CapEcon: If Iran Closes The Strait Of Hormuz, Crude Would Jump To $150

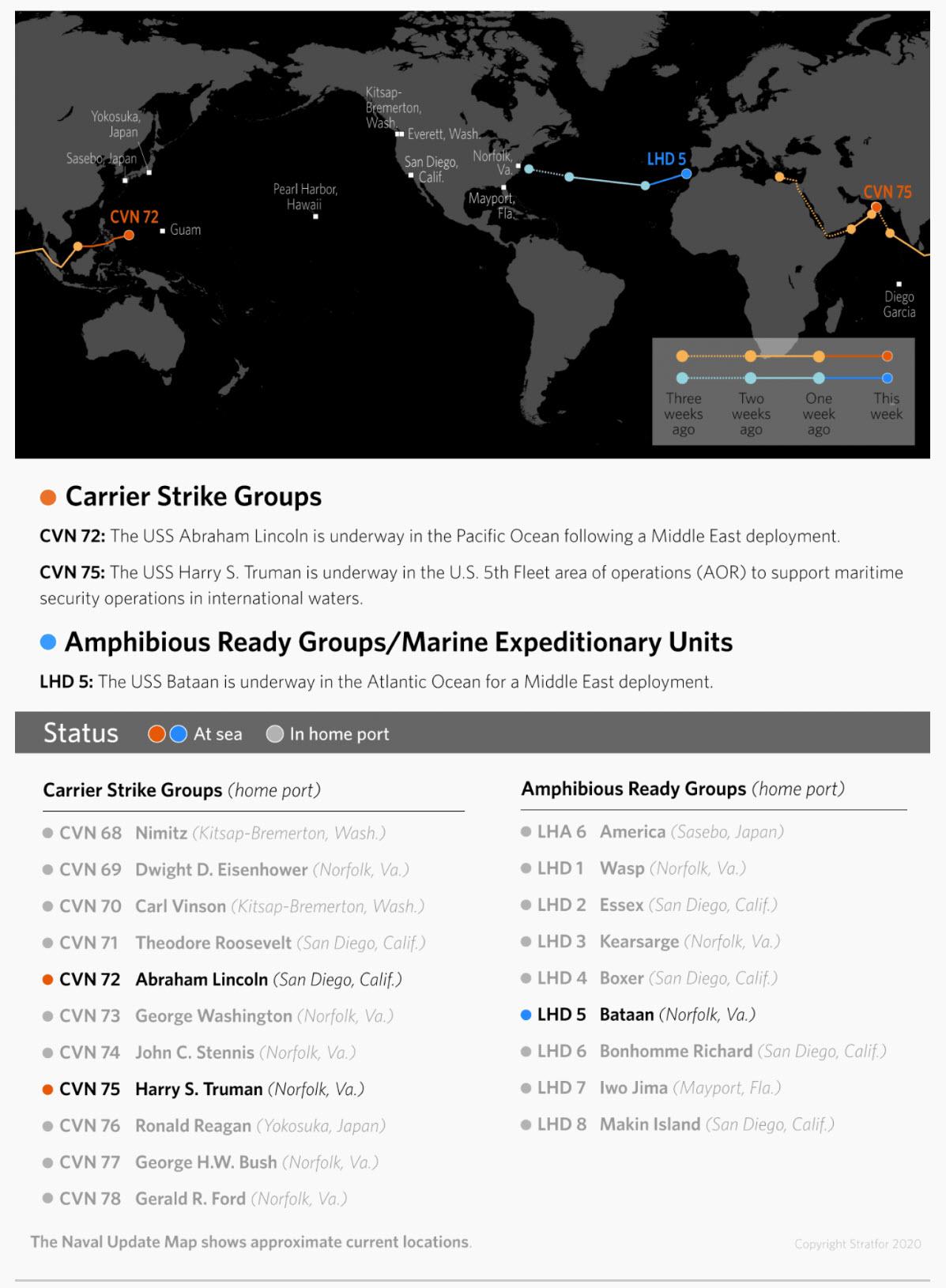

When we first reported the news of Qassam Suleimani’s assassination, one of the first things we showed was the placement of US naval ship around the globe, emphasizing the location of aircraft carrier CVN 75 “Harry Truman” which is currently located just off the Straits of Hormuz in the Gulf of Mexico (and may or may not have been instrumental in the Baghdad airport strike that took out Suleimani).

So why was one of the only two US carriers currently deployed in immediate proximity to the Straits of Hormuz?

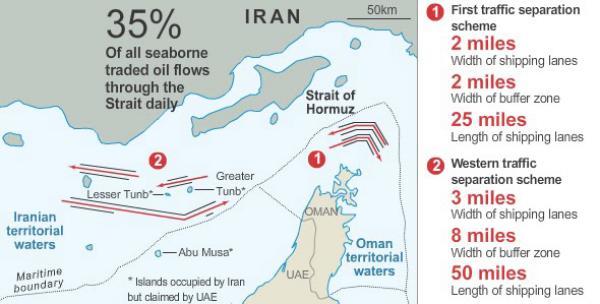

Simple: the tiny strait represents the most important choke point for global energy flows, with roughly third of all seaborne traded oil flowing through the Strait daily…

… and is also why speculation is rife that if an enraged Iran really wants to retaliate against the US, its primary goal may be to shut down the strait (even if Iran ally China would strenuously object), which in turn would result in a worst case scenario for the global economy, potentially sending oil as high as $150 according to to Capital Economics, and tipping the world into recession.

Below we repost a fast take from CapEcon on its views on “Soleimani’s death and the threat of US-Iran war”:

Soleimani’s death and the threat of US-Iran war

The assassination of Qassem Soleimani, a major figure in the Iranian regime, in a US airstrike last night has significantly raised the chances of an outright conflict between the US and Iran. We’ve previously estimated that a US-Iran war could shave 0.5%-pts or more off global GDP, mainly due to a collapse in Iran’s economy but also due to the impact from a surge in oil prices.

It’s extremely difficult to know how events will play out from here. But Iran’s Supreme Leader has promised “tough revenge” for the death of Mr. Soleimani. This could come via numerous channels, including attacks on US embassies in the region, assaults on neighbouring US allies (such as Saudi Arabia) or even strikes on US military facilities in the Gulf.

Clearly, the major concern for the world economy is that events spiral out of control and the US launches a full-blown military assault on Iran. We would direct clients to a Focus published last year for a discussion of the possible geopolitical and economic implications of a direct conflict between the US and Iran. We won’t go into all the details here, but there are few key points worth reiterating.

First, the resulting collapse in Iran’s economy could knock as much as 0.3%-pts off global GDP – equal to our estimate of the damage from the US-China trade war. The impact on the other MENA countries would ultimately depend on whether they get directly caught up in the conflict. Past experience suggests that they could actually come through relatively unscathed – many of the Gulf countries recorded rapid growth during the First Gulf War.

Second, and more importantly for the rest of the world, oil prices would surge. In response to last night’s events, oil prices have risen by more than 3% today to $68pb. But if Iran tried to close off the Strait of Hormuz, we’ve previously estimated that Brent crude would jump to $150pb. This would push up inflation across the world – by as much as 3.5-4.0%-pts in the OECD countries.

Central banks in the developed world would probably look through this. But in EMs, those countries where higher oil prices exacerbate balance of payments strains or an inflation problem would probably hike interest rates. Turkey would be a prime candidate, but India would face strains too.

Third, there would also be indirect effects via a hit to sentiment and possible disruption to shipping routes. Our central scenario is that the global economy will bottom out in the early part of this year and recover thereafter. But the outbreak of war between the US and Iran would put the recovery on ice.

In terms of financial markets, equity and bond markets across the Middle East would probably come under pressure. But we suspect that dollar pegs in the Gulf would remain intact. At a global level, a dent to risk appetite would cause risky assets to suffer – equities would fall and EM currencies would weaken – and safe haven assets to rally.

Tyler Durden

Fri, 01/03/2020 – 09:50

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com