler Durden

Tue, 05/24/2022 – 21:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com