The Best Early Recession Indicator

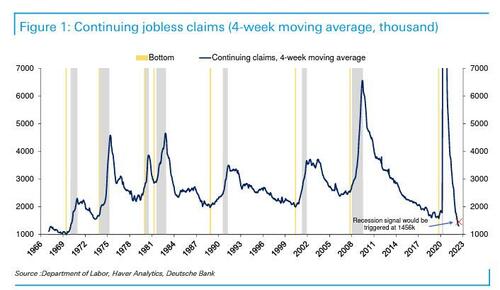

As we approach the end of the first half, it’s safe to say that how the second progresses will likely be determined by whether the US moves into recession or not (and how soon). In regards to this key question, Deutsche Bank’s Jim Reid writes that those readers looking for lead indicators, the bank’s economists have long believed that continuing claims are the best signal for an imminent slide into recession. In a recent piece, they show how an +11.5% rise above the minimum level over the previous year provides the most accurate and timely signal of recession risks since the data becomes available in the 1960s. It works for each recession and normally leads by around 2 months.

In this cycle, the current low was 1306k hit on May 20th 2022. So far it’s up less than 1% to 1315k and would need to hit 1456k for the 2-month recessionary countdown clock to start ticking.

However, as one can can see from the chart below, this isn’t a big pick-up in historical terms so although we’re not trending there at the moment, it wouldn’t take too much to change the picture.

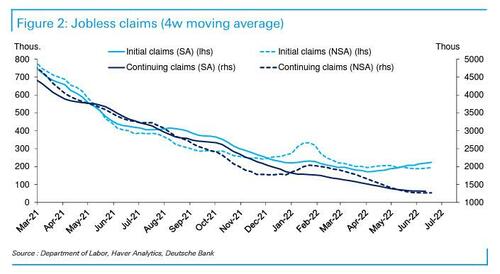

Indeed one concern is that initial jobless claims are up from a trough of 166k in March to 229k last week. Over time, Reid writes, these two series are very well correlated so this is a big enough move to confirm an imminent recession if continuing claims catch up. However this series is seasonally adjusted and non-seasonally adjusted claims are still bumping along the bottom and DB economist Matt Luzzetti thinks there may be some issues with seasonally adjusting so he wouldn’t yet read anything too significant into the pick-up in SA claims.

In any case, Thursday 8:30am EST when the weekly claims data is released, is “showtime” each week for the foreseeable future according to Reid.

Separately, DB’s asset allocation team put out an excellent piece last week (available to professional subscribers) looking at what all the short, medium and long-range US recession indicators are currently telling us. In brief, most that turn down early (6-14 months before a recession) are flashing red, most that warn 1-5 months out are mixed, whereas those that turn late are still mostly showing no signs of recession, however these can often turn only in real time.

More in the full note available to pro subs.

Tyler Durden

Tue, 06/28/2022 – 22:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com