Futures Slide, Yields Jump And Oil Surges As Inflation Fears Return Ahead Of Biden-Powell Meeting

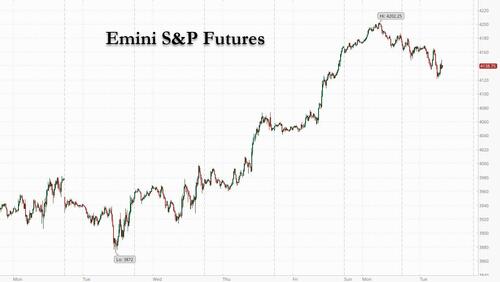

After posting solid gains on Monday when cash markets were closed in the US for Memorial Day, boosted by optimism that China’s covid lockdowns are effectively over, and briefly topping 4,200 – after sliding into a bear market below 3,855 just over a week earlier – on Tuesday US equity futures fell as oil’s surge following a partial ban on crude imports from Russia added to concerns over the pace of monetary tightening, exacerbated by the latest data out of Europe which found that inflation had hit a record 8.1% in May. As of 7:15am ET, S&P futures were down 0.4% while Nasdaq futures rose 0.1% erasing earlier losses. European bourses appeared likely to snap four days of gains, easing back from a one-month high while Treasury yields climbed sharply across the curve, joining Monday’s selloff in German bunds and European bonds. The dollar advanced and bitcoin continued its solid rebound, trading just south of $32,000. Traders will be on the lookout for any surprise announcement out of the White House after 1:15pm when Joe Biden holds an Oval Office meeting with Fed Chair Jerome Powell and Janet Yellen.

As noted last night, Brent oil rose to above $124 a barrel after the European Union agreed to pursue a partial embargo on Russian oil in response to the invasion of Ukraine, exacerbating inflation concerns; crude also got a boost from China easing coronavirus restrictions, helping demand.

With the price of oil soaring, energy stocks also jumped in premarket trading; Exxon gained as much as 1.5% while Chevron rose as much as 1.4%, Marathon Oil +2.9%, Coterra Energy +3.7%; smaller stocks like Camber Energy +8.8% and Imperial Petroleum rose 15%, leading advance. US-listed Chinese stocks jumped, on track to wipe out their monthly losses, as easing in lockdown measures in major cities and better-than-expected economic data gave investors reasons to cheer. Shares of e-commerce giant Alibaba Group Holding Ltd. were up 4.4% in premarket trading. Among other large-cap Chinese internet stocks, JD.com Inc. advanced 6.7% and Baidu Inc. gained 7%. Cryptocurrency stocks also rose in premarket trading as Bitcoin trades above $31,500, with investors and strategists saying the digital currency is showing signs of bottoming out. Bitcoin, the largest cryptocurrency, advanced 1.2% as of 4:30 a.m. in New York. Crypto stocks that were rising in premarket trading include: Riot Blockchain +9%, Marathon Digital +8.1%, Bit Digital +6.1%, MicroStrategy +9.4%, Ebang +3.4%, Coinbase +5.3%, Silvergate Capital +5.2%.

“It’s very hard to have conviction at the moment,” Mike Bell, global market strategist at JPMorgan Asset Management, said in an interview with Bloomberg Television. “We think it makes sense to be neutral on stocks and pretty neutral on bonds actually.” The possibility that Russia could retaliate to the EU move on oil by disrupting gas flows “would make me be careful about being overweight risk assets at the moment,” he said.

U.S. stocks are set for a slightly positive return in May despite a dramatic month in markets, which saw seven trading days in which the S&P 500 Index posted a move bigger than 2%. Global stocks are also on track to end the month with modest gains amid skepticism about whether the market is near a trough and as volatility stays elevated. Fears that central bank rate hikes will induce a recession, stubbornly high inflation and uncertainty around how China will boost its flailing economy are keeping investors watchful. On the other hand, attractive valuations, coupled with hopes that inflation may be peaking has made investors buy up stocks.

In Europe, Stoxx 600 Index was set to snap four days of gains, retreating from a one-month high, with technology stocks among the heaviest decliners. The UK’s FTSE 100 outperforms, adding 0.4%, CAC 40 lags, dropping 0.6%. Travel, real estate and construction are the worst-performing sectors. Among individual stock moves in Europe, Deutsche Bank AG slipped after the lender and its asset management unit had their Frankfurt offices raided by police. Credit Suisse Group AG dropped after a Reuters report that the bank is weighing options to strengthen its capital. Unilever Plc jumped as activist investor Nelson Peltz joined its board. Royal DSM NV soared after agreeing to form a fragrances giant by combining with Firmenich.

Asian stocks rose Tuesday, helped by a rally in Chinese shares after Shanghai further eased virus curbs and the nation’s factory activity showed signs of improvement. The MSCI Asia Pacific Index climbed as much as 0.5% Tuesday, on track for the first monthly advance this year, even as investors sold US Treasuries on renewed inflation concerns. Chinese stocks capped their longest winning streak since June.

“Asia has seen the worst earnings revision of any region in the world,” David Wong, senior investment strategist for equities at AllianceBernstein, told Bloomberg Television. “When the news is really bleak, that is when one wants to establish a position in Chinese equities,” he said. “It is very clear that the policy support is on its way.” Tech and communication services shares were among the biggest sectoral gainers on Tuesday. Asia stocks are on track to eke out a gain of less than a percentage point in May as the easing of China’s lockdowns improves the growth outlook for the region. Still, the impact of aggressive monetary-policy tightening on US growth and higher energy and food costs globally are weighing on sentiment in the equity market as traders struggle to assess the earnings fallout.

Japanese stocks dropped after data showed the nation’s factory output dropped in April for the first time in three months as China’s Covid-related lockdowns further disrupted supply chains. Benchmark gauges were also lower as 22 Japanese companies were set to be deleted from MSCI global standard indexes at Tuesday’s close. The Topix Index fell 0.5% to 1,912.67 on Tuesday, while the Nikkei declined 0.3% to 27,279.80. Nippon Telegraph & Telephone Corp. contributed the most to the Topix’s drop, as the telecom-services provider slumped 2%. Among the 2,171 companies in the index, shares in 1,369 fell, 720 rose and 82 were unchanged. “Until after the FOMC in June, stocks will continue to sway,” said Shingo Ide, chief equity strategist at NLI Research Institute, said referring to the US Federal Reserve.

India’s benchmark equities index clocked its biggest monthly decline since February, as a surge in crude oil prices raised prospects of tighter central bank action to keep a lid on inflation. The S&P BSE Sensex slipped 0.6% to 55,566.41 in Mumbai, taking its monthly decline to 2.6%. The NSE Nifty 50 Index dropped 0.5% on Tuesday. Mortgage lender Housing Development Finance Corp. fell 2.6% and was the biggest drag on the Sensex, which had 16 of the 30 member stocks trading lower. Of the 19 sectoral indexes compiled by BSE Ltd., 10 declined, led by a measure of power companies. The price of Brent crude, a major import for India, climbed for a ninth consecutive session to trade around $124 a barrel. “The primary focus in the coming weeks will be on central banks’ policy measures to stabilize inflation,” Mitul Shah, head of research at Reliance Securities Ltd. wrote in a note. “Changes in oil prices and amendments to import and export duties might play a role in assessing the market’s trajectory.”

Similarly, in Australia the S&P/ASX 200 index fell 1% to close at 7,211.20, with all sectors ending the session lower. The benchmark dropped 3% in May, notching its largest monthly decline since January. Suncorp was among the worst performers Tuesday after it was downgraded at Morgan Stanley. De Grey Mining rose after an update on its Mallina Gold Project. In New Zealand, the S&P/NZX 50 index rose 1.5% to 11,308.34.

With rate hikes in full swing in the US and the UK, the ECB is preparing to lift borrowing costs for the first time in more than a decade to combat the 19-member currency bloc’s unprecedented price spike. In the US, Federal Reserve Governor Christopher Waller said he wants to keep raising interest rates in half-percentage point steps until inflation is easing back toward the central bank’s goal.

In rates, Treasuries are off worst levels of the day although yields remain cheaper by 5bp-7bp across the curve as opening gap higher holds. 10-year TSY yields around 2.815%, cheaper by 7.7bp on the day, while intermediate-led losses widen 2s7s30s fly by ~4.5bp; bund yields around 2bp cheaper vs Monday close, following hot euro- zone inflation prints. European bonds also pressure Treasuries lower after euro-zone inflation accelerated to a fresh all-time high and ECB hike premium was added across front-end. Italian bond yields rose by up to 6bps after data showed that euro-zone consumer prices jumped 8.1% from a year earlier in May, exceeding the 7.8% median estimate in a Bloomberg survey. Comments from Fed’s Waller on Monday — backing half-point hike at several meetings — saw Treasury yields reset higher from the reopen, following US Memorial Day holiday.Front-end weakness reflects Fed hike premium returning in US swaps, with around 188bp of hikes now priced in for December FOMC vs 182bp at Friday’s close.

In FX, the Bloomberg Dollar Spot Index rose 0.2% as the greenback outperformed all Group-of-10 peers apart from the Norwegian krone, though the gauge is still set for its first monthly fall in three. The euro erased Monday’s gain after data showed that euro-zone consumer prices jumped 8.1% from a year earlier in May, exceeding the 7.8% median estimate in a Bloomberg survey. Norway’s krone rallied after the central bank said it will reduce its daily foreign currency purchases on behalf of the government to the equivalent of 1.5 billion kroner ($160 million) next month. Norway has been benefiting from stronger revenue from oil and gas production as the war in Ukraine contributed to higher petroleum prices. Sterling slipped against the broadly stronger dollar. UK business confidence rose for the first time in three months in May, with more companies planning to increase prices. Cable may see its first month of gains since December. The yen fell as Treasury yields surged. Japanese government bonds also took a hit from selling in US bonds while a two-year note auction went smoothly. Australian and New Zealand bonds extended an opening fall as cash Treasuries dropped on return from a long weekend. Dollar strength weighed on the Aussie and kiwi.

In commodities, Brent rises 2% to trade around $124 after European Union leaders agreed to pursue a partial ban on Russian oil. Spot gold falls roughly $4 to trade at $1,852/oz. Base metals are mixed; LME nickel falls 1.7% while LME zinc gains 0.9%.

Looking at the day ahead, the data highlights will include the flash CPI reading for May from the Euro Area, as well as the country readings from France and Italy. On top of that, we’ll get German unemployment for May, UK mortgage approvals for April, and Canada’s Q1 GDP. Over in the US, there’s then the FHFA house price index for March, the Conference Board’s consumer confidence indicator for May, the MNI Chicago PMI for May and the Dallas Fed’s manufacturing activity for May. Otherwise, central bank speakers include the ECB’s Villeroy, Visco and Makhlouf.

Market Snapshot

- S&P 500 futures little changed at 4,159.50

- STOXX Europe 600 little changed at 446.27

- MXAP up 0.5% to 169.92

- MXAPJ up 0.9% to 559.23

- Nikkei down 0.3% to 27,279.80

- Topix down 0.5% to 1,912.67

- Hang Seng Index up 1.4% to 21,415.20

- Shanghai Composite up 1.2% to 3,186.43

- Sensex little changed at 55,914.64

- Australia S&P/ASX 200 down 1.0% to 7,211.17

- Kospi up 0.6% to 2,685.90

- German 10Y yield little changed at 1.05%

- Euro down 0.3% to $1.0743

- Brent Futures up 1.6% to $123.60/bbl

- Gold spot up 0.1% to $1,856.27

- U.S. Dollar Index little changed at 101.63

Top Overnight News from Bloomberg

- ECB Governing Council member Francois Villeroy de Galhau said the latest acceleration in inflation warrants a “gradual but resolute” normalization of monetary policy

- The ECB’s interest- rate hiking must proceed in an “orderly” way to avoid threatening the integrity of the euro zone, Governing Council member Ignazio Visco said

- German joblessness dropped the least in more than a year, pointing to labor-market vulnerabilities as the war in Ukraine and surging inflation weigh on Europe’s largest economy

- China’s factories still struggled in May, but the slower pace of contraction suggests that the worst of the current economic fallout may be coming to an end as the country starts to ease up on its tough lockdowns

- A debt crisis in China’s property industry has sparked a record wave of defaults and dragged more developer bonds down to distressed levels

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mixed as most indices lacked firm direction amid month-end and mixed data. ASX 200 was subdued by tech underperformance and after a deluge of data releases. Nikkei 225 traded rangebound with the index restricted after Industrial Production data missed forecasts. Hang Seng and Shanghai Comp were initially indecisive following the Chinese PMI data which printed above estimates but remained at a contraction, although risk appetite gradually picked amid further support measures and improved COVID situation in China.

Top Asian News

- China’s Cabinet issued a series of policies to stabilise the economy, according to a Cabinet document cited by Reuters. China is to accelerate the issuance of local government special bonds and add new types of infrastructure and energy projects to the project pool eligible for fundraising, while it is to step up VAT credit rebates, boost fiscal spending and will guide actual lending rates lower.

- China reported 97 new COVID-19 cases on May 30th which was the first time infections were below 100 since March 2nd, according to Bloomberg.

- Shanghai official said the city is moving into a normalised epidemic control phase and looks to resume normal life. The official added that malls and shops will be able to reopen with capacity capped at 75% although the reopening of high-density venues such as gyms will be slower, while all workers in low-risk areas should be able to return to work from June 1st, according to Reuters.

- Hong Kong Chief Executive Lam said they will likely begin the third stage of easing COVID-19 restrictions in late June, according to Bloomberg.

- RBNZ Deputy Governor Hawkesby said the central bank needs to keep decreasing stimulus and tighten conditions beyond the neutral of 2.0%.

European bourses are mixed, Euro Stoxx 50 -0.8%, with sentiment cautious after a mixed APAC handover and in wake of hot EZ CPI before Powell’s meeting with Biden. Note, the FTSE 100 and AEX are bucking the trend given their exposure to Unilever after Trian Fund Management confirmed a 1.5% stake. US futures are pressured, ES -0.6%, succumbing to the broader risk moves after relatively steady initial trade as sentiment remains cautious with multiple factors in play. IATA Chief says that demand is very strong and traffic will likely return to 2019 levels nearer to 2023 than 2024. Question does remain regarding the impact of inflation on disposable incomes and travel demand. Higher oil prices will result in higher ticket prices; rule of thumb is a 10% change in ticket prices can impact demand by 1%.

Top European News

- Senior Tory MPs said UK PM Johnson is likely to face a no-confidence vote as leader of the Conservative Party if they lose two parliamentary by-elections next month, according to FT.

- Pressure is increasing for the ECB to hike rates after German CPI rose to its highest in half a century, according to The Times.

- ECB’s Visco Insists on ‘Orderly’ Rate-Hike Pace to Avoid Stress

- UK Mortgage Approvals Fall to 65,974 in April Vs. Est. 70,500

- UK Could Reopen Top Gas Storage to Endure Energy Crisis

- BNP Paribas Aims to Hire 7,000 People in France in 2022

- Russia’s Biggest Lender Sberbank Targeted in EU Sanctions Plan

FX

- Buck bounces into month end as US Treasury yields rebound amidst rally in crude prices and hawkish Fed commentary, DXY towards top of firmer 101.800-410 range.

- Kiwi undermined by downbeat NBNZ business survey findings and recession warning from RBNZ; NZD/USD hovering just above 0.6500 and AUD/NZD back over 1.1000.

- Euro fades from Fib resistance irrespective of Eurozone inflation exceeding consensus, EUR/USD down through 1.0750 vs circa 1.0787 at best on Monday.

- Yen hampered by mixed Japanese data and UST retreat, but back above 128.00 and retracement level (128.27 Fib retracement).

- Aussie limits losses alongside recovering Yuan after better than feared Chinese PMIs and economic stability policies from the Cabinet, AUD/USD stays within sight of 0.7200, USD/CNH reverses from 6.6900+ and USD/CNY from just shy of 6.6750.

- Petro currencies cushioned by oil gains after EU embargo on some Russian exports; USD/CAD beneath 1.2700, EUR/NOK probes 10.1000 with added impetus as Norges Bank plans to trim daily FX purchases in June.

Fixed Income

- Bonds succumb to more downside pressure as oil soars, inflation data exceeds consensus and Central Bank hawks get more aggressive.

- Bunds only just hold above 152.00, Gilts lose 117.00+ status and 10 year T-note retreats through 120-00 ahead of cash re-open from 3-day holiday weekend.

- Bobl supply snapped up at final sale of current 5 year batch and end of month Italian offerings relatively well received, albeit at much higher gross yields.

- BoJ maintains bond-buying operations for June at May levels.

Commodities

- WTI and Brent are bid as China’s COVID situation remains fluid, but with incremental improvements, alongside EU leaders reaching a watered-down Russian sanctions package.

- Currently, the benchmarks are holding comfortably above USD 119/bbl and in proximity to the top-end of the sessions range.

- Reminder, given the US market holiday there was no settlement on Monday.

- IEA’s Birol says oil market could get tight in the summer and sees bottlenecks with diesel, gasoline, and kerosene, especially in Europe.

- Spot gold is modestly pressured but yet to stray much from the USD 1850/oz mark while base metals are mixed as sentiment slips.

Central Banks

- ECB’s Visco says rate hikes will need to be gradual given uncertainties, recent widening in the IT/GE spread shows the need to strengthen public finances and lower debt. Need to ensure tha t normalisation does not lead to unwarranted fragmentation in the Eurozone.

- ECB’s Villeroy says the May inflation numbers confirm expectations for an increase and need for progressive monetary normalisation. Speaking in relation to the French inflation data.

US Event Calendar

- 09:00: 1Q House Price Purchase Index QoQ, prior 3.3%

- 09:00: March S&P/Case-Shiller US HPI YoY, prior 19.80%

- 09:00: March S&P/CS 20 City MoM SA, est. 1.90%, prior 2.39%

- 09:00: March S&P CS Composite-20 YoY, est. 19.80%, prior 20.20%

- 09:00: March FHFA House Price Index MoM, est. 2.0%, prior 2.1%

- 09:45: May MNI Chicago PMI, est. 55.0, prior 56.4

- 10:00: May Conf. Board Expectations, prior 77.2

- 10:00: May Conf. Board Present Situation, prior 152.6

- 10:00: May Conf. Board Consumer Confidenc, est. 103.8, prior 107.3

- 10:30: May Dallas Fed Manf. Activity, est. 1.5, prior 1.1

DB’s Jim Reid concludes the overnight wrap

Yesterday we published our May market participant survey with 560 filling in across the globe. The highlights were that property was seen as the best inflation hedge with crypto only winning favour with 1%. 61% think a recession will be necessary to rein in inflation but less think the Fed will be brave enough to take us there. A majority think the ECB will have to throw in a 50bps hike at some point in this cycle but only around a quarter think the Fed will do a 75bps hike. Only a quarter think equities have now bottomed over a horizon of the next 3-6 months but responders have reduced their view of bubbles in the market from the last time we asked. Finally inflation expectations continue to edge up. See the link here for lots of interesting observations and thanks again for your continued support.

It may have been a quieter session over the last 24 hours with the US on holiday, but inflation concerns were put firmly back on the agenda thanks to another upside surprise in German inflation, as well as a further rise in oil prices that sent Brent Crude back above $120/bbl (it was as low as $102 three weeks ago). That led to a fresh selloff in sovereign bonds, as well as growing speculation about more hawkish central banks, which marks a shift in the dominant narrative over the last couple of weeks, when growing fears of a recession had led to a rally in sovereign bonds, not least since there were growing doubts about the extent to which central banks would be able to take policy into restrictive territory, if at all.

In reality though, that German inflation print for May provided significant ammunition to the hawkish side of the argument, with the EU-harmonised reading coming in above every estimate on Bloomberg at +8.7% (vs. +8.1% expected). For reference, that leaves German CPI at its highest level since the 1950s (using the numbers for West Germany before reunification), and that holds even if you use the national definition of CPI, which rose to a slightly lower +7.9% (vs. +7.6% expected). It was a similar story from Spain earlier in the day, which reported inflation on the EU-harmonised measure at +8.5% (vs. +8.3% expected). Speaking to our German economist Stefan Schneider he thinks temporary energy tax reductions should reduce the annual rate to below 7% in June but it’s likely that it’ll be back above 7% by September when this and other charges roll-off, and then only modestly fall into year-end. That’s a long period of high inflation where second round effect and wage pressures can build.

With upside surprises from both Germany and Spain yesterday, that’ll heighten interest in this morning’s flash CPI print for the entire Euro Area, not least since the next ECB meeting is just 9 days away. Indeed, those bumper inflation readings have only added to expectations that the ECB will follow the Fed in moving by a larger-than-usual 50bps rather than 25bps once they start hiking. Overnight index swaps reacted accordingly, and are now pricing in a +33bps move higher in rates by the July meeting, which is the highest to date and leaves it just a few basis points away from being closer to 50bps than 25bps. On top of that, the amount of hikes priced in for the year as a whole rose to 114bps, which again is the highest to date.

Ahead of that meeting, there were some further comments from policymakers, with the ECB’s Chief Economist Lane saying in an interview that “increases of 25 basis points in the July and September meetings are a benchmark pace.” Interestingly he didn’t rule out the possibility of a 50bp move, saying that “The discussion will be had”, but also said that their “current assessment … calls for a gradual approach to normalisation.”

Against that backdrop, there was a significant selloff in European sovereign bonds, with yields on 10yr bunds (+9.4bps), OATs (+8.5bps) and BTPs (+9.9bps) all moving higher. The prospect of tighter policy meant those rises in yields were more pronounced at the front end of the curve, with 2yr German yields up +10.9bps to 0.43%, which is a level unseen in over a decade. The only major exception to that pattern were Swedish government bonds, where 10yr yields were down -6.2bps after the country’s economy contracted by a larger-than-expected -0.8% in Q1, which was above the -0.4% contraction in the flash estimate from April.

Whilst Treasury markets were closed for the US Memorial Day holiday, Fed funds futures provided a sense that the direction of travel was similar in the US to Europe, since the implied fed funds rate by the December FOMC meeting ticked up +7bps. Furthermore, we also had a speech from Fed Governor Waller, who commented that he was in favour of “tightening policy by another 50 basis points for several meetings”, and said that he was “not taking 50 basis-point hikes off the table until I see inflation coming down closer to our 2% target”. Up to now, there’s been a pretty strong signal from Fed Chair Powell and others that 50bps were likely at the next two meetings (in June and July), but in September there’s been speculation they might begin to slow down to a 25bp pace, with futures currently pricing in something in between the two at present. In Asia, US sovereign yields are playing catch-up after reopening with 2yr through to 10yr yields 8-11bps higher across the curve.

The main other story yesterday was a significant rise in oil prices, with Brent Crude up +1.97% on the day to close at $121.15/bbl, whilst WTI rose +1.82% to $117.17/bbl. That marks an 8th consecutive daily increase in Brent Crude prices, and leaves it at its highest closing level in over two months, and will not be welcome news for policymakers already grappling with higher energy prices. Part of that increase has come amidst the easing of Covid restrictions in China, but the prospect of an EU embargo on Russian oil has also played a role.

Indeed, following an extraordinary European Council summit, EU leaders agreed late last night, a political deal to impose a partial ban on most Russian oil imports. Under a compromise plan, the 27-nation bloc has decided to cut 90% of oil imports from Russia by the end of 2022 with EU leaders agreeing to exempt Hungary from Russian oil embargo. The embargo will cover seaborne oil and partially exempt pipeline oil thus providing an important concession to the landlocked nation. Following this, oil prices are building on yesterday’s gains with Brent and WTI up just under 1.5% as I type.

Asian equity markets are mostly treading water this morning but with China higher. The Nikkei (+0.13%), Hang Seng (+0.24%) and Kospi (+0.11%) are slightly higher with the Shanghai Composite (+0.75%) and CSI (+0.98%) leading gains after China’s official factory activity contracted at a slower pace. The official manufacturing PMI advanced to 49.6 in May (vs 49.0 expected) from 47.4, as COVID-19 curbs in major manufacturing hubs were eased. This is still three months below 50 now. In line with the weakness in the factory sector, services sector activity remained soft, but did bounce. The non-manufacturing PMI came in at 47.8 in May, up from 41.9 in April.

US equities were closed for the holiday yesterday, but in spite of the prospect of faster rate hikes being back on the table, futures still managed to put in a decent performance, with those on the S&P 500 up over +0.5% around the time of the European close. That’s dipped to +0.2% as I type though. European indices made gains, with the STOXX 600 up +0.59% thanks to an outperformance among the more cyclical sectors, and the index built on its +2.98% advance last week. Those gains were seen across the continent, with the DAX (+0.79%), the CAC 40 (+0.72%) and the FTSE 100 (+0.19%) all moving higher on the day.

Finally, there wasn’t much other data yesterday, although the European Commission’s economic sentiment indicator for the Euro Area stabilised in May having fallen in all but one month since October. The measure came in at 105.0 (vs. 104.9 expected), up from a revised 104.9 in April.

To the day ahead now, and the data highlights will include the flash CPI reading for May from the Euro Area, as well as the country readings from France and Italy. On top of that, we’ll get German unemployment for May, UK mortgage approvals for April, and Canada’s Q1 GDP. Over in the US, there’s then the FHFA house price index for March, the Conference Board’s consumer confidence indicator for May, the MNI Chicago PMI for May and the Dallas Fed’s manufacturing activity for May. Otherwise, central bank speakers include the ECB’s Villeroy, Visco and Makhlouf.

Tyler Durden

Tue, 05/31/2022 – 07:51

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com