Despite Crashing Stocks And Cryptos, Retail Investors Just Won’t Stop Buying All The Dips

Something remarkable is taking place in the markets: despite a near record 10 out of 11 weekly drops in the S&P500…

… and a now unprecedented and record 11 of 12 weekly declines in the Dow Jones average…

… retail investors are buying the dip, again and again and again and so on. And not only that, their buying gets more aggressive the lower stocks slide.

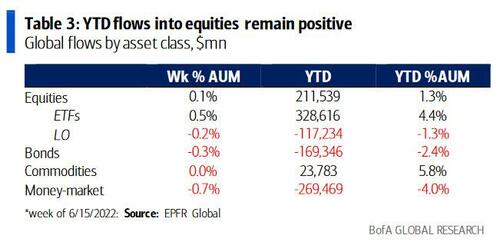

According to the latest EPFR data, investors plowed a whopping $16.6bn to stocks, all of it passive of course, with $32.3BN to ETFs offset by $15.7bn from mutual funds, bringing the YTD ETF inflows to $328BN vs $117BN in long-only outflows.

Last week also saw the 6th consecutive week of inflows into US equities, with a breakdown by style as follows: inflows to US small cap ($6.6bn), US value ($5.8bn), US large cap ($5.5bn); with only outflows from US growth ($0.4bn).

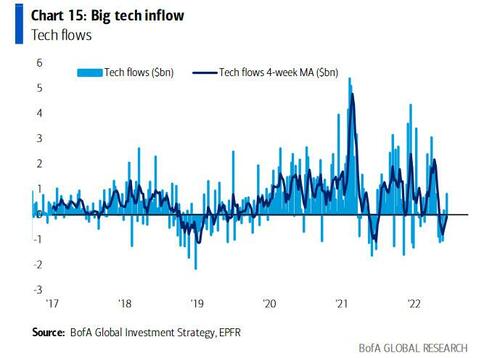

Broken down by sector, there were inflows into tech ($0.8bn) – the first in 9 weeks…

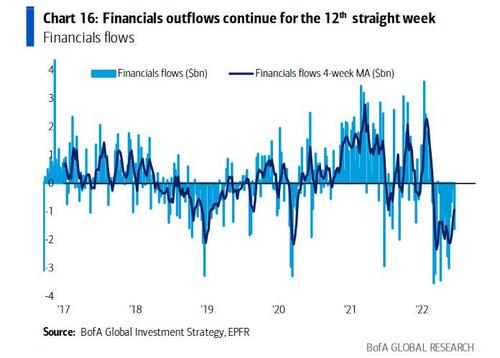

… materials ($0.3bn), healthcare ($0.3bn), utilities ($0.1bn) while on the other side, there were outflows from communication services ($74mn), consumer ($0.2bn), energy ($0.3bn), real estate ($0.5bn), financials ($1.6bn), which has now seen outflows for 12 straight weeks, something which wouldn’t happen if markets were expect anything but a stagflation.

Last week also saw the 1st inflow to EM equities in 6 weeks ($1.3bn), as well as the largest inflow to US small cap since Dec’21 ($6.6bn), to US value in 13 weeks ($5.8bn); meanwhile capital flight continued from Japan, with outflows from the past 4 weeks ($1.1bn) and Europe which has seen non-stop outflows for past 18 weeks ($1.0bn).

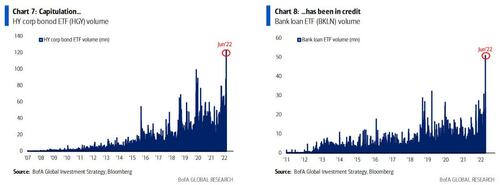

Meanwhile, as US equity inflows prove remarkably resilient, the same can not be said for credit, which just suffered the largest outflows since Mar’20 from junk bonds ($7.8bn), bank loans ($2.1bn), and munis ($4.9bn).

In fact, as BofA’s Michael Hartnett calculates, for every $100 of inflow since Jan’20, there has been $35 of outflow from IG + HY + EM debt vs $0 from equities…

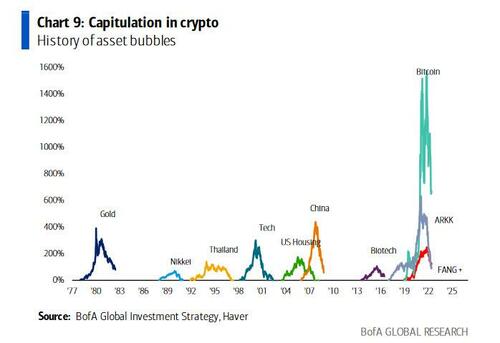

… suggesting that the capitulation has been in credit…

… and crypto

… but not stocks – why we Hartnett is worried that equity lows are still not in.

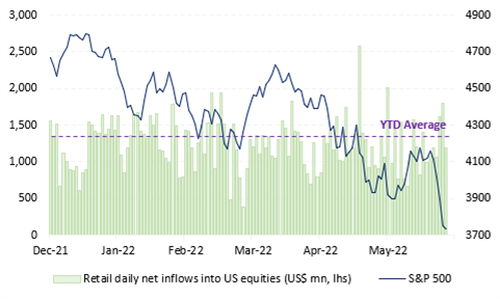

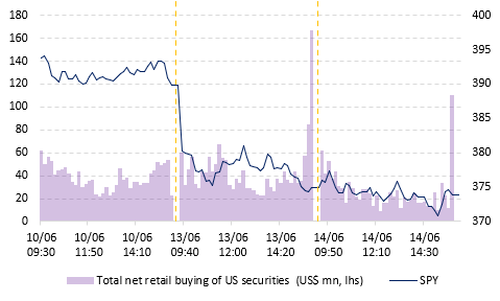

The latest analysis from Vanda Research confirms that far from capitulating, retail investors continue to pile in with little signs of waning retail enthusiasm. VandaTrack data showed a robust buy-the-dip activity by retail investors last Monday as markets tumbled into a bear market, with the total net inflow reaching +US$ 1.8BNn on the day.

That said, the aggregate net buying appears predominantly driven by investors with a long-term investment horizon that are willing to continue Dollar-Cost-Averaging into a sliding stock market. Even so, Vanda believes that there must be a pain threshold for short-term losses – albeit it is proving more elusive than we initially thought.

Meanwhile, the impressive retail flow in the cash market has yet to show signs of capitulation, although as Vanda cautions, retail sentiment can change quickly, especially towards the last innings of a sell-off when the bottom usually sets in).

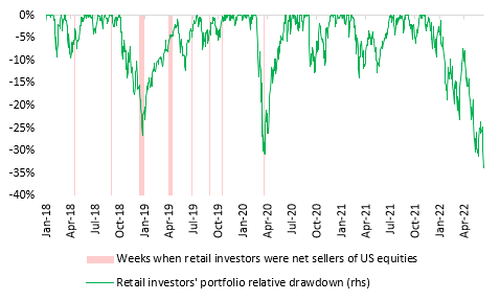

And until we wait, here are some more stats: first, the drawdown of the average retail portfolio is now -34%: larger than in any other recent sell-off episode, including March 2020!

One difference between now and prior sell-offs lies in the speed of the drawdown. During March 2020, for instance, the S&P 500 dropped by 30% in just over a month, while the current drawdown is in its 6th month (and counting). This slow-burn slide has two implications:

- retail investors may take longer to run out of capital to invest as they keep collecting paychecks (assuming the labour situation remains stable) and,

- losses are less “traumatic” as investors usually suffer from “short memory” bias.

All told, these two factors plus the expectation that the Fed will capitulate soon enough, contribute to retail’s resilience for now.

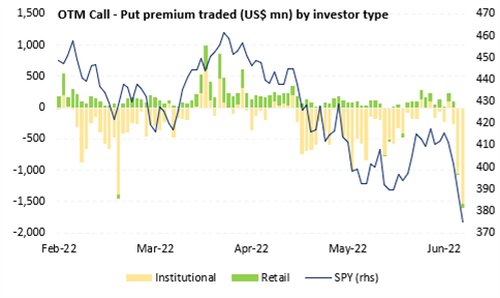

Outside the cash market, options flows still point to overall weakening sentiment as investors traded more put than call options in recent days (which is also one of the reasons selling pressure has been muted since so many are hedged). The difference in call-put premium traded by retail investors was relatively small at -$55MM on Monday. According to Vanda, those in the retail community engaging in the options market are primarily hedging themselves for any further downside via put options in Exchange Traded Funds (SPY, QQQ, HYG, etc.) however, the total option imbalance was mainly driven by institutional investors buying protection.

Despite continued buying pressure, there are days when selling overtakes demand. Case in point, the lack of retail demand likely amplified the large sell-off at the market open on Monday as most of the retail inflows into US equities were concentrated towards the end of the day. The sizeable net inflow at the close was still insufficient to drive a tactical rebound – unlike prior instance. However resilient retail investors have been this year, they could not overpower the institutional investor selling pressure following headlines of a possible 75 bps FOMC hike this week.

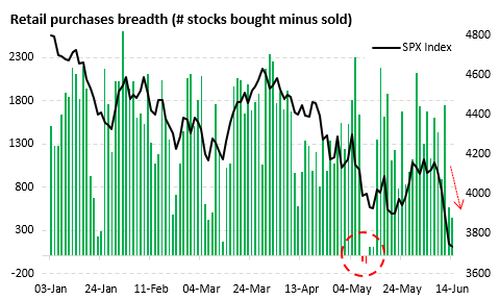

Another potential warning sign: the breadth of retail purchases is deteriorating again, though it is not flashing any red flags. The total number of US securities (ETFs and single stocks) bought vs. those sold is decreasing. This is a sign of narrowing market breadth due to retail investors directing their capital towards a more concentrated basket of assets. As a historical aside, the two weeks before any retail capitulations had witnessed approx. five days of negative breadth and the number of securities net-sold being -250 or less, on average. We’re not there yet.

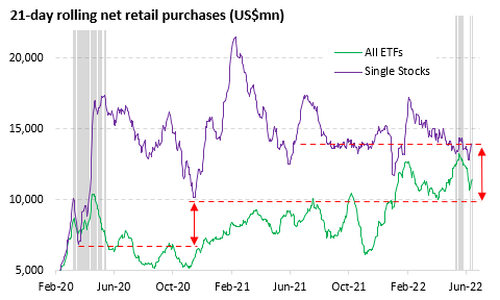

Adding to the confusion, another of Vanda’s favorite capitulation indicators is actually showing improvement signs: in a reversal of the trend from the past month, purchases of single stocks relative to ETFs have picked up again. In the past, when the going got rough, retail investors tended to rotate away from single stock purchases and direct capital towards broad ETFs. This behaviour tended to coincide with weak market periods where conviction in stock-picking abilities dwindled, and retail investors found refuge in more diversified instruments. Only when net selling in single stocks and ETFs concurrently happened did market bottoms form. As the chart below shows, using a 1-month rolling sum, we note that retail net flows sit well above prior key capitulation levels for both instruments.

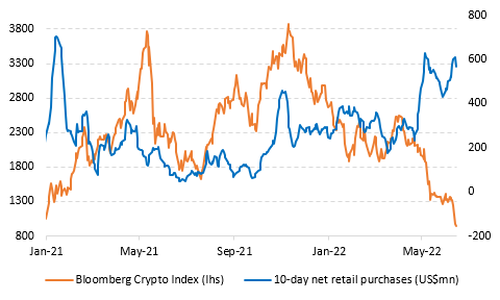

One final sentiment indicator to track is retail participation crypto where once contrary to expectations, retail keeps piling in and providing exit liquidity to institutional investors dumping crypto proxy names. With BTC and ETH tumbling below $20K and $1,000 respectively, it is no surprise that publicly listed crypto-related companies are also experiencing selling pressure. However, the VandaTrack data shows that retail crowds are taking this opportunity to buy into crypto-related stocks and ETFs to the tune of $570MM over the past 10 trading days – a pace not seen since Jan ‘21.

There are currently a lot of moving parts in crypto land, with the latest panic selling likely triggered several big protocols and funds (Celsius/3AC) gating and blocking user redemptions or simply liquidating. But why does this matter? Well, we have recently highlighted how older cohorts of the retail community have started reducing exposure to riskier assets while younger and more speculative investors continue to hang on. Monitoring activity around crypto-related plays can give us early signs of capitulation as this is a highly speculative area of the markets.

Tyler Durden

Sat, 06/18/2022 – 14:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com