Japanese Bond Futures Suffer Biggest Rout Since 2013, Trigger Circuit-Breakers After ‘Soros’-Style Bets Build

Circuit-breakers were triggered overnight in the Japanese bond futures markets as the death-match between bond traders and The Bank of Japan played out on its largest scaled yet.

“It’s a challenge by foreign players to YCC or moves based on their views the BOJ will tweak policy,” said Katsutoshi Inadome, a strategist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo.

“Tension is heightening toward Friday’s BOJ decision.”

Ten-year JGB futs crashed by the most since 2013 as traders bet that the BOJ will be forced to abandon its pledge to cap yields at 0.25%.

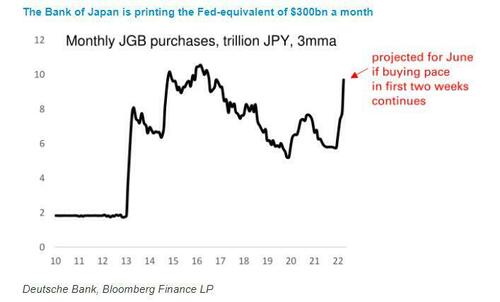

Even after the BoJ ramped up its “unlimited” buying ‘intervention’ to maintain the cap on yields…

JGB futs were smashed lower in price, clearly signaling the market’s belief that the BoJ will fold on its unlimited bond buying curve control program.

Meanwhile, since defense of YCC means continued collapse of the yen (or vice verse), the yen tumbled to a fresh 24-year low of 135.60 per dollar amid the growing policy divergence between the BOJ and the Fed.

“It depends on what comes out of FOMC tonight but if overseas yields keep rising, the BOJ will continue doing that it’s been doing, buying unlimited amounts for 10-year or seven-year JGBs,” said Takenobu Nakashima, chief rates strategist at Nomura Securities in Tokyo.

This move comes after we reported that BlueBay Asset Management – one of the world’s biggest hedge funds – as it gears up to become this generation’s George Soros caught in a crushing battle with the Bank of England Bank of Japan.

As the BOJ escalates attempts to keep a lid on bond yields, BlueBay is betting that our thesis laid out in March is right, and that the central bank will be forced to abandon a policy that’s increasingly out of sync with global peers. Echoing what we said just a few days ago, Mark Dowding, BlueBay’s London-based chief investment officer, said that the BOJ’s so-called yield curve control is “untenable.”

“We have a sizable short on JGBs,” Dowding, whose firm oversees about $127 billion across hedge funds and other fixed income products, said in an interview with Bloomberg on Monday. BlueBay started shorting Japan’s sovereign debt when the yen slid close to the 130 per dollar level several weeks ago, not too long after we wrote that “Yen At Risk Of “Explosive” Downward Spiral With Kuroda Trapped.“

Dowding is not the only one to agree with our core thesis that the beginning of the end of MMT will start in Japan: he joins other market veterans such as former Goldman “BRIC” economist Jim O’Neill and JPM’s Seamus Mac Gorain in predicting the BOJ will eventually alter its stance on yields, just as Australia’s central bank did last November.

“We do think that the BOJ will be forced to capitulate at some point,” Russel Matthews, senior portfolio manager at BlueBay, said in an interview with Bloomberg Television. And while a normal response would be for the yen to spike even as yields surge, what will be the worst possible outcome is for both the yen and JGBs to both plunge at the same time.

If and when that happens, it’s game over for Japan, MMT and fiat.

Tyler Durden

Wed, 06/15/2022 – 08:21

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com