Futures Crash, Dow Down 600 As Recession Reality Sets In

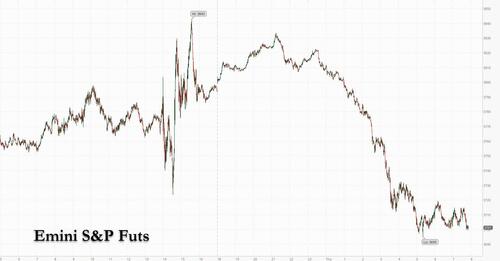

In our preview of how to trade the Fed’s 75bps rate hike, we said to expect a “kneejerk move higher (especially if we get an outsized hike, hinting the Fed is hoping to catch up to the curve), then a gradual drift lower” (a reco which was later echoed by Goldman). Sure enough, in the aftermath of the FOMC announcement yesterday, we got the knejerk move higher… and then overnight, the drift lower has also appeared tight on schedule, with futures tumbling in the US, undoing the entire post-FOMC move higher, and dragging global stocks lower as traders come to grips with the realization that 75bps of hikes – far from bullish – means that a recession is now on deck. As a result, S&P futures were down 2.2%, tumbling as much as 130 points from overnight session highs, while Dow futures puked a whopping 600 points as central banks lose control over markets. European stocks headed for a 16-month low and Chinese Internet shares dropped in premarket New York trading

And speaking of losing control, while normally yields would be tumbling ahead of a recession, this time they are doing the opposite with 10Y yields blowing out just shy of 3.50%, up 20 bps on the session after sliding following the biggest Fed hike in 28 years, as the bond market is starting to price in the uglier stagflation part of the coming recession, while stocks focus on the collapse in spending.

“The volatility in bond markets is definitely not over,” Jasmin Argyrou, director and portfolio manager at Credit Suisse Private Bank, said on Bloomberg Television. “The likelihood is that policy rates in the US may need to go to a more restrictive stance than even the market is pricing in.”

After the Fed raised interest rates by the most since 1994, Powell indicated a monetary stance similar to that of Paul Volcker, who broke the back of elevated inflation four decades ago but paid a price in the form of soaring unemployment and a credit squeeze. Powell’s comments signaled the Fed’s resolve to continue on an aggressive path of rate hikes, and that bond yields and equity risk premiums must rise to adjust to the new reality.

“It hasn’t taken long for the post-Fed bounce in stocks to fade, and given the gloomier outlook for growth, that is hardly surprising,” said Chris Beauchamp, the chief market analyst at IG Group in London. “We are still living in the same world we were 24 hours ago, one where growth is slowing, earnings are still falling and prices keep on rising. This is not a great environment for stocks.”

Nvidia, Tesla, Netflix, GM, Amazon, Ford, Apple and Microsoft were among the worst performers in premarket trading, as major US technology and internet stocks fell, poised to erase all or most of Wednesday’s gains. Apple -2.2%, Microsoft -2.5%, Amazon.com -2.5%, Alphabet -2.3%, Meta Platforms -2.3%, Nvidia -3.2%. Shares in Twitter rose ahead of a reported company-wide meeting between Tesla CEO Elon Musk and employees of the social media firm. Here are some other notable premarket movers:

- AC Immune (ACIU) shares slump 23% after the pharma firm said that its Alzheimer’s treatment Crenezumab did not meet its primary endpoints in a study.

- Arthur J Gallagher (AJG) is upgraded to outperform from sector perform at RBC Capital Markets, with broker citing the insurance broker’s growth, visibility and strong cash flows. Shares declined 2%.

- AutoZone and Dollar General (DG) are upgraded to overweight from equal- weight at Morgan Stanley, while AirSculpt Technologies and Sally Beauty Holdings see downgrades, as broker shuffles ratings to favor “defensive stocks with offensive characteristics.” Shares decline 1%.

- Cryptocurrency-related stocks resumed their slump on Thursday as a broad-based selloff in risk assets sent Bitcoin lower for a 10th straight session, its longest losing streak ever, according to data compiled by Bloomberg going back to 2010. Coinbase (COIN) shares decline 4%.

- Electric-vehicle stocks fall in US premarket trading as worries over rising inflation and the possibility of a recession hit shares in high-growth companies, while Jefferies cut its global EV sales estimates for this year and next. Tesla falls 4% in US premarket trading, Rivian -3%, Lucid -3%, Nikola -4%

- Twitter (TWTR) shares rise 2% in premarket trading, outperforming declines for most big tech stocks, ahead of a reported company-wide meeting between Tesla CEO Elon Musk and employees of the social media firm the billionaire agreed to buy for $44 billion in April.

- Volta Inc. (VLTA) is downgraded to neutral from overweight at Cantor Fitzgerald, which cites recent management changes at the electricvehicle charging company. Shares decline 1.3%.

Growth stocks are likely to suffer even more in the near-term, according to Richard Carter, head of fixed income research at Quilter Cheviot. “Investors are understandably concerned that such a sharp pace of monetary tightening will lead to a recession and markets are likely to remain volatile until we reach a peak in inflation,” he said.

In Europe, retailers and tech companies were among the biggest decliners in the Stoxx Europe 600 Index, which fell 2.1% to a fresh 16-month low; the Euro Stoxx 50 slumped over 2.5%, with Germany’s DAX underperforming and losing as much as 2.8%. Losses are broad based with all Stoxx 600 sectors in the red. Retail is the standout underperformer, dropping over 4.5%; tech and chemical sectors decline over 3.5%. Chipmaker ASML Holding dropped 4.9% in Amsterdam. Here are other notable movers:

Online retailers drop across the board after Asos cut its forecast for full-year sales, while peer Boohoo recorded the first UK sales decline in its history. Asos shares slid as much as 30%, Boohoo -19%, Zalando -12%, AO World -7.7%

- THG falls as much as 23% after Nick Candy walked away from making an offer, just hours after a rival consortium also dropped its pursuit.

- Philips declines as much as 9.1% after UBS downgraded the stock to sell from hold, saying overhangs from legal issues related to the DreamStation recall will continue to weigh on shares in the foreseeable future.

- Thule drops as much as 8.8%, taking the YTD slump in the bike rack and cargo-carrier maker’s shares to about 50%. Nordea trimmed its estimates “again.”

- Atos slumps as much as 10% after Bryan Garnier slashed its PT for the French IT services company to a Street low of EU13 from EU24, saying the stock will look unattractive for a year.

- European chemicals stock index drops as much as 4% amid a broad decline in markets. BASF underperforms, while beyond the index Synthomer sinks on a downgrade from Barclays. BASF shares down as much as 6.6%, Synthomer -7.9%

- Tech stocks in Europe slide amid fears of a more likely recession, with the Federal Reserve committed to bring down raging inflation. ASML shares slide as much as 5.1%, Infineon -5.2%, Just Eat -6.3%, Deliveroo -5.6%

- Euronext climbs as much as 4.2% after the stock-market operator was upgraded to overweight from neutral at JPMorgan due to “increasingly” attractive valuation and improving earnings momentum.

- Inchcape jumps as much as 6.5% after the automotive distributor published a trading statement, which Peel Hunt said was “positive.”

Earlier in the session, Asian stocks were mostly positive and followed suit to the gains on Wall Street. ASX 200 traded higher but with gains capped as participants reflected on the latest data releases including a mixed jobs report and a further rise in consumer inflation expectations. Nikkei 225 shrugged off mixed trade data as Japan seeks to raise the minimum hourly wage above JPY 1000 and is also looking to implement steps to increase tourist demand next month. Hang Seng and Shanghai Comp. were choppy with COVID-related concerns stoked by an increase in cases in Hong Kong and with Shanghai to conduct weekly community COVID testing across all districts until end-July, while property names lagged after Chinese house prices contracted Y/Y.

Japanese stocks climbed amid relief over the Federal Reserve’s plan for interest rate hikes as investors awaited a decision from the Bank of Japan due Friday. The Topix rose 0.6% to close at 1,867.81, while the Nikkei advanced 0.4% to 26,431.20. The yen resumed weakening against the dollar. Toyota Motor Corp. contributed the most to the Topix gain, increasing 2.9%. Out of 2,170 shares in the index, 1,414 rose and 657 fell, while 99 were unchanged.

“Relief that the FOMC rate hike passed without a hitch, mostly within market expectations, is pushing Japanese stocks higher,” said Shogo Maekawa, a strategist at JPMorgan Asset Management, who will not be happy when he sees today’s action. “The focus from here in the market will be on how far inflation can be contained by the FOMC before the US economy slows, but the outlook still remains uncertain.”

In Australia, rhe S&P/ASX 200 index swung to a loss of 0.2% to close at 6,591.10, weighed by declines in banks and healthcare shares. Seven of the 11 subgauges ended lower, while mining stocks rebounded to end a four-day losing streak. In New Zealand, the S&P/NZX 50 index rose 0.1% to 10,646.58

India’s key stock indexes plunged to their lowest level in over a year on concerns aggressive interest rate hikes by global central banks will begin to hurt demand amid higher cost pressures on companies. The S&P BSE Sensex fell 2% to 51,495.79 in Mumbai, after rising as much as 1.1% earlier in the session. The NSE Nifty 50 Index declined 2.1%. Both measure have dropped nearly 17% from their October peaks. Reliance Industries Ltd. fell 1.4% to its lowest level in nearly a month. It was the biggest drag on the Sensex which saw all but one of its 30-member stocks trading lower. All 19 sectoral indexes compiled by BSE Ltd., fell, led by a measure of metal companies. “Analysts are already prepping for earnings downgrades as central banks around the world step up with large rate hikes to keep inflation tethered,” said Abhay Agarwal, a fund manager at Piper Serica Advisors. The US Federal Reserve raised rates 75 basis points Wednesday, in line with the most recent projection of economists, stepping up its fight against inflation. In India, consumer-price inflation is above the central bank’s target, while input costs continue to rise for manufacturers. “A double whammy of higher costs and lower demand due to rate hikes would mean lower margins for companies,” Agarwal said

In FX, the Bloomberg Dollar Spot Index rose as the greenback strengthened against all of its Group-of-10 peers apart from the yen and the Swiss franc. European currencies were the worst performers, with Sweden’s krona slumping to a three-month low against the euro. The Swiss franc advanced by as much as 1.7% against the dollar and 2.1% versus the euro after SNB’s announcement. SNB President Thomas Jordan said the central bank would be prepared to purchase foreign currency if there were to be an excessive appreciation of the Swiss franc and also consider selling foreign currency if the Swiss franc were to weaken. The euro traded around $1.04 after earlier touching a day low of 1.0381. German bonds and euro-area peers tumbled led by the belly of the curve and money markets cranked up ECB rate hike bets on the back of the SNB’s move. Treasuries also slid while UK bonds erased gains and sterling fell against the dollar and the euro ahead of the BOE monetary policy announcement. Cable one-day volatility hit its highest level since 2020 Wednesday, rising toward the 30 vols handle.

In rates, Treasuries tumbled to fresh lows, with yields cheaper by 10bp to 15bp across the curve while post-Fed rally in stocks also fades. US 10-year yields around 3.435%, cheaper by 14bp on the day with bunds lagging by 3bp on the sector and gilts outperforming by 7bp; in Treasuries, front- and belly led declines flattens 2s10s, 5s30s spreads. Losses led by front-end of the curve as another 75bp rate hike gets priced back in for the July meeting. Gilt extended losses after Bank of England raised benchmark rate to 1.25% in a 6-3 vote. Fed-dated swaps price in 75bp of rate hikes for the July meeting and an additional 280bp of hikes by the end of the year. IG dollar issuance slate empty so far; Thursday’s activity may include some corporate issuers offering short-duration bonds.

In commodities, crude futures decline with WTI hitting lows for the week near $114.50. Spot gold is little changed at $1,830/oz. Base metals are mixed; LME aluminum falls 1.1% while LME lead gains 0.4%.

Looking at the day ahead now, and one of the highlights will be the aforementioned BoE decision. In addition, there’s an array of ECB speakers including Vice President de Guindos, along with the ECB’s Visco, Villeroy, Panetta, Vasle, Knot, Centeno, De Cos and Makhlouf. Data releases include US housing starts and building permits for May, the weekly initial jobless claims, and the Philadelphia Fed’s business outlook survey for June.

Market Snapshot

- S&P 500 futures down 1.8% to 3,721.25

- STOXX Europe 600 down 1.4% to 407.43

- MXAP down 0.3% to 158.95

- MXAPJ down 0.9% to 524.81

- Nikkei up 0.4% to 26,431.20

- Topix up 0.6% to 1,867.81

- Hang Seng Index down 2.2% to 20,845.43

- Shanghai Composite down 0.6% to 3,285.39

- Sensex down 1.5% to 51,771.21

- Australia S&P/ASX 200 down 0.2% to 6,591.10

- Kospi up 0.2% to 2,451.41

- German 10Y yield little changed at 1.75%

- Euro down 0.6% to $1.0385

- Brent Futures up 0.4% to $118.97/bbl

- Brent Futures up 0.4% to $118.97/bbl

- Gold spot down 0.1% to $1,832.27

- U.S. Dollar Index up 0.14% to 105.31

Top Overnight News from Bloomberg

- The Swiss National Bank unexpectedly increased interest rates for the first time since 2007, shifting away from a battle to tame a stronger currency to focus on inflation that threatens to get out of hand

- The ECB will raise interest rates from historic lows in a gradual and sustained fashion to bring inflation back to the 2% target, according to Governing Council member Francois Villeroy de Galhau

- Investors shouldn’t question the ECB’s resolve to undue prevent panic on government bond markets as interest rise from record lows, according to Vice President Luis de Guindos

- European authorities will announce that Greece is on track to exit its enhanced surveillance status in August in a statement later Thursday, Greek Finance Minister Christos Staikouras says in an interview with state-run radio Proto Programma

- Banque Pictet & Cie is expanding the scope of financial derivatives that it trades on behalf of clients, in a move that underscores how wealth managers are seeking new ways to protect assets against global shocks

- The first batch of a Chinese offshore yuan sovereign bond sale saw the strongest demand in nearly two years, defying a recent stream of outflows at a time when the global debt market is showing deepening levels of stress

- Hungary unexpectedly hiked the country’s key interest rate after the forint fell to a record this week

- Taiwan’s central bank raised the discount rate to banks by 0.125 percentage points to 1.5%, less than the estimate 1.625%

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly positive and followed suit to the gains on Wall Street in the aftermath of the FOMC meeting where the Fed hiked rates by 75bps and lifted its Fed funds rate projections, while markets found relief from Fed Chair Powell’s press conference as he does not expect 75bp moves to be common and kept the door open for either a 50bps or 75bps hike in July. ASX 200 traded higher but with gains capped as participants reflected on the latest data releases including a mixed jobs report and a further rise in consumer inflation expectations. Nikkei 225 shrugged off mixed trade data as Japan seeks to raise the minimum hourly wage above JPY 1000 and is also looking to implement steps to increase tourist demand next month. Hang Seng and Shanghai Comp. were choppy with COVID-related concerns stoked by an increase in cases in Hong Kong and with Shanghai to conduct weekly community COVID testing across all districts until end-July, while property names lagged after Chinese house prices contracted Y/Y.

Top Asian News

- HKMA raised its base rate by 75bps to 2.00%, as expected, following the earlier Fed rate hike.

- China’s NDRC said it will ensure reasonable economic growth in Q2 to provide a firm foundation for H2 and will expand the scope of use of funds raised by local government special bonds to include high-tech infrastructure for the first time, according to Reuters.

- White House official said US President Biden will keep his mind open regarding relaxing tariffs on Chinese goods, according to Reuters.

- China is to continue expanding high-level opening up, according to MOFCOM’s Shu and is confident foreign trade will be in a reasonable range.

- Hong Kong reports 1085 (prev. 1047) new COVID cases.

European bourses and US futures are hampered following a surprise SNB hike, Euro Stoxx 50 -2.4%; an announcement that exacerbated the modest pressure seen at the European cash open, in-spite of initial modest upside in the regions futures. Stateside, losses are relatively broad-based though the NQ -2.5%, lags its peers modestly given the pronounced upside in yields.

Tesla (TSLA) has raised US prices for all vehicles, according to its website, confirming an earlier report in Electrek; by as much as USD 6k. Samsung Electronics (005930 KS) has temporarily reduced procurement amid inventory pressure, Nikkei reports; has asked component makers and others to delay shipments. Toyota (7203 JT) is to suspend some domestic plant operations from June 17th; remains difficult to look ahead given the shortage of semis. Global production plan for June to be revised to ~750k units.

Top European News

- Villeroy Backs Gradual, Sustained Rate Hikes: ECB Update

- Ferrari Unveils Spending Push to Speed Up Electric Shift

- CEZ Says It Covered Gap in Gazprom Supplies From Other Sources

- Pictet Widens Derivatives Bets to Hedge Against Turmoil

- Air France CEO Says Business Travel Is Returning This Summer

- Putin’s Economic Team Puts on a Brave Face at Shrunken Forum

FX

- Franc soars as SNB strikes with half point hike to prevent further rise in inflation and spread to Swiss goods and services. Bank also removes highly valued tag even as USD/CHF tanks from high 0.9900s to sub-0.9800 and EUR/CHF probes 1.0200 vs 1.0400+.

- Yen rebounds strongly as risk sentiment sours significantly on the eve of BoJ; USD/JPY through 132.50 compared to 134.65+ peak and a Fib retracement (133.42) along the way.

- Dollar revival from post-FOMC lows derailed irrespective of deteriorating market tone and 75 bp rate rise, DXY back down around 105.000 within a 105.500-104.700 range.

- Pound precarious pre-BoE on premise that MPC will stick to steady 25bp policy normalisation steps; Cable choppy either side of 1.2100 and EUR/GBP pivoting 0.8600.

- Kiwi undermined by negative NZ Q1 GDP print and Aussie labours even though jobs data was largely better than expected; NZD/USD under 0.6300 and AUD/USD below 0.7000.

- Brazilian Central Bank raised the Selic rate by 50bps to 13.25%, as expected, through a unanimous decision and it left the door open for further monetary tightening, while it sees another rate increase of equal or lesser magnitude at the next meeting.

- Russian First Deputy PM said Rouble is overvalued and industry would be more comfortable if it fell between 70-80 against the Dollar, while Russian Y/Y inflation will be around 15% in December 2022, according to TASS.

Fixed Income

- Bonds collapse as SNB unexpectedly strikes against inflation with a 50bp rate hike

- Bunds recoil from 145.00+ to sub-142.00 at worst as ECB tightening expectations rise and BTPs reverse gains made on anti-fragmentation efforts between 119.20-116.01 parameters

- Gilts caught in the cross-fire ahead of BoE and down below 112.00 vs 113.12 at one stage even though MPC is seen maintaining 25 bp pace

- US Treasuries revert to bear-flattening after dovish reaction to FOMC overall and await housing data, jobless claims and Philly Fed

Commodities

- Crude benchmarks are hampered in-fitting with the global tone as markets digest the shock 50bp hike from the SNB.

- Currently, WTI and Brent are lower by just shy of USD 1.00/bbl and holding just above yesterday’s troughs.

- US Department of Energy requested to meet with refiners regarding prices no later than June 21st, according to Reuters sources.

- US reportedly fears the EU and UK ban on insuring Russian oil tankers could result in surging crude prices and urges European capitals to seek ways to ease the impact of their ban on insuring Russian oil cargoes, according to FT.

- Ukraine’s energy minister said gas production could fall to 16-17 BCM in 2022 from around 20 BCM in 2021, according to Reuters.

- Russian Deputy PM Novak says Russian can raise oil output in July; Russian oil production is restoring as oil flows are redirected.

- OPEC+ document shows Russian oil output at 9.27mln BPD in May, according to Reuters; OPEC+ was producing 2.695mln BPD beneath its targets in May, document says.

- China will set up a centralised iron ore buyer to counter the dominance of Australia as it hopes bulk buying will secure lower prices, according to FT.

- Spot gold is relatively contained in a sub-USD 10/oz range in-spite of the pronounced price action in the USD and Fixed Income spaces; with any upside for the metal capped again by a cluster of DMAs between USD 1840-46/oz.

Central banks

- Swiss SNB Policy Rate (Q2) -0.25% vs. Exp. -0.75% (Prev. -0.75%); cannot rule out further rate increases. Inflation Forecasts: 2022 2.8% (prev. 2.1%), 2023 1.9% (prev. 0.9%), 2024 1.6% (prev. 0.9%). Exemption Threshold: 28x (prev. 30x). Click here for newsquawk analysis and reaction.

- SNB’s Jordan: tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland; CHF is no longer highly valued.

- BoJ fixed rate bond buying operation receives take-up of JPY 733bln.

- ECB’s Visco says price rises are being mostly driven by energy and gas, not being driven by higher demand.

- ECB’s de Guindos says inflation expectations are “quite anchored”.

- NBH hikes one-week deposit rate to 7.25% (prev. 6.75%) at the weekly tender.

- CBR’s Nabiullina says there will not be a ban on USD and foreign currency accounts within Russia; FY economic contraction will be smaller than thought in April, are in discussions with many nations on settlements in national currencies. Do not currently have the technical ability to purchase EUR or USD.

US Event Calendar

- 08:30: May Building Permits MoM, est. -2.5%, prior -3.2%, revised -3.0%

- 08:30: May Housing Starts MoM, est. -1.8%, prior -0.2%

- 08:30: June Continuing Claims, est. 1.3m, prior 1.31m

- 08:30: May Building Permits, est. 1.78m, prior 1.82m, revised 1.82m

- 08:30: May Housing Starts, est. 1.69m, prior 1.72m

- 08:30: June Philadelphia Fed Business Outl, est. 5.0, prior 2.6

- 08:30: June Initial Jobless Claims, est. 216,000, prior 229,000

DB’s Jim Reid concludes the overnight wrap

There is an assembly for grandparents at school today and as our kids don’t have any anymore we as parents are invited instead. However I turned it down as I can’t face the prospect of going and finding some grandparents younger than me. However given I started in banking in 1995, at least until yesterday I was young enough to have never worked in a 75bps Fed hike world. That changed overnight though as the Fed met their leaked, 48-hour earlier, forward guidance and did their first 75bps move since 1994.

Our economists have reviewed the meeting here but let’s go through the highlights. The one thing we should all learn to ignore is forward guidance. However the key market reaction to the meeting was a big rally in rates, especially at the front end, and a decent rebound in equities, as Powell suggested 50bps in July was still possible just as the market had fully priced 75bps. So forward guidance is dead, long live forward guidance. A key phrase was that “I don’t expect these moves to be common”. This seemed to have a big impact. More later on this but let’s review chronologically.

Before the press conference, the statement and dots were more or less in line with what the market came to price ahead of the meeting. But the Fed is now painting a central scenario that is getting much closer to a hard landing, with unemployment getting revised as high as 4.1% by year-end 2024 – a number I’d expect to rise more as they try to tame inflation. PCE inflation was revised almost a full percentage point higher for this year, to 5.2%, with end-2023 inflation hitting 2.6%.

In the press conference, the Chair again emphasised the Fed’s commitment to bringing down inflation, and admitted the path to doing so whilst engineering a soft landing was getting more and more difficult. Indeed, the statement notably omitted the line: “With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong”, which the Chair explained by asserting that monetary policy alone would not be able to engineer a soft landing. Unemployment looks like it will need to rise in order to slow demand. Powell suggested it would also need help from a supply-side expansion, citing shocks such as the war, runaway oil prices, and supply chains sensitive to China’s Covid lockdowns. Without this, the landing would be hard, it was inferred. A theme he referred to time and again in the presser.

Another key focus of the press conference was the appropriate pace of rate hikes going forward. The Chair explained the Committee broke from its overwhelming communications for a 50bp hike in reaction to the CPI and University of Michigan inflation expectations that surprised to the upside and accelerated further during the blackout period. The path for rate hikes will be dependent on the month-over-month path for inflation, effectively making every inflation data release a ‘live’ event over the near-term. On appropriate hike sizes, markets cheered the fact the Chair said 75bp hikes are not normal and didn’t expect them to become commonplace (as discussed at the top), and that the July hike was in all likelihood between 50bp or 75bp. Later however, the Chair did not explicitly rule out hikes larger than 75bps. So it was forward guidance of sorts but highly uncertain.

This morning, Fed funds futures are pricing in 66bps of tightening in July, versus pricing 74bps at the close Tuesday. One wonders what would have happened if the answer not ruling out hikes larger than 75bps came earlier. Nevertheless, Treasury yields reversed some of the recent selloff, with 2yr yields falling -23.6bps (the most since October 2008) and 10yr yields down -18.9bps (the most since March 2020). Notably, 10yr breakevens were only +2.3bps higher despite the pricing out of tightening. And this morning there’s only been a modest reversal, with 10yr yields up +3.6bps to 3.32%. Risk assets were supported and the S&P 500 climbed +1.46%, almost all of which came during the press conference, with interest rate sensitive sectors leading the way. In line with that, the NASDAQ (+2.50%) and FANG+ (+3.66%) outperformed. It’s worth remembering it was not so long ago that the Chair ruled out completely 75bps for this meeting, so what may look like the modal path for rate policy today could change very quickly.

Whilst the Fed provided the main headlines yesterday, there was also an enormous rally in European sovereign bonds after the ECB Governing Council held an ad hoc meeting where they reiterated their pledge to act against fragmentation risks. Our European economists put out a piece summarising the announcement and implications herebut we’ll run through the takeaways.In their statement, they said that they “will apply flexibility in reinvesting redemptions coming due in the PEPP portfolio”, and that they would also “accelerate the completion of the design of a new anti-fragmentation instrument” for their consideration. So although we didn’t get a formal tool announced, it’s clear that this is on the ECB’s mind, and has helped reassure investors whose concern has grown about Europe’s debt sustainability over recent days. Around the US close, Reuters reported that the planned anti-fragmentation measures were not likely to come with burdensome conditionality, which should support the periphery. Our European economics team noted that with the anti-fragmentation tool coming earlier than expected, the ECB can embark on an even faster rate hike cycle, which prompted our team to add a third +50bp hike this December to their call.

With that in mind, peripheral debt led the moves lower in yields yesterday, with those on 10yr Italian (-36.4bps) and Greek (-45.5bps) debt seeing astonishing declines on the day. Spain (-23.0bps) and Portugal (-25.6bps) followed with what were still outsized moves by normal standards, whilst bunds saw one of the more subdued performances as yields “only” came down by -11.1bps. Indeed, the decline in the spread of 10yr Italian yields over bunds was the largest in a single day in over two years. That performance was mirrored on the equity side too, with Italy’s FTSE MIB (+2.87%) outperforming the broader STOXX 600 (+1.42%) as it snapped a run of 6 consecutive daily declines.

The euro itself initially strengthened in reaction to that ECB meeting happening, before falling around the statement, and then re-strengthened to +0.36% versus the dollar following the FOMC. Separately Bitcoin fell -1.48% in its 9th consecutive decline, having been nearly -9% lower earlier in the day and hitting an intraday low of $20,081, before rebounding along with risk after the FOMC to close at $21,640, and this morning it’s advanced further to reach $22,244.

Another significant story in Europe came on the energy side yesterday, with natural gas futures up by +24.00% (on top of the 16.35% rise on Tuesday) after Russia further squeezed gas supplies to Europe via the Nord Stream pipeline, with a cap in supplies to 67m cubic metres per day. That leaves futures at €120.33/MWh, which is the most they’ve been since late-March and represents a further piece of unwelcome news for policymakers trying to deal with inflation.

Those moves higher in equities have been echoed overnight in Asian markets, with investors focusing on Chair Powell’s comment that he did not “expect moves of this size to be common.” In terms of the moves, the Nikkei (+1.41%) has advanced thanks to a rally in auto and tech stocks whilst the Kospi (+1.46%), Shanghai Composite (+0.25%) and CSI (+0.32%) have also moved higher. The only exception is the Hang Seng (-0.40%), which has reversed its initial gains following the open. DM equity futures are pointing higher as well, although similarly we’ve seen a decline over the last couple of hours whereby S&P futures have gone from being up +1.05% to just +0.32% at time of writing. Oil prices have rebounded this morning too, with Brent futures +0.49% up at $119.09/bbl, after falling to its lowest closing level in nearly two weeks.

Looking forward, central bankers will stay in the spotlight today since we’ll get the Bank of England’s latest decision at midday in London. Like the Fed and the ECB, they’re facing similar inflationary pressures with UK CPI rising to a multi-decade high of +9.0% in April, and our economist expects they’ll continue their campaign of rate hikes with a further 25bp move, which would take Bank Rate up to a post-GFC high of 1.25%. Market pricing is between a 25bp move and a larger hike, with overnight index swaps placing a 43% chance that we’ll get a 50bp move instead. Indeed, last time 3 of the 9 members on the committee wanted 50bps rather than 25bps, so it’ll be interesting to see what the vote breakdown looks like.

On the data side, yesterday’s main release came from the US retail sales for May, where the headline number unexpectedly contracted -0.3% (vs. +0.1% expected), and the previous month’s expansion was also revised down two-tenths to +0.7%. That’s the first monthly contraction so far this year as well. Elsewhere in the US, the NAHB’s housing market index for June fell to a 2-year low of 67 as expected. Otherwise, the Euro Area saw industrial production grow by +0.4% in April (vs. +0.5% expected).

To the day ahead now, and one of the highlights will be the aforementioned BoE decision. In addition, there’s an array of ECB speakers including Vice President de Guindos, along with the ECB’s Visco, Villeroy, Panetta, Vasle, Knot, Centeno, De Cos and Makhlouf. Data releases include US housing starts and building permits for May, the weekly initial jobless claims, and the Philadelphia Fed’s business outlook survey for June.

Tyler Durden

Thu, 06/16/2022 – 08:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com