Crypto Trading Cycle Flips: Asia’s Now Buying What Americans Are Dumping

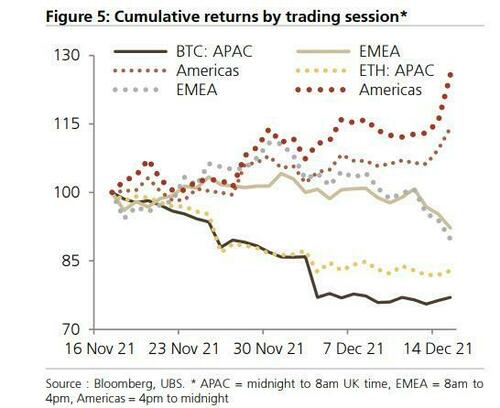

Late in 2021 we detailed the strange phenomenon whereby crypto markets were dramatically underperforming during the overnight (Asia) session relative to the US day session.

Whoever (or whatever – cough Asian central banks cough) was ‘selling’ crypto overnight was met with a volley of bids from US whales scooping up that ‘cheap’ coin.

But now, as scorched-earth regulatory pressures perhaps swing from Beijing to Washington, that regime has flipped with US ‘paper hands’ dumping their crypto during the US day-session as Asian HODLers scoop up the ‘cheap’ coins overnight.

Specifically, as the chart above shows, a hypothetical strategy that buys the coin at the equity-market close (at 1600ET) and sells it at the next day’s open (0930ET) yields gains of roughly 260% going back to the start of 2020, according to Bespoke Investment Group.

Conversely, buying it at the US market open and selling it at the close spits out an advance of 3.6%.

The coin even tends to trend higher during weekends, the firm found, when stock investors are resting or barbecuing or doing whatever weekend activities they’re fond of.

While no one seems to be able to agree on why this might be happening, Bloomberg’s Vildana Hajric and Katie Greifeld outline five perspectives on why the phenomenon might be happening:

1. The Nature of a 24/7 Market

The fact that cryptocurrencies trade around the clock every day of the week makes Bitcoin, by default, the most watched and traded asset when traditional markets are closed, and that’s a top reason for the overnight phenomenon, says Bloomberg Intelligence’s Mike McGlone.

“It’s the most fluid global 24/7 trading vehicle in history, which means it’s a leading indicator on the downside too,” he said.

2. Geographical Differences

In the US and certain other geographies, riskier assets have sold off this year as the Federal Reserve and other central banks institute policies to combat high inflation. But that might not be the case everywhere, and risk-on attitudes may still be at play across Asia, for instance, says Noelle Acheson, head of market insights at Genesis Global Trading.

Back in 2015 and 2016, China had been a focal point for Bitcoin trading — that’s where mining took off and most of the trading volume originated, she said. “There are different cultural attitudes toward riskier investments.”

Source: Glassnode, as of June 8

In addition, some investors might be more drawn toward using leverage, and international venues are sometimes more permissive in that way. Original crypto exchanges used to offer 125x leverage, said Acheson, though, in the US, regulators have looked to curtail such access. “So they are much more used to high leverage, it’s much more what they expect,” she said.

3. Longer Span of Time

Bitcoin’s correlation to equities could be another factor at work, which is something analysts have been pointing to all year as both cryptos and equities have sold off. Both stocks and digital assets are considered riskier plays, so the two have moved hand-in-hand, says Jake Gordon at Bespoke Investment Group.

Still, the correlation to stocks may not explain why the trend of after-hours outperformance also existed when the market was rallying over the past two years, he said. So another explanation is that the post-close strategy covers a longer span of time, “meaning there is the potential for more news/catalysts to account for.”

4. Watching the Charts

From 2021 onwards, due to China’s crackdown on crypto, trading volumes and flows have tended to peak around 9:30 a.m. Eastern Time, according to Chiente Hsu, co-founder and CEO at ALEX, a DeFi platform. “So trading volume is highly correlated to the US stock market trading hours,” she said in an interview. Hsu, who used to work at Morgan Stanley, cited a research paper showing that the overnight trend of buying at the close and selling at the open was also prevalent in the stock market before the pandemic.

But why might that be the case? Hsu says information flows build up overnight, though that’s mostly prevalent during uptrend markets. What about bear markets? “In a downtrend market, it shouldn’t work, particularly in very volatile, range-bound markets,” she said, adding that she’d like to see more research on these types of topics, as well as how transaction costs play a part.

5. Correlations

Vetle Lunde, analyst at Arcane Research, says he expected US trading hours to be the most significant contributor to the Bitcoin selloff in recent months, but hadn’t expected to see that being the only contributor. “Then again, it confirms what we’ve seen elsewhere in the market,” Lunde said, citing the coin’s strong correlation to stocks this year.

“We saw in mid-2020 to early 2021 that US trading hours were the key trading hours for the initial liftoff during the early bull market. That period was characterized as a period of huge institutional flows into Bitcoin,” Lunde wrote in a message.

“Now, most of the institutional market has been focused on de-risking, with the macro backdrop related to inflation and interest-rate hikes being the key component behind the de-risking. This has most definitely had a severe impact on Bitcoin and is likely the root cause behind the very potent continuous selling pressure during US trading hours.”

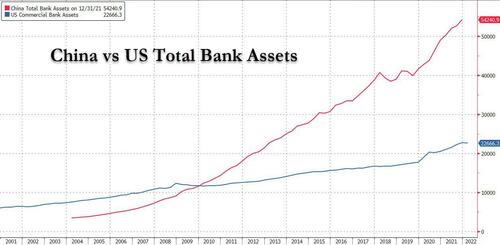

Finally, as we detailed previously, we suggest another more ominous reason for Asia’s bid for alternative currency. Traders are front-running the growing risk that China, and its $54 trillion in bank assets or 150% more than the US…

… will suffer another devaluation, sparking another massive capital exodus using bitcoin and other crypto instruments.

As UBS previously noted, none of this is to argue that crypto is sliding into oblivion, quite the contrary – after all Wall Street and Silicon Valley have invested tens of billions in crypto infrastructure and manpower (most did so around the time cryptos peaked),. Yet what it does point to is how the future will look very different. According to UBS’ James Malcom, players will have to embrace regulation and collaborate with existing financial service providers; thus Singapore’s just-launched Project Guardian, which represents a pilot project for the central bank to explore tokenized bonds and deposits via the establishment of permissioned liquidity pools in collaboration with DBS, JPMorgan and Marketnode. They must also have to compromise even as they seek to disrupt longstanding tradfi practices, per FTX’s bold bid to disintermediate derivatives trading by clearing customers’ swaps without the involvement of FCMs.

The good news is that, as UBS concludes, those who can last beyond the near-term downward pressure and volatility, the longer-term demand-side outlook looks exceedingly healthy when recast in such terms. Accenture’s newly released Future of Asian Wealth Management survey revealed that more than half of its 3,200 respondents already hold digital assets, and nearly three quarters plan to do so by year-end. However, two thirds of the 500 financial advisors surveyed have no plans to offer such services due to regulatory uncertainty and unfamiliarity with the space, which would require specialized research capabilities plus substantial investment in training for relationship managers. Little wonder satisfaction ratings with primary counterparts score rather lowly. It is also not surprising that many allocators end up relying on potentially less reliable online advice in consequence. UBS’ Global Family Office Report 2022 finds, by contrast, most of the bank’s clients are ‘cryptocurious’ rather than ‘crypto-committed’— wanting to learn about the space rather than invest. It pegged just a quarter of Asian participants as active in the space, though that rises to more than a third in North America. The vast majority of allocations amount to less than 3% of portfolios and are being made to better understand the technology as much as on the expectation of strong, diversified returns at this point.

Tyler Durden

Mon, 06/13/2022 – 12:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com