It Costs $22,648 And Requires 11 Agencies To Start A Restaurant In San Francisco

By Simon Black of Sovereign Man

In a report called Barriers to Business, the Institute for Justice (IJ) analyzed 20 US cities for how easy it is to open five different types of businesses. To cover a range, those businesses included a restaurant, a retail bookstore, a food truck, a barbershop, and a home-based tutoring business.

Entrepreneurs who want to start a restaurant, for example, have 13 different fees totaling $5,300, on average across the 20 cities. In San Francisco, those fees reach $22,648.

Remember, these costs and regulatory hurdles are all in addition to the normal costs and work of opening a restaurant.

The IJ also looked at the number of regulatory steps, and the number of government agencies it took to open a business. On average, across the 20 cities, it took 55 steps and eight government agencies just to open a barbershop.

And as if the cost and time burden wasn’t enough, the report found that in many of the cities, it was not even clear what all the requirements were to start a business.

For example, the report analyzed if a city gave entrepreneurs a “one-stop-shop” to open a business.

That means a website which clearly lays out the requirements, and allows the owner to complete most forms in one portal. IJ also looked at whether the portal is user-friendly and allows the business owner to track progress and organize their information from one online account.

None of the cities received a 5/5 for the one-stop-shop, while Birmingham and Des Moines received a 0. But Atlanta, Detroit, New Orleans, New York, Pittsburgh and San Francisco came close, with a 4/5.

And that shows that simply looking at one factor is not enough. Sure, San Francisco may make it relatively easy to navigate the process, but that doesn’t make up for the enormous cost.

And in Raleigh, it may only cost about $1,300 in fees to open a restaurant, but the city meets only 1/5 one-stop-shop criteria.

What this means:

The report correctly observes that “You shouldn’t need a law degree to start the small business of your dreams.” Obviously, these types of costs and burdens are the exact opposite of what made America so strong and prosperous in the first place.

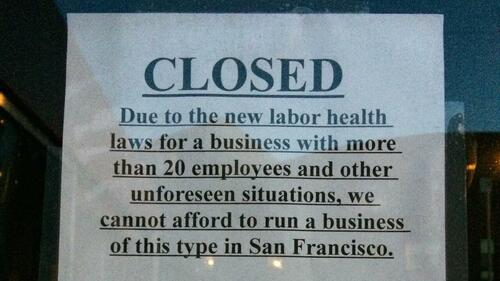

It’s no surprise that businesses are fleeing San Francisco, where it costs tens of thousands of dollars in fees to start a restaurant.

Meanwhile, in San Antonio, Texas, it costs $2,477 and in Jacksonville, Florida, it’s $2,794.

Sadly, in terms of the number of agencies and bureaucratic steps involved, these cities aren’t much better than San Francisco.

What you can do about it:

We’ve said it before and we’ll say it again: local really matters. It is worth noting that the report only looked at medium to large cities. But when you are looking to start a business, you may be locating in a smaller city or town.

It makes sense to shop around, by town or county, to see what the requirements are before committing to a location. This will make it easier on you, but it also represents voting with your feet.

Also consider the type of business you will be opening. The total steps it took to open a home-based tutoring business was the fewest of any other business analyzed in all 20 cities.

That is a good sign, since many of the most promising small-business opportunities these days are home-based. We even talked about the revolution in alternative schooling programs to replace public schools in this Sunday Intelligence article from March.

Service providers are popping up to support micro-schools, and regulations in many states, like Florida, allow former public school teachers to easily start a home-based schooling program. Some states, such as Arizona, even allow school choice funds to be spent on these types of private programs.

With parents fed-up with woke indoctrination and COVID protocols in school, the market is there. And in many places, the regulatory burden is relatively small.

If you have an online business which provides services, you should consider Puerto Rico’s Act 60 tax incentives. Companies which export their services to customers outside of Puerto Rico can pay just a 4% corporate tax rate, then distribute dividends to the company owner tax free.

And of course, you should always consider looking outside of your home country for opportunities as well.

As we mentioned earlier, the free-market American dream of starting any business easily is not what it used to be.

Tyler Durden

Sun, 06/26/2022 – 21:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com