Will $30BN In Month-End Pension Buying Send The S&P Above 4,000: Kolanovic Thinks So

Earlier today we laid out two traders views, one bull and one bear, both of which agreed that the next leg in stocks will be higher, and laid out their reasons. Now a third potential catalyst for a major month-end rally has emerged: according to Goldman trading desk estimates, there is a net $30 billion of US equities to buy from US pensions given the moves in equities and bonds over the month and quarter.

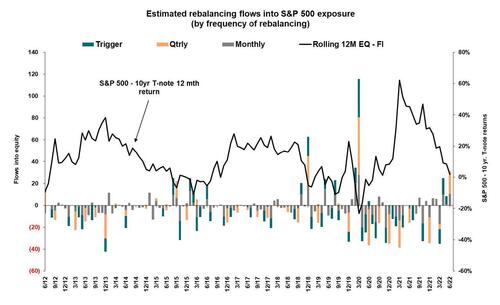

How does this stack up vs history? This ranks in the 72nd percentile amongst all buy and sell estimates in absolute dollar value over the past three years and in the 92nd percentile going back to Jan 2000. Additionally, the buying imbalance also ranks in the 94th percentile amongst all estimates on a net basis (-$70bn to +$150bn scale) over the past three years and in the 96th percentile going back to Jan 2000.

JPMorgan’s Marko Kolanovic – Wall Street’s biggest permabull bar none and nothing: he has told clients to the dip every single week this year, prompting many to ask just how much money to lose do JPM’s clients have – naturally agreed with this bullish take and in a Friday note co-written with Bram Kaplan writes that the month- and quarter-end rebalance could push stocks 7% higher, driving the S&P well above 4,000 in the process. Some excerpts from the note:

This year the impact of rebalances have been significant due to large market moves and low liquidity. For instance, near the end of the first quarter, the market was down ~10%, and experienced a significant ~7% rally in the last week going into quarter-end. On the most recent monthly rebalance, near the end of May, the market was down 10%, and experienced a significant rally of ~7% going into month end.

Let’s look at the current rebalance setup. Broad equities are down 21% for the year (9% vs bonds), 16% for the quarter (11% vs bonds), and 9% for the month (7% vs bonds).

In summary, Kolanovic finds that “rebalances across all 3 lookback windows would reinforce and, based on historical regression, would imply a ~7% move up in equities next week” Of course, having been wrong in 2022 with his relentless calls to BTFD, Kolanovic hedges somewhat and says that this assessment “takes into account the current market liquidity, as measured by futures market depth, which is ~5 times lower than the historical average.”

The Croat also hedges that rebalances are not the only drivers and the estimated move is assuming ‘all else equal’ (which of course never is). At the same time, bonds would feel moderate downward pressure from rebalances and the increase of yields could further result in rotation towards cyclical equities (and away from defensives). Or it could just lead to another bout of broad-based selling.

That said, with pensions clearly set to lift offers into month end (and beyond), odds are that we will see further technical and positional buying in the coming days.

More in the full note available to pro subs.

Tyler Durden

Fri, 06/24/2022 – 13:24

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com